The Canadian Dream Deferred: Exploring The High Cost Of Homeownership

Table of Contents

Skyrocketing House Prices: A National Crisis

The Canadian housing market is experiencing a crisis of affordability. House prices have been escalating at an alarming rate, making homeownership a distant dream for many. This rapid increase is a complex issue with several contributing factors.

H3: Factors Driving Up Prices:

-

Limited housing supply: Urban sprawl limitations, restrictive zoning regulations, and a lack of investment in new construction have created a significant shortage of housing units, especially in major urban centers. This scarcity drives up prices, exacerbating the affordability problem. The slow approval process for new developments further contributes to this issue.

-

Increased demand: Canada's growing population, fueled by both natural increase and immigration, is placing significant pressure on the housing market. More people competing for a limited number of homes inevitably drives up prices. This increased demand is particularly acute in popular urban areas.

-

Low interest rates (past policies fueling speculation): Historically low interest rates, while intended to stimulate the economy, inadvertently fueled speculation in the real estate market. Easy access to credit encouraged investors to purchase properties, driving up prices further. This created a bubble, which is now impacting affordability.

-

Foreign investment in the real estate market: Foreign investment, while contributing to the economy, has also played a role in inflating house prices in some Canadian cities. The influx of capital from international sources increases competition and pushes prices higher. This is particularly notable in Vancouver and Toronto.

-

Speculation and flipping of properties: The practice of purchasing properties with the intention of quickly reselling them at a higher price (flipping) contributes to market volatility and price inflation. This speculative activity exacerbates the already challenging affordability landscape.

Bullet Points:

- The average price of a home in Toronto has increased by X% in the last Y years, while Vancouver has seen a Z% increase. Montreal has also experienced significant price growth, although at a slightly slower pace.

- The average Canadian household income is significantly lower than the average price of a home, creating a vast affordability gap.

- Compared to other developed nations, Canada's housing prices are among the highest, making it significantly more difficult for Canadians to afford a home.

The Impact of Rising Interest Rates

The Bank of Canada's efforts to combat inflation have led to a significant increase in interest rates. This has had a profound impact on the Canadian housing market, further hindering affordability.

H3: Mortgage Affordability Challenges:

-

The effects of rising interest rates on monthly mortgage payments: Higher interest rates translate directly into higher monthly mortgage payments, making it more difficult for homeowners to manage their finances. Even a small increase in the interest rate can significantly impact affordability.

-

Stress tests and their impact on borrowing capacity: Stricter stress tests implemented by financial institutions limit the amount prospective homebuyers can borrow, making it harder to qualify for a mortgage. These tests are designed to protect borrowers, but they also reduce purchasing power.

-

The increased difficulty for first-time homebuyers to secure mortgages: First-time homebuyers, who often have less financial stability and smaller down payments, are disproportionately affected by rising interest rates and stricter lending criteria. They face an uphill battle in securing a mortgage in the current market.

Bullet Points:

- Mortgage rates have increased by X% in the last Y months, substantially impacting affordability.

- Households earning less than $X annually face significant difficulties affording a mortgage in major Canadian cities.

- The psychological stress associated with escalating housing costs and the fear of mortgage default is a growing concern.

Government Policies and Their Effectiveness

The Canadian government has implemented several policies aimed at improving housing affordability. However, the effectiveness of these initiatives remains a subject of ongoing debate.

H3: Current Government Initiatives:

-

Analysis of existing federal and provincial housing policies: Policies like the First-Time Home Buyer Incentive aim to help Canadians enter the housing market. However, their impact on overall affordability has been limited. Other initiatives focus on increasing the supply of affordable housing, but progress remains slow.

-

Evaluation of the effectiveness of these policies: While these programs offer some support, their impact is often marginal compared to the scale of the affordability challenge. Many argue that more comprehensive and innovative solutions are necessary.

-

Discussion of potential policy improvements and alternative solutions: Experts suggest exploring alternative approaches, such as streamlining approval processes for new housing developments, implementing stronger regulations to curb speculation, and investing heavily in affordable housing projects.

Bullet Points:

- The First-Time Home Buyer Incentive has helped a limited number of Canadians, but its impact on the overall market is negligible.

- Tax policies and land-use regulations significantly influence housing prices, highlighting the importance of reviewing these frameworks.

- Innovative solutions, such as increased density in urban areas and incentivizing the construction of affordable housing, could alleviate the crisis.

The Long-Term Consequences of the Deferred Canadian Dream

The inability of many Canadians to achieve homeownership has profound long-term consequences for individuals, families, and the economy.

