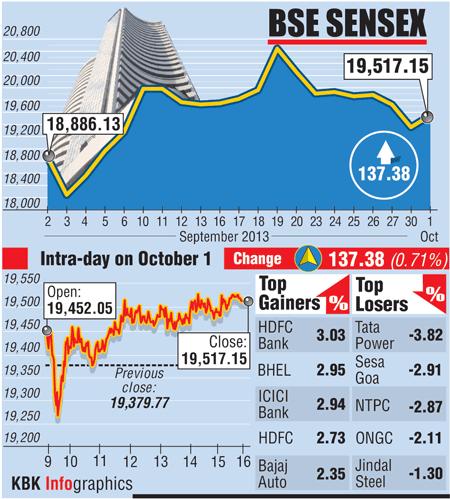

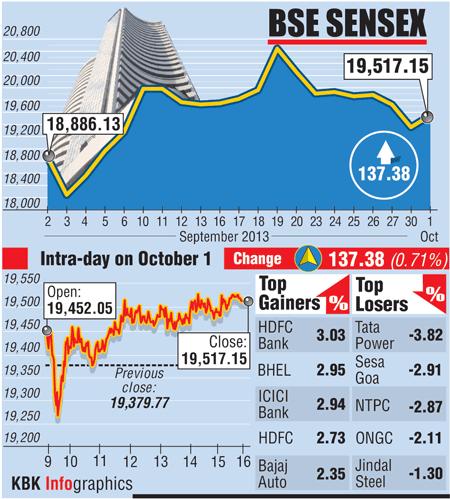

Top BSE Gainers: Sensex Rise Fuels Double-Digit Returns

Table of Contents

Keywords: Top BSE Gainers, BSE Gainers Today, Sensex Rise, Double-Digit Returns, Stock Market, Indian Stock Market, Investment Opportunities, Stock Market Analysis, Sensex Index, Market Volatility, Economic Growth, Investor Sentiment, Sectoral Performance, Top Performing Stocks, High Growth Sectors, Stock Analysis, Investment Strategy, Risk Assessment, Return on Investment, Investment Strategies, Risk Management, Portfolio Diversification, Financial Planning

The Indian stock market is buzzing! A significant surge in the Sensex has propelled several stocks to impressive double-digit returns, creating exciting opportunities for investors. This article delves into the reasons behind this recent market rally, identifies the top BSE gainers, and provides insights into potential investment strategies. Let's explore the current landscape of top BSE gainers and the factors driving their success.

Understanding the Sensex's Recent Surge

The recent rise in the Sensex Index isn't a random event; it's a confluence of factors contributing to a positive market sentiment. Several key elements are fueling this growth:

- Positive Global Market Sentiment: A generally optimistic outlook in global markets, driven by factors such as easing inflation concerns in some regions and positive economic data, has boosted investor confidence, leading to increased investment in the Indian stock market.

- Strong Corporate Earnings Reports: Many Indian companies have reported robust earnings, exceeding market expectations. This strong performance reflects a healthy economic climate and reinforces investor confidence in the long-term prospects of these businesses.

- Government Policy Announcements Boosting Investor Confidence: Government initiatives aimed at stimulating economic growth and improving the business environment have played a crucial role in boosting investor sentiment. These policies create a favorable environment for businesses to thrive.

- Increased Foreign Institutional Investment (FII): Significant inflows of foreign institutional investment into the Indian stock market indicate a strong belief in the country's economic potential. This influx of capital further fuels market growth and drives up stock prices.

The Sensex's recent performance demonstrates the interplay between global and domestic factors, highlighting the dynamic nature of the Indian stock market. Market volatility, while always present, appears to be relatively subdued in the face of these positive trends. This period of economic growth has fostered a positive investor sentiment.

Top Performing Sectors and Their BSE Gainers

Several sectors have significantly outperformed the market in this recent rally. Let's examine some of the top-performing sectors and their star performers:

IT Sector: The IT sector has experienced remarkable growth, driven by:

- Strong Export Orders: Increased demand for technology services from global clients has fueled substantial growth for Indian IT companies.

