Spot Market Strategies: EU Debates Russian Natural Gas Ban

Table of Contents

The Impact of a Russian Gas Ban on the Spot Market

A ban on Russian natural gas would have profound consequences for the European spot market, triggering significant price volatility and supply chain disruptions.

Increased Price Volatility

A sudden reduction in Russian gas supply would drastically tighten the market, leading to sharp price increases and unpredictable price swings. This volatility creates immense risk for businesses relying on natural gas for their operations.

- Increased demand for alternative sources: The EU would scramble to find alternative sources, driving up demand for Liquefied Natural Gas (LNG) and potentially pipeline gas from Norway and other suppliers. This increased competition will fuel price spikes.

- Potential for market manipulation and price gouging: The scarcity of supply could create opportunities for market manipulation and price gouging, necessitating stringent regulatory oversight.

- Need for robust risk management strategies: Businesses must develop sophisticated risk management strategies to mitigate the impact of these extreme price fluctuations. This includes hedging and diversification, as discussed below.

Supply Chain Disruptions

Diversifying the EU's gas supply will be a monumental task, fraught with logistical challenges and potential delays. Existing infrastructure may struggle to cope with the sudden shift in supply sources.

- Increased reliance on pipeline gas from Norway and other sources: Existing pipeline infrastructure will be pushed to its limits, requiring careful management and potential upgrades.

- Increased import of Liquefied Natural Gas (LNG): A significant increase in LNG imports will place considerable strain on LNG terminal capacity and shipping logistics. Competition for available LNG cargoes will intensify, driving up prices.

- Strain on existing infrastructure: The EU's current infrastructure may not be adequately equipped to handle the rapid shift away from Russian gas, leading to bottlenecks and delays.

Spot Market Strategies for Businesses

Businesses face a critical need to adapt their strategies to navigate the increased volatility and uncertainty in the natural gas spot market. Proactive measures are crucial for mitigating risk and ensuring business continuity.

Hedging and Risk Management

Implementing effective hedging strategies is paramount to mitigate the impact of price volatility. This involves locking in future prices to reduce exposure to unexpected price swings.

- Utilizing futures contracts: Futures contracts allow businesses to lock in a price for future gas deliveries, providing price certainty and reducing risk.

- Exploring options contracts: Options contracts offer flexibility, allowing businesses to buy the right, but not the obligation, to purchase gas at a predetermined price. This offers protection against price spikes while maintaining some upside potential.

- Diversifying energy sources: Reducing reliance on a single supplier or energy source is crucial. This involves exploring alternative fuels and renewable energy options.

Supply Diversification

Reducing dependence on Russian gas requires a proactive approach to sourcing alternative supplies and energy sources. This involves long-term planning and investment.

- Investing in renewable energy sources: Transitioning to renewable energy sources like solar and wind power can significantly reduce reliance on natural gas and contribute to long-term sustainability.

- Improving energy efficiency: Reducing overall energy consumption through efficiency improvements minimizes vulnerability to price fluctuations and supply disruptions.

- Securing long-term contracts with reliable suppliers: Negotiating long-term contracts with diverse suppliers can provide price stability and secure access to alternative gas supplies.

Monitoring Market Trends

Continuous market monitoring is critical for informed decision-making in this volatile environment. This requires staying abreast of real-time price fluctuations and geopolitical developments.

- Tracking real-time price fluctuations: Closely monitoring spot prices and futures markets provides essential insights into market dynamics and potential price trends.

- Analyzing geopolitical developments impacting supply: Understanding geopolitical factors influencing gas supply and demand is crucial for anticipating market shifts.

- Utilizing market analysis tools and expert opinions: Employing advanced analytics tools and consulting with energy market experts can enhance decision-making capabilities.

The EU's Response and Policy Implications

The EU's response to a potential Russian gas ban will significantly shape the future energy landscape, requiring substantial policy changes and investments.

Regulatory Changes

The EU is likely to implement regulatory changes to ensure market stability and prevent manipulation in the face of reduced Russian gas supply.

- Increased transparency requirements for gas trading: Enhanced transparency can help to prevent market manipulation and promote fair pricing.

- Potential price caps or subsidies: Price caps or subsidies could be implemented to protect consumers and businesses from excessive price increases.

- Investing in energy infrastructure upgrades: Significant investment will be needed to upgrade and expand existing energy infrastructure to accommodate alternative supply sources.