H3: Social and Economic Impacts:

-

The impact on intergenerational wealth transfer: The high cost of housing is hindering the ability of older generations to transfer wealth to their children, perpetuating economic inequality. The traditional pathway of homeownership as a means of wealth building is becoming increasingly difficult.

-

Effects on family formation and population growth: The difficulty of securing affordable housing can delay or prevent family formation, potentially impacting Canada's long-term population growth. Young adults may postpone starting families due to financial constraints.

-

Increased inequality and social stratification: The widening gap between house prices and incomes contributes to increased social and economic inequality. The dream of homeownership becomes increasingly exclusive, exacerbating existing disparities.

Bullet Points:

- Homeownership rates among young Canadians are declining, signaling a growing affordability crisis.

- Housing insecurity contributes to increased stress, anxiety, and mental health challenges.

- A stagnant housing market can negatively impact economic growth and overall prosperity.

Conclusion

The high cost of homeownership in Canada is a multifaceted issue with significant social and economic consequences. Skyrocketing house prices, rising interest rates, and limited supply have created a challenging environment for prospective homebuyers, delaying or denying many Canadians the "Canadian Dream" of owning a home. Government policies, while well-intentioned, have not always been effective in addressing the root causes of this crisis. The Canadian Dream Deferred is not simply a housing crisis; it's a societal challenge demanding comprehensive solutions.

Call to Action: Understanding the complexities of the "Canadian Dream Deferred" is crucial for advocating for meaningful change. We need to push for innovative solutions that address affordability challenges, promote sustainable housing development, and ensure that homeownership remains a realistic goal for future generations. Join the conversation and let's work together to find solutions to address the high cost of homeownership in Canada, ensuring the Canadian Dream is attainable for all.

Featured Posts

-

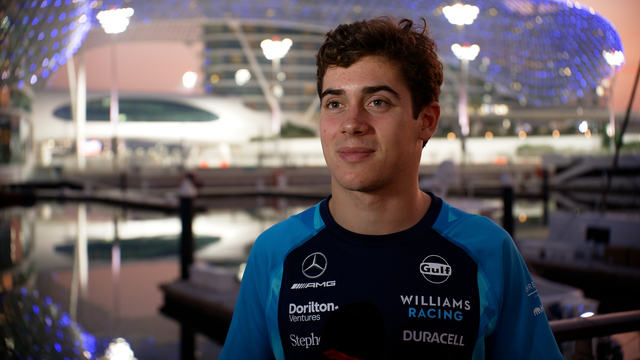

Formula 1s Next Star Colapinto Emerges As Strong Contender

May 09, 2025

Formula 1s Next Star Colapinto Emerges As Strong Contender

May 09, 2025 -

Analyzing The Potential For Bitcoin To Reach 100 000 Under Trumps Presidency

May 09, 2025

Analyzing The Potential For Bitcoin To Reach 100 000 Under Trumps Presidency

May 09, 2025 -

2025 Iditarod Ceremonial Start A Spectacle In Downtown Anchorage

May 09, 2025

2025 Iditarod Ceremonial Start A Spectacle In Downtown Anchorage

May 09, 2025 -

The Tesla Dogecoin Connection Analyzing Recent Market Volatility

May 09, 2025

The Tesla Dogecoin Connection Analyzing Recent Market Volatility

May 09, 2025 -

Should You Buy Palantir Stock Before May 5 A Prudent Investors Guide

May 09, 2025

Should You Buy Palantir Stock Before May 5 A Prudent Investors Guide

May 09, 2025

Latest Posts

-

Exclusive Nottingham Attack Survivors Emotional Account Of The Tragedy

May 09, 2025

Exclusive Nottingham Attack Survivors Emotional Account Of The Tragedy

May 09, 2025 -

Nottingham Attack Survivor Speaks Out I Wish He D Taken Me Instead

May 09, 2025

Nottingham Attack Survivor Speaks Out I Wish He D Taken Me Instead

May 09, 2025 -

Character Development In Wynne And Joanna All At Sea

May 09, 2025

Character Development In Wynne And Joanna All At Sea

May 09, 2025 -

Sex Slur Scandal Wynne Evans Removed From Go Compare Advertisements

May 09, 2025

Sex Slur Scandal Wynne Evans Removed From Go Compare Advertisements

May 09, 2025 -

Wynne And Joanna All At Sea A Deep Dive Into The Narrative

May 09, 2025

Wynne And Joanna All At Sea A Deep Dive Into The Narrative

May 09, 2025