Stock Market Valuations: BofA's Reassurance For Investors

Table of Contents

BofA's Key Findings on Current Stock Market Valuations

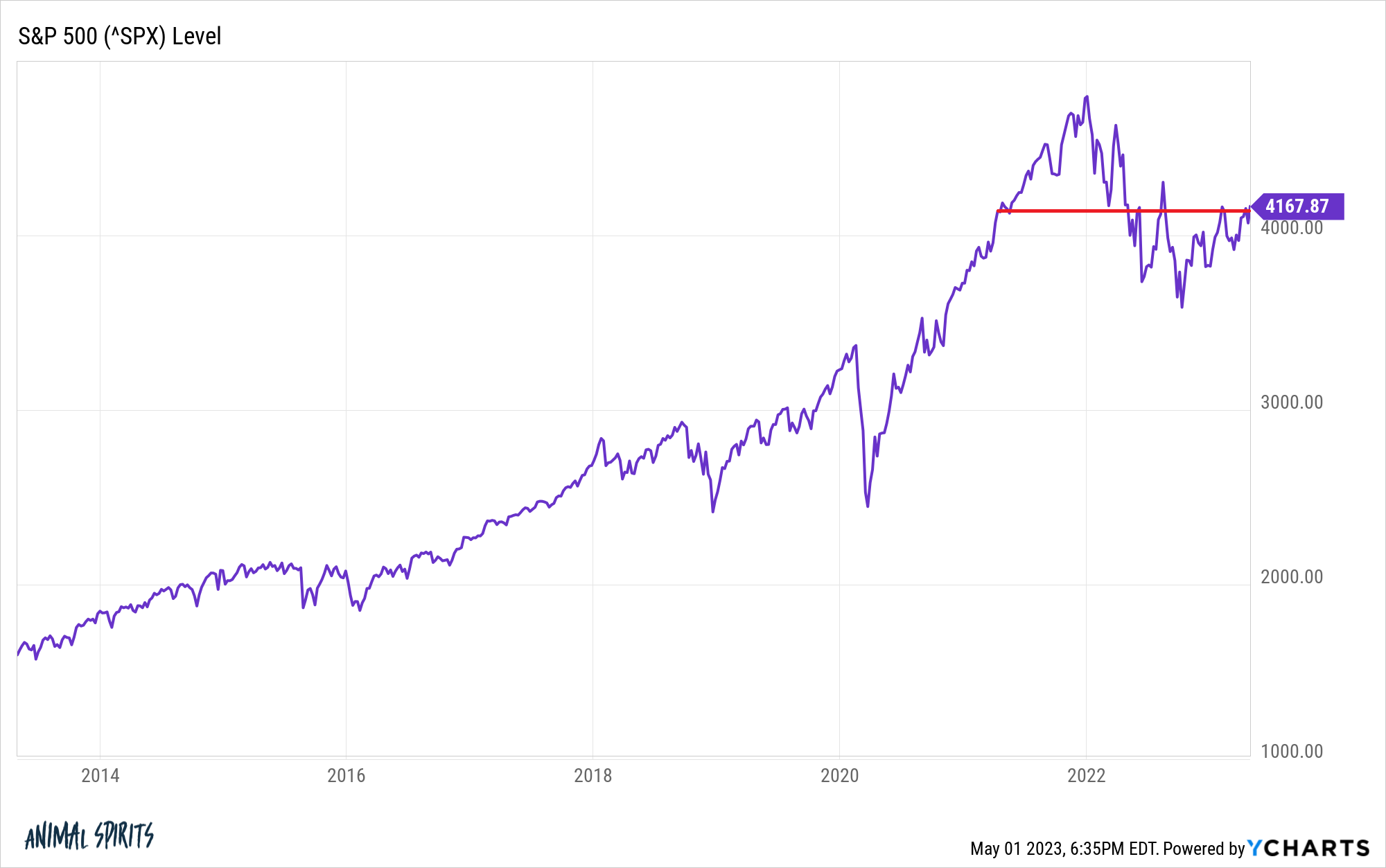

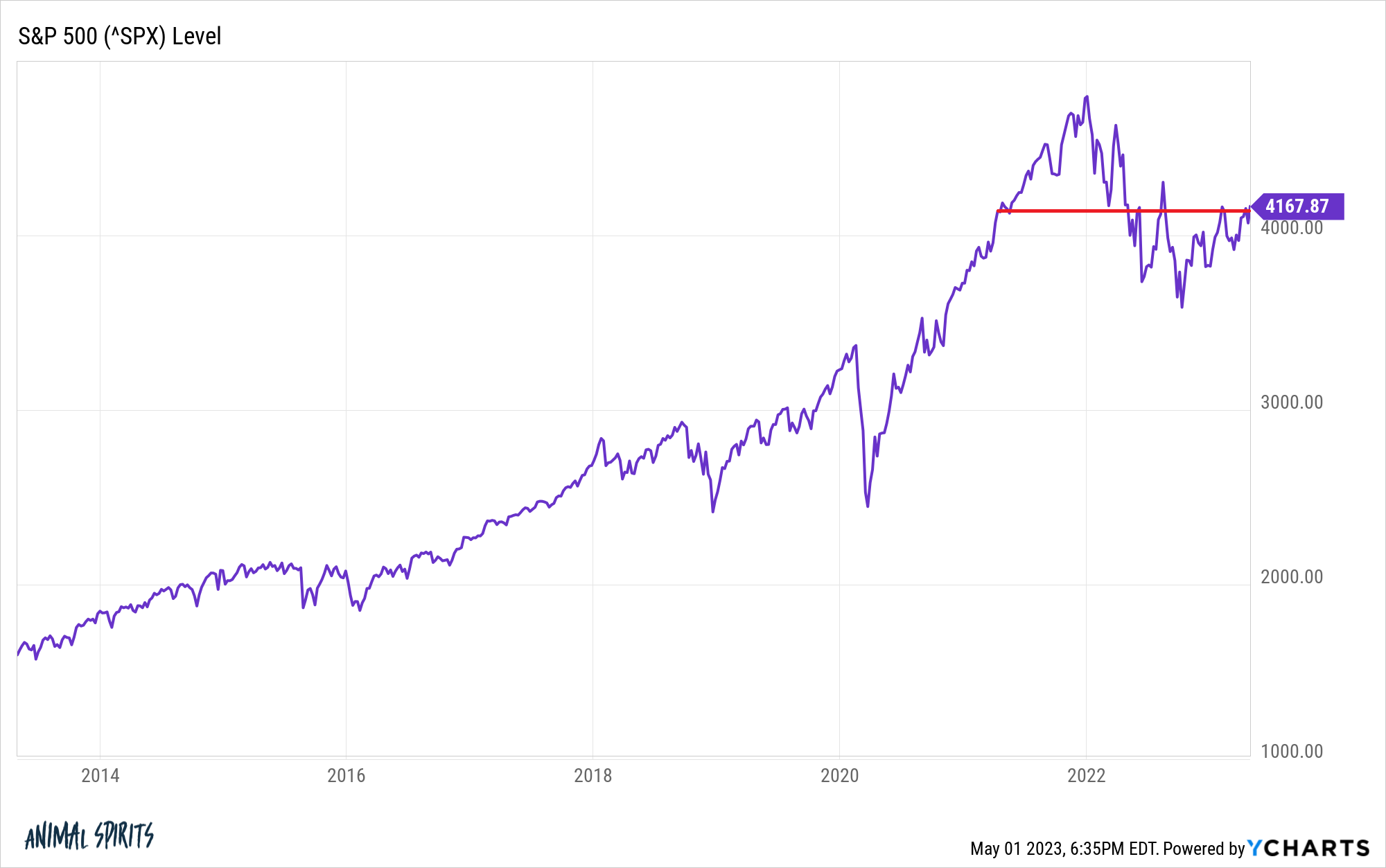

BofA's latest report offers a nuanced perspective on current stock market valuations, suggesting a more balanced picture than some headlines might suggest. While acknowledging the elevated valuations in certain sectors, they argue that the overall market isn't drastically overvalued. Their analysis utilizes a blend of traditional and forward-looking market valuation metrics.

