Seven Tech Titans: $2.5 Trillion In Lost Market Value This Year

Table of Contents

The Role of Rising Interest Rates in the Tech Sector Downturn

Increased interest rates represent a major headwind for tech companies, many of which rely heavily on future growth projections for their valuations. Higher interest rates directly impact:

- Increased Borrowing Costs: Tech companies often rely on debt financing for expansion and innovation. Higher rates make borrowing more expensive, reducing profitability and impacting investment strategies.

- Lower Valuation Multiples: Higher rates increase the discount rate used in discounted cash flow (DCF) models, a common valuation method for tech stocks. This leads to lower valuations, as future earnings are discounted more heavily.

- Reduced Investment: Higher bond yields make government bonds more attractive, diverting investment away from riskier tech stocks.

Examples include companies like [mention specific examples, e.g., Meta, Amazon] whose valuations have been significantly affected by rising interest rates set by the Federal Reserve in response to persistent inflation.

Inflation and its Impact on Consumer Spending and Tech Demand

Soaring inflation has significantly eroded consumer purchasing power, leading to reduced demand for non-essential tech products. This impacts various sectors:

- Consumer Electronics: Sales of smartphones, laptops, and other consumer electronics have slowed as consumers tighten their belts.

- Software-as-a-Service (SaaS): While SaaS companies might be less directly affected by immediate spending cuts, prolonged inflation can lead to reduced customer acquisition and increased churn.

Companies like [mention specific examples, e.g., Apple, Microsoft] have reported slower growth or decreased sales, reflecting this decreased consumer demand driven by the economic slowdown and recessionary fears.

