Stock Market Defies Recession Fears: Investors See Continued Growth

Table of Contents

Strong Corporate Earnings Drive Market Optimism

Robust corporate earnings reports, exceeding analysts' expectations, are a primary driver of the current market optimism. Companies across various sectors are demonstrating impressive financial results, bolstering investor confidence and pushing stock prices higher. This positive trend suggests a resilience within the economy that many had not predicted.

- Increased consumer spending despite inflation: Even with persistent inflation, consumer spending remains surprisingly strong, fueling corporate revenue growth. Consumers are adapting their spending habits, prioritizing essential goods and services while still maintaining a level of discretionary spending.

- Innovative product launches and market expansion: Companies are successfully launching innovative products and expanding into new markets, driving sales and boosting profitability. This demonstrates adaptability and strategic foresight in the face of economic uncertainty.

- Effective cost-cutting measures by companies: Many corporations have implemented effective cost-cutting measures, improving their profit margins even amidst rising input costs. This operational efficiency contributes significantly to strong earnings.

- Stronger-than-anticipated demand for goods and services: Demand for goods and services, across multiple sectors, has remained remarkably resilient, exceeding initial forecasts and supporting strong corporate performance. This indicates a degree of underlying economic strength.

Resilient Consumer Spending Defies Recessionary Predictions

Contrary to recessionary indicators, consumer spending remains surprisingly robust. This unexpected resilience is a key factor underpinning the stock market's defiance of recession fears and signals a more complex economic picture than initially anticipated.

- High employment rates mitigating the impact of inflation: High employment rates are cushioning the blow of inflation for many consumers, allowing them to maintain spending levels. This strong labor market is a crucial support for the economy.

- Government stimulus measures and their lingering effects: The lingering effects of previous government stimulus measures continue to support consumer spending, though their impact is gradually waning.

- Pent-up demand from previous lockdowns: Pent-up demand from pandemic-related lockdowns continues to contribute to consumer spending in certain sectors, providing a temporary boost.

- Shifting consumer spending habits and priorities: Consumers are adapting their spending habits, prioritizing experiences and durable goods over non-essential items, further shaping market dynamics.

Inflation Shows Signs of Cooling, Easing Monetary Policy Concerns

Easing inflation is significantly impacting investor sentiment and reducing concerns about aggressive interest rate hikes. The downward trend in inflation data offers a more optimistic outlook for economic growth and corporate profitability.

- Recent inflation data showing a downward trend: Recent economic data shows a clear downward trend in inflation rates, easing concerns about runaway price increases. This positive trend is fueling market optimism.

- Central bank responses and their influence on market expectations: Central banks' responses to inflation are carefully monitored by investors. As inflation cools, the expectation is that interest rate hikes will become less aggressive, supporting economic growth.

- Impact of easing inflation on corporate profitability: Easing inflation directly improves corporate profitability by reducing input costs and improving margins. This positive impact further fuels market growth.

- Reduced uncertainty regarding future interest rate adjustments: The decreased uncertainty surrounding future interest rate adjustments contributes to increased investor confidence and willingness to invest.

Technological Advancements and Emerging Markets Fuel Growth

Technological advancements and the growth potential of emerging markets are playing an increasingly significant role in driving market performance, offering new avenues for growth and investment opportunities.

- Investments in artificial intelligence and other emerging technologies: Massive investments in artificial intelligence, renewable energy, and other emerging technologies are creating new industries and driving economic growth.

- Growth opportunities in developing economies: Developing economies offer significant growth potential for investors, providing diversification and attractive returns.

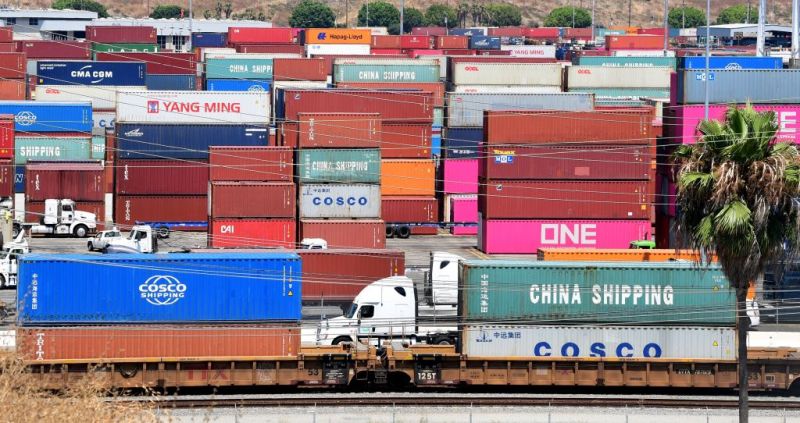

- Increased global trade and investment flows: Increased global trade and investment flows are further fueling economic growth and creating opportunities for investors.

- The rise of new disruptive businesses and industries: The emergence of disruptive businesses and industries is creating new investment opportunities and reshaping existing markets.

Cautious Optimism: Navigating Uncertainty in the Stock Market

While the current market performance is encouraging, investors should maintain a cautious optimism, acknowledging both potential risks and opportunities. A balanced approach is crucial for navigating the uncertainties that still exist.

- Diversification of investment portfolios: Diversifying investment portfolios across different asset classes and sectors is crucial to mitigate risk.

- Long-term investment strategies vs. short-term trading: Adopting long-term investment strategies is generally more prudent than engaging in short-term trading in this volatile environment.

- Risk assessment and management: A thorough risk assessment and effective risk management strategies are essential for protecting investments.

- Seeking advice from financial professionals: Seeking advice from qualified financial professionals can provide valuable insights and guidance for navigating the complexities of the market.

Conclusion

While recession fears persist, the current stock market performance presents a complex picture. Strong corporate earnings, resilient consumer spending, and signs of cooling inflation are contributing to continued growth. However, investors should maintain a cautious optimism, diversifying their portfolios and carefully considering long-term strategies. The influence of technological advancements and emerging markets also presents compelling opportunities. Understanding the nuances of the current market is crucial for navigating the future. Stay informed about the latest developments and continue to research effective investment strategies to capitalize on the opportunities presented by the stock market's defiance of recession fears. Don't hesitate to consult with a financial advisor to optimize your approach to the evolving stock market landscape.

Featured Posts

-

Sabrina Carpenters Fortnite Items A Collectors Guide

May 06, 2025

Sabrina Carpenters Fortnite Items A Collectors Guide

May 06, 2025 -

An Often Overlooked Collaboration Spike Lee And Denzel Washingtons Early Success

May 06, 2025

An Often Overlooked Collaboration Spike Lee And Denzel Washingtons Early Success

May 06, 2025 -

Analysis Copper Price Increase Linked To China Us Trade Talks

May 06, 2025

Analysis Copper Price Increase Linked To China Us Trade Talks

May 06, 2025 -

Is Miley Cyruss Relationship With Billy Ray Cyrus Over A Look At Recent Events

May 06, 2025

Is Miley Cyruss Relationship With Billy Ray Cyrus Over A Look At Recent Events

May 06, 2025 -

Stiven King Na X Zayavi Pro Politiku Trampa Ta Maska

May 06, 2025

Stiven King Na X Zayavi Pro Politiku Trampa Ta Maska

May 06, 2025