Sensex And Nifty 50 End Flat: Bajaj Twins Losses And Geopolitical Tensions Weigh

Table of Contents

Bajaj Twins' Impact on Market Sentiment

The considerable drop in Bajaj Finance and Bajaj Auto share prices significantly influenced the overall market sentiment. These "Bajaj twins," as they are often referred to, represent a substantial weight in the market indices. Their decline triggered profit-booking across sectors, contributing to the subdued performance of the Sensex and Nifty 50. While precise percentage changes will vary based on the closing prices, analysts observed a notable decrease, impacting investor confidence.

-

Analysis of Bajaj Finance's quarterly results and their impact on investor confidence: Recent quarterly results for Bajaj Finance may have fallen short of market expectations, leading to profit-booking by investors who had previously bet on strong growth. Any perceived weakness in their financial performance directly translated into downward pressure on the stock price.

-

Examination of any news or announcements regarding Bajaj Auto affecting its stock price: Similarly, negative news or underwhelming announcements concerning Bajaj Auto could have contributed to the selling pressure. Market analysts frequently scrutinize news releases for any indicators of future performance.

-

Discussion on the overall contribution of Bajaj twins to the market indices: Given their significant market capitalization, even a modest percentage drop in Bajaj Finance and Bajaj Auto share prices can significantly impact the overall movement of the Sensex and Nifty 50, dampening the broader market's performance.

-

Mention the volume of trading in these stocks: High trading volume in these stocks further underscores the market's reaction to their price fluctuations, indicating significant investor activity driven by concerns about the companies' prospects.

Geopolitical Uncertainty and its Ripple Effect

Lingering geopolitical uncertainties continue to cast a shadow over global markets, including India. The ongoing conflict in Ukraine, coupled with escalating tensions between the US and China, fuels global risk aversion. This uncertainty directly impacts emerging markets like India, as investors seek safer havens for their capital.

-

Specific examples of geopolitical events impacting the market: The ongoing war in Ukraine, heightened US-China trade tensions, and instability in other regions create a volatile global landscape that affects investor confidence in emerging markets.

-

Explanation of how global uncertainty affects foreign investment flows into India: Geopolitical risks often lead to reduced foreign investment flows into India, as international investors become more cautious, preferring less volatile markets. This reduced inflow can put downward pressure on Indian stock indices.

-

Discussion on the impact of rising inflation and interest rates globally: Global inflationary pressures and the subsequent tightening of monetary policies by central banks worldwide add further complexity to the market. These factors contribute to global uncertainty and risk aversion.

-

Mention of any related news from credible sources: Reports from reputable financial news outlets highlighting global geopolitical instability and its effect on market sentiment should be cited here.

Sectoral Performance and Market Breadth

While the Bajaj twins' performance dominated the headlines, a broader analysis of sectoral performance reveals a more nuanced picture. While some sectors experienced slight gains, many mirrored the overall flat market trend, suggesting a lack of broad-based enthusiasm.

-

Performance summary of key sectors (e.g., IT, banking, FMCG): Detailed analysis of individual sector performances is crucial to understand the market's overall health. For example, the IT sector might have shown resilience amidst global uncertainty, while others experienced more significant losses.

-

Discussion on the overall market breadth – was it broad-based weakness, or concentrated in specific sectors?: Determining whether the flat market reflects a broad-based weakness or concentrated losses within specific sectors is essential for accurate market analysis.

-

Mention of any significant events affecting particular sectors: News-specific events, such as regulatory changes or industry-specific announcements, could explain the performance of certain sectors.

Expert Opinions and Future Outlook

Market experts offer varying perspectives on the current market situation and its future trajectory. Many point to the ongoing geopolitical uncertainties and potential for further interest rate hikes as factors that could continue to dampen investor sentiment in the short term. However, some analysts remain optimistic about the long-term growth prospects of the Indian economy.

-

Quotes from market analysts on the current market sentiment: Include quotes or paraphrased opinions from financial experts on the prevailing market mood and the factors driving it.

-

Predictions for the Sensex and Nifty 50 in the short-term and long-term: While precise predictions are impossible, summarizing expert opinions on the short-term and long-term outlook for the Sensex and Nifty 50 offers valuable insight.

-

Advice for investors considering investing in the Indian stock market: Experts usually advise investors to maintain a diversified portfolio, carefully manage risk, and consider their own risk tolerance before making investment decisions.