Investment in Renewable Energy

A Russian gas ban will likely accelerate the EU's transition to renewable energy sources.

- Increased funding for solar, wind, and other renewables: The EU is expected to significantly increase funding for renewable energy projects to accelerate the energy transition.

- Incentives for energy efficiency improvements: Incentives and regulations will likely be implemented to encourage energy efficiency measures across various sectors.

- Development of smart grids and energy storage solutions: Investment in smart grids and energy storage technologies is essential for integrating renewable energy sources effectively.

Conclusion

The EU's potential ban on Russian natural gas presents significant challenges and opportunities within the spot market. Businesses must proactively implement hedging strategies, diversify their energy sources, and closely monitor market trends. The EU's response will be crucial in shaping the future energy landscape, highlighting the need for robust regulatory frameworks and accelerated investment in renewable energy. Understanding these dynamics and effectively utilizing spot market strategies will be vital for navigating the energy crisis and securing future energy supplies. Don't hesitate to explore different spot market strategies to best manage your energy needs in this volatile environment. Effectively managing your exposure within the spot market is key to navigating the uncertainties surrounding the Russian natural gas ban.

Featured Posts

-

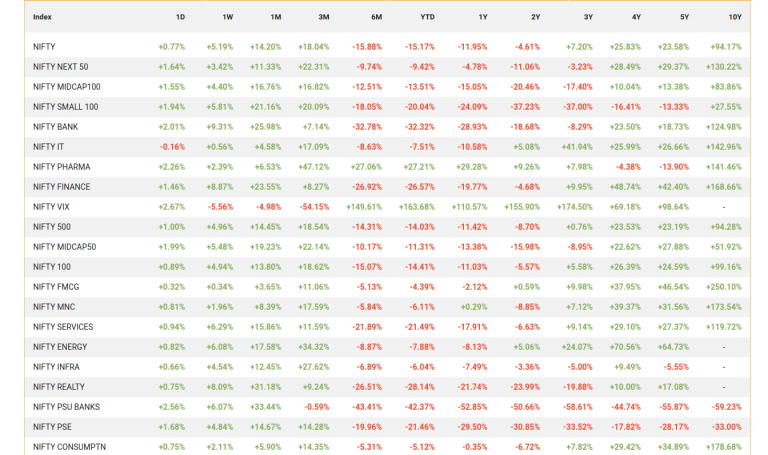

India Stock Market Analysis Niftys Robust Performance Explained

Apr 24, 2025

India Stock Market Analysis Niftys Robust Performance Explained

Apr 24, 2025 -

Assessing Liberal Fiscal Policies Are They Sustainable For Canadas Future

Apr 24, 2025

Assessing Liberal Fiscal Policies Are They Sustainable For Canadas Future

Apr 24, 2025 -

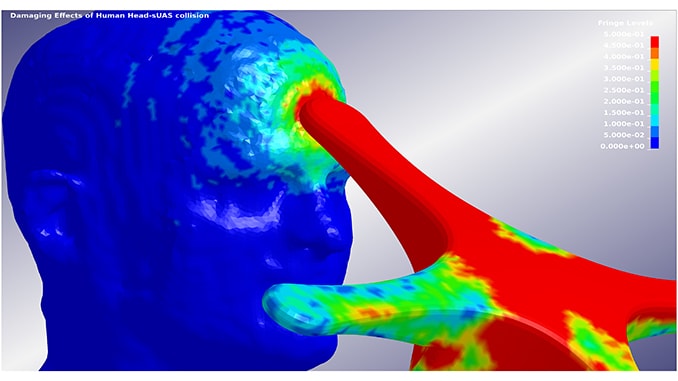

Faa Study Collision Risks At Las Vegas Airport

Apr 24, 2025

Faa Study Collision Risks At Las Vegas Airport

Apr 24, 2025 -

John Travoltas Heartfelt Tribute Photo Marks Late Sons Birthday

Apr 24, 2025

John Travoltas Heartfelt Tribute Photo Marks Late Sons Birthday

Apr 24, 2025 -

California Gas Prices Governor Newsom Seeks Industry Collaboration To Lower Costs

Apr 24, 2025

California Gas Prices Governor Newsom Seeks Industry Collaboration To Lower Costs

Apr 24, 2025