Surviving The Trade War: A Cryptocurrency's Path To Success

Table of Contents

Decentralization as a Shield Against Geopolitical Risks

Cryptocurrencies, unlike fiat currencies, are not beholden to the whims of single governments or institutions. This inherent decentralization is their greatest strength, offering a powerful shield against the disruptions caused by trade wars.

Reduced Dependence on Centralized Systems

The decentralized nature of cryptocurrencies significantly reduces their vulnerability to trade war sanctions and geopolitical maneuvering. This translates to tangible benefits for investors:

- Reduced risk of asset freezing or restrictions on international transactions: Unlike traditional bank accounts, cryptocurrency holdings are not easily subject to government seizure or freezing, offering a higher degree of asset protection.

- Increased financial freedom for individuals and businesses operating in volatile environments: In countries with unstable fiat currencies or strict capital controls, cryptocurrencies provide a viable alternative for financial transactions and wealth preservation.

- Example: Venezuela's hyperinflationary crisis saw a surge in Bitcoin adoption as citizens sought to protect their savings from the collapsing Bolivar. This demonstrates the real-world application of cryptocurrencies as a hedge against economic instability driven by geopolitical factors.

Transparency and Immutability

The underlying blockchain technology ensures transparency and immutability of transactions. This makes them resistant to manipulation or censorship, even under intense geopolitical pressure.

- Increased auditability and accountability, fostering trust even in uncertain markets: The public and permanent nature of blockchain records enhances transparency and accountability, building trust among users and reducing counterparty risk.

- Reduced susceptibility to manipulation by governments or large financial institutions: Decentralized consensus mechanisms make it extremely difficult for any single entity to manipulate the cryptocurrency market.

- Example: Blockchain's ability to track the provenance of goods along the supply chain could enhance compliance with trade regulations, even during periods of heightened scrutiny. This added transparency can help mitigate risks associated with sanctions and tariffs.

Cryptocurrency's Role in Facilitating Cross-Border Transactions

Trade wars frequently lead to increased scrutiny and delays in cross-border transactions. Cryptocurrencies offer a compelling alternative, providing a faster, cheaper, and more efficient solution for international payments.

Bypass Traditional Banking Systems

Cryptocurrencies allow businesses to bypass traditional banking systems and their associated complexities and restrictions.

- Reduced reliance on SWIFT and other centralized payment systems: Cryptocurrency transactions avoid the chokepoints and vulnerabilities inherent in traditional international payment systems, offering greater speed and resilience.

- Increased speed and efficiency of international trade: Transactions can be processed significantly faster and more efficiently compared to traditional banking, reducing delays and improving liquidity.

- Lower transaction costs compared to traditional banking: Cross-border transfers using cryptocurrencies can significantly reduce transaction fees compared to traditional banking methods.

Hedging Against Currency Volatility

Fluctuations in exchange rates during trade wars significantly impact businesses involved in international trade. Cryptocurrencies can act as a powerful hedge against this volatility.

- Diversification of assets to reduce exposure to currency risk: Holding cryptocurrencies can diversify investment portfolios, reducing dependence on volatile national currencies.

- Protection against devaluation of national currencies during trade disputes: Cryptocurrencies can offer a store of value independent of any single government's policies, shielding investors from currency devaluation.

- Example: Stablecoins, pegged to fiat currencies like the US dollar, can mitigate volatility while still offering the advantages of faster and cheaper cross-border transactions.

Adapting to the Changing Landscape: Risk Management and Investment Strategies

While cryptocurrencies offer numerous advantages, their inherent volatility demands careful consideration and effective risk management.

Understanding Volatility

The volatile nature of the cryptocurrency market requires prudent investment strategies.

- Diversification of cryptocurrency holdings: Investing in a range of cryptocurrencies can help spread risk and mitigate potential losses.

- Dollar-cost averaging to mitigate risk: Regularly investing smaller amounts over time helps average out price fluctuations.

- Setting stop-loss orders to limit potential losses: These orders automatically sell your cryptocurrencies when they reach a predetermined price, limiting potential losses.

