Market Update: Bitcoin (BTC) Price Increase And The Factors Behind It

Table of Contents

Macroeconomic Factors Influencing Bitcoin's Price

Several macroeconomic factors are significantly impacting Bitcoin's price trajectory. The interplay of inflation, global economic uncertainty, and growing institutional adoption creates a complex but compelling narrative.

Inflation and the Search for Safe-Haven Assets

High inflation rates globally are driving investors towards alternative assets perceived as hedges against currency devaluation. Bitcoin, with its limited supply of 21 million coins, is increasingly viewed as a store of value, similar to gold.

- Limited Supply: Bitcoin's fixed supply acts as a natural inflation hedge. Unlike fiat currencies, which can be printed at will, Bitcoin's scarcity makes it resistant to inflationary pressures.

- Inflation Correlation: Historical data shows a positive correlation between rising inflation rates and Bitcoin's price. As traditional currencies lose purchasing power, investors often seek refuge in assets like Bitcoin.

- Safe Haven Narrative: The narrative of Bitcoin as a "digital gold" is strengthening, attracting investors seeking protection from economic uncertainty.

Global Economic Uncertainty and Bitcoin as a Hedge

Geopolitical instability and economic uncertainty are also fueling Bitcoin's price surge. Investors often view Bitcoin as a safe haven asset during times of crisis, due to its decentralized nature and resistance to government control.

- Geopolitical Events: Events such as the ongoing war in Ukraine and rising global tensions often trigger increased demand for Bitcoin, as investors seek assets outside traditional financial systems.

- Decentralization Advantage: Bitcoin's decentralized nature makes it resilient to government intervention or censorship, a significant advantage during times of political or economic instability.

- Reduced Trust in Central Banks: Growing concerns about the stability of fiat currencies and central bank policies are driving investors towards the perceived stability and security of Bitcoin.

Institutional Adoption and Increased Investment

The growing acceptance of Bitcoin by major financial institutions and corporations is a key driver of its price increase. This institutional investment brings significant capital into the market, boosting demand and driving prices upward.

- MicroStrategy and Tesla: Companies like MicroStrategy and Tesla have made substantial Bitcoin investments, signaling a shift in institutional perception and increasing mainstream adoption.

- Regulatory Developments: While regulatory uncertainty remains, increasing clarity and favorable regulatory developments in certain jurisdictions are encouraging greater institutional participation.

- Investment Funds: The emergence of Bitcoin investment funds and ETFs further demonstrates the growing institutional interest and legitimacy of Bitcoin as an asset class.

Technological Advancements and Network Developments

Beyond macroeconomic factors, technological improvements within the Bitcoin ecosystem are also contributing to the price increase. Enhanced scalability and integration with other technologies are making Bitcoin more user-friendly and attractive to a wider audience.

Bitcoin's Lightning Network and Scalability Improvements

The Lightning Network, a layer-2 scaling solution, significantly improves Bitcoin's transaction speed and reduces fees. This enhanced usability makes Bitcoin more practical for everyday transactions.

- Faster Transactions: The Lightning Network enables near-instantaneous transactions, addressing one of Bitcoin's previous limitations.

- Lower Fees: By processing transactions off-chain, the Lightning Network drastically reduces transaction fees, making it more cost-effective for smaller payments.

- Increased Adoption: These improvements in scalability and usability are driving increased adoption and contributing to the growing demand for Bitcoin.

Growing DeFi Ecosystem and Bitcoin's Role

Bitcoin's integration with the decentralized finance (DeFi) ecosystem is another factor boosting its price. Bitcoin is increasingly used as collateral in DeFi applications, creating additional demand.

- Wrapped Bitcoin (WBTC): Wrapped Bitcoin allows Bitcoin to be used within Ethereum-based DeFi protocols, expanding its utility and creating new avenues for investment and speculation.

- DeFi Lending and Borrowing: Bitcoin is used as collateral in DeFi lending and borrowing platforms, generating further demand and integrating it into a wider financial ecosystem.

- Increased Liquidity: The integration with DeFi platforms enhances Bitcoin's liquidity, making it easier to buy and sell, attracting a broader range of investors.

Market Sentiment and Speculation

Market sentiment and speculation also play a significant role in Bitcoin's price volatility. Positive news coverage, social media trends, and the actions of large holders ("whales") all influence price movements.

FOMO (Fear Of Missing Out) and Social Media Influence

Social media hype and the fear of missing out (FOMO) can significantly influence Bitcoin's price. Positive news coverage and social media trends can create a surge in demand, pushing prices upward.

