Sensex Today: 800+ Point Surge, Nifty Above 18,500 - LIVE Updates

Table of Contents

Driving Forces Behind Today's Sensex and Nifty Rally

Several factors contributed to the remarkable performance of the Sensex and Nifty today. Let's explore the key drivers:

Global Market Sentiment

Positive global cues played a significant role in boosting investor sentiment. The improved outlook from US markets, fueled by positive economic indicators and easing inflation concerns, had a knock-on effect on the Indian stock market.

- Stronger-than-expected US jobs data indicated a resilient economy.

- Positive earnings reports from major US tech companies instilled confidence.

- Easing inflation concerns reduced anxieties about aggressive interest rate hikes.

This positive global sentiment significantly improved investor confidence, leading to increased buying activity in the Indian market.

Sector-Specific Performance

The rally wasn't uniform across all sectors. Certain sectors significantly outperformed others, contributing heavily to the overall surge.

- IT Sector: The IT sector witnessed substantial gains, driven by positive quarterly results and optimistic future growth projections from leading companies. Percentage gains ranged from 2% to 5% for several key players.

- Banking and Financials: The banking and financial sectors also showed impressive growth, fueled by positive regulatory developments and improved credit growth. This sector saw gains averaging around 3-4%.

- Pharmaceuticals: Positive news regarding new drug approvals and strong export numbers contributed to the robust performance of pharmaceutical stocks.

Key Stocks Leading the Charge

Several individual stocks played a crucial role in driving the indices higher.

- Reliance Industries experienced a significant surge, boosted by positive news on its energy and petrochemical businesses.

- Infosys and TCS saw strong gains due to positive quarterly earnings and an optimistic outlook.

- HDFC Bank and ICICI Bank contributed significantly to the banking sector's robust performance.

Technical Analysis of Sensex and Nifty's Movement

Analyzing the technical aspects of today's market movement provides valuable insights into the underlying trends.

Chart Patterns

The charts displayed several bullish patterns, suggesting strong upward momentum.

- A clear breakout above a significant resistance level was observed in both the Sensex and Nifty charts.

- Bullish engulfing candlesticks confirmed the strength of the upward trend.

- The Relative Strength Index (RSI) indicated a strong buying momentum. (Include a chart here showing these patterns)

Trading Volume and Volatility

Trading volume increased significantly compared to previous days, indicating strong participation from investors. While volatility was present, it remained within acceptable levels, suggesting a relatively orderly market movement.

- Trading volume was approximately 20% higher than the average daily volume for the last week.

- Volatility, as measured by the VIX index, remained below the critical threshold, suggesting a stable market environment.

Expert Opinions and Market Outlook (Sensex & Nifty Predictions)

Market experts offer varied perspectives on the current market situation and future prospects.

Analyst Views

Several analysts believe that the current rally is sustainable, citing strong underlying economic fundamentals and positive global sentiment. However, others caution against excessive optimism, highlighting potential risks.

- "The Indian market is well-positioned for further growth, driven by strong domestic demand and positive global cues," stated leading market analyst, [Analyst's Name].

- Another analyst cautioned, "While the current rally is encouraging, investors should remain cautious about potential geopolitical risks and inflation concerns."

Potential Risks and Cautions

Despite the positive momentum, several potential risks could impact future market performance.

- Geopolitical uncertainties remain a concern, potentially affecting investor sentiment.

- Inflationary pressures could lead to further interest rate hikes, impacting market valuations.

- Global economic slowdown could dampen the growth outlook for Indian companies.

Conclusion: Sensex and Nifty's Impressive Performance – What's Next?

Today's market witnessed an impressive surge, with the Sensex gaining over 800 points and the Nifty crossing 18,500. This rally was driven by positive global sentiment, strong sector-specific performance, and impressive gains in several key stocks. While experts remain optimistic, potential risks need to be considered. To stay informed about future market movements and receive continuous updates on Sensex and Nifty performance, stay tuned for more "Sensex Today" and "Nifty Today" live updates. Subscribe to our newsletter or check back regularly for further in-depth market analysis.

Featured Posts

-

The Canadian Dream Deferred Exploring The High Cost Of Homeownership

May 09, 2025

The Canadian Dream Deferred Exploring The High Cost Of Homeownership

May 09, 2025 -

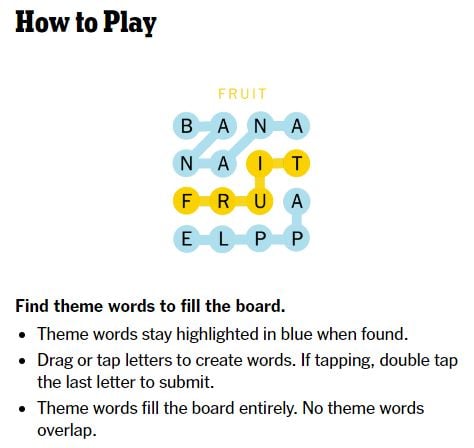

Nyt Spelling Bee April 9 2025 Strands Find The Pangram And All Words

May 09, 2025

Nyt Spelling Bee April 9 2025 Strands Find The Pangram And All Words

May 09, 2025 -

Su Viec Bao Mau Tat Tre O Tien Giang Bai Hoc Ve An Toan Tre Em

May 09, 2025

Su Viec Bao Mau Tat Tre O Tien Giang Bai Hoc Ve An Toan Tre Em

May 09, 2025 -

Harassment Case Polish Woman And Associate Deny Targeting Mc Cann Family Home

May 09, 2025

Harassment Case Polish Woman And Associate Deny Targeting Mc Cann Family Home

May 09, 2025 -

R4 5

May 09, 2025

R4 5

May 09, 2025

Latest Posts

-

Dealing With Risque Comedy Bert Kreischer And His Wifes Experience

May 10, 2025

Dealing With Risque Comedy Bert Kreischer And His Wifes Experience

May 10, 2025 -

Exploring Bert Kreischers Netflix Content And His Wifes Perspective

May 10, 2025

Exploring Bert Kreischers Netflix Content And His Wifes Perspective

May 10, 2025 -

Bert Kreischers Netflix Stand Up A Look At His Marriage And Material

May 10, 2025

Bert Kreischers Netflix Stand Up A Look At His Marriage And Material

May 10, 2025 -

How Bert Kreischers Wife Feels About His Netflix Sex Jokes

May 10, 2025

How Bert Kreischers Wife Feels About His Netflix Sex Jokes

May 10, 2025