Should You Invest In Ripple (XRP) While It's Under $3?

Table of Contents

Ripple's Current Market Position and Price Analysis

To answer "Should you invest in Ripple (XRP) while it's under $3?", we must first analyze its current market standing.

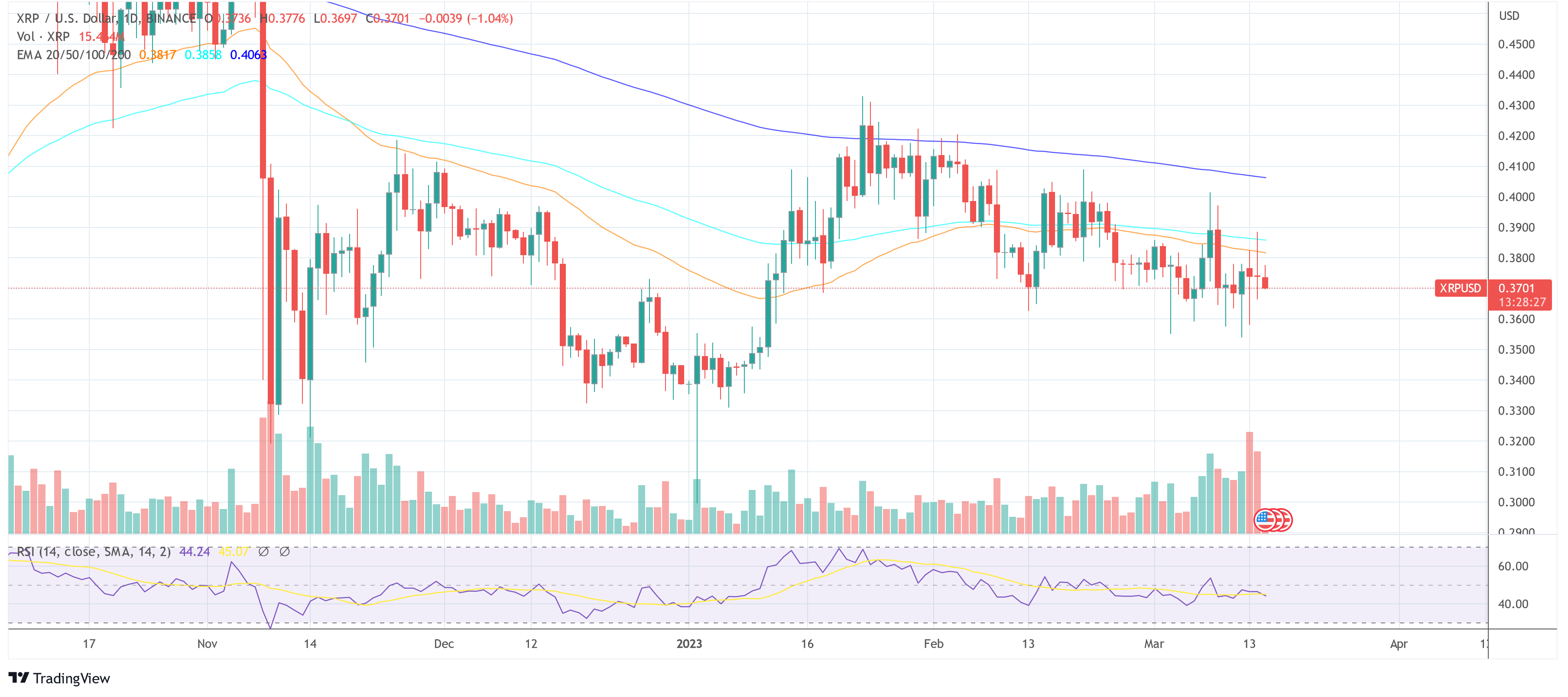

XRP Price History and Volatility

XRP, like most cryptocurrencies, has experienced significant price volatility. Its history is marked by periods of rapid growth and equally dramatic crashes. (Include a relevant chart showing XRP's price history here). Analyzing past performance can help identify potential support and resistance levels, offering insights into future price movements. However, past performance is not indicative of future results. Remember that cryptocurrency markets are notoriously unpredictable.

Market Sentiment and News Impact

Recent news significantly influences XRP's price. Let's examine some key events:

- SEC Lawsuit Update: The ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) continues to cast a shadow over XRP's price. Recent court filings (cite specific filings and their implications – positive or negative) suggest a potential [positive/negative] outcome, affecting investor confidence.

