Student Loan Debt? A Financial Planner Offers Solutions

Table of Contents

Understanding Your Student Loan Debt

Before tackling your student loan debt, it's crucial to understand its nature and your overall financial picture.

Types of Student Loans

Understanding the differences between federal and private student loans is critical for effective debt management.

- Federal Student Loans: These loans are offered by the US government and often come with benefits like income-driven repayment plans and loan forgiveness programs. Types include:

- Subsidized Loans: The government pays the interest while you're in school (under certain conditions).

- Unsubsidized Loans: Interest accrues while you're in school.

- Grad PLUS Loans: Loans for graduate students with a credit check.

- Private Student Loans: Offered by banks and credit unions, these loans typically have higher interest rates and fewer repayment options than federal loans. They often require a creditworthy co-signer.

To check your loan details, visit the National Student Loan Data System (NSLDS) website.

Assessing Your Current Financial Situation

Creating a realistic budget is essential for effective student loan repayment. This involves:

- Tracking your income from all sources.

- Categorizing your expenses (housing, food, transportation, etc.).

- Identifying areas where you can cut back on spending.

Budgeting apps like Mint, YNAB (You Need A Budget), and Personal Capital can help simplify this process.

Calculating Your Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is a crucial indicator of your financial health. It's calculated by dividing your total monthly debt payments (including student loans) by your gross monthly income. For example, if your monthly debt payments are $1,000 and your gross monthly income is $5,000, your DTI is 20%. A lower DTI generally makes it easier to qualify for loans and manage your debt.

Strategies for Managing Student Loan Debt

Several strategies can help you effectively manage your student loan debt.

Repayment Plans

Federal student loans offer various repayment plans:

- Standard Repayment: Fixed monthly payments over 10 years.

- Extended Repayment: Longer repayment period (up to 25 years), resulting in lower monthly payments but higher total interest paid.

- Income-Driven Repayment (IDR): Monthly payments are based on your income and family size. Plans include ICR, PAYE, REPAYE, and IBR.

- Graduated Repayment: Payments start low and gradually increase over time.

Check the official federal student aid website for detailed information on each plan.

Refinancing Student Loans

Refinancing can be beneficial if you qualify for a lower interest rate, potentially saving you money over the life of the loan. However, consider these factors:

- Potential benefits: Lower interest rates, simplified payments, shorter repayment terms.

- Potential drawbacks: Loss of federal loan protections, potential for higher fees.

Carefully compare offers from different lenders before refinancing.

Debt Consolidation

Consolidating multiple loans into a single loan can simplify payments and potentially lower your interest rate. However, be wary of predatory lenders offering unrealistic terms. Consider the following:

- The process involves applying for a new loan to pay off existing loans.

- Factors to consider include interest rates, fees, and repayment terms.

Always research lenders thoroughly.

Seeking Professional Help

Consider consulting a financial advisor or credit counselor for personalized guidance and support. They can help you develop a comprehensive debt management plan tailored to your specific circumstances.

Preventing Future Student Loan Debt

Proactive planning can significantly reduce the burden of student loan debt.

Planning for College Expenses

Start saving early for college expenses:

- Explore 529 plans and other savings vehicles.

- Apply for scholarships and grants (use resources like Fastweb and Scholarship America).

- Consider part-time jobs or summer employment to help offset costs.

Thorough research and financial aid planning are critical.

Choosing a Wise Educational Path

Carefully consider the cost of education and potential return on investment (ROI) when choosing a major and institution:

- Research potential salary ranges for different careers.

- Consider the value of a degree versus the cost of obtaining it.

Making informed decisions can significantly impact your future financial stability.

Conclusion: Finding Solutions for Your Student Loan Debt

Effectively managing student loan debt involves understanding your loan types, creating a budget, and exploring various repayment options like refinancing, consolidation, and income-driven repayment plans. Remember that seeking professional financial advice is crucial for developing a personalized plan tailored to your unique circumstances. Don't let student loan debt overwhelm you. Contact a financial planner today to create a personalized plan to manage your student loan debt effectively. [Link to Contact Information/Resource]

