Southeast Asian Solar Imports Face Steep US Tariffs: A 3,521% Duty

Table of Contents

The 3,521% Tariff: A Deep Dive

The imposition of such a high tariff stems from a Commerce Department investigation into allegations of circumvention of existing tariffs on Chinese solar products. This anti-circumvention investigation focused on claims that Southeast Asian manufacturers were bypassing earlier tariffs designed to protect the domestic US solar industry. These trade remedies, while intended to safeguard American businesses, have now sparked a new wave of controversy.

Understanding the Circumvention Investigation

The investigation delved into whether Southeast Asian solar panel producers were essentially acting as fronts for Chinese companies, circumventing previous tariffs imposed on Chinese solar imports. This involved a complex analysis of supply chains, manufacturing processes, and ownership structures.

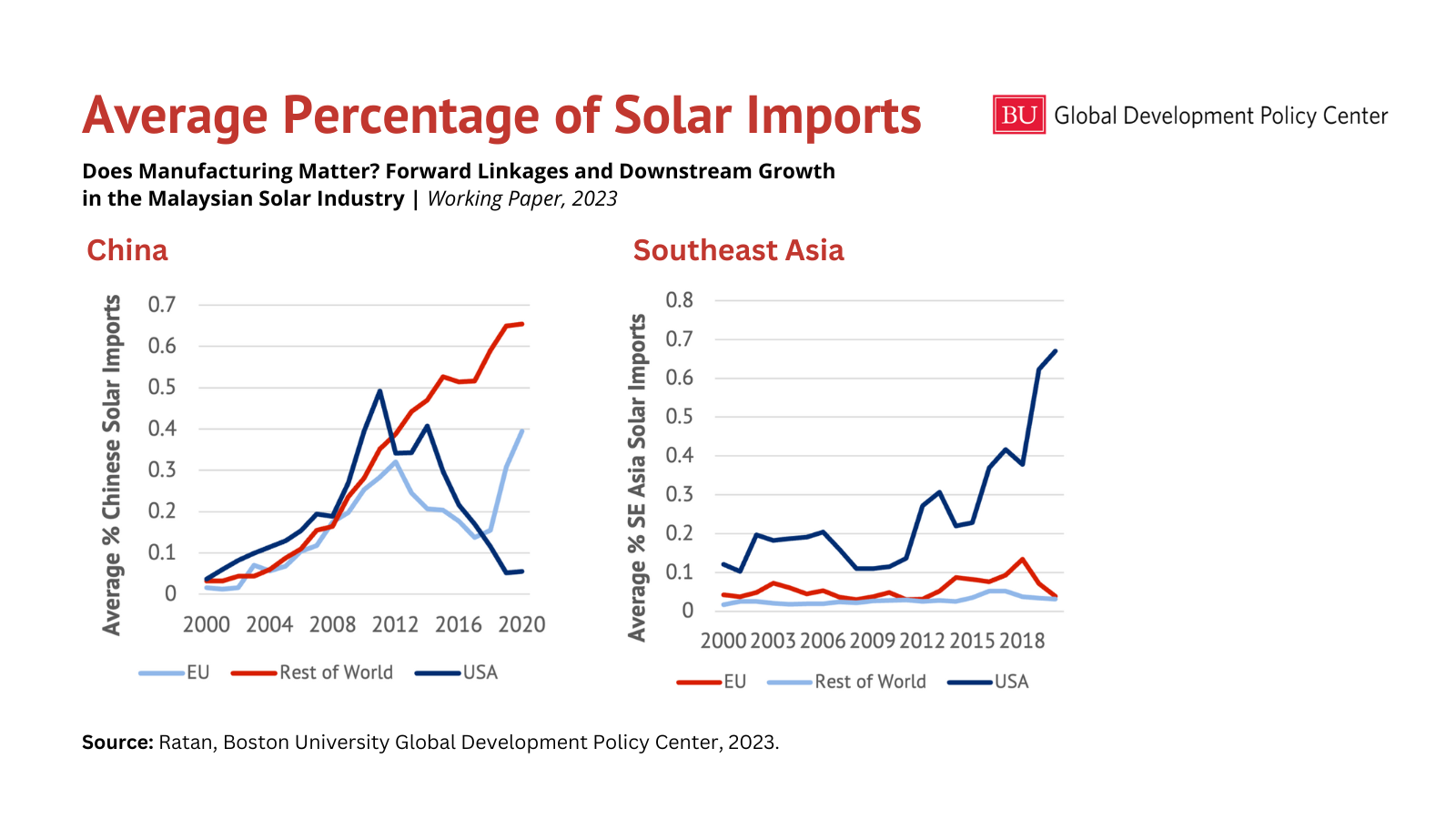

- History of Tariffs on Chinese Solar Panels: Previous years saw the imposition of tariffs on Chinese solar panels due to allegations of dumping and subsidies. These tariffs aimed to level the playing field for domestic US manufacturers.

- Southeast Asian Companies Affected: The investigation specifically targeted several major solar panel producers in Cambodia, Malaysia, Thailand, and Vietnam, impacting their ability to export to the US market. The full list of affected companies and their individual import volumes is still being compiled and released in stages.

- Types of Solar Panels Subject to the Tariff: The 3,521% tariff applies specifically to certain crystalline silicon photovoltaic (CSPV) solar panels and cells. The exact specifications are detailed in the Commerce Department's final determination.

- Legal Basis for the Commerce Department's Decision: The decision rests on the legal framework of US trade law, specifically provisions that allow for the imposition of anti-circumvention duties to prevent the evasion of existing tariffs.

Impacts on the US Solar Industry and Consumers

The 3,521% tariff on Southeast Asian solar imports will have far-reaching consequences for the US solar industry and American consumers.

Increased Solar Panel Costs

This dramatic tariff increase will significantly inflate solar panel costs for US consumers and businesses. This directly impacts the affordability and accessibility of solar energy, potentially stifling the growth of the renewable energy sector.

