Simplifying Banking Regulation: ECB Establishes New Task Force

Table of Contents

The Current State of Banking Regulation: A Labyrinthine System

The current regulatory framework governing banks within the EU is undeniably complex. Years of accumulating regulations from various EU bodies, such as the European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA), have resulted in a labyrinthine system. This complexity presents significant challenges for banks of all sizes.

- Multiple overlapping regulations from different EU bodies: Banks often grapple with interpreting and complying with regulations from multiple sources, leading to confusion and inconsistencies.

- High compliance costs for banks, impacting profitability and innovation: The substantial resources dedicated to meeting regulatory requirements divert funds from crucial investments in innovation and core business activities. This directly impacts profitability, particularly for smaller institutions.

- Increased operational burden, diverting resources from core business activities: The administrative burden associated with compliance consumes significant manpower and technological resources, hindering efficiency and strategic growth.

- Potential for regulatory arbitrage and inconsistencies across member states: Variations in the interpretation and application of regulations across different member states create opportunities for regulatory arbitrage and undermine the level playing field.

The negative consequences are particularly acute for small and medium-sized banks (SMBs). Their limited resources make compliance with complex regulations disproportionately challenging, potentially hindering their growth and competitiveness. This can lead to market consolidation and reduced diversity within the banking sector.

The ECB Task Force: Objectives and Mandate

The newly established ECB task force has a clear mandate: to significantly simplify banking regulation within the Eurozone. Its specific objectives include:

- Identify areas of unnecessary regulatory complexity: The task force will meticulously analyze existing regulations to pinpoint areas where simplification is possible without compromising financial stability.

- Propose concrete measures for simplification and harmonization: The task force will develop concrete proposals for regulatory changes, aiming for a more streamlined and harmonized approach across the Eurozone.

- Assess the impact of proposed changes on financial stability and market integrity: A thorough assessment of the potential impact on financial stability and market integrity will be conducted to ensure that any simplification does not inadvertently create new vulnerabilities.

- Engage with stakeholders (banks, supervisors, etc.) to gather feedback: The task force will actively engage with all relevant stakeholders to gather valuable feedback and ensure a balanced and informed approach to regulatory reform.

The task force is comprised of leading experts from various fields within the financial sector and is expected to deliver its recommendations within a defined timeframe, although the exact timeline remains to be officially announced.

Potential Areas for Regulatory Simplification

Several key areas of banking regulation are ripe for simplification. The task force is likely to focus on:

- Capital requirements (reducing complexity and improving calibration): Simplifying the calculation and application of capital requirements can reduce complexity and improve their calibration to better reflect actual risk.

- Reporting requirements (streamlining data collection and submission): Streamlining data collection and submission processes can significantly reduce the administrative burden on banks, freeing up resources.

- Internal controls and governance (improving proportionality and effectiveness): Improving the proportionality and effectiveness of internal controls and governance requirements can reduce unnecessary burdens on smaller banks.

- Cross-border banking activities (reducing friction and promoting integration): Reducing friction associated with cross-border banking activities will promote greater integration within the Eurozone's banking market.

Simplification in these areas would lead to substantial benefits, including reduced compliance costs, increased efficiency, and improved competitiveness for banks.

Impact on Competitiveness and Innovation

Simplifying banking regulation can significantly boost competition and foster innovation within the European banking sector.

- Reduced compliance costs freeing up resources for investment in new technologies and services: Reduced compliance costs will free up valuable resources that can be invested in developing new technologies and innovative financial services.

- A level playing field for banks of all sizes, encouraging greater participation in the market: A simplified regulatory environment will create a more level playing field, encouraging greater participation from banks of all sizes and fostering greater competition.

- Attracting investment in the European banking sector, supporting economic growth: A more efficient and competitive banking sector will attract more investment, supporting overall economic growth within the Eurozone.

Furthermore, simplified regulations can contribute to increased financial inclusion by reducing barriers to entry for smaller banks and fintech firms, making financial services more accessible to underserved populations.

Challenges and Potential Risks

While simplification offers significant benefits, it's crucial to acknowledge potential challenges and risks.

- Maintaining adequate levels of financial stability and consumer protection: Simplification should not compromise the crucial goals of financial stability and consumer protection. Careful consideration must be given to ensure that simplification does not create new vulnerabilities.

- Ensuring consistent application of regulations across the Eurozone: Consistent application of simplified regulations across the Eurozone is vital to prevent regulatory arbitrage and maintain a level playing field.

- Avoiding unintended consequences that could create new vulnerabilities: Thorough impact assessments are crucial to avoid unintended consequences that could introduce new vulnerabilities into the financial system.