Featured Posts

-

April 4 6 Giants Mariners Series Examining The Injured Lists

May 17, 2025

April 4 6 Giants Mariners Series Examining The Injured Lists

May 17, 2025 -

Thibodeaus Evolution How He Saved The Knicks From Disaster

May 17, 2025

Thibodeaus Evolution How He Saved The Knicks From Disaster

May 17, 2025 -

Black Communitys Reaction To Trumps Student Loan Plan

May 17, 2025

Black Communitys Reaction To Trumps Student Loan Plan

May 17, 2025 -

Top Australian Crypto Casino Sites For 2025

May 17, 2025

Top Australian Crypto Casino Sites For 2025

May 17, 2025 -

Principal Financial Group Stock In Depth Analysis From 13 Analysts

May 17, 2025

Principal Financial Group Stock In Depth Analysis From 13 Analysts

May 17, 2025

Latest Posts

-

Limited Time Offer Free Cowboy Bebop Themed Items In Fortnite

May 17, 2025

Limited Time Offer Free Cowboy Bebop Themed Items In Fortnite

May 17, 2025 -

Fortnite Cowboy Bebop Skins A Guide To Getting The Free Rewards

May 17, 2025

Fortnite Cowboy Bebop Skins A Guide To Getting The Free Rewards

May 17, 2025 -

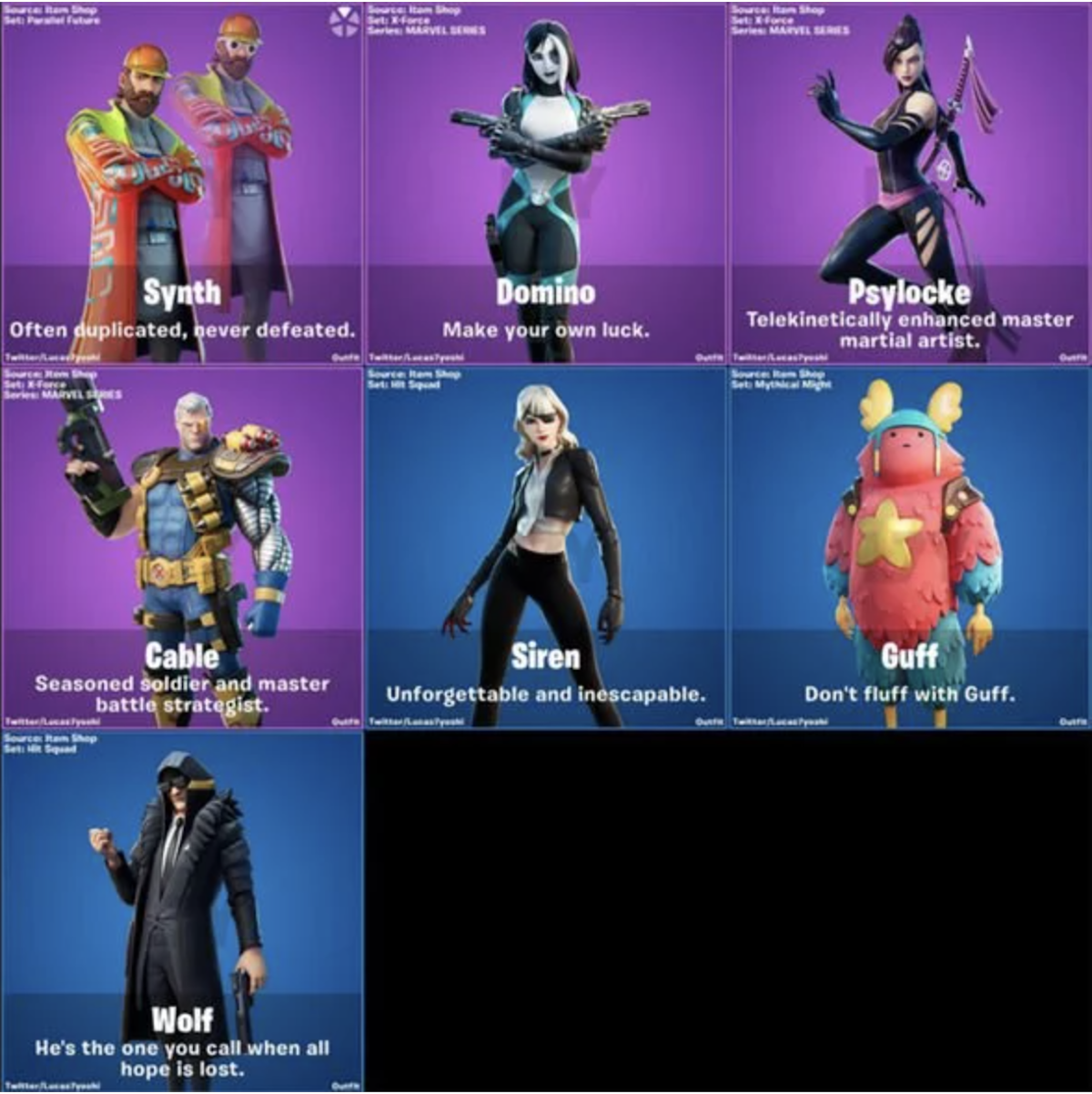

Fortnite Item Shop Navigating The Latest Update For Players

May 17, 2025

Fortnite Item Shop Navigating The Latest Update For Players

May 17, 2025 -

Fortnite Icon Skin A Closer Look At The New Collaboration

May 17, 2025

Fortnite Icon Skin A Closer Look At The New Collaboration

May 17, 2025 -

Secure Your Free Cowboy Bebop Fortnite Cosmetics

May 17, 2025

Secure Your Free Cowboy Bebop Fortnite Cosmetics

May 17, 2025