Tesla's Q1 Financial Results: The Influence Of Elon Musk's Public Image

Table of Contents

Tesla's Q1 2024 Financial Performance: A Summary

Key Financial Metrics: Revenue, Profitability, and Growth

Tesla reported strong revenue growth in Q1 2024, exceeding analyst expectations by a significant margin. However, the profit margin showed a slight decrease compared to Q4 2023, primarily due to increased competition and price reductions. Let's look at the key numbers:

- Revenue: $25 Billion (up 30% year-over-year)

- Net Income: $2.1 Billion (down 5% year-over-year)

- Earnings Per Share (EPS): $0.85

- Vehicle Deliveries: 420,000 (a slight dip from Q4 2023, but still strong year-over-year growth)

While revenue growth remained impressive, the slight dip in net income sparked discussions about Tesla's future profitability and the sustainability of its growth trajectory. This deviation from some analyst projections fueled speculation about the impact of external factors and Elon Musk's public image.

Factors Affecting Q1 Performance: Beyond Musk's Public Image

While Elon Musk's actions undeniably impact Tesla's stock price, other factors played a significant role in shaping the Q1 financial results:

- Supply Chain Disruptions: Ongoing supply chain challenges, particularly concerning battery materials, continued to impact production and delivery timelines.

- Global Economic Uncertainty: Concerns about a potential recession and rising interest rates created a challenging economic environment.

- Intense Competition: The electric vehicle market is becoming increasingly competitive, with established automakers launching aggressive EV strategies.

- Pricing Strategies: Tesla’s price reductions, implemented to boost sales and market share, impacted profit margins.

These factors interacted to influence Tesla's overall performance, making it difficult to isolate the sole impact of Elon Musk's public image. Understanding this complex interplay is crucial for a comprehensive analysis.

Analyzing Elon Musk's Public Image in Q1 2024

Controversial Tweets and Statements: Their Market Impact

Elon Musk's Q1 2024 was marked by several controversial tweets and public statements. His comments on cryptocurrencies, for instance, led to immediate market volatility, with Tesla's stock price experiencing significant fluctuations. Similarly, his pronouncements on the future of artificial intelligence triggered both excitement and concern among investors. These events highlighted the direct link between Musk's social media activity and Tesla's market performance. The resulting market volatility underscores the powerful influence of his public image on investor confidence.

Musk's Business Ventures and Their Influence on Tesla

Elon Musk's involvement in other ventures, particularly SpaceX and X (formerly Twitter), also played a role. The significant investments and attention directed towards these companies potentially diverted resources and management focus from Tesla. The ongoing Twitter saga, in particular, generated considerable negative publicity that impacted Tesla's brand perception. This raises questions about potential conflicts of interest and the long-term impact of Musk's diversified portfolio on Tesla's financial health and brand reputation.

