Taiwan's Energy Shift: Increased Reliance On LNG Following Nuclear Closure

Table of Contents

The Phasedown of Nuclear Power in Taiwan

Taiwan's nuclear power phase-out is a complex issue with deep historical roots. The island nation initially embraced nuclear energy as a solution to its energy needs, but public opinion shifted dramatically following the Fukushima Daiichi nuclear disaster in 2011.

- Timeline: The decision to phase out nuclear power wasn't immediate. It involved a gradual process, with plants scheduled for decommissioning over several years. This phased approach aimed to minimize disruption to the energy supply while exploring alternative sources.

- Public Opinion and Safety Concerns: The Fukushima disaster significantly heightened public concerns about nuclear safety, leading to widespread protests and a demand for a nuclear-free Taiwan. This public pressure played a crucial role in shaping government policy.

- The Impact of Fukushima: The Fukushima Daiichi accident dramatically changed the political landscape concerning nuclear power globally, and Taiwan was no exception. The perceived risks associated with nuclear energy became significantly amplified, accelerating the momentum towards phasing out nuclear power plants.

The Rise of LNG as a Primary Energy Source

With nuclear power plants gradually closing, Taiwan experienced a substantial increase in LNG imports to fill the energy gap. This shift necessitated significant investments in infrastructure and has brought with it various geopolitical and economic implications.

- Increased LNG Imports: LNG imports have skyrocketed since the decision to phase out nuclear power. This reliance on a single, imported energy source represents a critical vulnerability for Taiwan's energy security.

- Infrastructure Development: Massive investments have been made in building new LNG import terminals, pipelines, and storage facilities to handle the increased volume of LNG imports. This infrastructure development is vital for ensuring a stable and reliable supply of energy.

- Geopolitical Implications: Taiwan's heavy reliance on LNG imports exposes it to geopolitical risks and price volatility influenced by global market dynamics and supplier relationships. Diversifying LNG sources is paramount to mitigate these risks.

- Price Volatility of LNG: Fluctuations in global LNG prices directly impact Taiwan's energy costs and overall economic stability. This volatility necessitates robust strategies for managing price risks and ensuring energy affordability.

Challenges and Opportunities Associated with LNG Reliance

While LNG offers a relatively cleaner alternative to coal, its reliance poses several challenges and opportunities for Taiwan.

- Environmental Concerns: Although cleaner than coal, LNG combustion still produces greenhouse gas emissions, contributing to climate change. Therefore, mitigating these emissions through carbon capture and other technologies is crucial.

- Energy Diversification Strategies: To enhance energy security and reduce reliance on a single fuel source, Taiwan is actively exploring and investing in renewable energy sources, including solar, wind, and geothermal energy.

- Technological Advancements: Advancements in LNG technologies, such as improved liquefaction and regasification processes, offer opportunities to enhance efficiency and reduce the environmental footprint of LNG utilization.

- Economic Considerations: The economic implications of increased LNG reliance are multifaceted. While ensuring energy security is vital, the costs associated with importing and utilizing LNG must be carefully managed to avoid negative impacts on the economy.

Government Policies and Regulations

The Taiwanese government has responded to the energy transition with various policy adjustments and regulatory measures.

- Energy Policy Adjustments: The government has implemented policies designed to manage the transition away from nuclear power and towards a more diversified energy mix, including increased support for renewable energy sources.

- Investment in Renewable Energy Sources: Significant investments are being made to boost renewable energy capacity through subsidies, tax incentives, and regulatory frameworks that facilitate renewable energy development.

- Regulatory Framework for LNG Imports: A robust regulatory framework has been established to oversee the safe, efficient, and reliable import of LNG, addressing concerns related to transportation, storage, and distribution.

Conclusion: Navigating Taiwan's Energy Future with LNG and Beyond

Taiwan's energy shift, driven by the nuclear phase-out, has resulted in a significant increase in its reliance on LNG. While LNG provides a relatively cleaner and readily available alternative to nuclear power, it presents challenges related to price volatility, geopolitical dependencies, and environmental impact. The government's efforts to diversify its energy mix, particularly through investment in renewable energy sources, are crucial for ensuring a sustainable and secure energy future. Understanding the complexities of Taiwan's energy shift is vital for navigating the challenges and harnessing the opportunities presented by this transition. Learn more about Taiwan's increased reliance on LNG and the future of its energy policy to gain a deeper understanding of this critical issue.

