Shifting Gears: Honda's US Tariff Response And Canadian Export Potential

Table of Contents

Honda's Strategic Response to US Tariffs

Honda's initial reaction to the US tariffs involved a multi-pronged approach focusing on price adjustments, production shifts, and proactive lobbying efforts. This strategic response aimed to minimize the negative impacts on profitability and market share while securing the long-term competitiveness of its North American operations.

Production Adjustments and Restructuring

Faced with increased import costs, Honda initiated significant production adjustments:

- Shifting Production: Honda shifted some production of specific models from US plants to its facilities in Mexico and Canada, leveraging lower manufacturing costs in those regions.

- Investment in Canadian Plants: There has been a notable increase in investment and capacity expansion at Honda's Canadian manufacturing facilities.

- Impact on US Jobs: This production shift inevitably resulted in job losses in some US plants, sparking debate about the economic implications of trade policies and their impact on American workers. The exact number of job losses varies depending on the specific model and plant affected.

- Production Volume Changes: While precise figures are often proprietary, reports suggest a decrease in US-based production volume for certain models, offset by increased production in Canada and Mexico.

Price Adjustments and Market Impact

The US tariffs directly influenced Honda vehicle pricing in the US market. To maintain competitiveness, Honda implemented price increases on some models, resulting in:

- Reduced Consumer Demand: Higher prices inevitably led to reduced consumer demand for certain Honda vehicles in the US market.

- Market Share Impact: While Honda maintained a significant market share, the price adjustments affected its competitive positioning against rivals who were able to better absorb the tariff costs.

- Data and Research: Market research data from firms like J.D. Power and IHS Markit provides insights into the precise impact on sales figures and consumer sentiment following the tariff implementation.

Lobbying Efforts and Policy Advocacy

Honda actively engaged in lobbying efforts with both US and Canadian governments, participating in trade negotiations and advocating for policies that would reduce trade barriers and ensure fair competition:

- USMCA Negotiations: Honda played an active role in shaping the provisions of the USMCA, aiming to create a more favorable trade environment for its North American operations.

- Bilateral Discussions: The company engaged in bilateral discussions with both governments to address concerns regarding tariff impacts and advocate for solutions.

- Industry Collaboration: Honda also collaborated with other automakers and industry associations in joint lobbying efforts to influence trade policy.

Increased Canadian Export Potential for Honda

The challenges presented by US tariffs have highlighted the advantages of increased Canadian production and exports to the US market for Honda. This strategy offers several compelling benefits.

Lower Manufacturing Costs in Canada

Compared to the US, Canada offers several advantages regarding manufacturing costs:

- Labor Costs: Canadian labor costs, particularly in certain regions, are generally lower than those in the US, offering potential savings for Honda.

- Energy Prices: Energy costs in certain Canadian provinces are also comparatively lower, reducing production expenses.

- Government Incentives: The Canadian government offers various incentives and support programs to attract and retain automotive manufacturing businesses, which benefit Honda's operations.

Strengthened USMCA Provisions

The USMCA offers several provisions that facilitate increased Canadian exports for Honda:

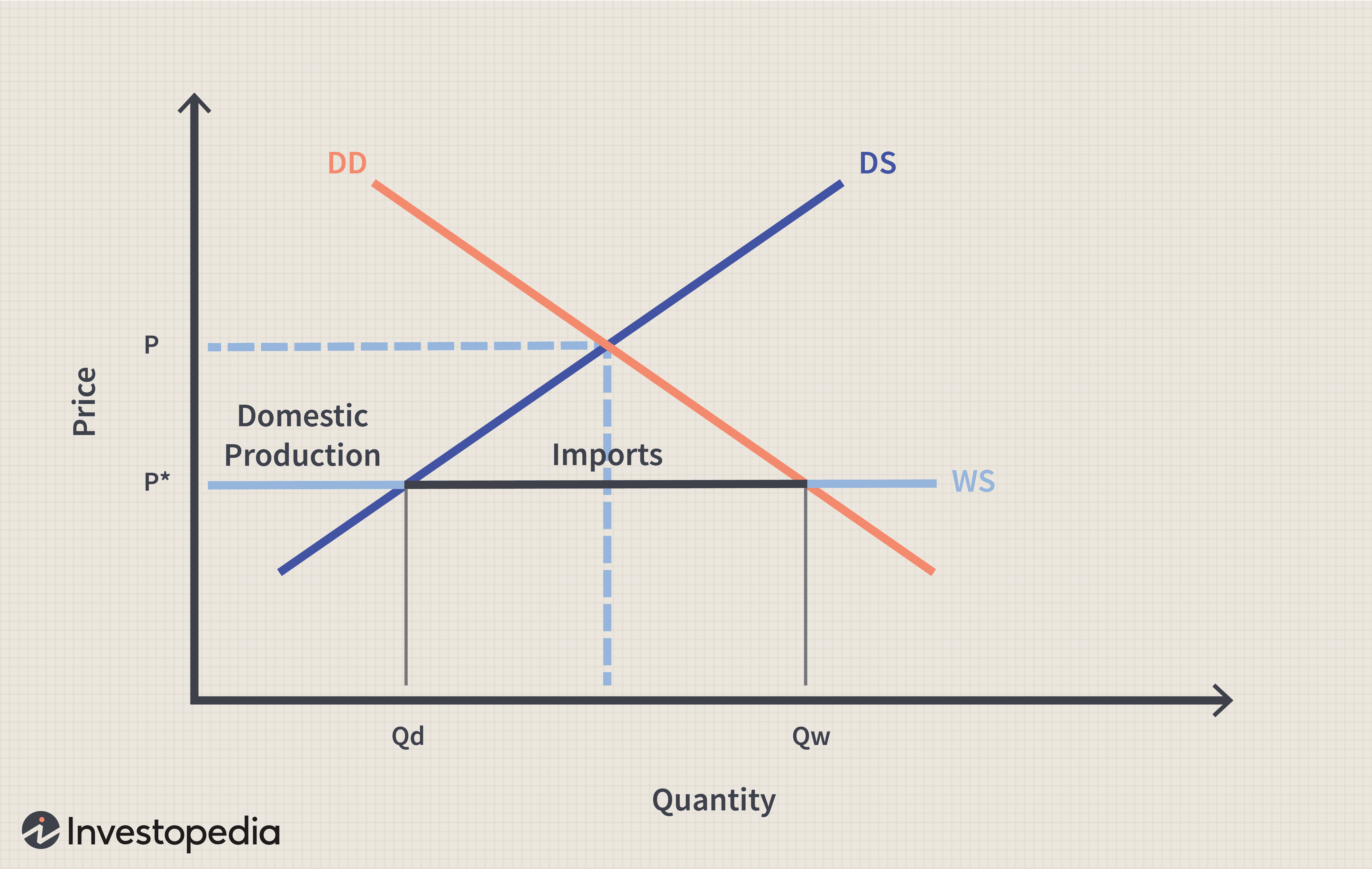

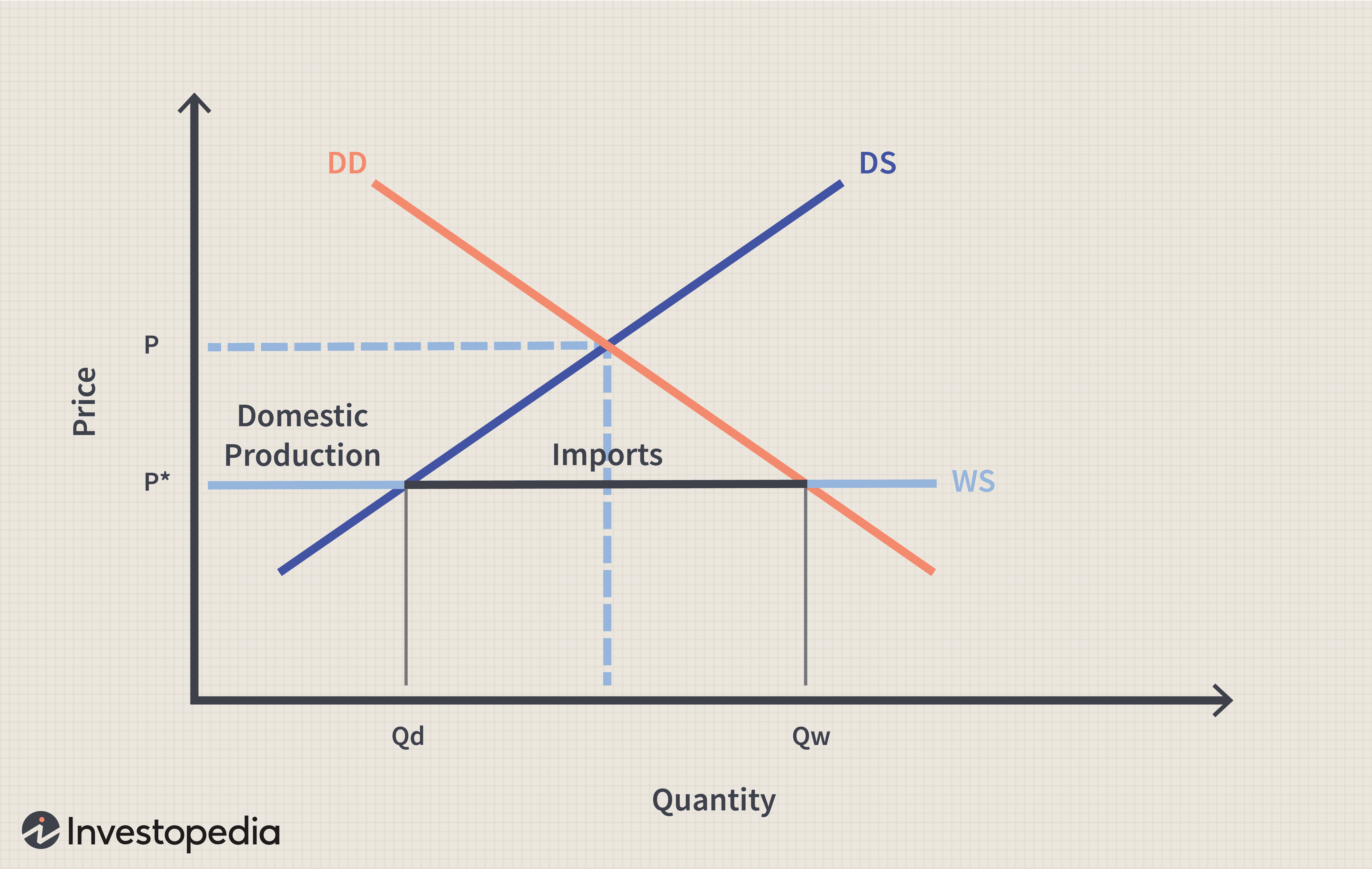

- Rules of Origin: The USMCA's rules of origin stipulate the percentage of content that must originate within North America for vehicles to qualify for tariff-free trade. Honda is strategically aligning its production to meet these requirements.

- Dispute Resolution Mechanisms: The agreement provides mechanisms for resolving trade disputes, offering some protection against unpredictable tariff changes.

- Reduced Non-Tariff Barriers: The USMCA aims to reduce various non-tariff barriers, streamlining the process of exporting vehicles from Canada to the US.

Opportunities for Growth and Diversification

The increased focus on Canadian exports presents opportunities for Honda to grow and diversify its operations:

- Expansion of Canadian Facilities: Honda is likely to explore the expansion of its existing Canadian manufacturing facilities to accommodate increased production volumes.

- Increased Production of Specific Models: Certain models might be better suited for production in Canada, considering factors like labor costs and proximity to the US market.

- Market Potential: The US market remains vast, presenting significant potential for increased sales of Canadian-made Honda vehicles.

Challenges and Risks Associated with Increased Canadian Exports

While increasing Canadian exports offers advantages, Honda faces certain challenges:

Transportation Costs and Logistics

Exporting from Canada to the US incurs transportation costs and logistical challenges:

- Increased Shipping Costs: Transporting vehicles from Canadian plants to US dealerships adds to the overall cost, potentially impacting profitability.

- Logistical Complexity: Managing the logistics of cross-border transportation requires efficient supply chain management and coordination.

- Infrastructure limitations: Addressing potential infrastructure limitations for efficient transportation between Canada and the US is critical.

Canadian Labor Relations and Regulations

Differences in labor relations and regulations between Canada and the US could influence manufacturing costs:

- Unionization Rates: Higher unionization rates in some Canadian provinces could lead to higher labor costs compared to certain US states.

- Regulatory Differences: Compliance with different labor regulations in Canada adds to operational complexity.