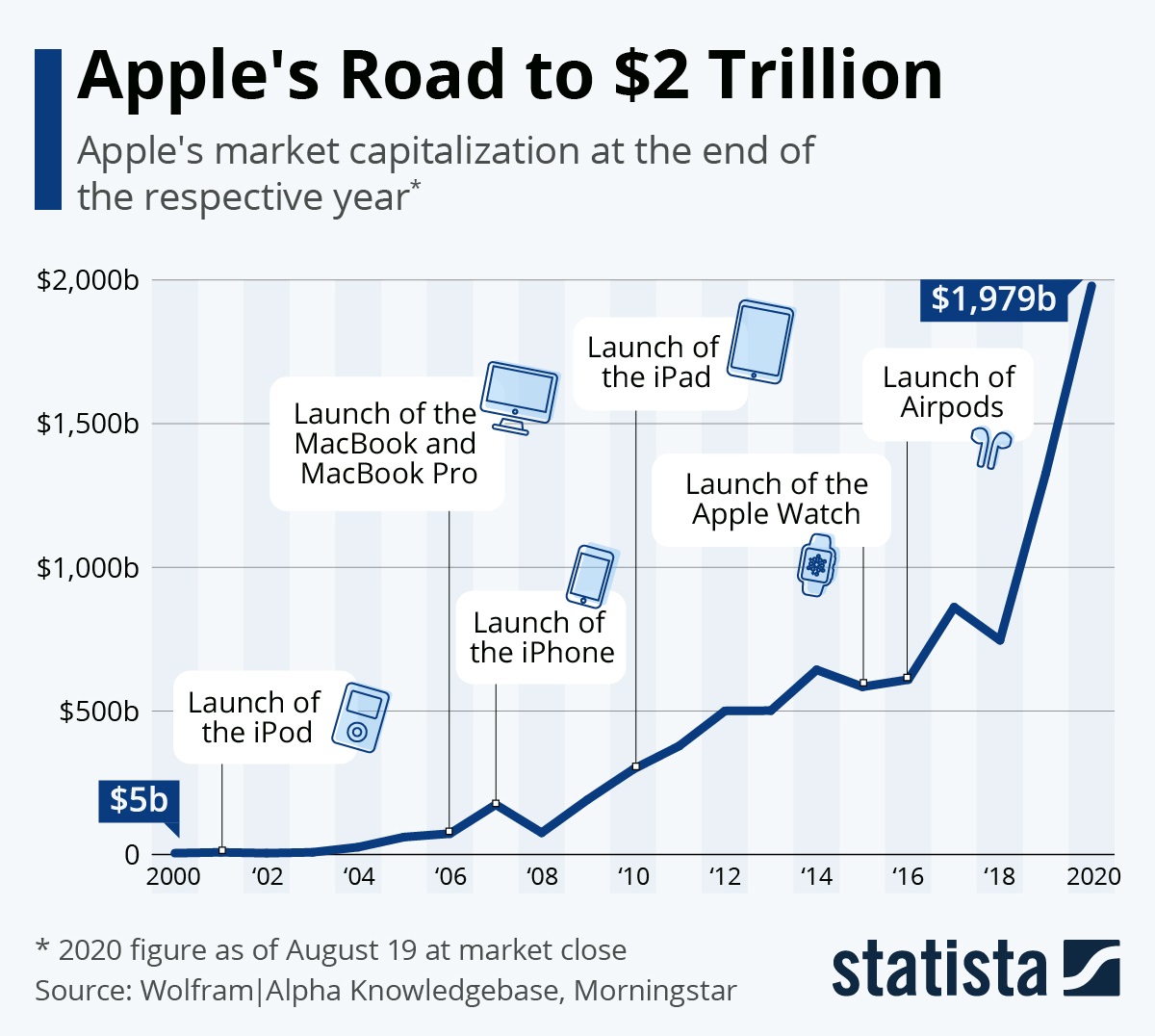

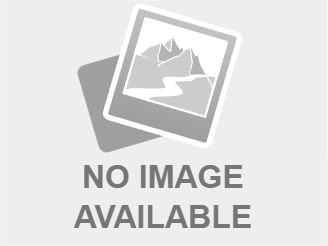

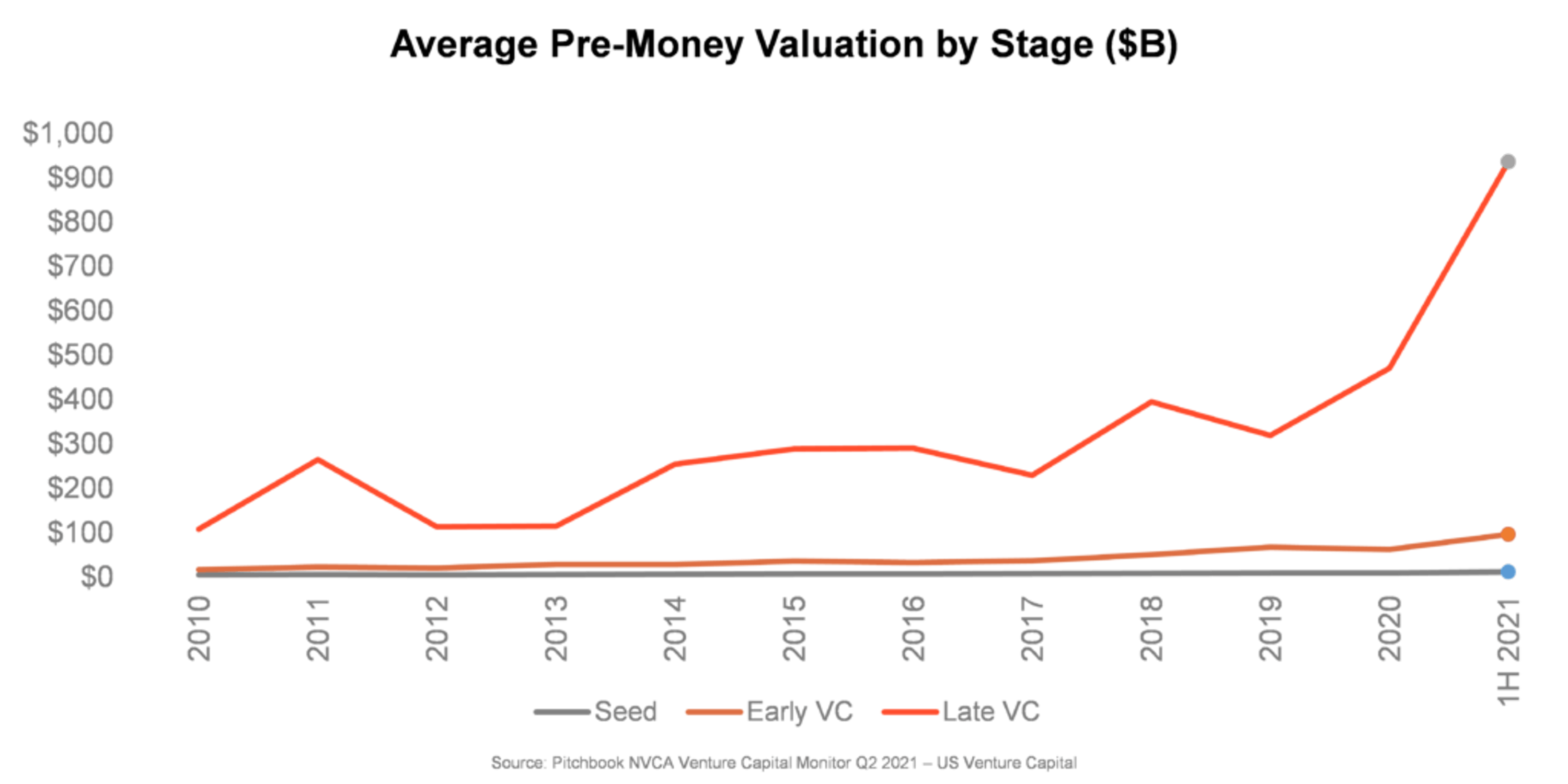

The Overvaluation Correction in the Tech Market

The tech sector experienced a period of significant overvaluation leading up to 2024. Speculative investment fueled by abundant venture capital inflated valuations beyond sustainable levels. This led to:

- A Stock Bubble: The rapid rise in valuations was unsustainable and ultimately resulted in a correction, with prices falling back to more realistic levels.

- Decreased Investor Confidence: As overvaluation became apparent, investor confidence waned, triggering a sell-off.

This correction is a natural market mechanism adjusting for previous excesses, but the speed and magnitude of the correction have been dramatic.

Geopolitical Factors and Supply Chain Disruptions

Geopolitical instability and persistent supply chain disruptions have added further pressure on the tech sector.

- Trade Wars and Sanctions: Disruptions to global trade, particularly concerning semiconductors, have impacted manufacturing and production timelines.

- Geopolitical Uncertainty: Global events create uncertainty, making investors more risk-averse and impacting investment in the tech sector.

The ongoing semiconductor shortage exemplifies the impact of geopolitical factors and supply chain vulnerabilities on the tech industry's ability to meet demand.

The Impact of Increased Competition and Market Saturation

Intense competition within the tech industry, coupled with market saturation in certain segments, has created challenges for many companies.

- Market Share Battles: Companies are fiercely competing for market share, leading to price wars and reduced profit margins.

- Disruptive Technologies: The emergence of disruptive technologies can quickly render established players obsolete.