Featured Posts

-

A Critical Analysis Of Trumps Aerospace Industry Agreements

May 20, 2025

A Critical Analysis Of Trumps Aerospace Industry Agreements

May 20, 2025 -

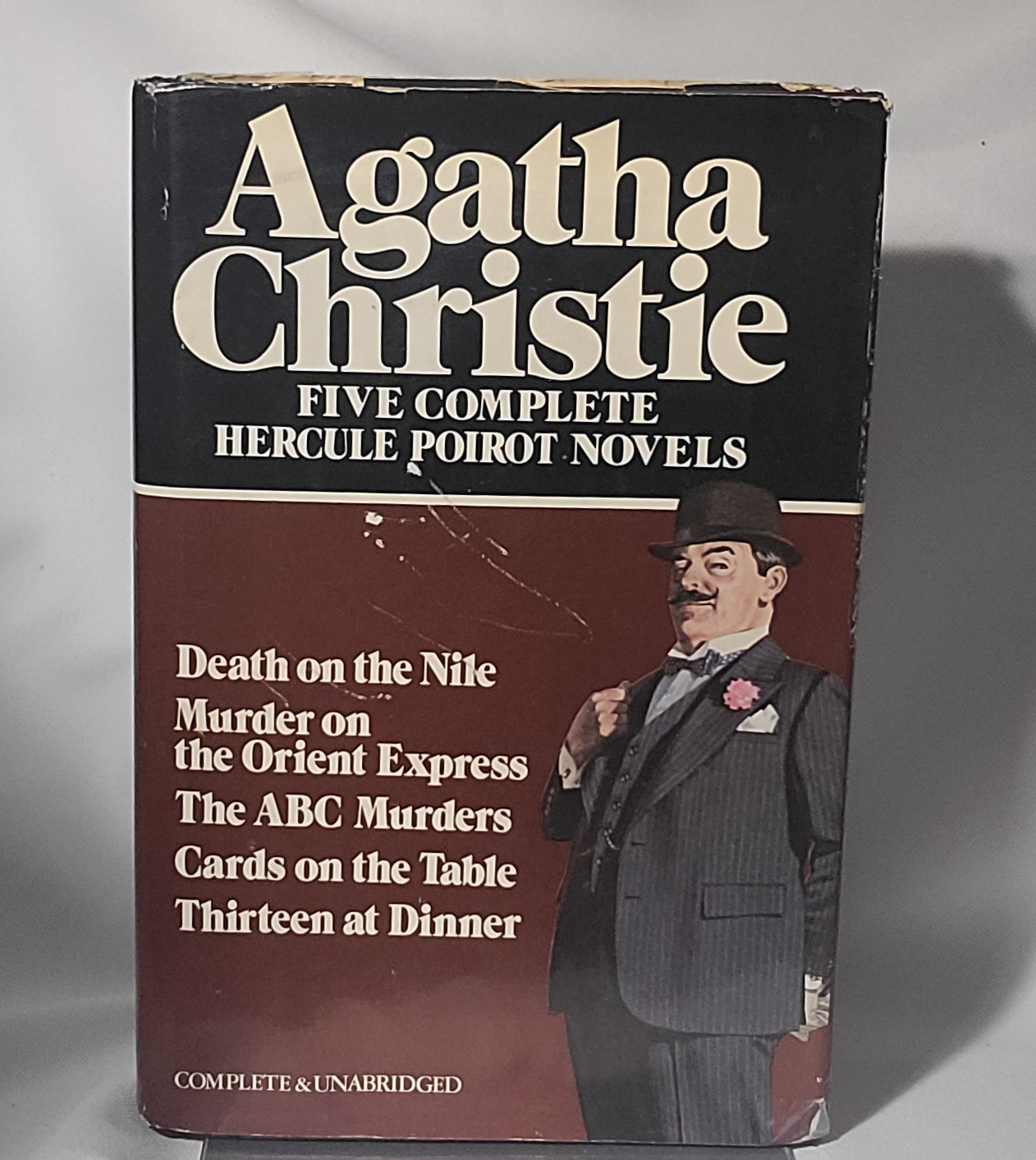

Exploring The World Of Agatha Christies Poirot Novels Adaptations And Legacy

May 20, 2025

Exploring The World Of Agatha Christies Poirot Novels Adaptations And Legacy

May 20, 2025 -

Una Noticia Esperanzadora Para Michael Schumacher Y Sus Seres Queridos

May 20, 2025

Una Noticia Esperanzadora Para Michael Schumacher Y Sus Seres Queridos

May 20, 2025 -

I Los Antzeles Thelei Ton Giakoymaki

May 20, 2025

I Los Antzeles Thelei Ton Giakoymaki

May 20, 2025 -

Market Reaction Dow Futures And Dollar Slip Following Moodys Downgrade

May 20, 2025

Market Reaction Dow Futures And Dollar Slip Following Moodys Downgrade

May 20, 2025