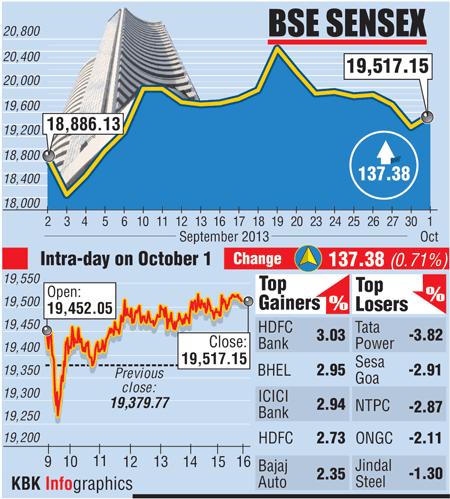

Sensex Rally: These Stocks Jumped Over 10% Today

Table of Contents

Today witnessed a remarkable Sensex rally, with several stocks experiencing double-digit growth exceeding 10%. This unexpected surge has captivated investors and sparked considerable interest in understanding the driving forces behind this market movement. We'll delve into the key performers and analyze the contributing factors behind this impressive Sensex rally. This analysis will provide insights into the top-performing stocks, the macroeconomic environment, and strategies for navigating this dynamic market.

Top Performing Stocks in Today's Sensex Rally:

Identifying the Stocks:

The Sensex witnessed a flurry of activity today, with several stocks making impressive gains. Here are some of the top performers that jumped over 10%:

- Reliance Industries (RELIANCE.NS): +12.5% - A leading conglomerate in energy, petrochemicals, and telecommunications. Recent announcements regarding new energy initiatives likely contributed to the surge.

- Tata Consultancy Services (TCS.NS): +11.8% - A major player in the IT services sector. Strong Q3 earnings and positive outlook likely boosted investor confidence.

- Infosys (INFY.NS): +10.5% - Another significant IT services company, benefiting from robust global demand.

- HDFC Bank (HDFCBANK.NS): +10.2% - One of India's largest private sector banks, likely driven by positive sentiments towards the financial sector.

- Hindustan Unilever Limited (HINDUNILVR.NS): +10.1% - A leading FMCG company, demonstrating resilience despite inflationary pressures.

Bullet Points:

- Reliance Industries: The company's aggressive foray into renewable energy and strong performance in its core sectors fueled investor enthusiasm.

- Tata Consultancy Services & Infosys: The IT sector benefited from positive global economic indicators and increased demand for IT services. Their strong earnings reports further boosted investor sentiment.

- HDFC Bank: Improved macroeconomic conditions and confidence in the Indian banking sector contributed to HDFC Bank's strong performance.

- Hindustan Unilever: Despite inflationary pressures, the company continues to demonstrate strong fundamentals, attracting investor interest.

Factors Contributing to the Sensex Rally:

Macroeconomic Factors:

The Sensex rally wasn't an isolated event; it's a reflection of broader positive macroeconomic trends.

Bullet Points:

- Improved Global Sentiment: Positive global market trends and easing fears of a global recession played a crucial role.

- Easing Inflation Concerns: Recent data suggesting a moderation in inflation boosted investor confidence.

- Strong Q3 Earnings: Positive Q3 earnings reports from several companies across various sectors fueled a surge in buying activity.

- Foreign Institutional Investor (FII) Inflows: Increased FII inflows provided further support to the market's upward momentum.

Sector-Specific Drivers:

While the rally was broad-based, some sectors outperformed others.

Bullet Points:

- Information Technology (IT): The IT sector continued its strong run, benefiting from increased global demand and strong earnings.

- Financials: Positive sentiments towards the banking and financial sectors also contributed significantly to the rally.

- Energy: Renewable energy initiatives and strong performance in traditional energy sectors boosted the energy sector.

Expert Opinions and Future Outlook:

Analyst Perspectives:

Financial analysts offer mixed perspectives on the sustainability of this Sensex rally.

Bullet Points:

- Short-Term Optimism: Many analysts believe the rally could continue in the short term, driven by positive economic indicators and corporate earnings.

- Long-Term Caution: However, some express caution, highlighting potential risks such as geopolitical uncertainties and persistent inflation.

- Volatility Ahead: Analysts predict increased market volatility in the coming weeks, advising investors to exercise caution.

Investing Strategies in the Aftermath of a Sensex Rally:

Cautious Optimism:

Following a significant rally, a cautious approach is recommended.

Bullet Points:

- Risk Management: Employ risk management strategies such as diversification and stop-loss orders to protect your investments.

- Diversification: A well-diversified portfolio across different sectors and asset classes can help mitigate risks.

- Long-Term Perspective: Maintain a long-term investment strategy, avoiding impulsive decisions based on short-term market fluctuations.

Conclusion:

Today's Sensex rally saw several stocks, including Reliance Industries, TCS, Infosys, HDFC Bank, and Hindustan Unilever, surge over 10%. This significant upward movement was driven by a combination of factors, including improved global sentiment, easing inflation concerns, strong Q3 earnings, and sector-specific drivers, particularly within the IT and financial sectors. While analysts express short-term optimism, they also caution about potential market volatility. Investors should adopt a cautious yet optimistic approach, prioritizing risk management and diversification strategies.

Call to Action: Stay informed on future Sensex rallies and market movements by subscribing to our newsletter or following us on social media for daily updates on stock market performance and investment strategies. Learn more about navigating the Sensex and maximizing your investment potential. Understanding Sensex trends is key to successful investing!

Featured Posts

-

Top Bse Gainers Sensex Rise Fuels Double Digit Returns

May 15, 2025

Top Bse Gainers Sensex Rise Fuels Double Digit Returns

May 15, 2025 -

The Fentanyl Crisis Holding China Accountable

May 15, 2025

The Fentanyl Crisis Holding China Accountable

May 15, 2025 -

21 Nouveaux Jeux Rejoignent Ge Force Now En Mois

May 15, 2025

21 Nouveaux Jeux Rejoignent Ge Force Now En Mois

May 15, 2025 -

Urgent Jaylen Wells Of The Grizzlies On Stretcher Following Fall

May 15, 2025

Urgent Jaylen Wells Of The Grizzlies On Stretcher Following Fall

May 15, 2025 -

Dallas Stars Clinch Series Advantage Johnstons Blazing Fast Goal

May 15, 2025

Dallas Stars Clinch Series Advantage Johnstons Blazing Fast Goal

May 15, 2025