- Potential Price Increases: Industry analysts predict substantial price hikes, potentially ranging from 20% to 40% or more for residential and commercial solar installations, depending on the reliance on imports from the affected Southeast Asian nations.

- Impact on US Solar Market Growth: The increased cost will undoubtedly dampen the growth of the US solar energy market, slowing down the transition to cleaner energy sources.

- Potential Job Losses: The higher costs could lead to fewer solar installations, resulting in job losses within the US solar installation and manufacturing sectors.

Supply Chain Disruptions

The reliance of the US on Southeast Asian solar imports for a significant portion of its supply needs makes the industry particularly vulnerable. The tariff creates significant supply chain disruptions, leading to project delays and potential shortages.

- US Reliance on Southeast Asian Imports: A large percentage of US solar installations rely on components and panels sourced from Southeast Asia. This reliance highlights a critical vulnerability in the current US energy infrastructure.

- Alternative Sources and Limitations: While alternative sources exist (e.g., domestic production, imports from other countries), they may not be able to meet the immediate demand, leading to considerable delays in project completion.

- Vulnerability to Geopolitical Factors: This situation underscores the vulnerability of the US solar industry to geopolitical factors and the risks associated with over-reliance on specific regions for critical resources.

Political and Economic Ramifications

The decision to impose such steep tariffs carries significant political and economic ramifications.

Trade Relations with Southeast Asia

The 3,521% tariff will undoubtedly strain US trade relations with Southeast Asian nations. These countries may retaliate with measures impacting other US exports.

- Potential Retaliatory Measures: Southeast Asian countries may impose tariffs or other trade restrictions on US goods in response to the solar panel tariffs, escalating trade tensions.

- Impact on Broader US Foreign Policy Objectives: The strained relationships could complicate broader US foreign policy goals in the region, potentially hindering collaborations on other critical issues.

The Biden Administration's Stance on Renewable Energy

This decision creates a direct conflict with the Biden administration's ambitious climate change agenda and commitment to expanding renewable energy sources.