- Negotiating collective agreements: The company will need to navigate the complexities of negotiating collective agreements with Canadian unions.

Currency Fluctuations and Exchange Rates

Fluctuations in the US-Canadian dollar exchange rate impact profitability:

- Exchange Rate Risk: Changes in the exchange rate can affect the cost of Canadian-made vehicles sold in the US market.

- Hedging Strategies: Honda will need to implement hedging strategies to minimize the impact of currency fluctuations.

Conclusion

Honda's response to US tariffs has necessitated a strategic shift, with increased focus on Canadian production and export potential emerging as a key element. While challenges related to transportation costs, labor relations, and currency fluctuations exist, the opportunities presented by the USMCA and lower manufacturing costs in Canada offer significant potential for growth and diversification. Honda's continued adaptation and strategic decisions in response to Honda's US Tariff Response and Canadian Export Potential will significantly shape its future success in the North American market. To stay informed about the latest developments in this dynamic industry, continue to follow our analysis of Honda's US Tariff Response and Canadian Export Potential.

Featured Posts

-

How Tom Thibodeau Rescued The Knicks Addressing A Persistent Flaw

May 17, 2025

How Tom Thibodeau Rescued The Knicks Addressing A Persistent Flaw

May 17, 2025 -

Cheap Doesnt Mean Crappy Smart Shopping Guide

May 17, 2025

Cheap Doesnt Mean Crappy Smart Shopping Guide

May 17, 2025 -

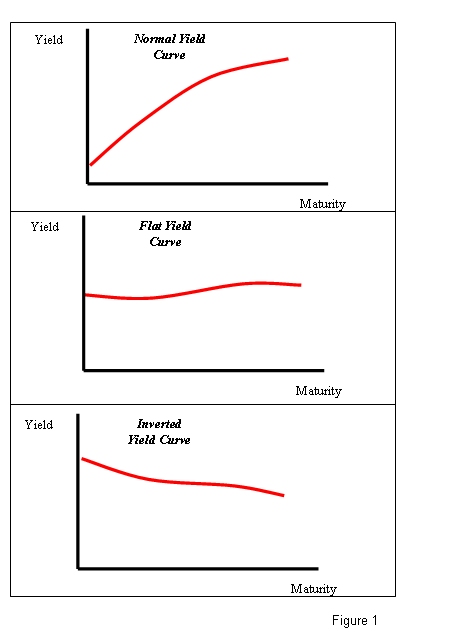

Investor Uncertainty Japans Steep Bond Curve And Its Market Effects

May 17, 2025

Investor Uncertainty Japans Steep Bond Curve And Its Market Effects

May 17, 2025 -

Seaweed Innovation Condo Collapse Concerns And Corporate Turmoil News Roundup

May 17, 2025

Seaweed Innovation Condo Collapse Concerns And Corporate Turmoil News Roundup

May 17, 2025 -

Midair Collision Averted An Air Traffic Controllers Exclusive Story

May 17, 2025

Midair Collision Averted An Air Traffic Controllers Exclusive Story

May 17, 2025

Latest Posts

-

Sbry Abwshealt Rhlt Fnyt Tukll Baltkrym Aljzayry

May 17, 2025

Sbry Abwshealt Rhlt Fnyt Tukll Baltkrym Aljzayry

May 17, 2025 -

Aljzayr Thtfy Binjazat Almkhrj Allyby Sbry Abwshealt

May 17, 2025

Aljzayr Thtfy Binjazat Almkhrj Allyby Sbry Abwshealt

May 17, 2025 -

Ahtfae Jzayry Bmwhbt Sbry Abwshealt Almkhrj Allyby Almtmyz

May 17, 2025

Ahtfae Jzayry Bmwhbt Sbry Abwshealt Almkhrj Allyby Almtmyz

May 17, 2025 -

Tkrym Astthnayy Llsynma Allybyt Fy Aljzayr Qst Sbry Abwshealt

May 17, 2025

Tkrym Astthnayy Llsynma Allybyt Fy Aljzayr Qst Sbry Abwshealt

May 17, 2025 -

Aljzayr Tuthry Alsynma Alerbyt Btkrym Almkhrj Sbry Abwshealt

May 17, 2025

Aljzayr Tuthry Alsynma Alerbyt Btkrym Almkhrj Sbry Abwshealt

May 17, 2025