Shareholder Litigation Against Tesla: The Fallout From Elon Musk's Compensation

Table of Contents

The Structure of Elon Musk's Compensation Package and its Controversies

Elon Musk's compensation package, approved in 2018, is structured around achieving ambitious performance milestones. It grants him stock options contingent on Tesla reaching specific market capitalization and operational targets over a 10-year period. This seemingly straightforward structure, however, has become the focal point of intense criticism and subsequent shareholder litigation.

The criticisms leveled against the package are multifaceted:

- Excessive Size and Potential for Misalignment of Incentives: The sheer size of the potential payout, potentially reaching tens of billions of dollars, dwarfs typical executive compensation packages. This raises concerns about whether such an enormous reward incentivizes actions in the best interest of shareholders or primarily benefits Musk himself.

- Lack of Transparency and Shareholder Input in the Approval Process: Critics argue that the approval process lacked transparency and sufficient shareholder input. The complexity of the compensation plan made it difficult for shareholders to fully understand its implications before voting.

- Concerns about the Achievability of Performance Targets and Potential Manipulation: Some argue that the performance targets, while ambitious, were not necessarily unattainable given Tesla's rapid growth trajectory. This raises concerns about potential manipulation of targets or prioritizing short-term gains over long-term shareholder value.

- Comparison to Executive Compensation at Other Companies: Compared to compensation packages at similar companies, Musk's compensation stands out significantly. This disparity further fuels the argument that the package is excessive and lacks justification.

Legally, these criticisms translate into arguments of breach of fiduciary duty, claiming that the Tesla board failed to act in the best interests of shareholders when approving such a generous package.

Key Arguments Presented in Shareholder Lawsuits

Several shareholder lawsuits have been filed, including derivative lawsuits (brought on behalf of the company) and class-action lawsuits (brought on behalf of a group of shareholders). These lawsuits center on several key claims:

- Waste of Corporate Assets: Plaintiffs argue that the compensation package represents a waste of corporate assets, given its potentially exorbitant cost and questionable alignment with shareholder interests.

- Breach of Fiduciary Duty by the Board of Directors: The lawsuits allege that the board of directors breached their fiduciary duty by approving a compensation plan that is excessively generous and lacks adequate justification.

- Violation of Corporate Governance Best Practices: The lawsuits contend that the approval process violated established corporate governance best practices regarding transparency, shareholder input, and the fair assessment of executive compensation.

- Failure to Adequately Disclose the Risks Associated with the Compensation Package: Shareholders claim that the risks associated with the compensation package were not adequately disclosed, preventing them from making informed decisions.

Legal precedent regarding executive compensation and fiduciary duty will play a crucial role in determining the outcome of these cases. Cases involving excessive CEO pay and insufficient board oversight will be key references.

The Role of the Tesla Board of Directors

The Tesla board's role in approving the compensation plan is central to the ongoing litigation. The independence and objectivity of the board members are being scrutinized. The process by which they evaluated and approved the plan, including the level of due diligence conducted, will be key evidence in the lawsuits. Individual directors could face personal liability if found to have acted negligently or in bad faith. The composition of the board, potential conflicts of interest, and the board's understanding of the compensation's financial implications will all come under intense legal examination.

Potential Outcomes and Implications of the Litigation

The lawsuits could result in several outcomes: settlements, dismissals, or judgments against Tesla or Elon Musk. A settlement could involve Tesla modifying the compensation package or making financial payments to shareholders. A dismissal would end the case without any repercussions. An adverse judgment could lead to significant financial penalties for Tesla and potentially for Elon Musk personally.

The financial implications are substantial. A large judgment could significantly impact Tesla's financial performance and its stock price. The broader implications extend beyond Tesla, affecting corporate governance and executive compensation practices across various industries.

- Increased Scrutiny of Executive Pay: The case is expected to increase scrutiny of executive compensation packages across the board, leading to greater transparency and accountability.

- Potential for Regulatory Changes: The lawsuits may prompt regulatory changes aimed at strengthening corporate governance rules regarding executive compensation.

- Impact on Investor Confidence: The outcome of the litigation will likely impact investor confidence in Tesla and potentially in other companies with similar compensation structures.

The Future of Shareholder Activism at Tesla

The shareholder litigation against Tesla signifies a rise in shareholder activism concerning executive compensation. This case is likely to embolden other shareholders to challenge excessive executive pay packages and demand greater transparency and accountability from corporate boards. Future shareholder litigation may target other corporate decisions made by Tesla's management, highlighting the increasing power and influence of active shareholders. The growing importance of Environmental, Social, and Governance (ESG) factors in investor decision-making further strengthens the trend of shareholder activism, linking corporate responsibility with financial performance.

Conclusion

The shareholder litigation against Tesla resulting from Elon Musk's compensation package presents a crucial case study in corporate governance and executive compensation. The lawsuits highlight concerns about excessive executive pay, lack of transparency, and potential breaches of fiduciary duty. The potential outcomes could significantly impact Tesla's financial performance, influence regulatory changes, and reshape corporate governance best practices. Stay informed about the ongoing developments in this crucial case of shareholder litigation against Tesla and its implications for corporate accountability. Further research into the details of the lawsuits and their legal ramifications is encouraged to understand the complexities of executive compensation and shareholder rights. Understanding Tesla shareholder litigation is critical for investors and anyone interested in corporate governance best practices.

