Should Investors Worry About Current Stock Market Valuations? BofA's View.

Table of Contents

BofA's Stance on Current Stock Market Valuations

BofA's stance on current stock market valuations is nuanced, often described as cautiously optimistic or neutral with bearish undertones, depending on the specific report and timeframe. While they haven't issued a blanket "buy" or "sell" signal, their recent analyses suggest a need for careful consideration. Their assessments frequently reference specific valuation metrics and economic indicators to support their conclusions.

-

Key arguments supporting BofA's position: BofA often points to the elevated price-to-earnings (P/E) ratios of certain sectors as a potential concern, suggesting that some stocks may be overvalued. They also consider the impact of interest rate hikes and inflation on future earnings growth.

-

Specific valuation metrics BofA uses: BofA utilizes a range of valuation metrics, including the Price-to-Earnings ratio (P/E), the Shiller PE ratio (also known as the cyclically adjusted price-to-earnings ratio, or CAPE), and other forward-looking metrics that account for anticipated earnings. They often compare these metrics to historical averages to gauge whether current valuations are justified.

-

Caveats and qualifications: BofA typically emphasizes the uncertainty inherent in market forecasting. They acknowledge that unforeseen economic events or shifts in investor sentiment could significantly impact valuations. They often recommend a diversified approach to investing, mitigating potential risks associated with overvalued sectors.

Factors Influencing BofA's Valuation Analysis

Several crucial factors influence BofA's analysis of stock market valuations. Understanding these elements is essential for comprehending their overall assessment.

