Stock Market Winners: Rockwell Automation Leads The Charge

Table of Contents

Rockwell Automation's Strong Financial Performance

Rockwell Automation's robust financial performance is a key indicator of its success and attractiveness as an investment. Analyzing recent quarterly and annual earnings reports reveals a compelling narrative of growth and profitability.

-

Revenue Growth: Consistent year-over-year revenue growth demonstrates strong market demand for Rockwell Automation's products and services. This growth is fueled by increasing adoption of industrial automation solutions across various sectors. Examine the company's 10-K filings for detailed breakdowns of revenue streams by segment.

-

Earnings Per Share (EPS): A consistently rising EPS indicates increasing profitability and efficiency. Analyzing the trend in EPS provides valuable insight into the company's capacity for generating shareholder value. Look for consistent upward trends to confirm strong performance.

-

Profit Margins: Healthy profit margins demonstrate effective cost management and pricing strategies. High and stable margins suggest a strong competitive advantage and ability to navigate economic fluctuations. Compare Rockwell's margins to industry competitors for a better perspective.

-

Stock Price Increase: The correlation between strong financial performance and a rising stock price is undeniable. Tracking Rockwell Automation's stock price alongside its earnings reports provides concrete evidence of its market success. Use charts and graphs to visually represent this correlation.

-

Financial Health: A strong balance sheet, characterized by a healthy debt-to-equity ratio and robust cash flow, further reinforces Rockwell Automation's financial stability and resilience. This provides investors with confidence in the company's long-term sustainability.

Factors Driving Rockwell Automation's Success

Rockwell Automation's success is not merely a matter of chance; it's the result of strategic positioning within a rapidly evolving market. Several key factors contribute to its strong performance:

-

The Rise of Industrial Automation: The global trend toward automation is a major tailwind for Rockwell Automation. Factors like labor shortages, the need for increased efficiency, and the adoption of Industry 4.0 principles are driving significant demand for automation solutions.

-

Innovation and Technology: Rockwell Automation's commitment to innovation is evident in its product offerings. Their integrated architecture and digital twin technology provide customers with advanced solutions for optimizing their operations. These technological advancements create a significant competitive advantage.

-

Strategic Partnerships and Acquisitions: Rockwell Automation's strategic partnerships and acquisitions have expanded its reach and capabilities, allowing it to better serve a broader range of customers and industries. These strategic moves enhance their market position and broaden their product portfolio.

-

Competitive Advantage: Rockwell Automation differentiates itself through a combination of technological leadership, strong customer relationships, and a comprehensive service portfolio. This allows them to maintain a strong competitive edge in a dynamic market.

Investment Implications and Future Outlook for Rockwell Automation Stock

Investing in Rockwell Automation presents both opportunities and risks, as with any stock. A thorough assessment is crucial before making any investment decision.

-

Growth Potential: Given the ongoing trends in industrial automation and Rockwell Automation's strategic initiatives, the company's long-term growth potential appears significant. This makes it attractive to investors seeking growth stocks.

-

Risk Assessment: Like any investment, Rockwell Automation stock carries inherent risks. Factors such as economic downturns, competition, and technological disruption need to be considered.

-

Stock Valuation: Comparing Rockwell Automation's valuation metrics (such as P/E ratio) to its peers provides valuable context for assessing its investment attractiveness. Consult financial analysis resources for in-depth valuation analysis.

-

Future Trends in Automation: The long-term outlook for the industrial automation sector remains positive, driven by continued technological advancements and increased global adoption. This bodes well for Rockwell Automation's future performance.

-

Balanced Perspective: It's crucial to consider both the potential upsides and downsides before making an investment decision. Thorough research and professional advice are invaluable.

Alternative Automation Stocks to Consider

While Rockwell Automation is a strong contender, diversification is key in any investment portfolio. Other notable players in the industrial automation sector include Siemens and Schneider Electric. These companies offer alternative investment opportunities within the same industry, providing diversification and potentially mitigating risk. Research these companies' financial performance and strategic positioning before considering them for investment.

Conclusion

Rockwell Automation's strong financial performance, driven by its innovative products, strategic partnerships, and the overall growth of the industrial automation sector, makes it a compelling stock market winner. Its promising future outlook, supported by ongoing technological advancements and increasing demand for automation solutions, solidifies its position as a potentially attractive long-term investment. However, conducting thorough research and considering expert financial advice before making any investment decisions related to Rockwell Automation or other automation stocks is crucial. Further explore the potential of Rockwell Automation and other leading automation stocks to make informed investment choices.

