Should I Buy Palantir Stock Before May 5th? A Data-Driven Approach

Table of Contents

H2: Palantir's Recent Financial Performance and Future Projections

Palantir's financial health is a crucial factor in determining whether to buy PLTR stock. Let's delve into its recent performance and future projections.

H3: Revenue Growth and Profitability

Palantir has shown significant revenue growth in recent quarters. However, profitability remains a key area of focus for investors. Analyzing year-over-year comparisons is essential for understanding the company's trajectory.

- Revenue Growth: Examine the quarterly and annual revenue growth rates. Are they accelerating or decelerating? Understanding the sources of this growth (government vs. commercial) is crucial.

- Profitability: Analyze Palantir's operating margins and net income. Is the company moving towards profitability, and at what pace? Factors like increased operating expenses and investment in research and development can impact profitability.

- Key Metrics: Consider key metrics like customer acquisition cost (CAC), customer lifetime value (CLTV), and revenue churn rate to assess the sustainability of Palantir's growth.

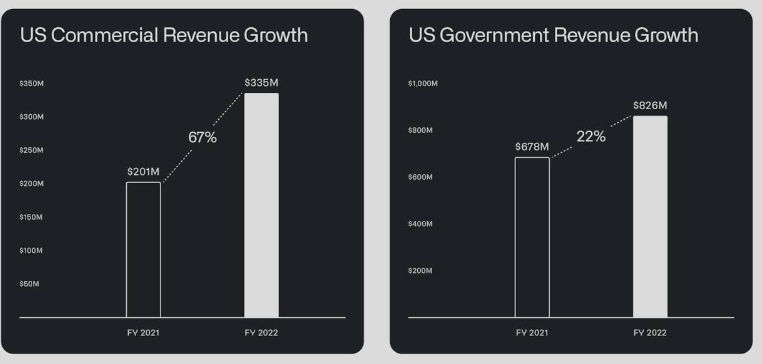

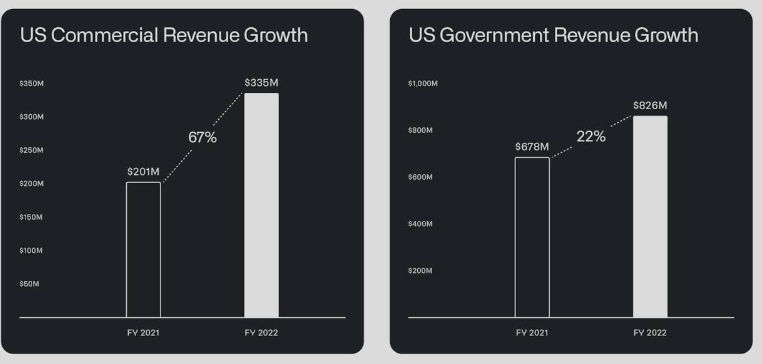

H3: Government vs. Commercial Contracts

Palantir's revenue stream is divided between government and commercial contracts. Understanding the dynamics of each sector is crucial for assessing future performance.

- Government Contracts: These contracts provide stability and predictability, but growth might be slower compared to the commercial sector. Analyze the percentage of revenue from government contracts and their renewal rates.

- Commercial Contracts: These contracts offer potentially higher growth but carry higher risk. Evaluate the growth rate of Palantir's commercial contracts and the potential for expanding into new markets.

- Contract Wins and Losses: Significant contract wins or losses can significantly impact Palantir's stock price. Monitor news releases and financial reports for updates on this front.

H2: Market Sentiment and Analyst Opinions

Analyzing market sentiment and expert opinions helps understand the overall outlook for Palantir stock.

H3: Stock Price Analysis

Examining recent stock price trends, including highs, lows, and volatility, is crucial for making informed investment decisions.

- Price Movements: Identify significant price movements and their causes. Were these movements triggered by news events, earnings reports, or other market factors?

- Technical Indicators: While not a foolproof method, examining technical indicators like moving averages, RSI, and MACD can offer insights into potential price trends (use with caution and in conjunction with fundamental analysis).

- Chart Patterns: Identify any chart patterns that might suggest future price movements, such as head and shoulders, double tops, or triangles.

H3: Analyst Ratings and Price Targets

Consulting analyst ratings and price targets provides valuable perspectives from financial experts.

- Consensus View: What is the average price target for PLTR stock? A higher price target generally suggests a more bullish outlook.

- Rating Distribution: What percentage of analysts rate Palantir stock as a "buy," "hold," or "sell"? This provides a snapshot of overall sentiment.

- Analyst Upgrades/Downgrades: Monitor any changes in analyst ratings, as these can significantly impact the stock price.

H2: Risks and Potential Downsides of Investing in Palantir Before May 5th

Before investing in Palantir stock, it's essential to acknowledge and assess potential risks.

H3: Geopolitical Risks

Palantir's business, particularly its government contracts, is susceptible to geopolitical risks.

- International Relations: Changes in international relations can affect the demand for Palantir's services, particularly in government sectors.

- Political Instability: Political instability in key markets can disrupt contracts and operations.

- Regulatory Changes: New regulations or policy changes can limit Palantir's ability to operate in certain markets.