- Contradiction Between Tariff and Climate Goals: The steep tariff increase directly contradicts the administration's stated goal of transitioning to a cleaner energy future by making solar energy less accessible and affordable.

- Potential Policy Adjustments: The administration may need to consider policy adjustments to mitigate the negative impact of the tariff on the clean energy transition and potentially explore alternative solutions to ensure domestic solar energy production.

Conclusion

The 3,521% tariff on Southeast Asian solar imports presents a major challenge to the growth of the US solar energy sector. This decision will likely result in higher prices, supply chain disruptions, and damaged international relations. The impact on the accessibility and affordability of solar power for American consumers is undeniable.

Call to Action: Understanding the implications of these steep Southeast Asian solar imports tariffs is crucial for policymakers, businesses, and consumers alike. Staying informed about further developments and advocating for policies that support a sustainable and affordable renewable energy future is vital. Let's work towards finding solutions that promote both clean energy and healthy trade relationships – a future where the growth of renewable energy isn't stifled by trade disputes.

Featured Posts

-

Metz 2026 Jacobelli Se Presentera T Il Aux Municipales

May 30, 2025

Metz 2026 Jacobelli Se Presentera T Il Aux Municipales

May 30, 2025 -

Allaebt Awstabynkw Wnjahha Almtzayd Ela Almlaeb Altrabyt

May 30, 2025

Allaebt Awstabynkw Wnjahha Almtzayd Ela Almlaeb Altrabyt

May 30, 2025 -

The Transformative Power Of An Adult Autism Diagnosis

May 30, 2025

The Transformative Power Of An Adult Autism Diagnosis

May 30, 2025 -

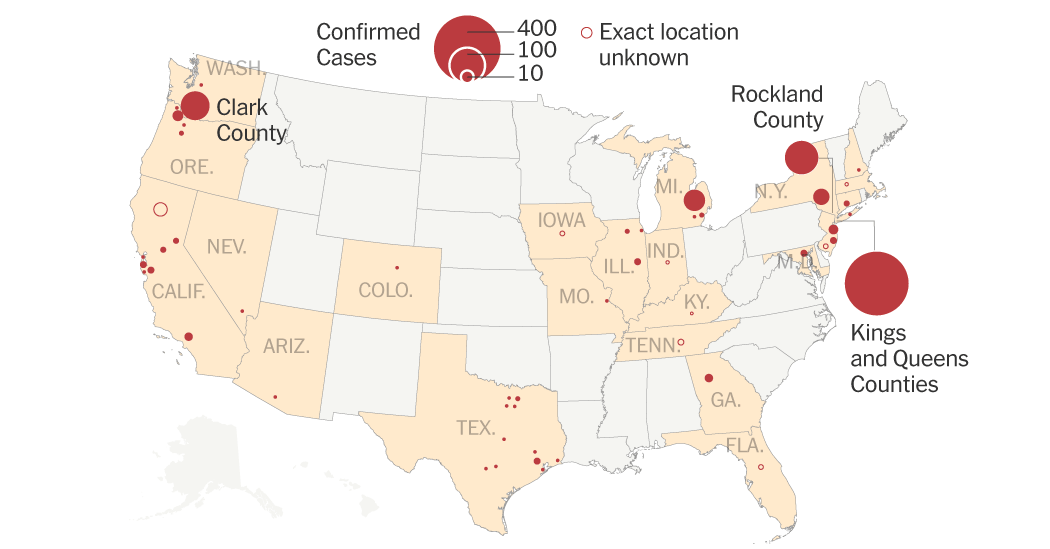

Measles Cases In The U S An Update On The Current Outbreak

May 30, 2025

Measles Cases In The U S An Update On The Current Outbreak

May 30, 2025 -

Golacos E Emocao Manchester United E Arsenal Ficam No Empate

May 30, 2025

Golacos E Emocao Manchester United E Arsenal Ficam No Empate

May 30, 2025