U.S. Federal Reserve Maintains Rates: Inflation, Unemployment Weigh Heavily

Table of Contents

Inflation Remains a Persistent Challenge

Inflation continues to be a significant headwind for the U.S. economy. While the headline inflation rate, as measured by the Consumer Price Index (CPI), may show some signs of easing, underlying price pressures remain a concern. The core inflation rate, which excludes volatile food and energy prices, provides a clearer picture of persistent inflationary trends.

- CPI Figures and Interpretation: Recent CPI data reveals [insert current CPI data and source]. While this indicates [insert interpretation, e.g., a slight decrease/increase], it’s crucial to analyze the underlying components.

- Analysis of Core Inflation: Core inflation remains stubbornly high at [insert current core inflation data and source], suggesting that inflationary pressures are not solely driven by temporary factors like energy price spikes.

- Supply Chain Issues and Impact: Lingering supply chain disruptions continue to contribute to elevated prices for many goods. [Insert specific examples and data, if available]. While some improvements are noticeable, bottlenecks still constrain production and add to inflationary pressure.

- Potential Easing or Persistence of Inflationary Pressures: The persistence of inflation depends on several interacting factors, including the strength of consumer demand, wage growth, and the continued unwinding of global supply chain disruptions. The Fed will be closely monitoring these indicators to gauge the future trajectory of inflation.

Unemployment Figures and Labor Market Dynamics

The unemployment rate currently stands at [insert current unemployment rate and source]. While this indicates a relatively strong labor market, the picture is nuanced. The Fed must consider the interplay between unemployment and inflation, recognizing that a tight labor market can fuel wage growth, potentially contributing to further price increases.

- Current Unemployment Rate and Historical Comparison: Compared to historical averages, the current unemployment rate is [insert comparison – e.g., lower/higher]. This reflects [insert explanation, e.g., a robust job market/economic slowdown].

- Discussion of Job Creation and Sector-Specific Trends: Job growth has been [insert description – e.g., strong/weak] across various sectors, with [insert examples of strong and weak performing sectors].

- Analysis of Wage Growth and its Relationship to Inflation: Wage growth has been [insert description – e.g., accelerating/moderating], potentially adding to inflationary pressures or alleviating them, depending on the rate of increase and its impact on overall prices.

- Labor Force Participation Rate and its Impact: The labor force participation rate currently stands at [insert current rate and source]. Changes in this rate can significantly influence unemployment figures and the overall economic outlook.