Featured Posts

-

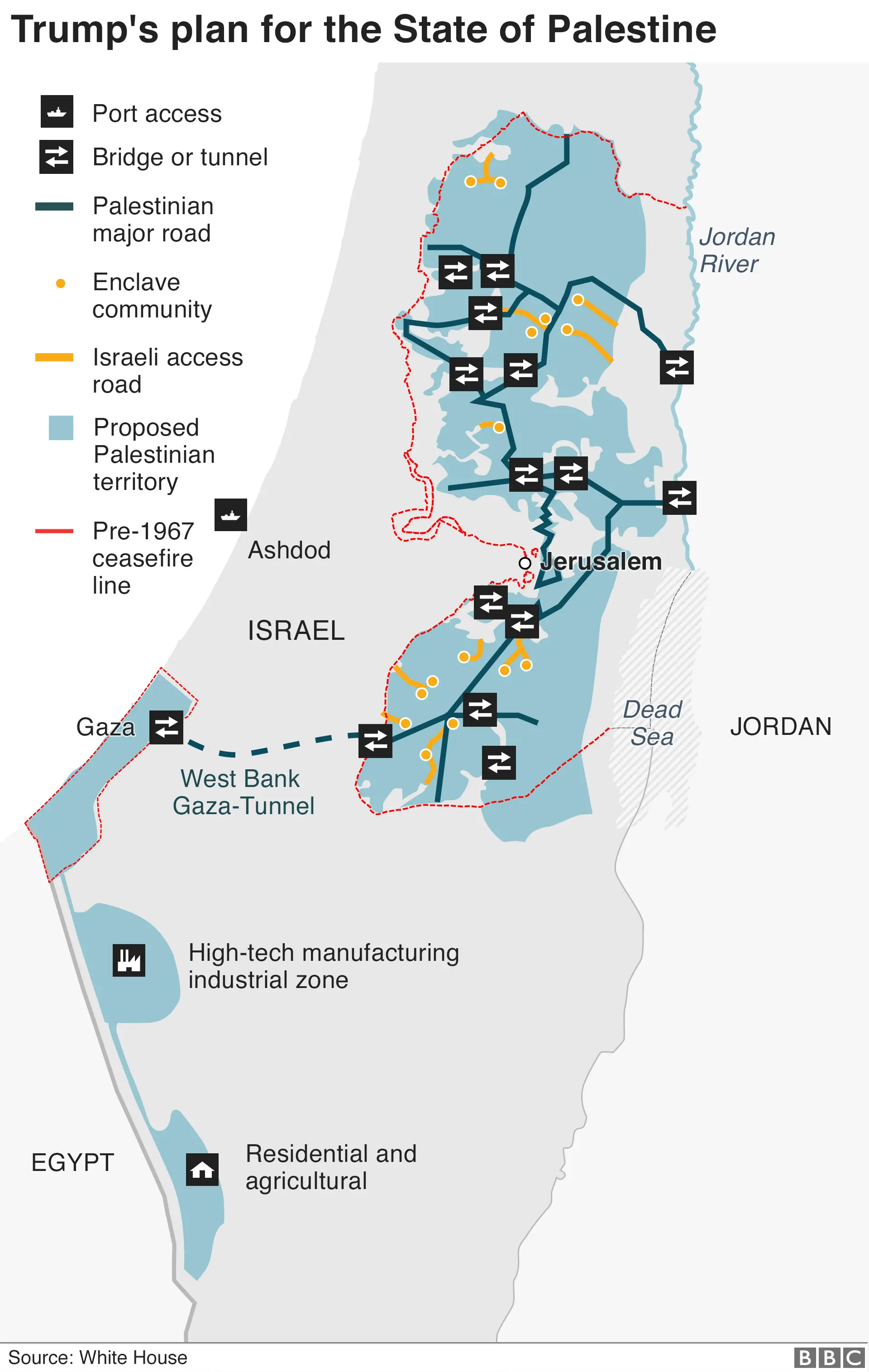

Trumps Middle East Engagement Winners And Losers

May 18, 2025

Trumps Middle East Engagement Winners And Losers

May 18, 2025 -

Maneskins Damiano David Unveils New Solo Track Next Summer

May 18, 2025

Maneskins Damiano David Unveils New Solo Track Next Summer

May 18, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Regarding January 6th Narratives

May 18, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Regarding January 6th Narratives

May 18, 2025 -

Dry Spell Threatens To Cancel Easter Bonfire Celebrations

May 18, 2025

Dry Spell Threatens To Cancel Easter Bonfire Celebrations

May 18, 2025 -

From Scatological Data To Engaging Podcast Ai Powered Digest Creation

May 18, 2025

From Scatological Data To Engaging Podcast Ai Powered Digest Creation

May 18, 2025

Latest Posts

-

Ego Nwodims Snl Weekend Update Audience Profanity

May 18, 2025

Ego Nwodims Snl Weekend Update Audience Profanity

May 18, 2025 -

Gold Plunges Amidst Trader Profit Booking On Us China Trade Optimism

May 18, 2025

Gold Plunges Amidst Trader Profit Booking On Us China Trade Optimism

May 18, 2025 -

Can Carneys Cabinet Deliver A Critical Assessment By Gary Mar

May 18, 2025

Can Carneys Cabinet Deliver A Critical Assessment By Gary Mar

May 18, 2025 -

Gold Price Drop Profit Taking And Us China Trade Deal Optimism

May 18, 2025

Gold Price Drop Profit Taking And Us China Trade Deal Optimism

May 18, 2025 -

Assessing Carneys Cabinet A Call For Responsible Governance

May 18, 2025

Assessing Carneys Cabinet A Call For Responsible Governance

May 18, 2025