Stock Market Valuations: BofA's Case For Why Investors Shouldn't Worry

Table of Contents

BofA's Argument: A Focus on Long-Term Growth Potential

BofA's analysis emphasizes the long-term growth potential of the market, focusing on factors beyond short-term fluctuations. They argue that current valuations, while potentially high in certain sectors, are justifiable when considering projected future earnings growth. Their approach prioritizes a long-term investment strategy, urging investors to look beyond the noise of daily market movements.

-

Focus on discounted cash flow (DCF) analysis to determine intrinsic value. BofA likely uses sophisticated DCF models to project future cash flows and discount them back to present value, providing a more robust measure of a company's true worth than simple price-to-earnings ratios. This methodology accounts for the time value of money and provides a more accurate assessment of long-term value.

-

Consideration of sustainable earnings growth over several years. Instead of fixating on short-term earnings blips, BofA's analysis likely focuses on the company's ability to generate consistent earnings growth over an extended period. This long-term perspective smooths out the volatility inherent in short-term market performance.

-

Identification of undervalued sectors with strong future prospects. BofA's research likely highlights specific sectors poised for growth, even if their current valuations seem high compared to historical averages. This sector allocation strategy helps investors identify opportunities within a seemingly overvalued market.

-

Emphasis on long-term investment horizons to weather short-term volatility. The core of BofA's message is the importance of patience. They advocate for a long-term investment strategy that allows investors to ride out short-term market corrections and benefit from the long-term growth potential of the market.

Addressing Concerns about High Price-to-Earnings Ratios (P/E)

High Price-to-Earnings ratios (P/E) are often cited as a leading indicator of an overvalued market, fueling investor worry. BofA counters this by highlighting the limitations of relying solely on P/E ratios and emphasizing the influence of factors like interest rates and inflation on earnings.