This competitive landscape necessitates constant innovation and adaptation to survive.

The Shift in Investor Sentiment and Risk Appetite

A significant shift in investor sentiment and risk appetite has contributed to the tech crash.

- Flight to Safety: Investors are moving away from riskier assets like tech stocks towards safer investments like government bonds.

- Increased Risk Aversion: The overall economic uncertainty has increased risk aversion among investors.

This shift reflects a broader macroeconomic trend impacting the overall stock market volatility.

Looking Ahead: Predictions and Potential Recovery Scenarios

Predicting the future of the tech sector is challenging, but several scenarios are possible:

- Gradual Recovery: A slow and steady recovery, driven by technological innovation and improved economic conditions.

- V-Shaped Recovery: A quick rebound driven by positive market sentiment and investor confidence.

- Prolonged Downturn: A sustained period of low growth or decline if underlying economic conditions don't improve.

Long-term growth will depend on the ability of tech companies to adapt to the changing economic landscape and continue to innovate.

Conclusion: Navigating the Tech Market After a $2.5 Trillion Loss

The $2.5 trillion loss in market value among seven tech titans reflects a confluence of factors: rising interest rates, inflation, overvaluation correction, geopolitical risks, increased competition, and a shift in investor sentiment. The future of the tech sector remains uncertain, but understanding these factors is crucial for navigating the market. Stay ahead of the curve by staying informed about market trends and developing a robust investment strategy to make informed investment decisions and master the tech market. Understanding the forces that influence tech stock performance and market capitalization is more critical than ever.