Mitigating these risks requires a phased approach, ongoing monitoring, and close collaboration between the ECB, national supervisors, and other stakeholders.

Conclusion

The ECB’s establishment of a task force focused on simplifying banking regulation signifies a crucial step toward creating a more efficient and competitive financial landscape within the Eurozone. By streamlining the complex regulatory framework, the ECB aims to reduce the burden on banks, fostering innovation and ultimately benefiting consumers and the broader economy. The success of this initiative depends on a careful and comprehensive approach, balancing simplification with the vital need to maintain financial stability and market integrity. Stay informed about the progress of this important initiative and its potential impact on the future of simplifying banking regulation by regularly checking the ECB’s website for updates.

Featured Posts

-

Bencic De Madre A Campeona En Nueve Meses

Apr 27, 2025

Bencic De Madre A Campeona En Nueve Meses

Apr 27, 2025 -

Justin Herbert Chargers 2025 Season Opener In Brazil

Apr 27, 2025

Justin Herbert Chargers 2025 Season Opener In Brazil

Apr 27, 2025 -

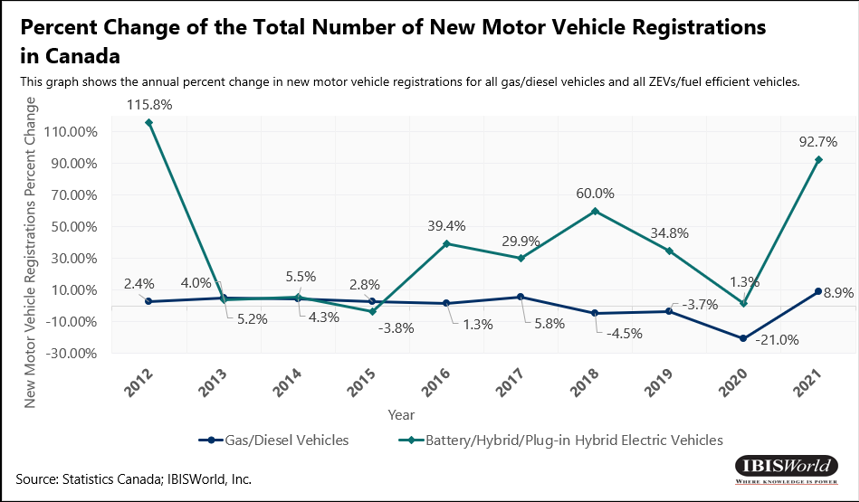

Declining Canadian Interest In Electric Vehicles

Apr 27, 2025

Declining Canadian Interest In Electric Vehicles

Apr 27, 2025 -

Nosferatu The Vampyre A Now Toronto Detour Worth Taking

Apr 27, 2025

Nosferatu The Vampyre A Now Toronto Detour Worth Taking

Apr 27, 2025 -

Juliette Binoche Cannes Film Festival Jury President 2025

Apr 27, 2025

Juliette Binoche Cannes Film Festival Jury President 2025

Apr 27, 2025

Latest Posts

-

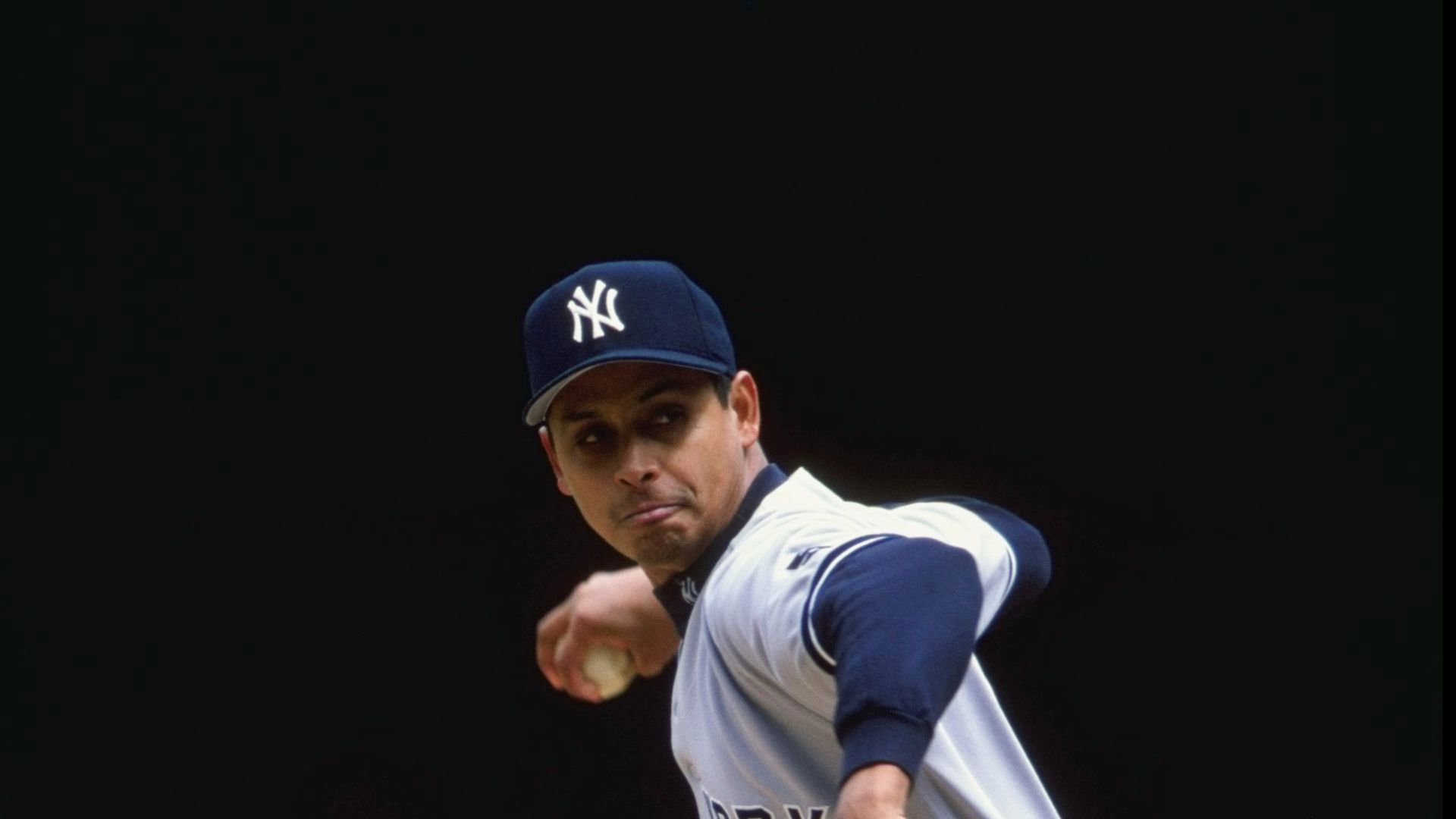

Free Live Stream Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025

Free Live Stream Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025 -

A Look Back 2000 Yankees Diary Victory Over The Royals

Apr 28, 2025

A Look Back 2000 Yankees Diary Victory Over The Royals

Apr 28, 2025 -

Yankees 2000 Season A Diary Entry The Royals Game

Apr 28, 2025

Yankees 2000 Season A Diary Entry The Royals Game

Apr 28, 2025 -

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025 -

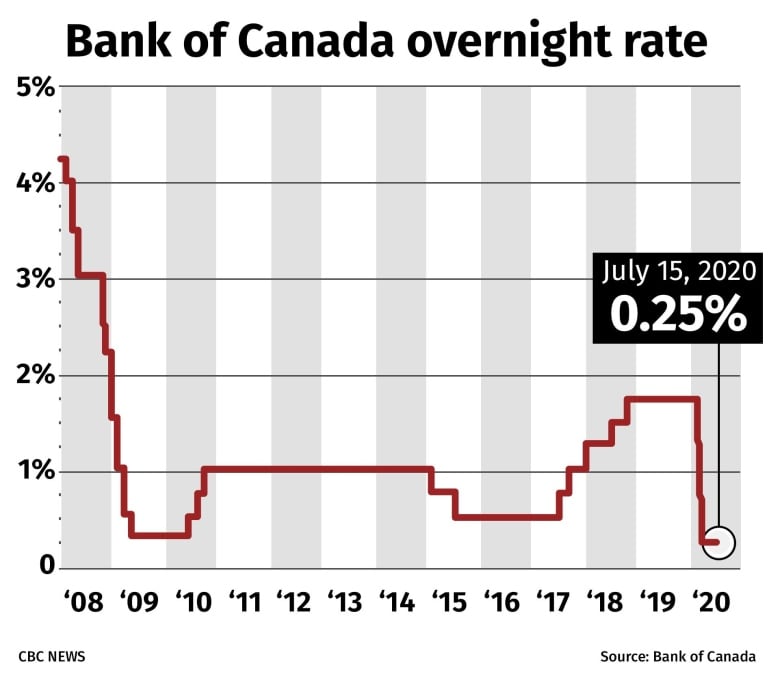

Bank Of Canada Rate Cuts A Response To Dismal Retail Sales Figures

Apr 28, 2025

Bank Of Canada Rate Cuts A Response To Dismal Retail Sales Figures

Apr 28, 2025