- Specific valuation metrics used by BofA: BofA's analysis incorporates a range of metrics, including the price-to-earnings ratio (P/E ratio), price-to-sales ratio (P/S ratio), and dividend yield. They consider these metrics alongside broader economic indicators to paint a comprehensive picture.

- BofA's conclusions regarding the overall market valuation: While acknowledging some sector-specific overvaluations, BofA concludes that the overall market valuation is currently within a reasonable range, considering the current economic environment and projected growth.

- Comparison to historical valuations: BofA's report compares current valuations to historical averages, demonstrating that while valuations are higher than some historical lows, they are not unprecedented and fall within the range of valuations seen during periods of strong economic growth. This historical context helps to temper concerns about an immediate market crash. Keywords: market valuation metrics, P/E ratio, price-to-sales ratio, historical valuations, BofA market outlook.

Factors Influencing BofA's Valuation Assessment

BofA's valuation assessment isn't made in a vacuum. Several macroeconomic factors heavily influence their conclusions. Understanding these factors is crucial for investors.

- Specific economic indicators and their impact on valuations: Interest rates, inflation rates, and GDP growth are key indicators BofA meticulously tracks. Lower interest rates, for instance, can support higher valuations by reducing the cost of borrowing for companies and boosting investor appetite for riskier assets. Conversely, high inflation can erode corporate profits and negatively impact valuations.

- Analysis of potential risks and opportunities: BofA's analysis identifies potential risks, such as persistent inflation or a sharp slowdown in economic growth, which could negatively impact valuations. However, they also highlight opportunities presented by technological advancements and strong corporate earnings in certain sectors.

- BofA's predictions for the future economic environment: BofA's report includes forecasts for future economic growth and inflation, providing a context for their valuation assessment and influencing their investment recommendations. Keywords: macroeconomic factors, interest rates, inflation, economic growth, risk assessment.

BofA's Recommendations for Investors Based on Current Valuations

Based on their comprehensive valuation analysis, BofA offers specific recommendations for investors. These recommendations aren't a blanket "buy" or "sell" but rather a strategic approach.

- Specific investment strategies suggested by BofA: BofA advocates a balanced approach, suggesting diversification across asset classes and sectors. They emphasize the importance of a long-term investment horizon and suggest regularly reviewing and adjusting portfolios based on market conditions.

- Sector-specific recommendations (if any): BofA may offer more specific recommendations for particular sectors. For example, they may suggest overweighting sectors showing strong growth potential while underweighting sectors facing headwinds.

- Advice on portfolio diversification: Diversification remains crucial. BofA likely stresses the importance of spreading investments across different asset classes (stocks, bonds, real estate) and sectors to mitigate risk and enhance returns. Keywords: investment strategy, portfolio diversification, sector allocation, buy signals, sell signals, BofA investment advice.

Addressing Investor Concerns about Stock Market Valuations

Many investors harbor concerns about market valuations. BofA's analysis directly addresses these concerns, providing reassurance and a balanced perspective.

- Rebuttal of common bearish arguments: BofA likely refutes common arguments suggesting an imminent market crash, providing data and reasoning to support their counterarguments.

- Highlighting potential upside opportunities: The report likely emphasizes potential upside opportunities based on strong corporate earnings, technological innovations, and continued economic growth in specific sectors.

- Emphasizing the long-term perspective: BofA likely underscores the importance of a long-term investment strategy, highlighting that short-term market fluctuations are normal and shouldn't dictate long-term investment decisions. Keywords: investor concerns, market volatility, long-term investment, risk mitigation.