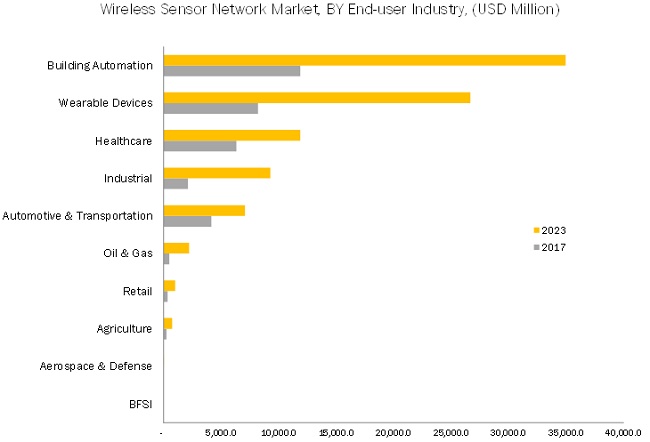

H3: Competition and Market Saturation

The data analytics market is competitive. Analyzing the competitive landscape is crucial.

- Key Competitors: Identify Palantir's main competitors and assess their strengths and weaknesses.

- Market Share: Is Palantir gaining or losing market share?

- Market Saturation: Is the market becoming saturated, limiting growth potential?

H3: Other Risks

Other potential risks include dependence on a few large clients, technological disruptions, and economic downturns. These factors could significantly impact PLTR stock.

3. Conclusion

Deciding whether to buy Palantir stock before May 5th requires careful consideration of its financial performance, market sentiment, and inherent risks. While Palantir demonstrates revenue growth and has potential in both government and commercial sectors, the company's profitability and exposure to geopolitical and competitive risks need thorough evaluation. This analysis provides a framework for your own research. Remember, this is not financial advice. Conduct your own thorough due diligence before making any investment decisions. By carefully considering the factors presented in this data-driven analysis, you can make an informed decision about whether to invest in Palantir stock before May 5th, based on your own risk tolerance and investment goals.

Featured Posts

-

Bundesliga 2 Spieltag 27 Koeln Ueberholt Hamburg An Der Spitze

May 09, 2025

Bundesliga 2 Spieltag 27 Koeln Ueberholt Hamburg An Der Spitze

May 09, 2025 -

Warren Buffetts Canadian Successor A Billionaire Without Many Berkshire Hathaway Shares

May 09, 2025

Warren Buffetts Canadian Successor A Billionaire Without Many Berkshire Hathaway Shares

May 09, 2025 -

Implantation D Un Nouveau Vignoble De 2500 M Aux Valendons Dijon

May 09, 2025

Implantation D Un Nouveau Vignoble De 2500 M Aux Valendons Dijon

May 09, 2025 -

Forecast Wireless Mesh Networks Market To Reach Market Size By Year At A 9 8 Cagr

May 09, 2025

Forecast Wireless Mesh Networks Market To Reach Market Size By Year At A 9 8 Cagr

May 09, 2025 -

Unlocking The Nyt Strands Puzzle April 9 2025 A Comprehensive Guide

May 09, 2025

Unlocking The Nyt Strands Puzzle April 9 2025 A Comprehensive Guide

May 09, 2025

Latest Posts

-

Suncors Record Production Sales Slowdown Amidst Inventory Build Up

May 10, 2025

Suncors Record Production Sales Slowdown Amidst Inventory Build Up

May 10, 2025 -

Suncor Production Record High Output Inventory Challenges

May 10, 2025

Suncor Production Record High Output Inventory Challenges

May 10, 2025 -

Analyzing The Succession A Canadian Billionaire And Berkshire Hathaways Future

May 10, 2025

Analyzing The Succession A Canadian Billionaire And Berkshire Hathaways Future

May 10, 2025 -

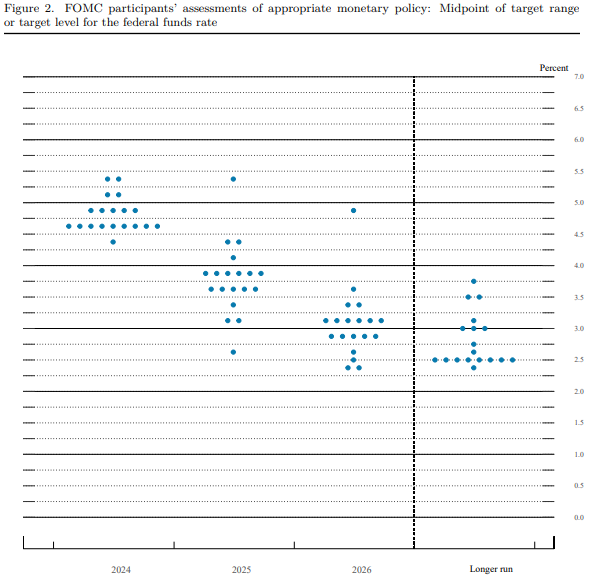

U S Federal Reserve Maintains Rates Inflation Unemployment Weigh Heavily

May 10, 2025

U S Federal Reserve Maintains Rates Inflation Unemployment Weigh Heavily

May 10, 2025 -

The Auto Industrys Ongoing Battle Against Ev Mandates

May 10, 2025

The Auto Industrys Ongoing Battle Against Ev Mandates

May 10, 2025