Stock Market Reaction To China's Economic Policies And Trade Disputes

Table of Contents

Impact of China's Economic Policies on Global Stock Markets

China's domestic economic policies significantly influence global stock market trends. These policies, ranging from stimulus packages to regulatory changes, create ripples felt across international markets.

Stimulus Packages and Market Response

The Chinese government frequently employs stimulus packages to boost economic growth. These initiatives can significantly impact investor confidence and market trends.

- Examples of stimulus packages: The massive infrastructure spending programs launched in response to the 2008 global financial crisis and subsequent smaller-scale interventions to counter economic slowdowns are prime examples.

- Short-term vs. long-term effects: While stimulus packages often lead to short-term stock market increases and improved investor sentiment (resulting in a rise in the Shanghai Composite Index, for example), their long-term effects are more complex and depend on factors such as the effectiveness of implementation and potential debt accumulation.

- Analysis of market reactions: Market reactions to these stimulus measures vary. While initial investor optimism might lead to increased buying, concerns about inflation or unsustainable debt levels can later trigger sell-offs. Analyzing past reactions offers valuable insights into potential future trends. Specific analysis of the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) performance following each stimulus is crucial for understanding the impact.

Regulatory Changes and Their Market Implications

Regulatory shifts within China, particularly in sectors like technology and finance, have profound implications for stock market performance, both domestically and globally.

- Examples of significant regulatory changes: Crackdowns on monopolistic practices in the tech sector, stricter regulations on data privacy, and changes to financial regulations have all had significant impacts.

- Their immediate and long-term effects: These changes can trigger immediate market volatility, impacting the valuations of affected companies. In the long term, they can reshape the competitive landscape and influence investment flows. The impact on Chinese tech stocks, for example, has been dramatic in recent years.

- Case studies of affected companies: Examining individual companies affected by regulatory changes provides a granular understanding of the market's response. Analyzing Alibaba's or Tencent's performance in the wake of regulatory crackdowns serves as a useful case study. Furthermore, analyzing delisting trends from US exchanges provides further insights.

China's Belt and Road Initiative and Global Investment

China's Belt and Road Initiative (BRI), a massive infrastructure project spanning numerous countries, has significantly impacted global investment flows and stock markets.

- Impact on infrastructure stocks: Companies involved in infrastructure development and construction have seen increased investment opportunities.

- Opportunities and risks for investors: The BRI presents both significant opportunities and risks. While infrastructure projects offer high potential returns, geopolitical risks and project execution challenges need careful consideration.

- Geopolitical implications: The BRI’s geopolitical implications extend far beyond mere financial considerations. Its effect on international relations, debt dynamics in participating nations, and trade flows should be considered within the broader context of global investment.

Stock Market Reactions to US-China Trade Disputes

The ongoing trade tensions between the US and China have significantly affected global stock markets. Tariffs, trade wars, and geopolitical uncertainties contribute to significant market volatility.

Tariffs and Trade Wars

The imposition of tariffs by both the US and China has had a profound effect on specific sectors and the overall market.

- Examples of tariffs imposed: The tariffs imposed on goods ranging from agricultural products to technology have had ripple effects across global supply chains.

- Impact on affected industries: Industries like technology, agriculture, and manufacturing have experienced varying degrees of impact, depending on their level of exposure to trade between the two countries.