-

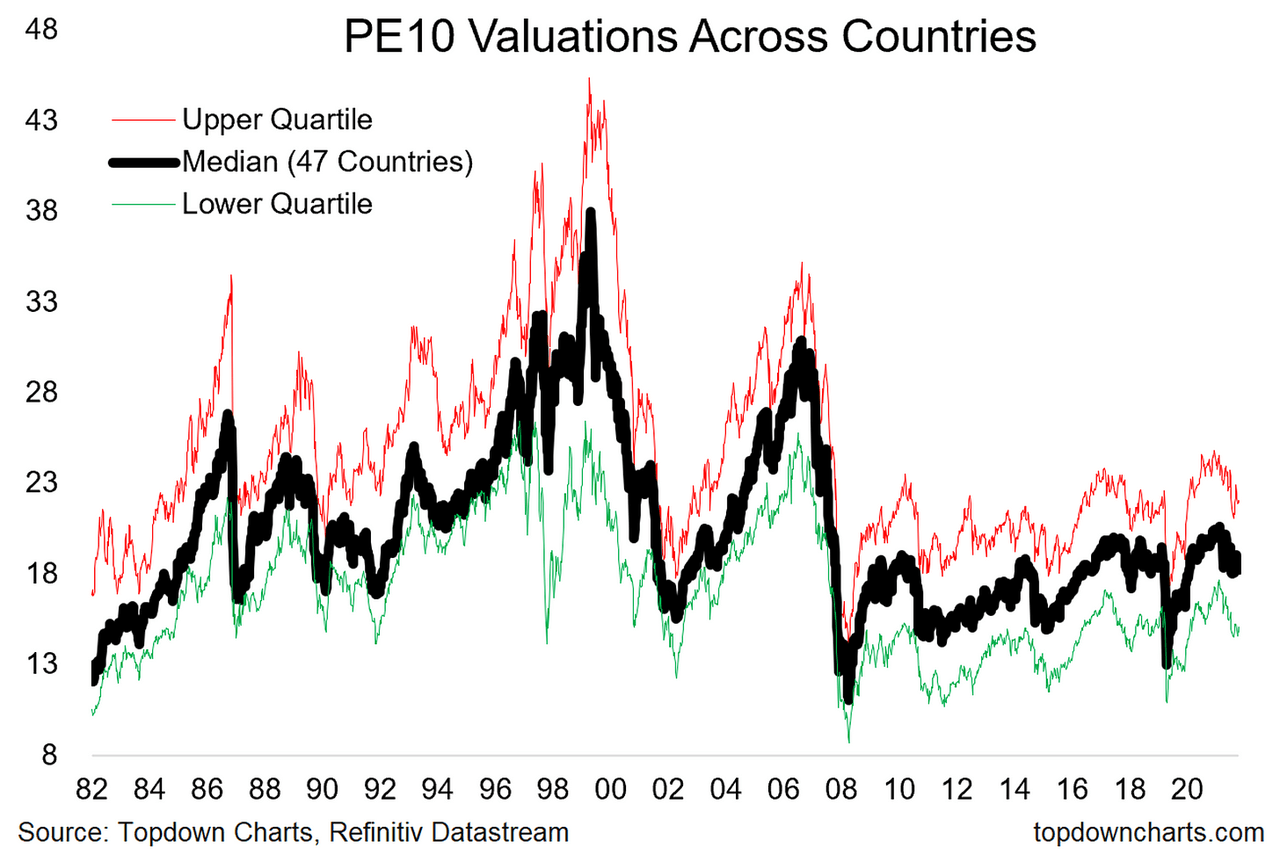

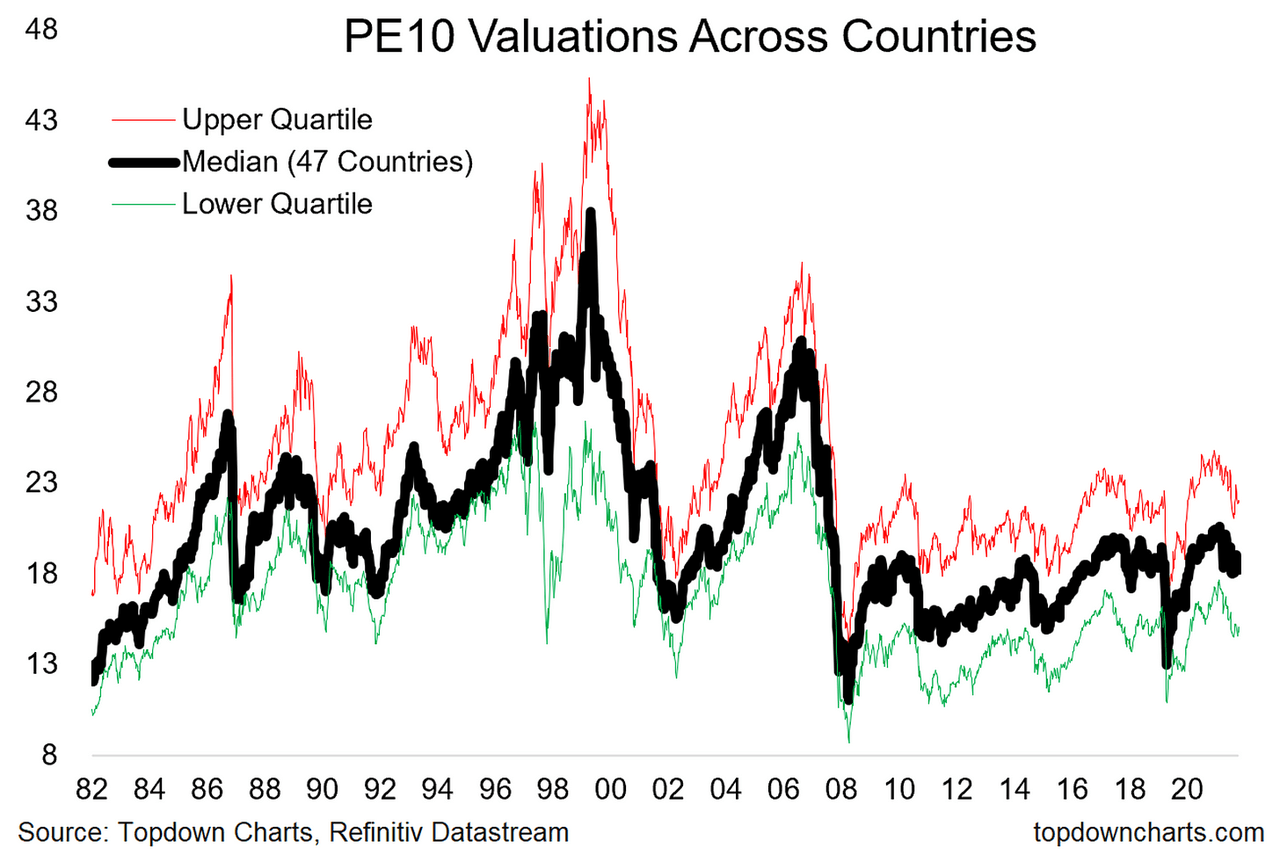

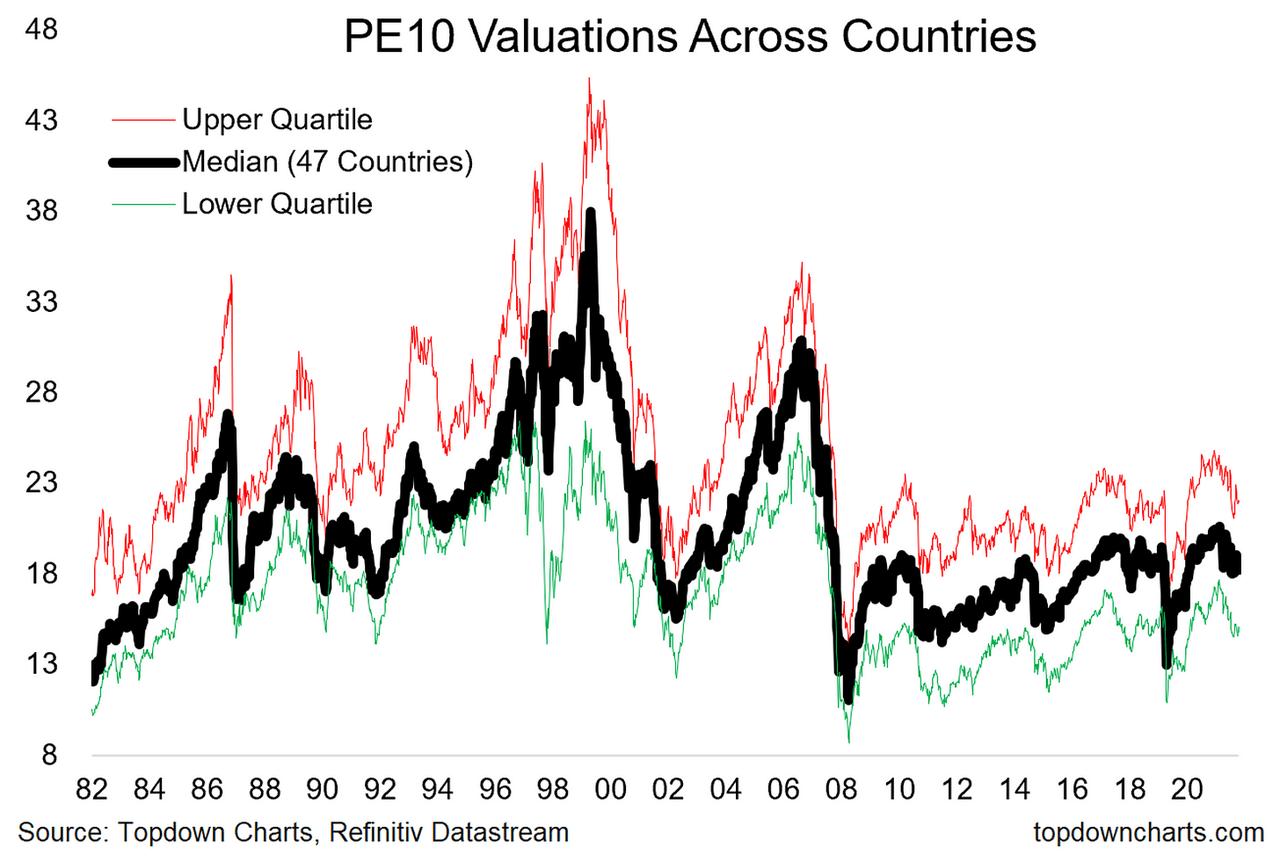

Comparison of P/E ratios to historical averages, adjusting for economic conditions. Simply comparing current P/E ratios to historical averages without considering the prevailing economic climate is misleading. BofA's analysis likely adjusts these comparisons to account for differences in inflation, interest rates, and overall economic growth.

-

Analysis of other valuation metrics beyond P/E, such as price-to-sales and enterprise value-to-EBITDA. A comprehensive valuation requires a multi-faceted approach. BofA likely utilizes a range of valuation metrics, including price-to-sales and enterprise value-to-EBITDA (earnings before interest, taxes, depreciation, and amortization), to get a more holistic picture.

-

Examination of the impact of interest rate increases and inflation on earnings and valuations. Rising interest rates and inflation significantly affect corporate earnings and investor sentiment. BofA's analysis would consider the impact of these macroeconomic factors on both company profitability and market valuations. The effect on the risk-free rate is also a key consideration.