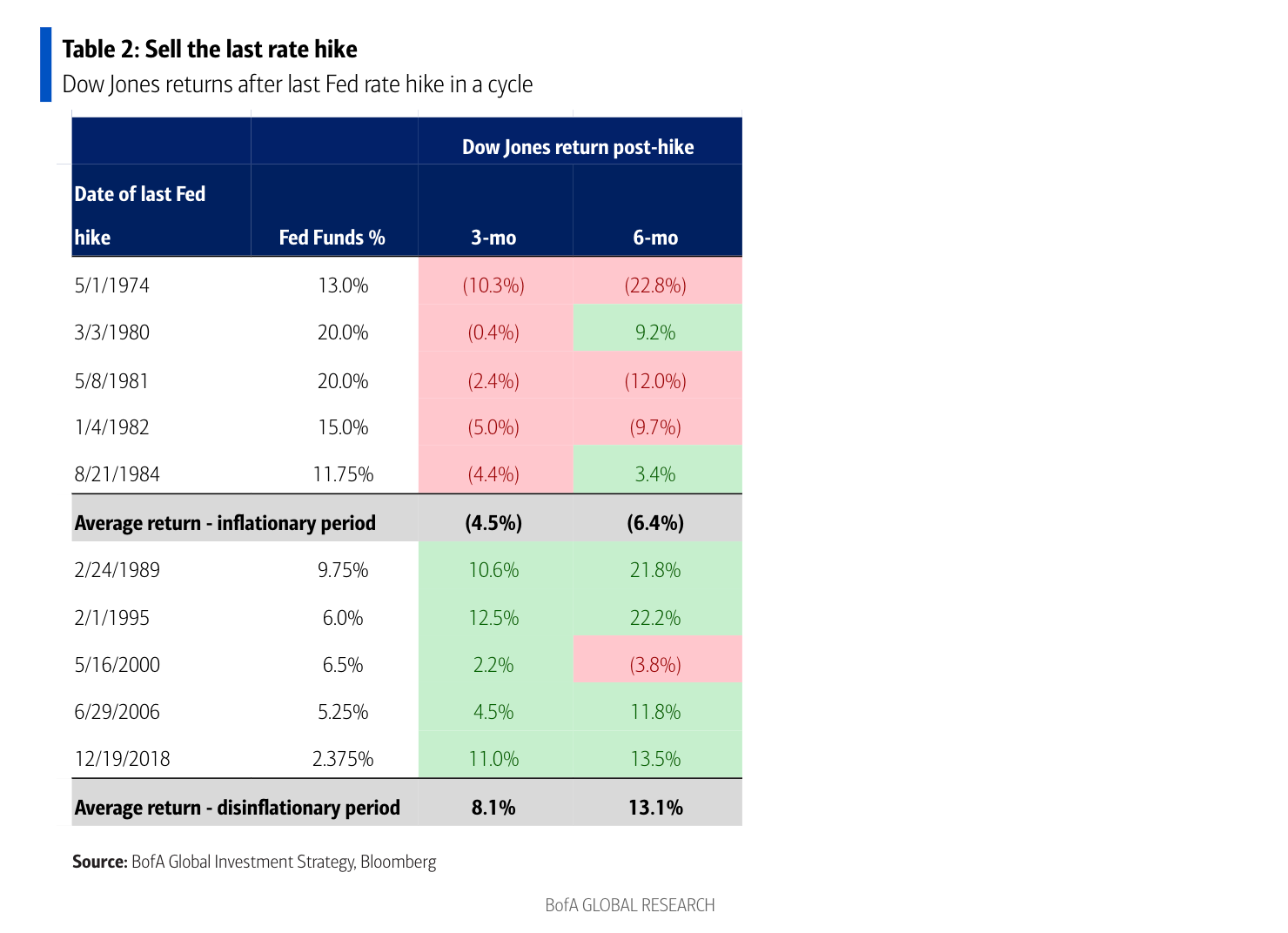

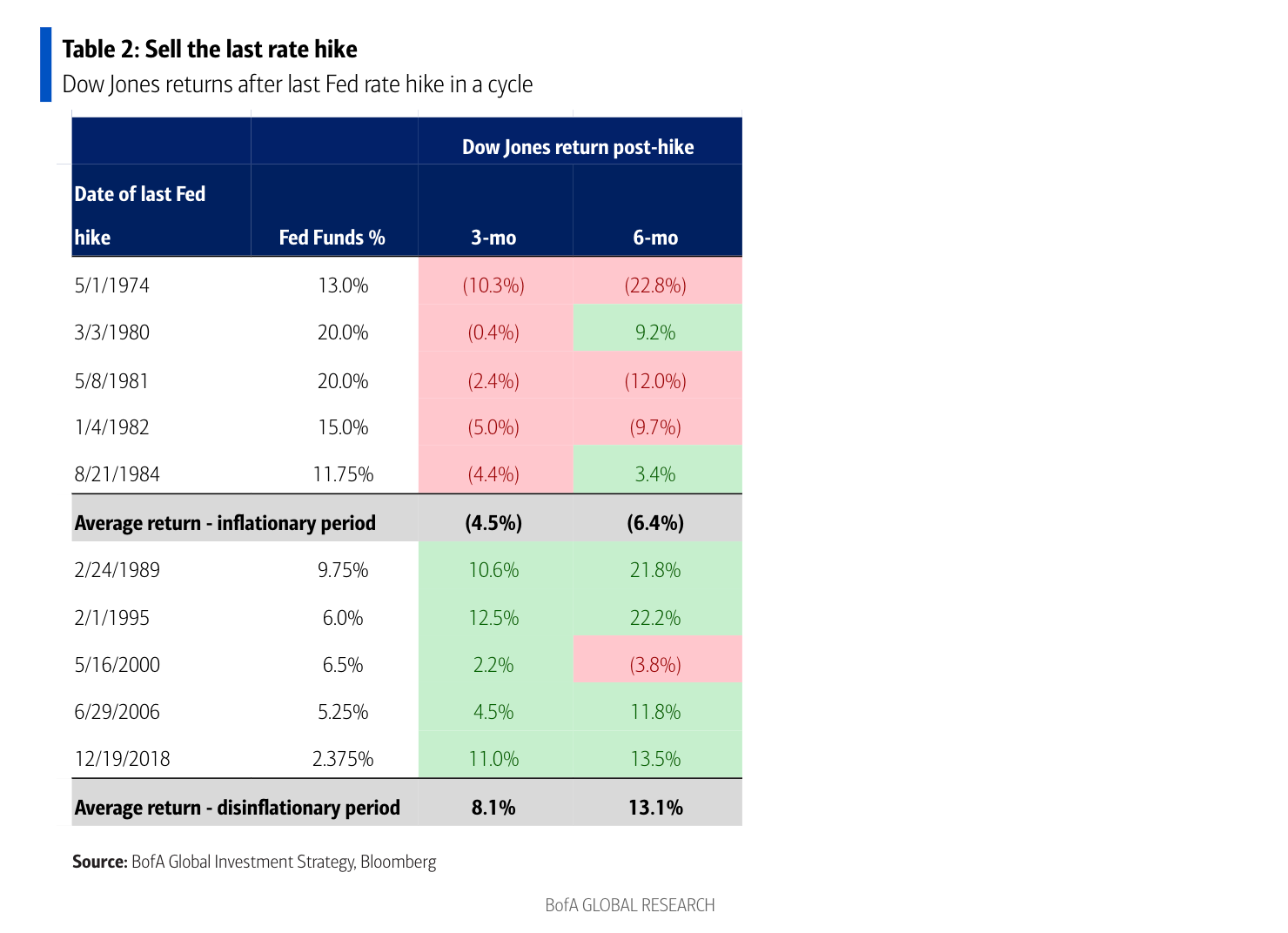

Interest Rate Hikes and Their Impact

Rising interest rates significantly impact stock valuations. The Federal Reserve's monetary policy directly affects borrowing costs for companies and investors.

-

Impact on company earnings: Higher interest rates increase borrowing costs, potentially reducing corporate profitability and impacting future earnings growth. This can lead to a decrease in stock valuations, especially for companies with high debt levels.

-

Effect on investor sentiment: Rising interest rates often shift investor preferences towards less risky, fixed-income investments like bonds, which offer higher returns in a rising rate environment. This can lead to reduced demand for stocks and a subsequent decrease in their valuations.

-

Potential for future rate hikes and their implications: BofA's analysis frequently incorporates projections for future interest rate hikes, assessing their potential impact on the stock market and corporate earnings. The uncertainty surrounding future rate hikes is a key factor in their cautious outlook.

Inflation and its Role in Stock Market Valuation

Inflation's impact on stock market valuations is complex and multifaceted.

-

How inflation affects corporate profitability: High inflation can erode corporate profit margins as businesses face higher costs for raw materials, labor, and energy. This reduced profitability can negatively affect stock valuations.

-

The impact of inflation on investor expectations: High inflation often leads to expectations of higher interest rates and reduced economic growth, negatively impacting investor sentiment and causing a decline in stock valuations.

-

BofA's predictions for future inflation: BofA's economic forecasts, which often include inflation projections, are integral to their valuation analysis. Their inflation forecasts significantly influence their outlook on stock market performance.

Geopolitical Risks and Market Volatility

Geopolitical events can introduce significant volatility into the stock market, impacting valuations.

-

Specific geopolitical factors BofA considers: BofA's analysis often considers factors such as international conflicts, trade wars, and political instability, assessing their potential impact on global economic growth and stock markets.

-

Their assessment of the potential impact on market stability: Geopolitical risks can lead to increased market uncertainty and volatility, affecting investor sentiment and potentially leading to sharp price swings. BofA incorporates assessments of these risks into their valuation analyses.

-

How this risk factor affects their valuation analysis: The presence of geopolitical risks often contributes to a more cautious and conservative valuation outlook, as unforeseen events can significantly impact market dynamics.