Featured Posts

-

Mwaeyd Wamakn Fealyat Fn Abwzby Ybda 19 Nwfmbr

Apr 29, 2025

Mwaeyd Wamakn Fealyat Fn Abwzby Ybda 19 Nwfmbr

Apr 29, 2025 -

Minnesota Twins Win Over New York Mets 6 3

Apr 29, 2025

Minnesota Twins Win Over New York Mets 6 3

Apr 29, 2025 -

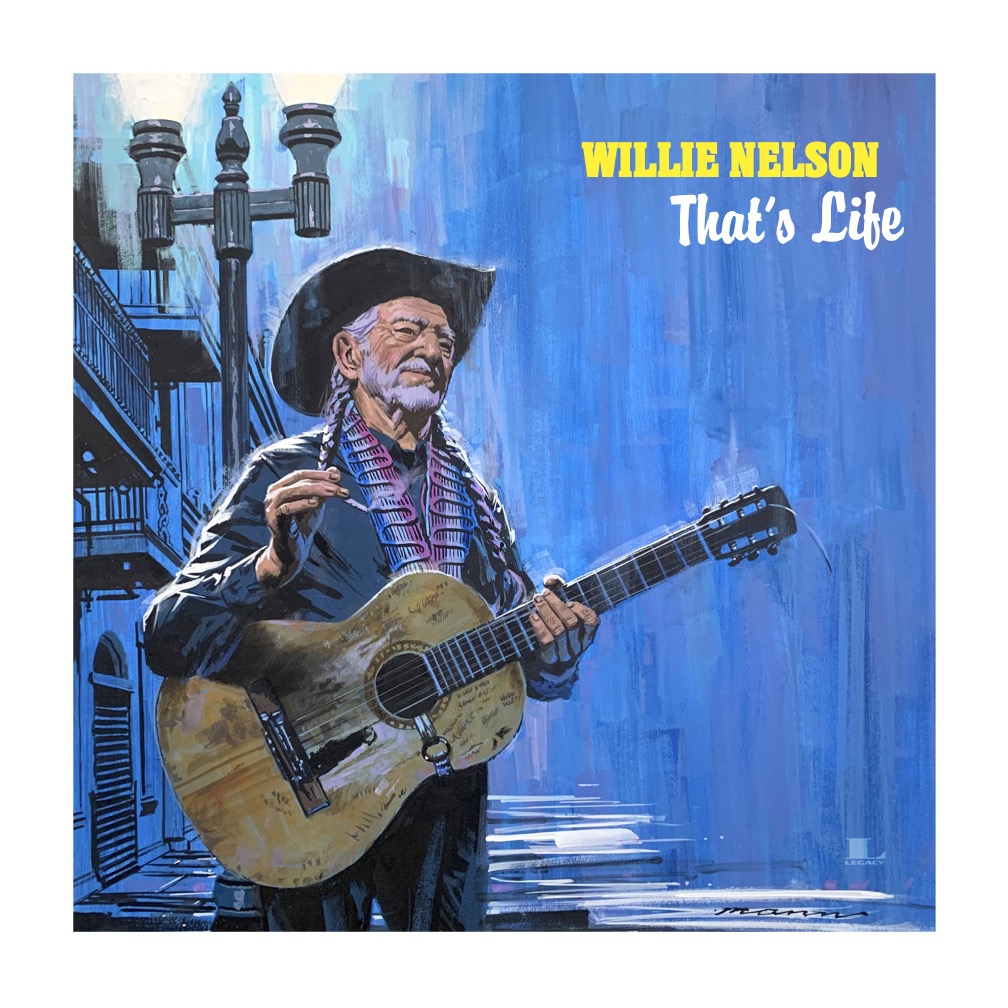

Wife Of Willie Nelson Addresses Media Inaccuracies

Apr 29, 2025

Wife Of Willie Nelson Addresses Media Inaccuracies

Apr 29, 2025 -

The Growing Appeal Of The Venture Capital Secondary Market

Apr 29, 2025

The Growing Appeal Of The Venture Capital Secondary Market

Apr 29, 2025 -

Resistance Grows Car Dealerships Renew Fight Against Electric Vehicle Regulations

Apr 29, 2025

Resistance Grows Car Dealerships Renew Fight Against Electric Vehicle Regulations

Apr 29, 2025

Latest Posts

-

Willie Nelsons Health Concerns Rise Amidst Rigorous Touring Schedule

Apr 29, 2025

Willie Nelsons Health Concerns Rise Amidst Rigorous Touring Schedule

Apr 29, 2025 -

Willie Nelsons Outlaw Music Festival Bob Dylan And Billy Strings In Portland

Apr 29, 2025

Willie Nelsons Outlaw Music Festival Bob Dylan And Billy Strings In Portland

Apr 29, 2025 -

Willie Nelson New Album Release Overshadowed By Family Drama

Apr 29, 2025

Willie Nelson New Album Release Overshadowed By Family Drama

Apr 29, 2025 -

At And T Sounds Alarm On Broadcoms Extreme V Mware Price Increase

Apr 29, 2025

At And T Sounds Alarm On Broadcoms Extreme V Mware Price Increase

Apr 29, 2025 -

Austin City Limits Celebrating Willie Nelson And Familys Legacy

Apr 29, 2025

Austin City Limits Celebrating Willie Nelson And Familys Legacy

Apr 29, 2025