Featured Posts

-

Finding The Best Stake Alternatives Top Crypto Gambling Sites For 2025

May 17, 2025

Finding The Best Stake Alternatives Top Crypto Gambling Sites For 2025

May 17, 2025 -

Rockwell Automation Earnings Beat Expectations Stock Surges With Other Market Leaders

May 17, 2025

Rockwell Automation Earnings Beat Expectations Stock Surges With Other Market Leaders

May 17, 2025 -

Nekretnine U Ujedinjenim Arapskim Emiratima Investicijski Potencijal

May 17, 2025

Nekretnine U Ujedinjenim Arapskim Emiratima Investicijski Potencijal

May 17, 2025 -

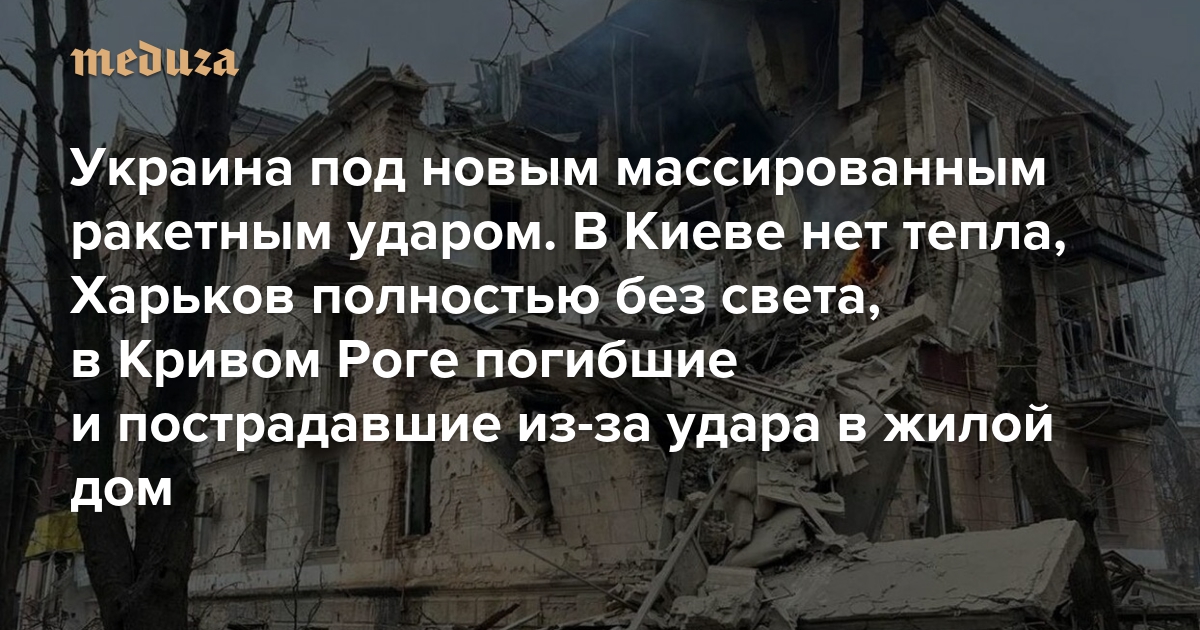

Ukraina Pod Massirovannym Obstrelom Rf Vypustila Bolee 200 Raket I Bespilotnikov

May 17, 2025

Ukraina Pod Massirovannym Obstrelom Rf Vypustila Bolee 200 Raket I Bespilotnikov

May 17, 2025 -

Investing In Ubers Autonomous Driving Tech Through Etfs

May 17, 2025

Investing In Ubers Autonomous Driving Tech Through Etfs

May 17, 2025

Latest Posts

-

Justes Jocytes Karjera Vilerbane Apzvalga Ir Ateities Planai

May 17, 2025

Justes Jocytes Karjera Vilerbane Apzvalga Ir Ateities Planai

May 17, 2025 -

Justes Jocytes Karjeros Etapas Vilerbane Oficialus Pabaigos Patvirtinimas

May 17, 2025

Justes Jocytes Karjeros Etapas Vilerbane Oficialus Pabaigos Patvirtinimas

May 17, 2025 -

Ultraviolette Tesseract E Scooter 3 Impressive Highlights

May 17, 2025

Ultraviolette Tesseract E Scooter 3 Impressive Highlights

May 17, 2025 -

Where And When To Watch Indiana Fevers 2025 Preseason Schedule Featuring Caitlin Clark

May 17, 2025

Where And When To Watch Indiana Fevers 2025 Preseason Schedule Featuring Caitlin Clark

May 17, 2025 -

Eminem And The Wnba A Potential Partnership

May 17, 2025

Eminem And The Wnba A Potential Partnership

May 17, 2025