- Increased Demand for Technology Services: The ongoing digital transformation across various industries globally continues to drive demand for IT services.

- Favorable Government Policies: Government initiatives promoting digitalization and technological advancement have created a conducive environment for the IT sector.

Top BSE Gainers (IT Sector – Example): (Note: Replace with actual data and ticker symbols)

- Infosys (INFY): +15%

- Tata Consultancy Services (TCS): +12%

- HCL Technologies (HCLT): +10%

(Repeat this section for other top-performing sectors, such as Pharma and Banking, with relevant data and examples.)

Analyzing Individual Top BSE Gainers and their Potential

Let's take a closer look at three top BSE gainers that have shown exceptional double-digit returns:

(Example – Replace with actual data and company information):

- Company A (TICKER): A leading pharmaceutical company known for its innovative drug development. Strong Q3 results and positive clinical trial data have driven this stock's impressive performance. However, dependence on a few key drugs presents a risk.

- Company Overview: Leading pharmaceutical company.

- Reasons for strong performance: Strong Q3 results, positive clinical trial data.

- Financial highlights: High revenue growth, increasing profit margins.

- Potential future growth prospects: Expansion into new markets, pipeline of innovative drugs.

- Associated risks: Dependence on a few key drugs, regulatory hurdles.

(Repeat this section for two more top-performing companies.) Remember to replace this example data with actual stock information and analysis.

Investing in Top BSE Gainers: Strategies and Considerations

Investing in high-performing stocks like these top BSE gainers can be lucrative, but it's crucial to approach it strategically:

- Importance of Research and Due Diligence: Thorough research is paramount before investing in any stock. Understand the company's fundamentals, financial performance, and future prospects.

- Diversification Across Sectors and Stocks: Don't put all your eggs in one basket. Diversify your investments across different sectors and stocks to mitigate risk.

- Setting Realistic Investment Goals: Define your investment goals and time horizon. This helps you make informed decisions aligned with your financial objectives.

- Understanding Risk Tolerance: Assess your risk tolerance before investing in potentially volatile stocks. High returns often come with higher risk.

- Consulting a Financial Advisor: Consider seeking advice from a qualified financial advisor to create a personalized investment strategy that aligns with your financial goals and risk profile.

Disclaimer: Investing in the stock market involves inherent risks. Past performance is not indicative of future results. This information is for educational purposes only and should not be considered financial advice.

Conclusion

The recent Sensex rise has created a wave of opportunities in the Indian stock market, with several top BSE gainers achieving impressive double-digit returns. Understanding the factors driving this market surge, identifying top-performing sectors, and carefully analyzing individual stocks are key to capitalizing on these opportunities. Remember to conduct thorough research, diversify your portfolio, and manage your risk effectively. Stay informed about the latest developments in the Indian stock market by regularly checking for updates on top BSE gainers. Learn more about investment strategies that can help you capitalize on future opportunities in the market and track the top BSE gainers to maximize your returns.

Featured Posts

-

Police Apprehend Individual Gsw Campus Secure

May 15, 2025

Police Apprehend Individual Gsw Campus Secure

May 15, 2025 -

Justice Sought Trans Master Sergeant Fights Unjust Discharge

May 15, 2025

Justice Sought Trans Master Sergeant Fights Unjust Discharge

May 15, 2025 -

Reciprocal Tariffs Assessing Second Order Risks To Key Indian Sectors

May 15, 2025

Reciprocal Tariffs Assessing Second Order Risks To Key Indian Sectors

May 15, 2025 -

Assessing The Impact Of Trumps Tariffs On Californias 16 Billion Revenue Loss

May 15, 2025

Assessing The Impact Of Trumps Tariffs On Californias 16 Billion Revenue Loss

May 15, 2025 -

Paddy Pimblett Predicts Ufc 314 Victory Eyes Championship Shot

May 15, 2025

Paddy Pimblett Predicts Ufc 314 Victory Eyes Championship Shot

May 15, 2025