The Economic Impact Of Trump's Trade War: Wall Street Bets Analysis.

Table of Contents

Impact on Specific Sectors

Trump's trade war didn't affect all sectors equally. The imposition of tariffs created winners and losers, a dynamic vividly reflected in Wall Street Bets' discussions.

-

Agriculture: The agricultural sector, particularly soybean farmers, felt the brunt of retaliatory tariffs from China. WSB users actively tracked the price fluctuations of soybean futures contracts and discussed the implications for farm incomes. The impact on agricultural exports became a significant topic, with many posts highlighting the struggles faced by farmers and the ripple effect on related industries. Specific stock tickers of agricultural companies were frequently mentioned, their performance analyzed against the backdrop of the trade war.

-

Manufacturing: The manufacturing sector, reliant on both imports and exports, faced significant challenges. WSB discussions included analyses of supply chain disruptions caused by tariffs, leading to increased production costs and price hikes for consumers. Many users debated the long-term competitiveness of US manufacturing given the increased costs associated with imported components. Discussions frequently included mentions of specific manufacturing stocks and their sensitivity to trade policy changes.

-

Technology: While the tech sector wasn't directly targeted as heavily as others, the overall global economic uncertainty created by the trade war impacted investor sentiment and stock prices. WSB users speculated on the potential impact of disrupted supply chains and increased input costs on tech companies, particularly those reliant on global manufacturing and distribution networks. The ripple effect of the trade war on consumer spending also became a significant discussion point within the context of tech sector performance. The analysis included discussions of specific tech stocks and their performance in relation to overall market trends influenced by the trade war.

Market Volatility and Investor Sentiment

The trade war significantly impacted market volatility, and WSB's discussions mirrored this turbulence.

-

Increased Volatility: WSB users actively tracked daily market fluctuations, often expressing anxiety and excitement in equal measure. The uncertainty surrounding trade policy led to significant swings in stock prices, creating opportunities for both gains and losses. The platform became a forum for sharing trading strategies, risk assessments, and real-time reactions to the ongoing trade negotiations.

-

Shifting Sentiment: Investor sentiment on WSB fluctuated wildly depending on the latest developments in the trade war. Periods of escalating tensions often resulted in a bearish sentiment, while moments of de-escalation could trigger bullish rallies. The platform offered a glimpse into the raw, emotional response of individual investors to the ongoing trade conflict.

-

Trading Strategies: The volatility created by the trade war spurred a variety of investment strategies within WSB. Some users employed short-selling strategies to capitalize on anticipated price declines, while others used hedging techniques to mitigate potential losses. Option trading and other derivatives became increasingly popular as users sought to navigate the uncertainty.

Global Economic Consequences & WSB’s Reaction

The Trump administration’s trade war had far-reaching global consequences, sparking discussions and analyses on Wall Street Bets.

-

Global Slowdown Concerns: WSB users expressed concerns about the potential for a global economic slowdown or recession as a result of the trade war. The interconnectedness of global supply chains meant that disruptions in one region could quickly impact others. Discussions often included predictions for global growth and concerns about the long-term economic health of various countries.

-

Geopolitical Risks: The trade war exacerbated existing geopolitical tensions, leading to anxieties about potential conflicts and instability. WSB users frequently discussed the impact of these risks on global markets, analyzing how escalating tensions between the US and other major economies affected investment opportunities and market sentiment.

-

International Relations: The impact of the trade war on international relations became a recurring theme within WSB discussions. The platform served as a forum for users to share their perspectives on the broader geopolitical landscape and its connection to market movements. Many users pointed out the complexity of international trade and the unpredictable nature of trade negotiations.

Comparison with Traditional Wall Street Analysis

The perspectives on the Trump trade war found on WSB offered a compelling contrast to those from traditional Wall Street analysts and mainstream media.

-

Contrasting Perspectives: While traditional analyses often focused on macro-economic indicators and fundamental valuations, WSB discussions often reflected a more visceral, real-time response to market events. This difference in perspective highlighted the gap between the theoretical assessments of established financial institutions and the lived experiences of retail investors.

-

Strengths and Limitations: Traditional Wall Street analysis generally benefited from access to extensive data and sophisticated modelling techniques. However, it could sometimes lack the immediacy and granular insight offered by the real-time discussions and opinions on platforms like WSB. WSB, conversely, offered a more spontaneous, emotional perspective, but lacked the rigorous methodology and data analysis of traditional research.

Conclusion

The economic impact of Trump's trade war, as observed through the lens of Wall Street Bets, reveals significant market volatility, sector-specific impacts, and a spectrum of investor sentiments. The platform provided a unique, unfiltered view of how individual investors reacted to this period of economic uncertainty. The contrast between WSB's often less conventional approach and traditional Wall Street analysis highlights the importance of considering multiple perspectives when assessing the effects of significant economic events. Understanding the economic impact of trade wars, as viewed through various lenses such as Wall Street Bets, is crucial for navigating future market fluctuations. Further research into similar online communities and analysis of historical trade disputes can provide invaluable insights into predicting market behavior. Continue learning about the economic impact of trade wars and stay informed about the ever-changing global economic landscape.