- New Partnerships: Ripple has forged partnerships with several financial institutions, expanding RippleNet's reach. These partnerships, such as those with [Company A] and [Company B], demonstrate growing adoption and could potentially drive future XRP demand. The implications of these partnerships remain to be seen, but they generally represent a positive sign.

- Technological Advancements: Upgrades and improvements to the XRP Ledger, such as increased transaction speeds and scalability enhancements, can positively impact XRP's appeal and adoption.

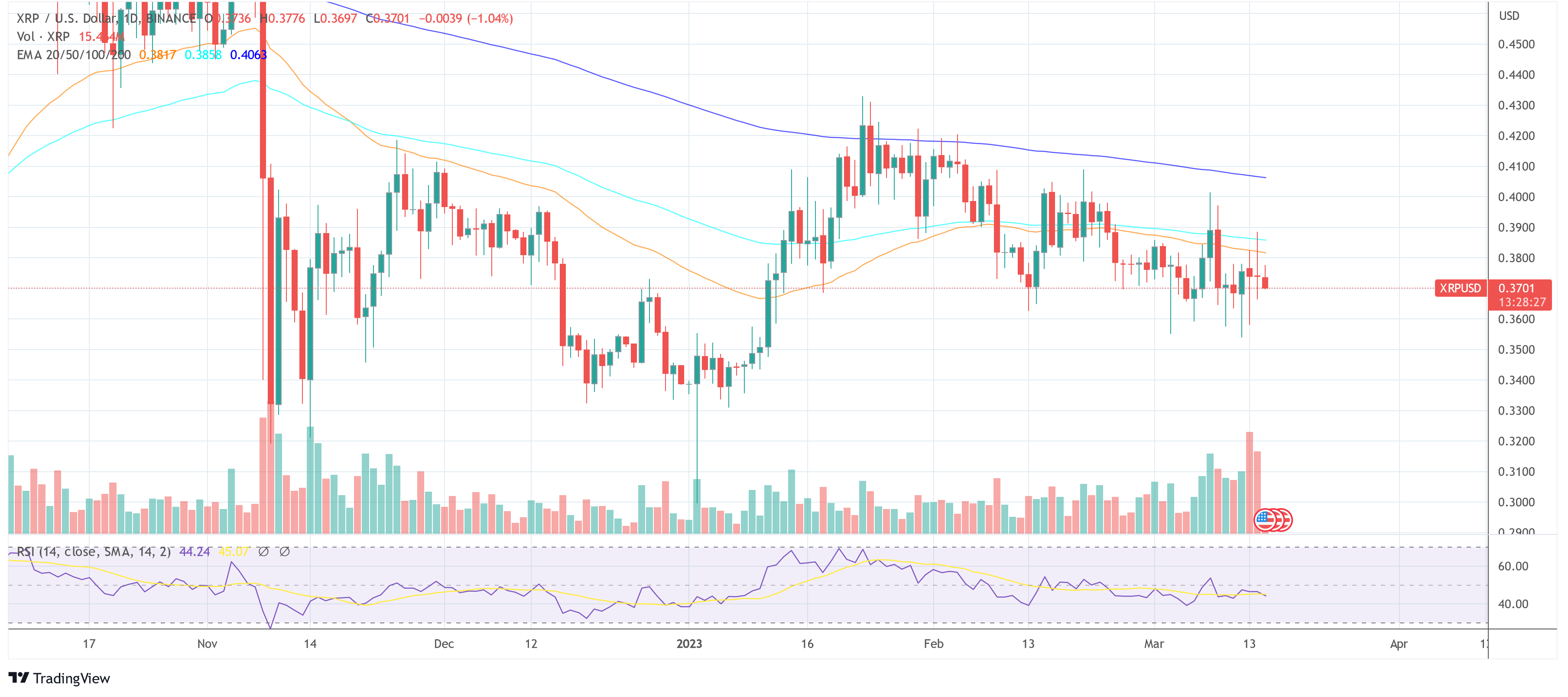

Technical Analysis of XRP

Technical analysis tools, such as moving averages, Relative Strength Index (RSI), and chart patterns (e.g., head and shoulders, double top/bottom), can provide insights into potential price trends. (Include a relevant chart with technical indicators here). However, it's crucial to remember that technical analysis is not foolproof and should be considered alongside fundamental analysis.

Ripple's Underlying Technology and Future Potential

Understanding Ripple's technology is key to assessing its long-term potential.

Understanding the XRP Ledger

The XRP Ledger is a decentralized, open-source public ledger that offers several advantages:

- Speed: XRP transactions are significantly faster than many other cryptocurrencies.

