Should Investors Buy Palantir Stock Ahead Of May 5th?

Table of Contents

Palantir's Recent Performance and Future Projections

Q1 2024 Earnings Expectations

Analyst predictions for Palantir's Q1 2024 earnings report vary. While some anticipate continued revenue growth, fueled by strong government contracts and expansion into the commercial sector, others express concerns about profitability margins. The consensus seems to be a modest increase in revenue, but the key will be the company's guidance for the remainder of the year.

- Revenue Growth: Analysts predict revenue growth in the low to mid-teens percentage range.

- Profitability: Margins are expected to remain under pressure, but potentially showing improvement compared to the previous quarter.

- Potential Surprises: Any significant deviation from these expectations – either positive or negative – could significantly impact the PLTR stock price. A beat on earnings and strong future guidance could lead to a rally, while a miss could trigger a sell-off.

Long-Term Growth Potential

Palantir's long-term growth strategy hinges on its ability to expand beyond its core government contracting business into commercial sectors. This includes leveraging its advanced data analytics platform to serve various industries, from healthcare to finance. Strategic partnerships and new product launches will be crucial to this expansion.

- Key Partnerships: Collaborations with major players in different sectors can unlock new market opportunities and boost revenue streams.

- New Product Launches: Innovative products and services catering to specific market needs will be critical for maintaining a competitive edge and attracting new clients.

- Market Opportunity: The market for big data analytics is vast and growing rapidly, offering substantial potential for Palantir's growth. However, intense competition from established players and emerging startups poses a significant challenge.

Risks and Challenges

Investing in Palantir stock involves inherent risks. These include:

- Competition: The data analytics market is highly competitive, with established players and innovative startups vying for market share.

- Regulatory Hurdles: Palantir's business involves sensitive data, making it subject to various regulatory requirements and scrutiny.

- Dependence on Government Contracts: A substantial portion of Palantir's revenue comes from government contracts, which can be subject to changes in government spending priorities.

Analyzing Palantir's Valuation

Current Stock Price and Market Sentiment

As of [Insert Current Date], Palantir's stock price is [Insert Current Price]. Market sentiment surrounding PLTR stock appears [Describe Market Sentiment – bullish, bearish, neutral]. Recent stock price fluctuations have been influenced by [Mention recent news events or factors impacting the stock price].