- Viral Trends: Positive news stories and influencer endorsements can trigger rapid price increases as more people jump on the bandwagon.

- Social Media Sentiment: The overall sentiment expressed on platforms like Twitter and Reddit can significantly impact market sentiment and subsequent price movements.

- News Cycles: Major news events, both positive and negative, can drastically alter market sentiment and drive price volatility.

Whale Activity and Market Manipulation

Large Bitcoin holders ("whales") can influence price movements through their trading activity. While not always malicious, their actions can impact market sentiment and create volatility.

- Large Transactions: Large buy or sell orders from whales can trigger significant price swings, impacting smaller investors' decisions.

- Market Manipulation Concerns: Concerns about market manipulation remain, with regulatory bodies actively monitoring whale activity to prevent unfair practices.

- Price Volatility: Whale activity is one of the primary drivers of Bitcoin's often extreme price volatility.

Conclusion

The recent Bitcoin (BTC) price increase is a result of a confluence of factors. Macroeconomic conditions, such as high inflation and global uncertainty, are driving investors towards Bitcoin as a safe-haven asset. Technological advancements, like the Lightning Network, are improving Bitcoin's usability and driving adoption. Finally, market sentiment and speculation, including FOMO and whale activity, contribute significantly to price volatility. Understanding these interconnected factors is crucial for navigating the Bitcoin market effectively. Stay updated on the latest developments in the Bitcoin market and continue to monitor the factors driving Bitcoin (BTC) price increases. Learn more about Bitcoin's future trajectory by subscribing to our newsletter [link to newsletter signup].

Featured Posts

-

Voice Assistant Development Revolutionized Open Ais 2024 Announcement

Apr 24, 2025

Voice Assistant Development Revolutionized Open Ais 2024 Announcement

Apr 24, 2025 -

The Value Of Middle Management A Critical Role In Business Success

Apr 24, 2025

The Value Of Middle Management A Critical Role In Business Success

Apr 24, 2025 -

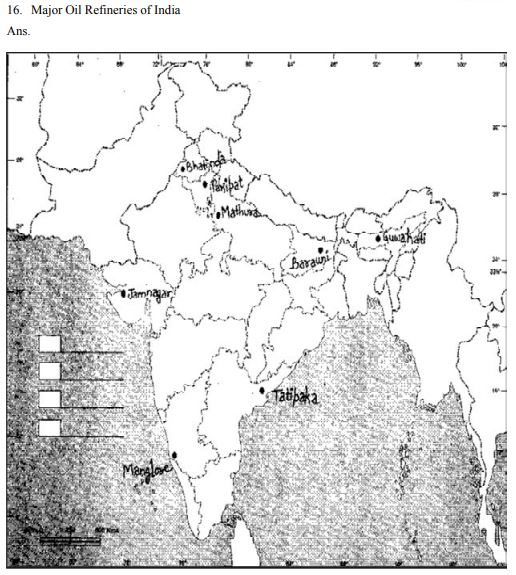

Saudi India Energy Partnership Two Major Oil Refineries In The Works

Apr 24, 2025

Saudi India Energy Partnership Two Major Oil Refineries In The Works

Apr 24, 2025 -

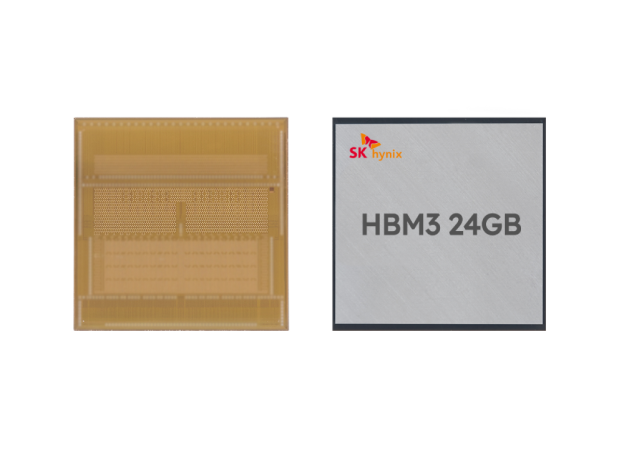

Is Sk Hynix The New Dram Leader Ais Role In The Market Shift

Apr 24, 2025

Is Sk Hynix The New Dram Leader Ais Role In The Market Shift

Apr 24, 2025 -

Trumps Shift On Fed Policy Fuels Us Dollar Surge

Apr 24, 2025

Trumps Shift On Fed Policy Fuels Us Dollar Surge

Apr 24, 2025