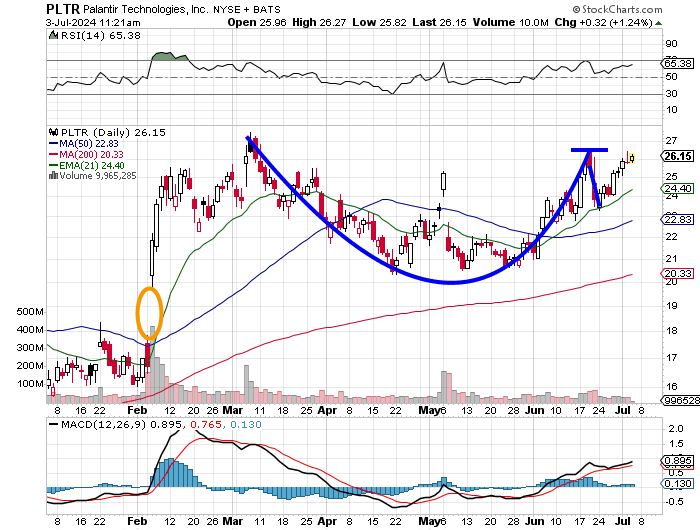

Should You Invest In Palantir After A 30% Price Drop?

Table of Contents

Palantir's Current Financial Performance and Future Growth Prospects

Palantir, a data analytics company known for its sophisticated software platforms, has shown a mixed bag in recent financial reports. While revenue growth has been positive, analyzing key performance indicators (KPIs) is crucial for assessing its investment potential.

- Revenue Growth: While Palantir has consistently shown revenue growth year-over-year, the rate of growth has fluctuated in recent quarters. Comparing this to previous years reveals whether the growth trajectory is sustainable.

- Profitability Margins: Examining profitability margins – gross, operating, and net – provides insight into the company's efficiency and ability to translate revenue into profit. Trends in these margins are vital for long-term viability.

- Customer Acquisition and Retention: Palantir's success hinges on attracting and retaining both government and commercial clients. High customer acquisition and retention rates signify a strong and stable business model.

- Government vs. Commercial Contracts: Palantir's revenue streams are derived from both government and commercial sectors. Understanding the growth trajectory of each sector is critical for gauging future revenue streams. A reliance on one sector over the other introduces specific risks.

Palantir's long-term growth strategy centers on expanding its platform capabilities and penetrating new markets. This strategy's success will significantly impact its stock price. However, the competitive landscape is fierce, with established players and new entrants vying for market share. Key competitors like AWS, Microsoft, and Google Cloud Platform all offer competing data analytics services, requiring Palantir to constantly innovate and differentiate itself.

Analyzing the 30% Price Drop: Understanding the Causes

The 30% drop in Palantir's stock price wasn't a single event but likely a confluence of factors. Understanding these causes is essential for determining whether the drop represents a temporary setback or a more significant issue.

- Specific News Events: Negative news or announcements concerning Palantir, such as disappointing earnings reports, missed projections, or regulatory concerns, can significantly impact investor sentiment.

- Overall Market Sentiment: The broader tech sector's performance and investor sentiment heavily influence individual tech stocks like Palantir. A general market downturn often impacts even fundamentally strong companies.

- Analyst Downgrades/Upgrades: Analyst ratings and price target adjustments can significantly affect a stock's price. Negative revisions often lead to selling pressure.

- Competitor Performance: The relative performance of Palantir's competitors can also impact investor perception and lead to comparisons that might trigger price drops.

By analyzing these factors, investors can gain a better understanding of the rationale behind the recent price decline and assess whether it's justified or an overreaction.

Risk Assessment: Potential Upsides and Downsides of Investing in Palantir Now

Investing in Palantir, or any tech stock, involves inherent risk. Weighing the potential upside against the downside is crucial before making any investment decision.

- Catalysts for Growth: New large government contracts, successful product launches, and expansion into lucrative new markets represent potential catalysts for future growth, which could drive the stock price upward.

- Risks Associated with Business Model: Palantir's dependence on large government contracts exposes it to the risks associated with government budgeting and procurement processes.

- Macroeconomic Factors: Economic downturns and shifts in government spending can significantly impact Palantir's performance.

- Valuation Analysis: A thorough valuation analysis, comparing Palantir's current price to its intrinsic value, helps determine if it's undervalued or overvalued.

The volatility of the tech sector, particularly in the data analytics space, must be considered. While a rebound is possible, the potential for further price drops remains.

Alternative Investment Strategies: Diversification and Risk Management

Diversifying your investment portfolio is paramount to mitigating risk. Investing solely in Palantir, especially considering its volatility, is not recommended.

- Diversification Strategies: Diversification across different asset classes (stocks, bonds, real estate) and sectors reduces the impact of a single investment's poor performance.

- Risk Tolerance Assessment: Understanding your personal risk tolerance is crucial. If you're risk-averse, a significant portion of your portfolio allocated to Palantir is unwise.

- Loss Mitigation Strategies: Implementing strategies like stop-loss orders can help limit potential losses if the stock price continues to decline.

Consider alternative investments to balance your portfolio and mitigate the risk associated with Palantir.