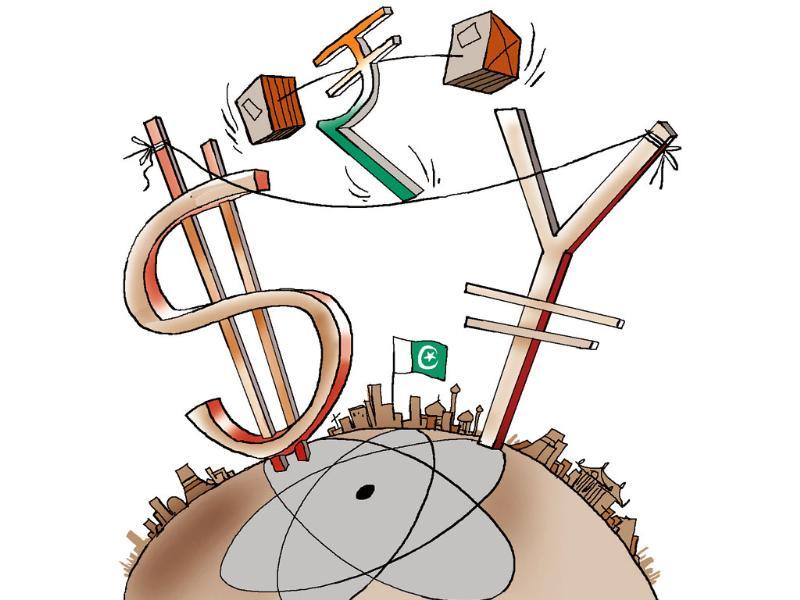

- Market volatility during trade tensions: Periods of heightened trade tensions have historically led to increased market volatility, with investor sentiment fluctuating significantly.

Geopolitical Risks and Investor Sentiment

Trade disputes between the US and China fuel geopolitical uncertainty, significantly affecting investor behavior.

- Examples of geopolitical risks stemming from trade conflicts: The potential for escalation, disruption to global supply chains, and the broader implications for international relations all contribute to increased risk aversion.

- The flight to safety phenomenon: During periods of heightened trade tensions, investors often shift towards safer assets, such as government bonds, leading to a "flight to safety."

- Diversification strategies: Investors are increasingly adopting diversification strategies to mitigate the risks associated with US-China trade tensions.

Impact on Emerging Markets

The spillover effects of US-China trade disputes extend beyond the two major economies, impacting emerging markets as well.

- Correlation between US-China tensions and other market movements: Emerging markets often experience a significant correlation with US-China trade tensions.

- Impact on global supply chains: Disruptions to global supply chains caused by trade disputes can disproportionately impact emerging markets, due to their reliance on export-oriented manufacturing.

Conclusion

The relationship between China's economic policies, trade disputes (especially with the US), and global stock market reactions is complex and highly interconnected. Understanding these dynamics is crucial for investors and businesses operating in the global marketplace. Stimulus packages, regulatory changes, and the Belt and Road Initiative all have significant, albeit often unpredictable, impacts on investor confidence and market trends. Similarly, trade wars and geopolitical risks stemming from US-China tensions create substantial volatility. To stay informed about China's economic policies and monitor stock market reactions to China's trade disputes, continuous research and analysis are essential. Analyze the impact of China's economic policies on your investment strategy and adapt accordingly. Stay informed – the future of global markets hinges on it.

Featured Posts

-

A Conservative Harvard Professors Plan To Save Harvard University

Apr 26, 2025

A Conservative Harvard Professors Plan To Save Harvard University

Apr 26, 2025 -

Bof As View Are Stretched Stock Market Valuations A Cause For Concern

Apr 26, 2025

Bof As View Are Stretched Stock Market Valuations A Cause For Concern

Apr 26, 2025 -

The Unlikely Path Of Ahmed Hassanein Could He Become Egypts First Nfl Player

Apr 26, 2025

The Unlikely Path Of Ahmed Hassanein Could He Become Egypts First Nfl Player

Apr 26, 2025 -

Trumps Tariffs Ceos Highlight Economic Risks And Consumer Anxiety

Apr 26, 2025

Trumps Tariffs Ceos Highlight Economic Risks And Consumer Anxiety

Apr 26, 2025 -

Ai Powered Blockchain Security Chainalysis Acquisition Of Alterya

Apr 26, 2025

Ai Powered Blockchain Security Chainalysis Acquisition Of Alterya

Apr 26, 2025