Staying Informed

Staying abreast of regulatory changes and market trends is crucial for success in the cryptocurrency market.

- Following reputable news sources and market analysis: Keep up-to-date with the latest developments and insights from reliable sources.

- Understanding the implications of new regulations on cryptocurrency trading: Stay informed about new regulations and their potential impact on your crypto investments.

- Participating in the cryptocurrency community to stay informed: Engage with the community through online forums and social media to share knowledge and stay updated.

Conclusion

The global trade war presents significant economic headwinds, but it also highlights the potential of cryptocurrencies. Their decentralized nature, role in facilitating cross-border transactions, and potential as a hedge against currency volatility make them compelling assets in times of uncertainty. By understanding the inherent risks and implementing effective risk management strategies, investors can leverage the unique advantages of cryptocurrencies to navigate the complexities of the global trade environment and position themselves for success. Learn more about navigating this volatile market and discover how to successfully use cryptocurrency to survive and even thrive in the face of a trade war, by exploring further resources on [link to relevant resource].

Featured Posts

-

U S Fed Holds Rates Amid Inflation And Unemployment Concerns

May 09, 2025

U S Fed Holds Rates Amid Inflation And Unemployment Concerns

May 09, 2025 -

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 09, 2025

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 09, 2025 -

High Potential Season 1 When Morgan Wasnt So Smart

May 09, 2025

High Potential Season 1 When Morgan Wasnt So Smart

May 09, 2025 -

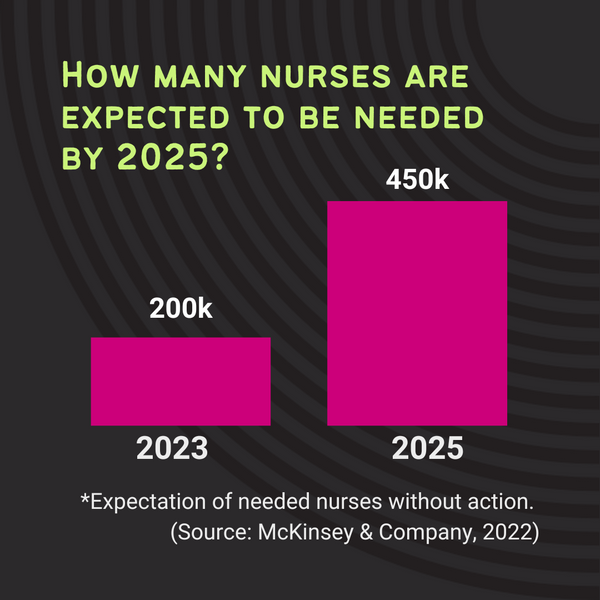

56 Million Boost For Community Colleges To Tackle Nursing Shortage

May 09, 2025

56 Million Boost For Community Colleges To Tackle Nursing Shortage

May 09, 2025 -

The Epstein Case Pam Bondis Statement On Client List

May 09, 2025

The Epstein Case Pam Bondis Statement On Client List

May 09, 2025

Latest Posts

-

Elon Musk Net Worth 2024 Has Us Economic Policy Affected Tesla

May 09, 2025

Elon Musk Net Worth 2024 Has Us Economic Policy Affected Tesla

May 09, 2025 -

2025 Hurun Report Elon Musks Wealth Reduced Yet Top Spot Secured

May 09, 2025

2025 Hurun Report Elon Musks Wealth Reduced Yet Top Spot Secured

May 09, 2025 -

Elon Musks Net Worth How Us Economic Shifts Impact Teslas Ceo

May 09, 2025

Elon Musks Net Worth How Us Economic Shifts Impact Teslas Ceo

May 09, 2025 -

Elon Musks Billions Diminished 2025 Hurun Global Rich List Reveals All

May 09, 2025

Elon Musks Billions Diminished 2025 Hurun Global Rich List Reveals All

May 09, 2025 -

Hurun Global Rich List 2025 100 Billion Drop Doesnt Stop Elon Musks Reign

May 09, 2025

Hurun Global Rich List 2025 100 Billion Drop Doesnt Stop Elon Musks Reign

May 09, 2025