Conclusion: Making Informed Decisions about Stock Market Valuations

BofA's analysis offers a valuable perspective on current stock market valuations, suggesting a more balanced outlook than might be perceived from headline news. Their findings highlight the importance of considering a range of valuation metrics, macroeconomic factors, and a long-term investment horizon. While acknowledging potential risks, BofA's recommendations encourage a strategic and diversified investment approach. Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions. Understand the nuances of stock market valuations and leverage BofA's insights to craft a robust investment strategy. Learn more about BofA's market analysis today!

Featured Posts

-

Navigating The Complexities Bmw Porsche And The Uncertainties Of The Chinese Automotive Market

Apr 29, 2025

Navigating The Complexities Bmw Porsche And The Uncertainties Of The Chinese Automotive Market

Apr 29, 2025 -

Porsche 911 Wersja Za 1 33 Mln Zl Podbija Serca Polakow

Apr 29, 2025

Porsche 911 Wersja Za 1 33 Mln Zl Podbija Serca Polakow

Apr 29, 2025 -

Carsten Jancker Wechsel Nach Seinem Engagement In Leoben

Apr 29, 2025

Carsten Jancker Wechsel Nach Seinem Engagement In Leoben

Apr 29, 2025 -

Nyt Spelling Bee April 1 2025 Pangram And Word List

Apr 29, 2025

Nyt Spelling Bee April 1 2025 Pangram And Word List

Apr 29, 2025 -

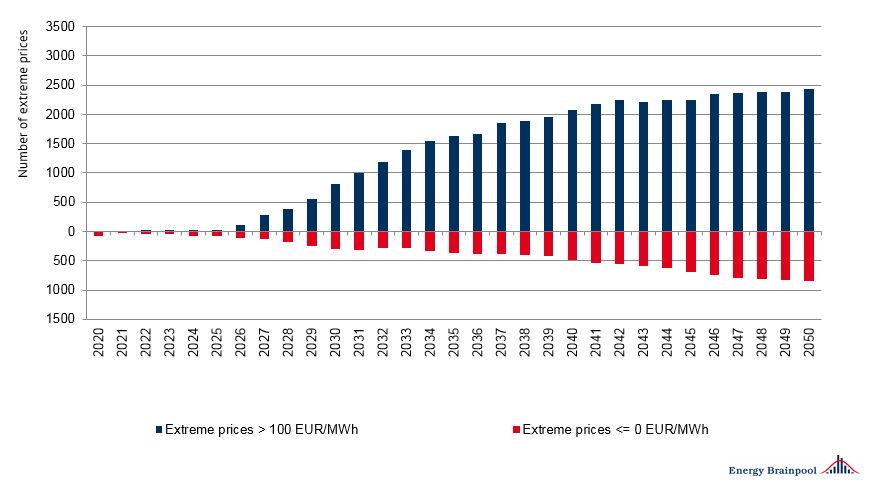

Negative European Electricity Prices A Solar Revolution

Apr 29, 2025

Negative European Electricity Prices A Solar Revolution

Apr 29, 2025

Latest Posts

-

Actor Jeff Goldblum Drops Debut Jazz Album

Apr 29, 2025

Actor Jeff Goldblum Drops Debut Jazz Album

Apr 29, 2025 -

Jeff Goldblum Releases Unexpected New Music Album

Apr 29, 2025

Jeff Goldblum Releases Unexpected New Music Album

Apr 29, 2025 -

London Welcomes Jeff Goldblum Jurassic Park Star Draws Huge Crowds

Apr 29, 2025

London Welcomes Jeff Goldblum Jurassic Park Star Draws Huge Crowds

Apr 29, 2025 -

Jeff Goldblums New Album A Surprise For Fans

Apr 29, 2025

Jeff Goldblums New Album A Surprise For Fans

Apr 29, 2025 -

Jeff Goldblums London Appearance A Jurassic Park Reunion For Fans

Apr 29, 2025

Jeff Goldblums London Appearance A Jurassic Park Reunion For Fans

Apr 29, 2025