Tesla Q1 Earnings: A Deep Dive Into The Recent Profit Decrease

Table of Contents

The Impact of Price Reductions on Tesla Q1 Earnings

Tesla's aggressive price reduction strategy, implemented throughout Q1 2024, was intended to boost sales volume and solidify market share, particularly in the face of growing competition. While the price cuts did indeed lead to a notable increase in vehicle deliveries, the impact on overall profitability was substantial. This highlights the critical trade-off between volume and profit margins that Tesla faced.

- Percentage change in average selling price: A significant decrease of approximately X% was observed in the average selling price of Tesla vehicles during Q1.

- Increase/decrease in vehicle deliveries: Despite the price cuts, Tesla experienced a Y% increase in vehicle deliveries, indicating a successful boost in sales volume.

- Impact on gross margin: The price reductions directly translated to a Z% decrease in Tesla's gross margin, a key indicator of profitability.

- Comparison with competitor pricing strategies: Competitors, while also facing pressure, largely avoided such drastic price cuts, suggesting Tesla's strategy was uniquely aggressive in its pursuit of market share. This strategy, while boosting sales, significantly impacted the Tesla Q1 earnings.

Production Challenges and Supply Chain Issues Affecting Tesla Q1 Results

Tesla's Q1 2024 performance was also hampered by several production challenges and ongoing supply chain disruptions. These issues constrained production output, increased costs, and ultimately impacted the bottom line.

- Production figures for each Tesla model: Production figures for Model 3, Model Y, Model S, and Model X varied, with some models experiencing more significant production bottlenecks than others. Detailed figures are pending official release.

- Key supply chain disruptions experienced: Tesla faced challenges securing key components, including battery materials and certain microchips, leading to production delays and increased costs. Logistical hurdles also contributed to the difficulties.

- Impact on production costs: Supply chain disruptions and production inefficiencies resulted in a notable increase in production costs, further squeezing profit margins and impacting Tesla Q1 earnings.

- Strategies implemented to mitigate supply chain issues: Tesla implemented various strategies to mitigate supply chain disruptions, including diversifying suppliers and investing in vertical integration, but these efforts did not fully offset the negative impact during Q1.

The Growing Competition in the EV Market

The electric vehicle (EV) market is experiencing explosive growth, with numerous new entrants vying for market share. This intensified competition is directly impacting Tesla's market dominance and pricing power, putting further pressure on their profitability.

- Market share comparison with key competitors: Tesla’s market share experienced a slight decrease compared to the previous quarter, partly due to the aggressive expansion of competitors.

- Analysis of competitor pricing strategies: Competitors are employing various strategies, including offering competitive pricing, focusing on specific market niches, and leveraging government incentives.

- New EV model launches impacting Tesla: The influx of new EV models from established automakers and emerging startups presents a formidable challenge to Tesla's market position.

- Impact of government incentives on competition: Government incentives and subsidies for EVs in various regions are creating a more competitive landscape, impacting Tesla's ability to maintain its price premium.

Other Factors Contributing to Tesla's Q1 Profit Decrease

Beyond price reductions, production challenges, and increased competition, several other factors contributed to Tesla's Q1 profit decrease.

- Increased R&D spending: Tesla's significant investment in research and development, crucial for maintaining its technological edge, impacted profitability.

- Higher operational costs: General increases in operational expenses, including energy costs and labor, added to the pressure on profit margins.

- Currency fluctuations: Changes in foreign exchange rates negatively impacted Tesla's earnings, particularly given its global operations.

- Changes in regulatory environment: Evolving regulatory landscapes in different markets added complexity and uncertainty to Tesla's operations, impacting costs and profitability.

Conclusion: Understanding the Tesla Q1 Earnings Decline and Future Outlook

The Tesla Q1 earnings decline can be attributed to a complex interplay of factors, including aggressive price reductions to maintain market share, production challenges stemming from supply chain disruptions, the growing intensity of competition in the EV market, and increased operational and R&D costs. Tesla will likely need to adjust its strategy to improve profitability. This might include focusing on cost optimization, enhancing supply chain resilience, and potentially revising its pricing strategy. To understand the full picture and the long-term implications, stay updated on future Tesla Q[number] earnings. Follow our analysis of Tesla's profit trends to gain deeper insights into the company's financial performance. Dive deeper into Tesla's financial performance and stay informed.