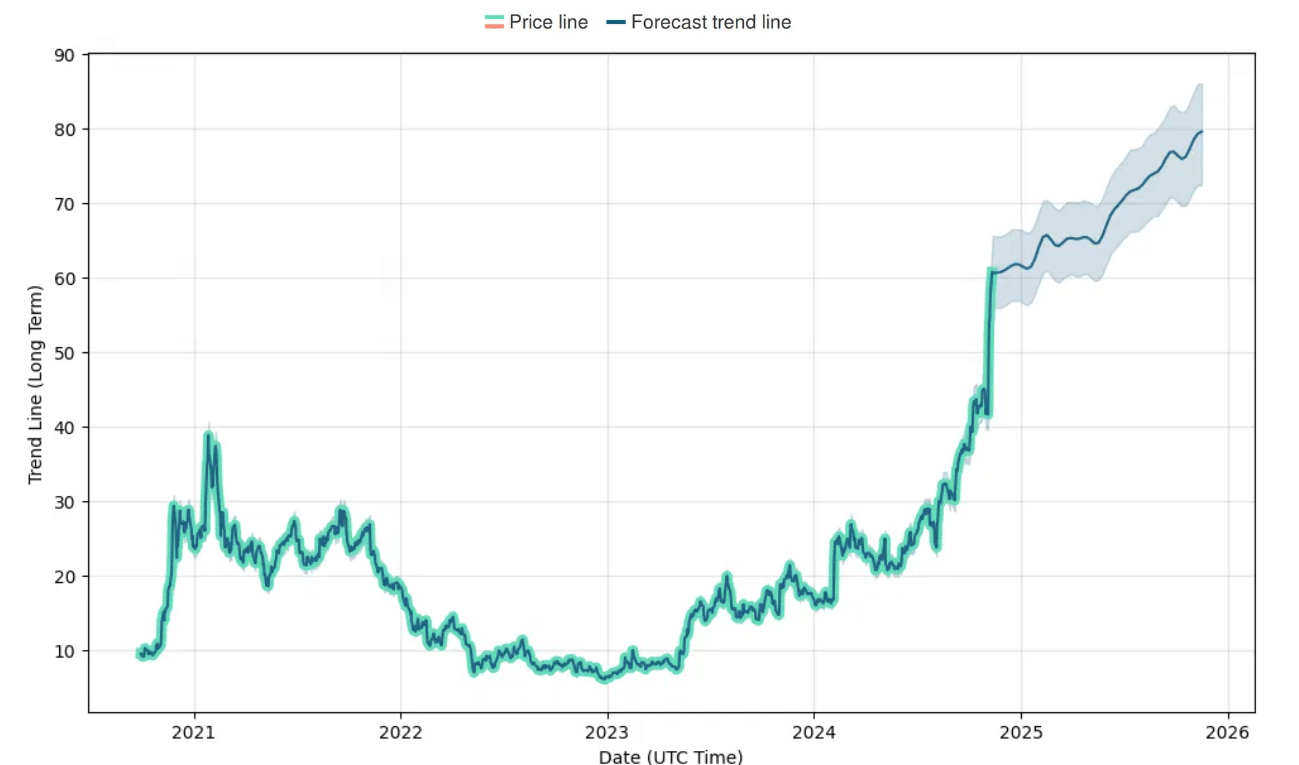

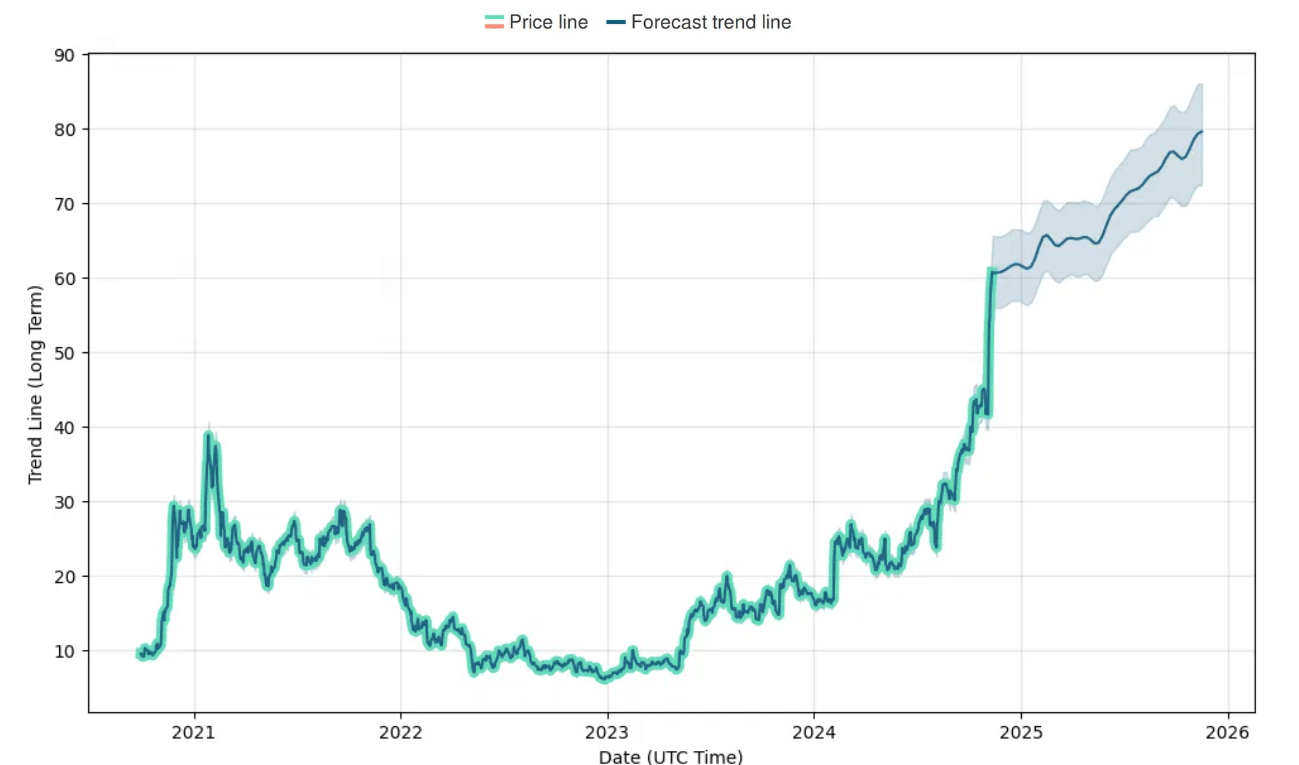

- Stock Price Fluctuations: [Include data on recent volatility, perhaps a percentage range or chart reference.]