Conclusion: Should You Invest in Palantir After a 30% Price Drop? The Verdict

Palantir's recent price drop presents both opportunities and risks. While the company exhibits growth potential, its dependence on government contracts and the competitive landscape introduce significant challenges. The reasons behind the price drop—a combination of market sentiment and potentially company-specific issues—need careful consideration.

Whether you should invest in Palantir at its current price depends on your individual risk tolerance, investment goals, and a thorough due diligence process. Considering investing in Palantir requires a careful assessment of its financial performance, future prospects, and the overall market conditions. Remember to conduct your own research and consider diversifying your portfolio to manage risk effectively. Only after carefully weighing the potential upsides and downsides should you decide whether to invest in Palantir stock.

Featured Posts

-

Jack Doohans Blunt Response To Colapinto F1 75 Launch Highlights

May 09, 2025

Jack Doohans Blunt Response To Colapinto F1 75 Launch Highlights

May 09, 2025 -

Palantir Stock Before May 5th Is It A Buy Wall Streets Verdict

May 09, 2025

Palantir Stock Before May 5th Is It A Buy Wall Streets Verdict

May 09, 2025 -

Further Eu Action Needed On Us Tariffs Says French Minister

May 09, 2025

Further Eu Action Needed On Us Tariffs Says French Minister

May 09, 2025 -

Manchester Uniteds De Ligt Inter Milans Shock Loan Pursuit

May 09, 2025

Manchester Uniteds De Ligt Inter Milans Shock Loan Pursuit

May 09, 2025 -

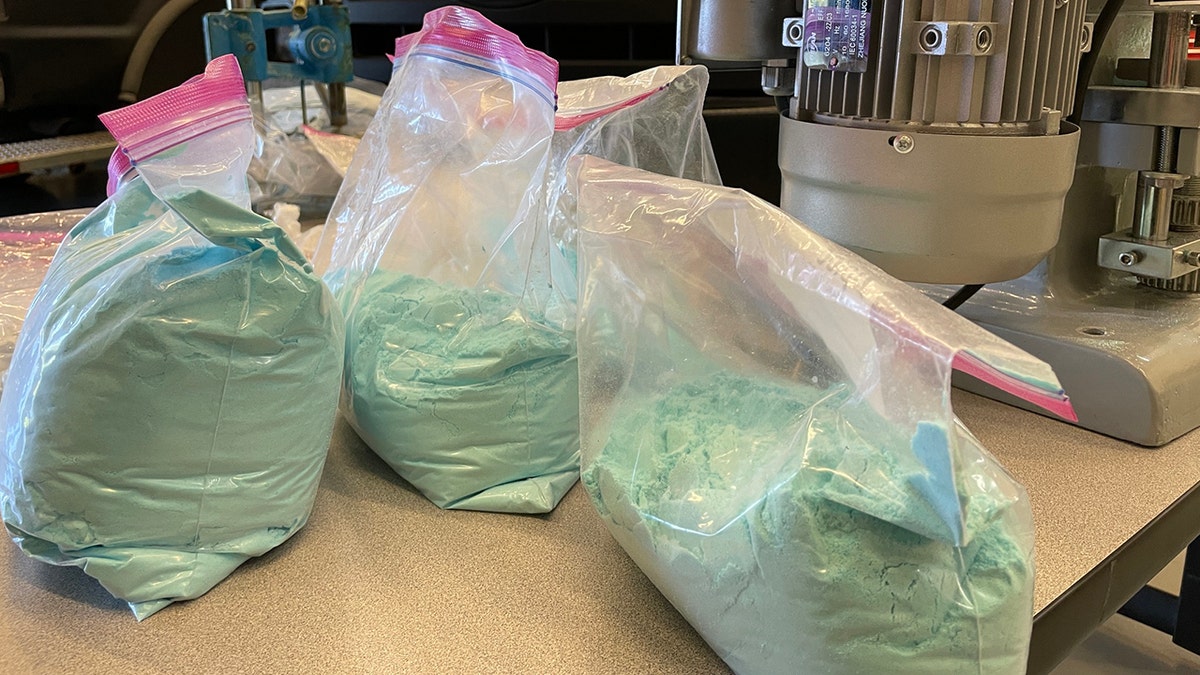

Record Fentanyl Seizure Bondi Unveils Details Of Major Drug Bust

May 09, 2025

Record Fentanyl Seizure Bondi Unveils Details Of Major Drug Bust

May 09, 2025

Latest Posts

-

Us Sees Largest Fentanyl Seizure Ever Led By Pam Bondi

May 10, 2025

Us Sees Largest Fentanyl Seizure Ever Led By Pam Bondi

May 10, 2025 -

Massive Fentanyl Bust Bondi Announces Largest Seizure In Us History

May 10, 2025

Massive Fentanyl Bust Bondi Announces Largest Seizure In Us History

May 10, 2025 -

Chinas Canola Search New Sources After Canada Rift

May 10, 2025

Chinas Canola Search New Sources After Canada Rift

May 10, 2025 -

Record Fentanyl Bust Pam Bondis Role In Historic Drug Seizure

May 10, 2025

Record Fentanyl Bust Pam Bondis Role In Historic Drug Seizure

May 10, 2025 -

Bondi Announces Record Breaking Fentanyl Seizure

May 10, 2025

Bondi Announces Record Breaking Fentanyl Seizure

May 10, 2025