- Scalability: The XRP Ledger can process a large volume of transactions efficiently.

- Low Transaction Fees: Compared to other networks, XRP transactions have very low fees.

These features make XRP an attractive option for cross-border payments and other financial applications.

RippleNet and Global Adoption

RippleNet, Ripple's payment network, is gaining traction globally. Its increasing adoption by financial institutions suggests growing demand for XRP as a bridge currency for international transactions. This growth signifies a positive long-term outlook for XRP.

Long-Term Vision and Roadmap

Ripple's long-term vision includes expanding its reach into new markets and enhancing the XRP Ledger's functionality. Key milestones and future developments include:

- Expansion into new markets: Ripple is actively targeting [Region] and other key areas for increased adoption of RippleNet.

- Technological upgrades: Planned improvements to the XRP Ledger's speed and efficiency will likely enhance its competitiveness.

The feasibility of these plans and their impact on XRP's price remain to be seen, but they provide a framework for long-term potential.

Risks and Considerations Before Investing in XRP

Before investing in XRP, it's crucial to acknowledge the inherent risks.

Regulatory Uncertainty

The ongoing SEC lawsuit creates significant regulatory uncertainty surrounding XRP. The outcome of this lawsuit could significantly impact XRP's price and future prospects.

Market Volatility and Risk Tolerance

Cryptocurrency markets are inherently volatile. XRP's price can fluctuate dramatically in short periods. Only invest an amount you can afford to lose. Assess your risk tolerance carefully before investing in XRP or any cryptocurrency.

Diversification and Investment Strategy

Diversification is crucial for mitigating risk. Don't put all your eggs in one basket. A well-diversified portfolio spreads your investment across different asset classes, reducing overall risk. Always consult a financial advisor before making any investment decisions.

Conclusion

Should you invest in Ripple (XRP) while it's under $3? The answer depends on your risk tolerance, investment strategy, and understanding of the factors discussed above. While XRP's underlying technology and growing adoption offer potential for future growth, the regulatory uncertainty and inherent market volatility present significant risks. This analysis provides valuable insights, but it's crucial to conduct your own thorough research before investing in XRP or any cryptocurrency. Weigh the pros and cons carefully before deciding whether to invest in XRP below $3. Remember, making informed decisions is key to successful investing.

Featured Posts

-

Thanh Pho Hue To Chuc Giai Bong Da Thanh Nien Lan Thu Vii Co Hoi Cho Tai Nang Tre

May 01, 2025

Thanh Pho Hue To Chuc Giai Bong Da Thanh Nien Lan Thu Vii Co Hoi Cho Tai Nang Tre

May 01, 2025 -

Une Star De Nba Fragilise Sa Carriere Et Sa Famille Par Ses Celebrations Avec Arme A Feu

May 01, 2025

Une Star De Nba Fragilise Sa Carriere Et Sa Famille Par Ses Celebrations Avec Arme A Feu

May 01, 2025 -

Tongas Strong Performance Dashes Samoan Hopes

May 01, 2025

Tongas Strong Performance Dashes Samoan Hopes

May 01, 2025 -

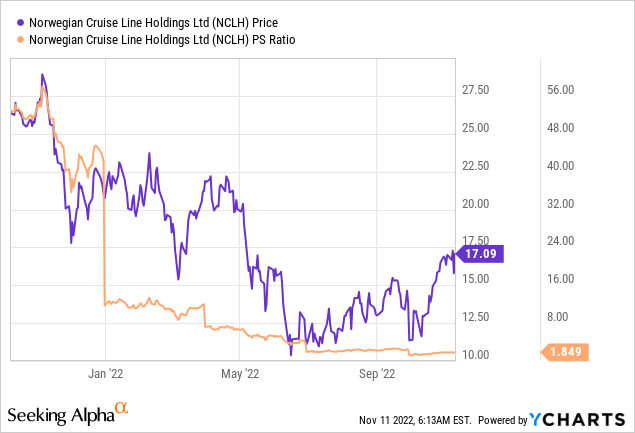

Norwegian Cruise Line Nclh Stock Jumps On Positive Earnings Report

May 01, 2025

Norwegian Cruise Line Nclh Stock Jumps On Positive Earnings Report

May 01, 2025 -

1050 V Mware Price Hike At And T Sounds Alarm On Broadcoms Acquisition

May 01, 2025

1050 V Mware Price Hike At And T Sounds Alarm On Broadcoms Acquisition

May 01, 2025