Taiwanese Firms Under Scrutiny For Pressuring Employees To Sell ETFs

Table of Contents

The Prevalence of Coercive ETF Sales in Taiwanese Companies

The scale of coercive ETF sales within Taiwanese companies is difficult to precisely quantify due to the often-secretive nature of these practices. However, anecdotal evidence and news reports suggest a concerning trend. While specific statistics remain elusive, reports from whistleblowers and employee testimonies paint a picture of widespread pressure.

- Examples of specific companies involved: While many companies remain unnamed due to fear of reprisal, rumors and discussions within online forums for Taiwanese employees suggest the problem is not confined to a single industry or a few specific firms.

- Methods used to pressure employees: Methods range from mandatory attendance at investment seminars heavily promoting specific ETFs, to subtle yet effective pressure tactics such as implying that non-participation reflects negatively on employee loyalty or future promotion prospects. Social pressure within teams also plays a significant role.

- Types of ETFs being pushed on employees: Reports indicate a variety of ETFs are being promoted, often those with higher fees or managed by companies with close ties to the employer. This raises concerns about potential conflicts of interest.

- Quantify the pressure: While precise figures remain unavailable, indications suggest that a significant percentage of employees within affected companies face this pressure, often with implicit or explicit sales targets tied to team performance.

Ethical and Legal Ramifications of Coercive Sales Tactics

The practice of pressuring employees to invest in ETFs raises serious ethical and legal questions. These actions constitute a significant conflict of interest, potentially violating both labor laws and securities regulations.

- Ethical conflicts of interest: Companies leveraging their power over employees for personal financial gain breaches basic ethical principles of trust and fairness. The inherent power imbalance between employer and employee makes such coercion inherently exploitative.

- Analysis of potential legal liabilities: Under Taiwanese labor laws, such actions could be considered undue influence or even coercion, potentially leading to legal action by affected employees. Securities regulations may also be breached if the sales tactics are deemed misleading or manipulative.

- Potential penalties for companies engaging in such practices: Depending on the severity and evidence, penalties could range from significant fines to reputational damage and even criminal charges.

- Employee rights and recourse available: Employees who have been coerced into investing in ETFs have recourse through legal channels, potentially filing lawsuits for damages or pursuing redress through labor tribunals.

Employee Perspectives and Experiences

The impact of coercive ETF sales on employees is significant and multifaceted. Many employees report feeling stressed, anxious, and financially vulnerable.

- Examples of employee experiences: Anecdotal evidence from online forums reveals stories of employees feeling obligated to invest even when they lack financial literacy or understanding of the risks involved. Many express feeling trapped between their job security and their financial well-being.

- Impact on employee morale and job satisfaction: The coercive nature of these practices significantly undermines employee morale and trust in their employers, creating a toxic work environment.

- Financial risks faced by employees: Employees may face significant financial losses if the ETFs underperform, particularly if they invested a substantial portion of their savings under duress.

- Employee responses to the pressure: While some employees comply out of fear of repercussions, others are actively resisting, seeking advice from legal professionals or reporting the practices to relevant authorities.

Regulatory Response and Future Outlook

The Taiwanese government and regulatory bodies are increasingly aware of this issue. While specific actions remain to be seen, the growing public awareness is likely to spur regulatory changes.

- Statements from regulatory bodies: While official statements are still emerging, the increasing media attention suggests a growing awareness and potential for future investigations.

- Proposed or enacted legislation: The pressure to protect employee rights and prevent exploitative practices is likely to result in new legislation or strengthened enforcement of existing laws.

- Potential for increased employee protection: Future regulatory changes may include clearer guidelines on ethical employer-employee interactions regarding financial matters, alongside stricter penalties for coercive sales tactics.

- Predictions for future practices: Increased scrutiny and potential regulatory changes are likely to deter companies from engaging in these practices, fostering a fairer and more ethical investment landscape for Taiwanese employees.

Conclusion

The practice of Taiwanese firms pressuring employees to invest in ETFs presents a serious ethical and legal challenge. The coercion involved undermines employee rights, creates financial risks, and damages workplace morale. The lack of transparent data emphasizes the need for greater scrutiny and proactive measures. Stay informed about the ongoing scrutiny of Taiwanese firms and their questionable practices related to pressure to invest in ETFs, and advocate for stronger employee protections. We must work towards a future where employees are empowered to make independent and informed investment decisions, free from coercive pressures from their employers. The issue of coerced ETF sales needs continued attention to ensure fair and ethical practices within Taiwanese companies.

Featured Posts

-

Roma Monza Partido En Directo

May 16, 2025

Roma Monza Partido En Directo

May 16, 2025 -

Car Dealerships Step Up Opposition To Electric Vehicle Sales Quotas

May 16, 2025

Car Dealerships Step Up Opposition To Electric Vehicle Sales Quotas

May 16, 2025 -

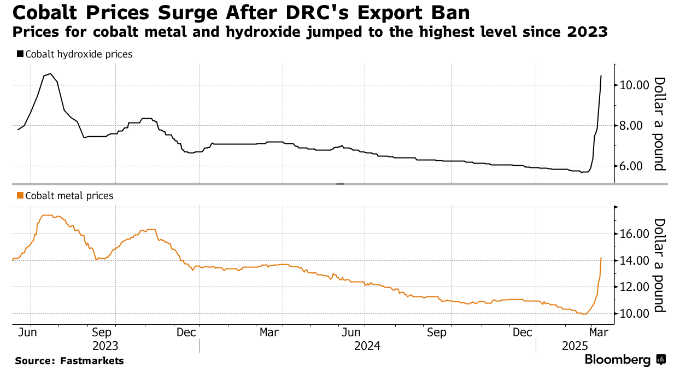

Drc Cobalt Export Ban Market Reaction And The Significance Of The Forthcoming Quota Plan

May 16, 2025

Drc Cobalt Export Ban Market Reaction And The Significance Of The Forthcoming Quota Plan

May 16, 2025 -

Did The Mavericks Suffer More From Brunson Leaving Than Trading Doncic Analyzing The Impact

May 16, 2025

Did The Mavericks Suffer More From Brunson Leaving Than Trading Doncic Analyzing The Impact

May 16, 2025 -

Giant Sea Wall Rapat Koordinasi Menko Ahy Update Pembangunan Terkini

May 16, 2025

Giant Sea Wall Rapat Koordinasi Menko Ahy Update Pembangunan Terkini

May 16, 2025