-

Discussion of the earnings yield as a counterpoint to the P/E ratio. The earnings yield, the inverse of the P/E ratio, offers another perspective. BofA likely highlights this metric to provide a more balanced view of market valuations.

The Role of Interest Rates and Inflation in Stock Market Valuations

Interest rate hikes and inflation significantly influence stock market valuations. BofA's analysis likely incorporates the impact of monetary policy on corporate earnings and investor behavior.

-

Analysis of the impact of rising interest rates on discount rates used in valuation models. Higher interest rates increase the discount rate used in DCF models, reducing the present value of future cash flows and potentially lowering valuations. BofA's analysis would factor this in.

-

Discussion of the effects of inflation on corporate earnings and profitability. Inflation erodes purchasing power and increases input costs, impacting corporate profit margins. BofA’s analysis considers how inflation affects companies’ ability to generate earnings.

-

Consideration of how central bank actions influence investor behavior and market sentiment. Central bank actions, such as interest rate adjustments, significantly impact investor sentiment and market behavior. BofA likely incorporates this into their analysis.

Identifying Opportunities within the Market

Despite potentially high overall market valuations, BofA likely identifies specific sectors or individual stocks they believe are undervalued or poised for significant growth.

-

Highlighting specific sectors with strong growth potential. BofA's research may pinpoint sectors that are less susceptible to macroeconomic headwinds or those poised to benefit from specific technological advancements or demographic trends.

-

Identifying specific companies with attractive valuations and future prospects. This section likely features examples of companies with strong fundamentals and attractive valuations, supporting their argument that opportunities exist even within a seemingly expensive market.

-

Providing a framework for investors to identify opportunities within the current market. BofA's analysis might provide investors with a framework or methodology for identifying undervalued companies and sectors, empowering investors to conduct their own research.

Conclusion

BofA's analysis suggests that while concerns about stock market valuations are understandable, a nuanced view considering long-term growth potential, various valuation metrics, and macroeconomic factors paints a less alarming picture. Their argument emphasizes a long-term investment strategy and identifying specific opportunities within the market. Don't let short-term market volatility dictate your investment strategy. Understand the complexities of stock market valuations and leverage BofA's insights to make informed decisions about your portfolio. Learn more about managing your investments effectively and navigating market fluctuations by researching further into long-term investment strategies and stock market valuation techniques. A thorough understanding of stock market valuations is key to successful investing.

Featured Posts

-

Mariners Athletics Series Injury Updates March 27 30

May 17, 2025

Mariners Athletics Series Injury Updates March 27 30

May 17, 2025 -

Stock Market Valuations Bof As Case For Why Investors Shouldnt Worry

May 17, 2025

Stock Market Valuations Bof As Case For Why Investors Shouldnt Worry

May 17, 2025 -

Tom Thibodeaus Plea Knicks Need More Resolve After Blowout

May 17, 2025

Tom Thibodeaus Plea Knicks Need More Resolve After Blowout

May 17, 2025 -

Fake Angel Reese Quotes The Spread Of Misinformation

May 17, 2025

Fake Angel Reese Quotes The Spread Of Misinformation

May 17, 2025 -

Hl Alhb Ytjawz Farq Alsn Twm Krwz Wana Dy Armas Mthala

May 17, 2025

Hl Alhb Ytjawz Farq Alsn Twm Krwz Wana Dy Armas Mthala

May 17, 2025

Latest Posts

-

Mariners Vs Tigers Injured Players For Opening Series March 31 April 2

May 17, 2025

Mariners Vs Tigers Injured Players For Opening Series March 31 April 2

May 17, 2025 -

April 4 6 Giants Mariners Series Examining The Injured Lists

May 17, 2025

April 4 6 Giants Mariners Series Examining The Injured Lists

May 17, 2025 -

Mariners Bryce Miller 15 Day Il Stint For Elbow Problem

May 17, 2025

Mariners Bryce Miller 15 Day Il Stint For Elbow Problem

May 17, 2025 -

High School Confidential 2024 25 Week 26 Highlights

May 17, 2025

High School Confidential 2024 25 Week 26 Highlights

May 17, 2025 -

Josh Harts Wife Reacts To Jaylen Browns Game 5 Performance

May 17, 2025

Josh Harts Wife Reacts To Jaylen Browns Game 5 Performance

May 17, 2025