The Fed's Rationale for Maintaining Rates

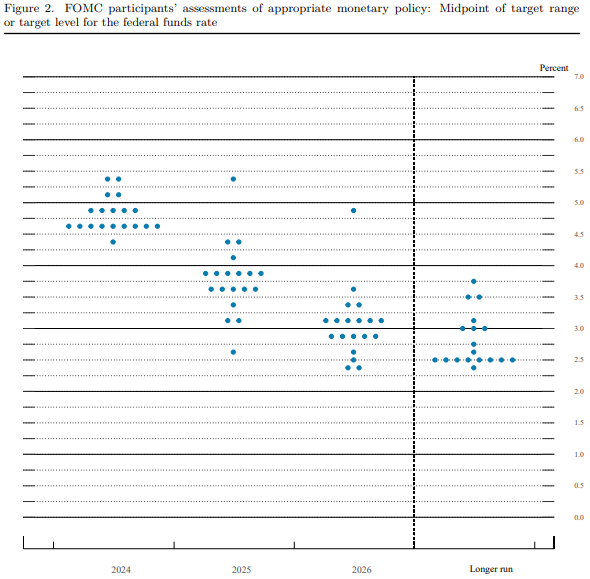

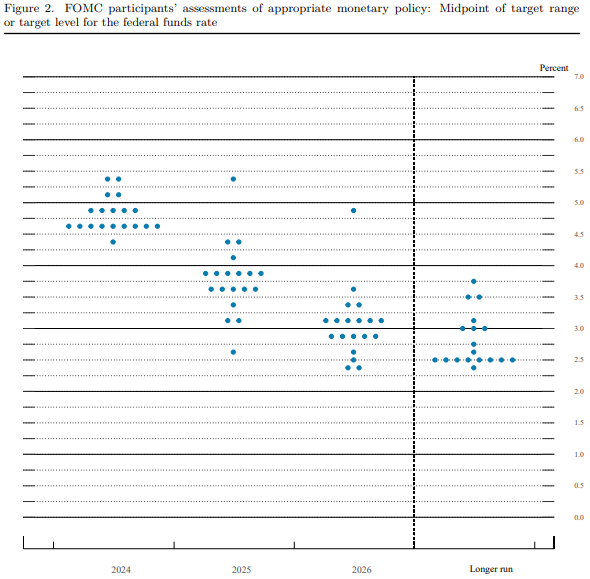

The Federal Open Market Committee (FOMC) decided to hold interest rates steady, citing a need to assess the ongoing impact of past rate hikes and closely monitor incoming economic data. Their statement emphasized the need to balance the risks of inflation and a potential economic slowdown.

- Summary of the FOMC's Statement: [Insert a concise summary of the FOMC's official statement, including key phrases and their interpretation].

- Explanation of the Fed's Assessment of Inflation Risks: The Fed acknowledged the persistent nature of inflation but noted signs of [insert specific signs mentioned by the Fed, e.g., moderating price increases in certain sectors].

- Discussion of the Fed's Forecasts for Economic Growth and Unemployment: The Fed’s forecasts suggest [insert summary of projected economic growth and unemployment rates].

- Analysis of the Potential Risks and Uncertainties Facing the Economy: The Fed highlighted several key uncertainties, including [insert specific examples mentioned by the Fed, e.g., geopolitical risks, global economic slowdown].

Potential Future Actions by the Federal Reserve

The Fed’s decision to pause rate hikes doesn't signal a definitive end to monetary tightening. Future actions will heavily depend on incoming economic data, specifically inflation and unemployment figures.

- Probability of Future Rate Increases or Decreases: The probability of future rate increases is [insert assessment, e.g., high/low/uncertain], contingent upon [insert specific conditions]. A decrease in rates is currently [insert assessment, e.g., unlikely/possible] unless [insert specific conditions].

- Potential for Further Quantitative Easing or Tightening Measures: The Fed may employ further quantitative tightening measures or reverse course depending on economic developments.

- Impact of Potential Policy Changes on Inflation and Employment: Any future policy adjustments will have significant implications for both inflation and employment, impacting economic growth and consumer confidence.

Conclusion

The U.S. Federal Reserve's decision to maintain interest rates reflects the complex interplay of persistent inflation and a relatively strong labor market. While inflation remains a significant concern, the Fed is carefully evaluating the impact of past rate hikes and monitoring economic data before making further adjustments to monetary policy. The future path of interest rates will depend heavily on the evolution of inflation, unemployment, and broader economic conditions. Stay informed about future developments from the U.S. Federal Reserve and its impact on interest rates and the overall economic landscape by regularly consulting reputable financial news sources and the Federal Reserve's official website. Understanding the U.S. Federal Reserve's monetary policy is crucial for navigating the current economic climate.

Featured Posts

-

Are We Normalizing Disaster The Los Angeles Wildfires And The Gambling Culture

May 10, 2025

Are We Normalizing Disaster The Los Angeles Wildfires And The Gambling Culture

May 10, 2025 -

Infineons Ifx Q Quarter Earnings Tariff Uncertainty Impacts Sales Outlook

May 10, 2025

Infineons Ifx Q Quarter Earnings Tariff Uncertainty Impacts Sales Outlook

May 10, 2025 -

Palantir Stock Wall Streets Verdict Before May 5th Should You Invest

May 10, 2025

Palantir Stock Wall Streets Verdict Before May 5th Should You Invest

May 10, 2025 -

Luis Enriques Psg Transformation How The French Side Secured Victory

May 10, 2025

Luis Enriques Psg Transformation How The French Side Secured Victory

May 10, 2025 -

Young Thugs Promise A Song About Cheating And Redemption

May 10, 2025

Young Thugs Promise A Song About Cheating And Redemption

May 10, 2025