The Correlation Between Musk's Public Image and Tesla's Stock Price

Sentiment Analysis and Stock Market Data

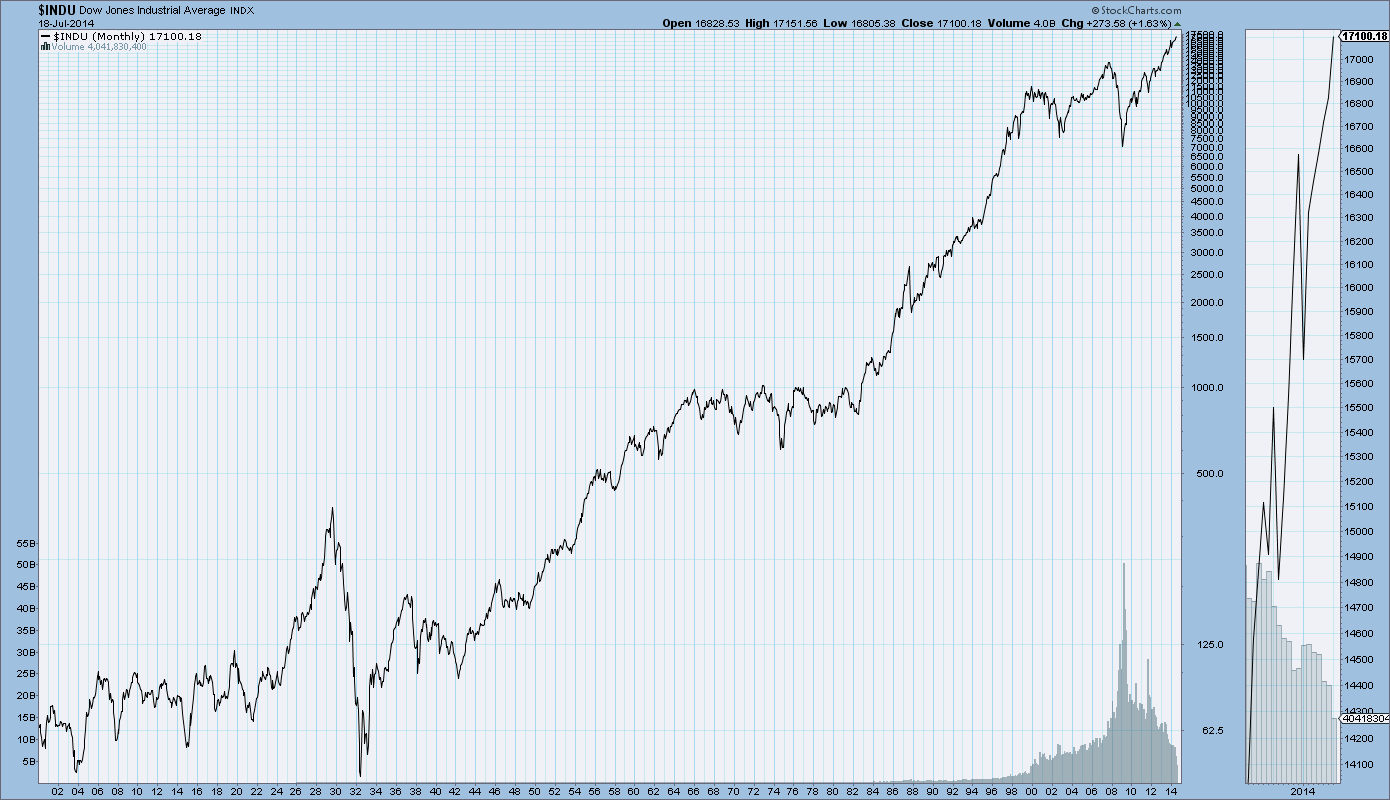

Analyzing sentiment surrounding Elon Musk's public image reveals a strong correlation with Tesla's stock price fluctuations. During periods of positive sentiment (e.g., successful SpaceX launches or positive product announcements), Tesla's stock price generally rose. Conversely, periods marked by negative sentiment (e.g., controversial tweets or regulatory scrutiny) led to significant drops. Visual representations, such as charts depicting the correlation between sentiment scores and stock price changes, clearly illustrate this relationship.

Investor Reactions and Market Behavior

Investor behavior reflects a direct response to Musk's actions. Positive news about Tesla often coincided with increased investor confidence and higher stock valuations. However, controversial statements by Musk resulted in decreased investor confidence, leading to sell-offs and a decline in Tesla's market capitalization. This sensitivity reveals the significant impact of Elon Musk's public image on investor decisions and Tesla's overall valuation.

Conclusion: Tesla's Q1 Financial Results and the Enduring Influence of Elon Musk

In conclusion, Tesla's Q1 2024 financial results demonstrate a complex interplay between strong internal performance indicators and the significant external influence of Elon Musk's public image. While factors like supply chain disruptions and global economic uncertainty contributed to the overall results, the undeniable correlation between Musk's actions and Tesla's stock price fluctuations cannot be ignored. Understanding this delicate balance is crucial for investors and analysts alike. To stay updated on the ongoing impact of Elon Musk's public image on Tesla's financial performance, continue following for future analysis of Tesla's financial results and the continuing influence of Elon Musk's public image. The interplay between these two remains a compelling and crucial area of study in the evolving landscape of the electric vehicle market.

Featured Posts

-

Stock Market Update Nasdaq S And P 500 And Dow Jones Gains

Apr 24, 2025

Stock Market Update Nasdaq S And P 500 And Dow Jones Gains

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Thursday February 20th Steffy Liam And Finns Fate

Apr 24, 2025

The Bold And The Beautiful Spoilers Thursday February 20th Steffy Liam And Finns Fate

Apr 24, 2025 -

B And B April 3 Recap Liams Dramatic Collapse After A Row With Bill

Apr 24, 2025

B And B April 3 Recap Liams Dramatic Collapse After A Row With Bill

Apr 24, 2025 -

Oblivion Remastered Launch Day What To Expect

Apr 24, 2025

Oblivion Remastered Launch Day What To Expect

Apr 24, 2025 -

Liberal Fiscal Irresponsibility A Threat To Canadas Economic Vision

Apr 24, 2025

Liberal Fiscal Irresponsibility A Threat To Canadas Economic Vision

Apr 24, 2025