Alternative Perspectives and Divergent Opinions

While BofA offers valuable insight, it's crucial to consider alternative perspectives. Other financial institutions and experts may offer contrasting opinions on current stock market valuations.

-

Other key valuation metrics and their implications: Other metrics, like the price-to-sales ratio (P/S) or price-to-book ratio (P/B), may provide different insights into valuations, potentially leading to different conclusions.

-

Briefly summarize opposing arguments: Some analysts may argue that current valuations are justified given anticipated future earnings growth or low interest rates in certain sectors.

-

Highlight any areas of agreement or disagreement with BofA's analysis: While there might be disagreements on specific valuation levels, there's often a general agreement on the importance of considering macroeconomic factors like inflation and interest rates when evaluating stock market valuations.

Strategies for Investors Based on BofA's View

BofA's cautious outlook suggests a need for a prudent investment strategy.

-

Strategies for investors who agree with BofA's view: Investors agreeing with BofA might prioritize diversification, focusing on less-valued sectors or defensive stocks. They may also consider increasing their cash holdings or allocating more to fixed-income investments.

-

Strategies for investors who hold a different perspective: Investors who believe the market is undervalued may seek growth opportunities in specific sectors or utilize strategies like dollar-cost averaging to mitigate risk.

-

Emphasize the importance of diversification and risk management: Regardless of individual viewpoints on stock market valuations, diversification and risk management remain crucial for navigating market uncertainty and protecting capital.

Conclusion

BofA's analysis of current stock market valuations highlights the importance of considering various economic factors, including interest rate hikes, inflation, and geopolitical risks. While their view is often cautious, it's crucial to understand that their assessment is not a definitive prediction. Different perspectives and valuation metrics exist, and understanding these diverse opinions is essential for informed decision-making.

Understanding current stock market valuations is crucial for informed investment decisions. Stay updated on BofA's analysis and other expert opinions to make well-informed choices about your investment strategy. Continuously monitor stock market valuations and adjust your portfolio accordingly. Don't hesitate to seek professional financial advice tailored to your specific circumstances and risk tolerance.