Conclusion

The flat performance of the Sensex and Nifty 50 today reflects a confluence of factors, primarily the significant losses in Bajaj Finance and Bajaj Auto shares, compounded by persistent geopolitical uncertainties. Understanding the interplay between individual stock performance, like that of the Bajaj twins, and macroeconomic factors, such as global geopolitical tensions, is crucial for navigating the complexities of the Indian stock market. The current market environment emphasizes the importance of diversification, risk management, and staying informed about both global and domestic events. Stay informed on the latest developments affecting the Sensex and Nifty 50. Regularly monitor market news and consult financial experts to make informed decisions regarding your investment strategies in the Indian stock market. Understanding the nuances of market movements, such as those influenced by the performance of stocks like Bajaj twins and geopolitical tensions, is paramount for success in navigating the Sensex and Nifty 50.

Featured Posts

-

Understanding The Value Proposition Of Middle Management Benefits For Companies And Employees

May 10, 2025

Understanding The Value Proposition Of Middle Management Benefits For Companies And Employees

May 10, 2025 -

Britannian Kruununperimysjaerjestys Kuka Seuraa Kuningas Charlesia

May 10, 2025

Britannian Kruununperimysjaerjestys Kuka Seuraa Kuningas Charlesia

May 10, 2025 -

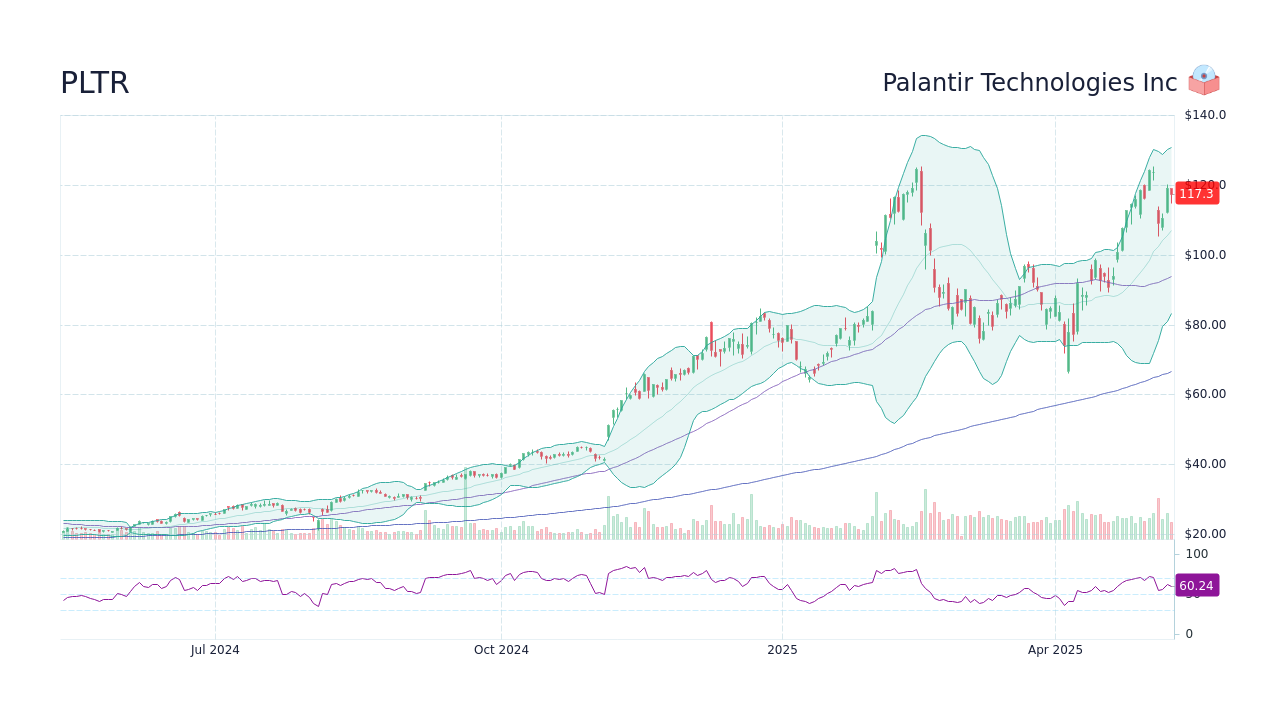

Palantir Technologies Stock Investment Potential And Future Outlook

May 10, 2025

Palantir Technologies Stock Investment Potential And Future Outlook

May 10, 2025 -

Enquete A Dijon Collision Volontaire Rue Michel Servet Le Conducteur Se Constitue Prisonnier

May 10, 2025

Enquete A Dijon Collision Volontaire Rue Michel Servet Le Conducteur Se Constitue Prisonnier

May 10, 2025 -

Your Guide To The Nl Federal Election Candidates

May 10, 2025

Your Guide To The Nl Federal Election Candidates

May 10, 2025