SEC Vs. Ripple: XRP's Future As A Commodity Hangs In The Balance

Table of Contents

The SEC's Case Against Ripple and XRP

The SEC's Argument

The SEC alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. They argue that the Howey Test is met because XRP investors expected profits based on Ripple's efforts. The Howey Test, a four-pronged test used to determine whether an investment is a security, considers whether there's an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The SEC contends that Ripple's actions in promoting XRP and its development efforts fueled investor expectations of profit, thereby satisfying the Howey Test criteria.

- Unregistered securities offerings: The SEC claims Ripple conducted unregistered sales of XRP, circumventing crucial investor protection measures.

- Profits based on Ripple's efforts: The SEC argues that investors anticipated profits based on Ripple's ongoing development and marketing of XRP, not solely on market forces.

- Investment contracts: The SEC classifies XRP sales as investment contracts under the Howey Test, arguing that the arrangement between Ripple and XRP purchasers constitutes a security.

Ripple's Defense

Ripple counters that XRP is a decentralized digital asset, operating similarly to Bitcoin and Ethereum, and therefore not a security. Their defense hinges on the argument that XRP functions as a medium of exchange and a store of value, lacking the centralized control and promise of profits based on a promoter's efforts that characterize securities. They emphasize the decentralized nature of XRP's network and its open-source code.

- Decentralized nature of XRP: Ripple highlights XRP's decentralized nature, emphasizing the lack of centralized control over its issuance and distribution.

- Comparison to Bitcoin and Ethereum: Ripple draws parallels between XRP and other established cryptocurrencies like Bitcoin and Ethereum, arguing that they share similar characteristics and functionalities.

- Lack of centralized control: Ripple stresses the absence of any centralized entity dictating the value or functionality of XRP, differentiating it from securities typically subject to centralized management.

The Potential Outcomes and Their Implications for XRP as a Commodity

SEC Victory

If the SEC wins, XRP could be deemed a security, potentially leading to significant repercussions for Ripple and XRP holders. This could include delisting from major cryptocurrency exchanges, substantial financial penalties for Ripple executives, and a wave of investor lawsuits seeking compensation for losses. Such an outcome would significantly impact the XRP price and its overall market viability.

- Delisting from exchanges: Many exchanges might delist XRP, severely restricting its accessibility and liquidity.

- Legal penalties for Ripple: Ripple and its executives could face hefty fines and other legal ramifications.

- Investor compensation claims: Investors could file class-action lawsuits seeking restitution for losses incurred due to the alleged unregistered securities offering.

Ripple Victory

A victory for Ripple could establish a significant precedent, potentially paving the way for clearer regulatory guidelines for other cryptocurrencies. This would bring much-needed regulatory clarity to the crypto market, boosting investor confidence and potentially encouraging wider adoption of XRP and other digital assets. A Ripple win could significantly reshape the regulatory landscape and foster innovation in the industry.

- Regulatory clarity for cryptocurrencies: A favorable ruling could help define the criteria for classifying cryptocurrencies as securities or commodities.

- Increased investor confidence: Clearer regulations would reduce uncertainty and encourage greater investment in the cryptocurrency market.

- Potential for wider adoption of XRP: A positive outcome could significantly increase XRP's adoption as a payment and settlement asset.

A Negotiated Settlement

A negotiated settlement between the SEC and Ripple remains a possibility. This could involve a consent decree where Ripple agrees to certain conditions, possibly including paying fines or modifying its business practices, without explicitly admitting guilt. A settlement would likely provide some degree of regulatory clarity, but its impact on XRP's classification and long-term prospects would depend significantly on the specific terms.

- Potential for consent decree: Ripple might agree to a consent decree to avoid a lengthy and costly trial.

- Limited admissions of guilt: A settlement might not involve an outright admission of guilt by Ripple.

- Impact on XRP price and trading: The terms of a settlement would significantly influence XRP’s price and trading volume.

The Broader Implications for the Cryptocurrency Market

Regulatory Uncertainty

The outcome of the SEC vs. Ripple case will significantly impact regulatory uncertainty in the crypto market. The ruling will influence how regulators approach other cryptocurrencies, potentially affecting initial coin offerings (ICOs) and security token offerings (STOs). A clear legal framework is crucial for investor protection and the responsible growth of the crypto industry.

- Impact on ICOs and STOs: The case’s outcome will shape future regulatory approaches to ICOs and STOs.

- Regulatory clarity for other digital assets: The ruling sets a precedent for how other digital assets will be classified.

- Investor protection considerations: The case highlights the importance of investor protection in the volatile cryptocurrency market.

Conclusion

The SEC vs. Ripple case has far-reaching consequences for the future of XRP and the broader cryptocurrency industry. The classification of XRP as a security or commodity will set a crucial precedent, impacting regulatory clarity, investor confidence, and the overall development of the crypto market. The potential outcomes – an SEC victory, a Ripple victory, or a negotiated settlement – each hold significant implications. Staying informed about the developments in this landmark case is crucial for anyone invested in or interested in the future of digital assets. Understanding the arguments surrounding XRP commodity status is key to navigating the evolving crypto landscape. Keep following the news and analysis surrounding the SEC vs. Ripple case to better understand the future of XRP and other digital assets.