- Trading Volume: [Mention trading volume trends – high or low, and what it might indicate.]

- Market Indices: [Relate Palantir's performance to relevant market indices like the S&P 500 or Nasdaq.]

Valuation Metrics

Analyzing Palantir's valuation requires looking at several key metrics. However, it's important to remember that these metrics are only one part of the picture.

- P/E Ratio: [Insert data and interpretation. Is it high, low, or in line with industry peers? Explain why.]

- PEG Ratio: [Insert data and interpretation. What does it suggest about the company's growth prospects relative to its valuation?]

- Other Metrics: [Consider mentioning other relevant metrics, such as revenue growth rate, debt-to-equity ratio, etc., with data and interpretation.]

Potential for Future Price Appreciation

Based on the above analysis, the potential for future price appreciation in Palantir stock is [Offer a cautious and balanced assessment – high, medium, low]. Factors such as the upcoming earnings report, execution of its growth strategy, and the overall market environment will significantly influence the stock's future trajectory.

Alternative Investment Options

Comparing Palantir to Competitors

Palantir faces competition from several established players and emerging startups in the data analytics sector. Key competitors include [List key competitors, such as Snowflake, Databricks, etc.]. Each has its own strengths and weaknesses, and a comparative analysis is crucial before investing in Palantir.

Diversification Strategies

It's crucial to diversify your investment portfolio to mitigate risk. Don't put all your eggs in one basket. Consider investing in other sectors or asset classes to reduce your overall portfolio volatility. Examples include bonds, real estate, or other technology stocks.

Conclusion: Should You Buy Palantir Stock Before May 5th?

The decision of whether to buy Palantir stock before May 5th is complex and depends on your individual risk tolerance and investment goals. While Palantir exhibits promising long-term growth potential, it also faces considerable risks. The upcoming earnings report will likely be a significant catalyst for stock price movement.

Final Verdict: Given the uncertainties surrounding the Q1 2024 earnings and the inherent risks associated with Palantir, a cautious approach is recommended. A "maybe" is the most accurate verdict. A thorough review of the earnings report and subsequent guidance will be essential before making an investment decision.

Call to Action: While this analysis provides insights into whether you should buy Palantir stock ahead of May 5th, remember to conduct your own thorough due diligence and consult with a financial advisor before investing in PLTR stock. The information provided here is for informational purposes only and not financial advice.

Featured Posts

-

Pakistan Stock Exchange Portal Down Volatility And Geopolitical Tensions

May 09, 2025

Pakistan Stock Exchange Portal Down Volatility And Geopolitical Tensions

May 09, 2025 -

Palantir Stock Before May 5th Is Now The Time To Buy Wall Streets Verdict

May 09, 2025

Palantir Stock Before May 5th Is Now The Time To Buy Wall Streets Verdict

May 09, 2025 -

Elizabeth City Weekend Shooting Arrest Announced

May 09, 2025

Elizabeth City Weekend Shooting Arrest Announced

May 09, 2025 -

Anchorage Witnesses Second Major Anti Trump Protest In Two Weeks

May 09, 2025

Anchorage Witnesses Second Major Anti Trump Protest In Two Weeks

May 09, 2025 -

Kaitlin Olson And The High Potential Repeats On Abc In March 2025

May 09, 2025

Kaitlin Olson And The High Potential Repeats On Abc In March 2025

May 09, 2025

Latest Posts

-

Vegas Golden Knights Win Hertls Double Hat Trick Leads The Charge

May 10, 2025

Vegas Golden Knights Win Hertls Double Hat Trick Leads The Charge

May 10, 2025 -

2025 A Banner Year For Stephen King Thanks To The Monkey

May 10, 2025

2025 A Banner Year For Stephen King Thanks To The Monkey

May 10, 2025 -

Netflix Rimeyk Na Kultov Roman Na Stivn King

May 10, 2025

Netflix Rimeyk Na Kultov Roman Na Stivn King

May 10, 2025 -

The Potential Of The Monkey Will It Make 2025 A Top Year For Stephen King Films

May 10, 2025

The Potential Of The Monkey Will It Make 2025 A Top Year For Stephen King Films

May 10, 2025 -

Stephen Kings The Monkey And Two Other Must See Movies Of 2024

May 10, 2025

Stephen Kings The Monkey And Two Other Must See Movies Of 2024

May 10, 2025