Featured Posts

-

Remembering Fallen Soldiers A Candlelight Vigil At Fort Belvoir

Apr 29, 2025

Remembering Fallen Soldiers A Candlelight Vigil At Fort Belvoir

Apr 29, 2025 -

You Tubes Growing Senior Audience Understanding The Trend

Apr 29, 2025

You Tubes Growing Senior Audience Understanding The Trend

Apr 29, 2025 -

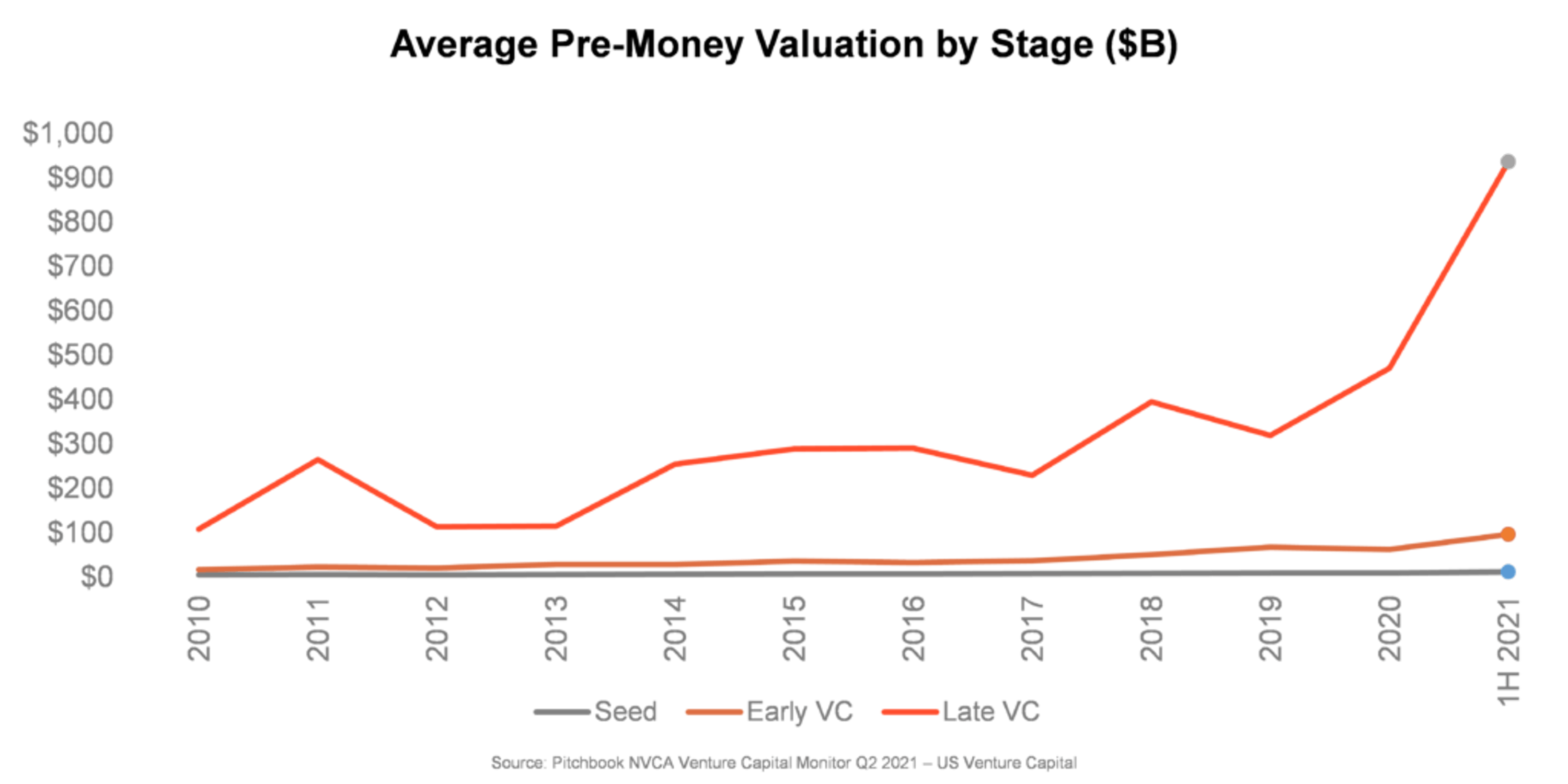

The Growing Appeal Of The Venture Capital Secondary Market

Apr 29, 2025

The Growing Appeal Of The Venture Capital Secondary Market

Apr 29, 2025 -

Teens Rock Throwing Spree Ends In Murder Conviction

Apr 29, 2025

Teens Rock Throwing Spree Ends In Murder Conviction

Apr 29, 2025 -

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Presence In Buildings

Apr 29, 2025

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Presence In Buildings

Apr 29, 2025

Latest Posts

-

Controversial Cardinals Conclave Voting Rights Under Scrutiny

Apr 29, 2025

Controversial Cardinals Conclave Voting Rights Under Scrutiny

Apr 29, 2025 -

Papal Conclave Disputed Voting Rights Of A Convicted Cardinal

Apr 29, 2025

Papal Conclave Disputed Voting Rights Of A Convicted Cardinal

Apr 29, 2025 -

Convicted Cardinal Fights For Conclave Voting Rights

Apr 29, 2025

Convicted Cardinal Fights For Conclave Voting Rights

Apr 29, 2025 -

Cardinal Maintains Voting Eligibility Despite Conviction

Apr 29, 2025

Cardinal Maintains Voting Eligibility Despite Conviction

Apr 29, 2025 -

Controversial Cardinal Fights For Conclave Inclusion

Apr 29, 2025

Controversial Cardinal Fights For Conclave Inclusion

Apr 29, 2025