Featured Posts

-

Us Vaccine Monitoring Intensifies In Response To Measles Rise

May 02, 2025

Us Vaccine Monitoring Intensifies In Response To Measles Rise

May 02, 2025 -

Government Funded Mental Health Courses A Comprehensive Guide To Ignou Tiss Nimhans Programs

May 02, 2025

Government Funded Mental Health Courses A Comprehensive Guide To Ignou Tiss Nimhans Programs

May 02, 2025 -

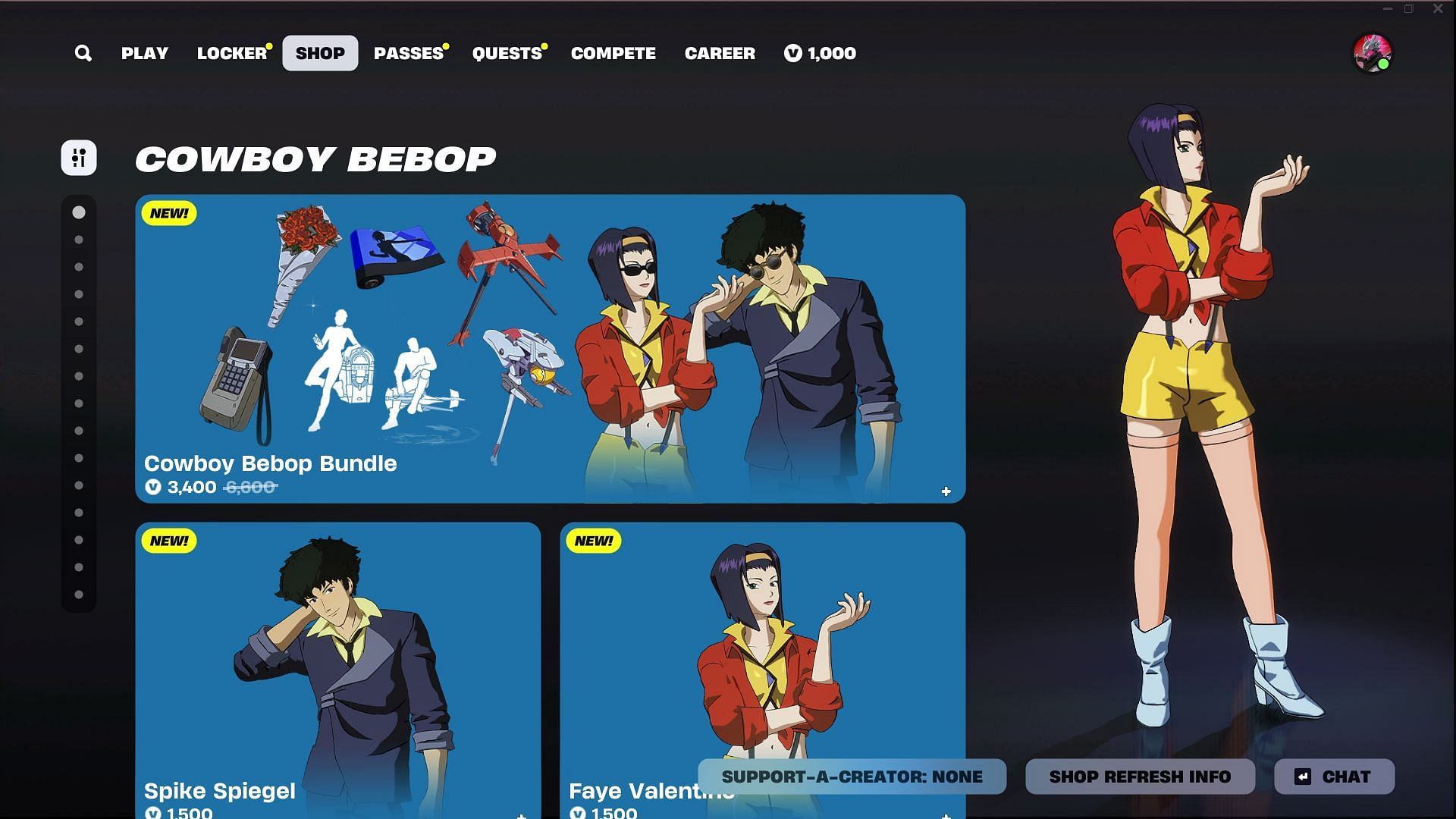

Fortnite Cowboy Bebop Collaboration How To Get The Freebies

May 02, 2025

Fortnite Cowboy Bebop Collaboration How To Get The Freebies

May 02, 2025 -

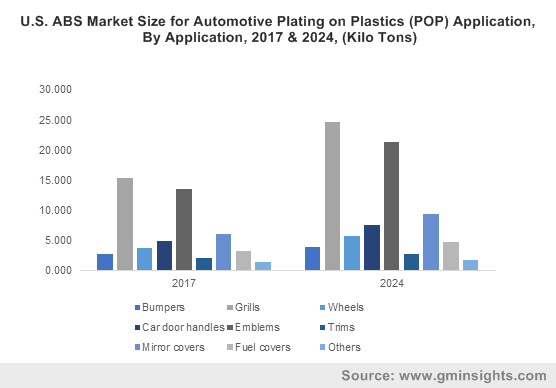

Saudi Arabias Abs Market Growth Opportunities After Regulatory Reform

May 02, 2025

Saudi Arabias Abs Market Growth Opportunities After Regulatory Reform

May 02, 2025 -

Ongoing Nuclear Litigation A Comprehensive Overview Of Current Cases

May 02, 2025

Ongoing Nuclear Litigation A Comprehensive Overview Of Current Cases

May 02, 2025