Featured Posts

-

De Ideale Ajax Trainer Volgens Van Hanegem

May 29, 2025

De Ideale Ajax Trainer Volgens Van Hanegem

May 29, 2025 -

Analyse Heitinga Als Topkandidaat Bij Ajax

May 29, 2025

Analyse Heitinga Als Topkandidaat Bij Ajax

May 29, 2025 -

Lush Nyc 30 Minute Bubble Bath Experience For 75

May 29, 2025

Lush Nyc 30 Minute Bubble Bath Experience For 75

May 29, 2025 -

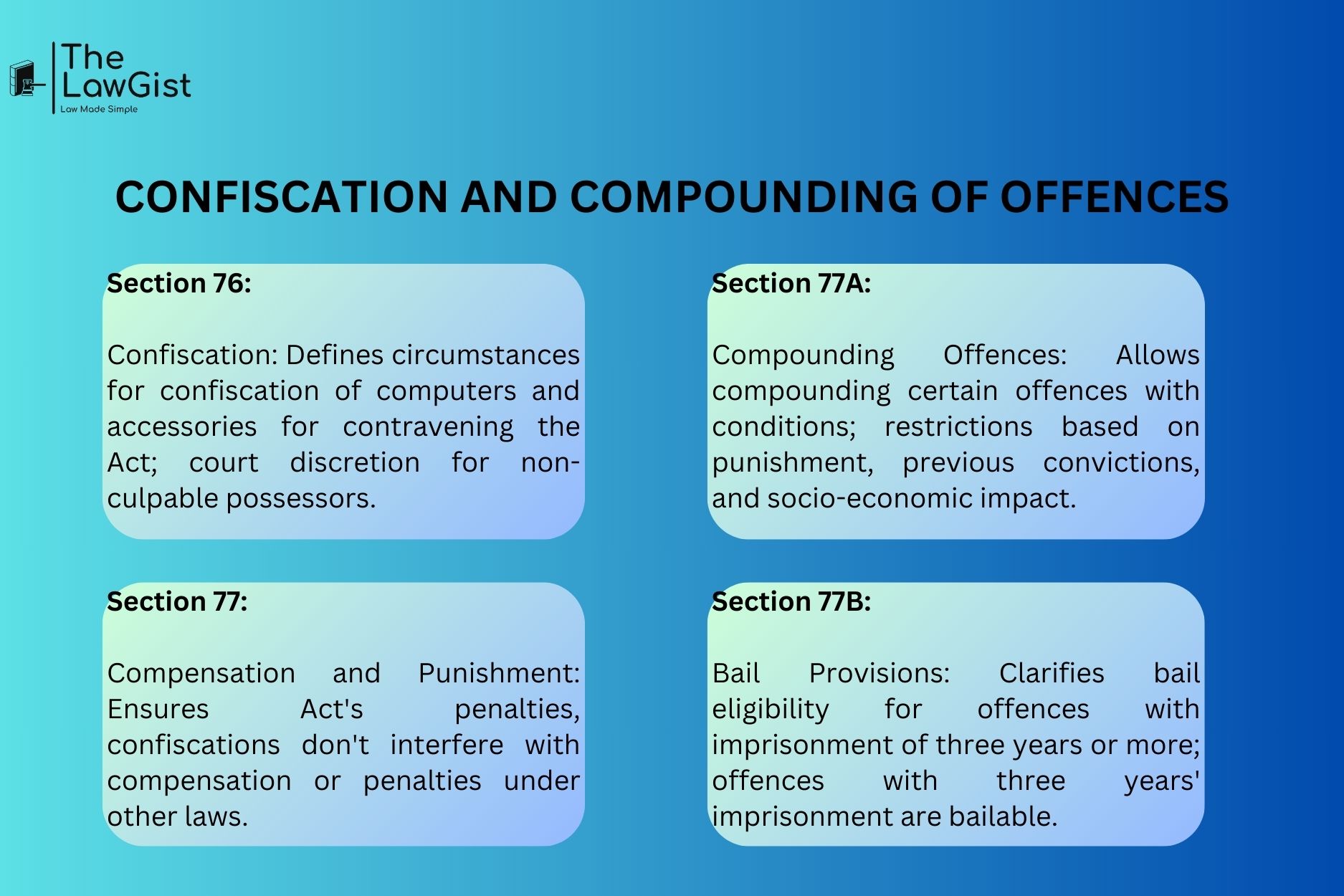

New French Law Phone Confiscation For Drug Related Offenses

May 29, 2025

New French Law Phone Confiscation For Drug Related Offenses

May 29, 2025 -

Live Nation Entertainment Stock Lyv A Deep Dive Into Investment Strategies

May 29, 2025

Live Nation Entertainment Stock Lyv A Deep Dive Into Investment Strategies

May 29, 2025