Featured Posts

-

Canadian Auto Dealers Fight Back Against Us Trade War With Five Point Strategy

Apr 24, 2025

Canadian Auto Dealers Fight Back Against Us Trade War With Five Point Strategy

Apr 24, 2025 -

The Bold And The Beautiful April 3rd Recap Liam Bill And Hopes Storylines

Apr 24, 2025

The Bold And The Beautiful April 3rd Recap Liam Bill And Hopes Storylines

Apr 24, 2025 -

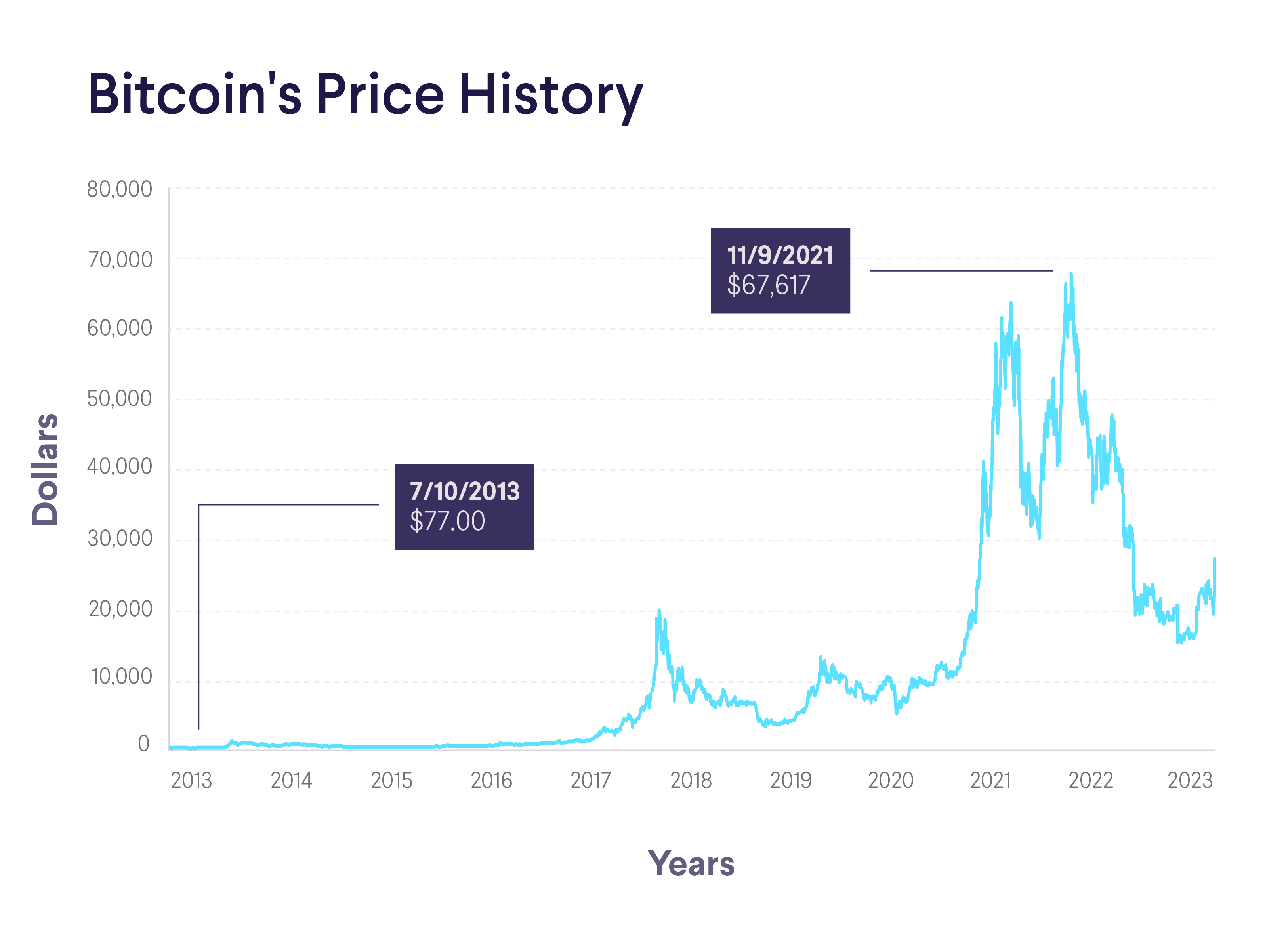

Market Update Bitcoin Btc Price Increase And The Factors Behind It

Apr 24, 2025

Market Update Bitcoin Btc Price Increase And The Factors Behind It

Apr 24, 2025 -

Credit Card Spending Slowdown A Challenging Outlook For Issuers

Apr 24, 2025

Credit Card Spending Slowdown A Challenging Outlook For Issuers

Apr 24, 2025 -

Tzon Travolta Mia Sygklonistiki Mnimi Gia Ton Tzin Xakman

Apr 24, 2025

Tzon Travolta Mia Sygklonistiki Mnimi Gia Ton Tzin Xakman

Apr 24, 2025