The Fight Within The GOP: Trump's Tax Plan In Jeopardy

Table of Contents

Internal Divisions Within the GOP

The Republican party is far from unified on Trump's Tax Plan, with significant disagreements fracturing the party along ideological lines. These divisions represent a significant hurdle to the plan's passage.

The Moderate Wing's Concerns

Moderate Republicans harbor serious reservations about key aspects of Trump's Tax Plan. Their concerns center on several crucial points:

- Increased National Debt: Many fear the tax cuts, particularly for corporations and high-income earners, will dramatically increase the national debt without generating sufficient economic growth to offset the cost.

- Disproportionate Benefits for the Wealthy: Critics argue the plan overwhelmingly favors the wealthy, offering minimal benefits to middle-class families and exacerbating income inequality.

- Lack of Middle-Class Tax Relief: Moderate Republicans advocate for more substantial tax breaks for middle-class families, arguing that Trump's plan doesn't adequately address their needs.

Several Republican representatives, including [Insert names of moderate Republicans and their districts], have publicly voiced these concerns. Representative [Name] stated, "[Insert quote expressing concerns about the national debt or lack of middle-class benefits]". They've proposed amendments to address these issues, suggesting alternative approaches to tax reform that prioritize fiscal responsibility and broader economic benefits. These proposed amendments, while aiming for "middle-class tax relief," are facing strong opposition from the conservative wing.

The Conservative Faction's Demands

The conservative faction within the GOP, while generally supportive of tax cuts, pushes for even more drastic measures than those proposed by Trump. Their demands often conflict directly with the moderate wing's concerns, further complicating the legislative process.

- Deeper Tax Cuts: Conservatives argue that Trump's proposed cuts aren't ambitious enough and call for even deeper reductions across the board, potentially further exacerbating the national debt.

- Elimination of Loopholes: While Trump's plan addresses some tax loopholes, conservatives demand a more thorough overhaul, targeting specific deductions and exemptions they see as unfair.

- Supply-Side Economics Focus: This faction firmly believes in supply-side economics, arguing that deep tax cuts will stimulate economic growth and ultimately increase tax revenue, despite potential initial increases in the budget deficit.

Influential conservative figures like [Insert names of conservative Republicans and their positions] have publicly advocated for these more aggressive approaches, creating a significant rift within the party and jeopardizing the plan's chances of passing Congress. Their adherence to "supply-side economics" often clashes with the moderates' concerns about "fiscal responsibility."

Economic Consequences of Failure

The failure of Trump's Tax Plan would have significant and far-reaching economic consequences, impacting both domestic and international markets.

Impact on the Stock Market

The uncertainty surrounding the tax plan's fate has already caused some volatility in the stock market. Failure to pass the legislation could trigger a more pronounced negative reaction.

- Decreased Investor Confidence: Uncertainty about future tax policies could erode investor confidence, leading to decreased investment and potential market downturns.

- Reduced Economic Growth: The lack of anticipated tax cuts could dampen economic growth, impacting business investment and consumer spending.

- Market Volatility: The market could experience significant volatility as investors react to the unfolding political situation and adjust their portfolios accordingly.

Economic experts predict [cite specific predictions and sources] varying reactions depending on the specific outcome; a complete failure would likely trigger the most dramatic negative market response, while a partial passage might lead to a more muted reaction.

Effect on the National Debt

The failure of Trump's Tax Plan could exacerbate the already substantial national debt.

- Increased Budget Deficits: Without the revenue increases anticipated by the plan, budget deficits would likely widen, potentially straining government finances and limiting the government's ability to respond to future economic challenges.

- Reduced Government Spending: The inability to cut taxes as planned might force the government to reduce spending in other areas, potentially impacting essential services and infrastructure projects.

- Long-Term Economic Instability: A growing national debt could lead to long-term economic instability, increasing interest rates and potentially hindering future economic growth. Experts project [cite specific numbers and sources] increases in the national debt depending on alternative fiscal policies.

Potential Compromises and Solutions

Despite the deep divisions within the GOP, several potential compromises and solutions could still lead to the passage of a modified tax plan.

Negotiations and Amendments

Negotiations between the moderate and conservative wings are crucial to finding common ground.

- Targeted Tax Cuts: A compromise might involve focusing tax cuts on specific sectors or income levels, rather than across-the-board reductions.

- Phased Implementation: The plan could be implemented gradually over several years, allowing for adjustments based on economic indicators and feedback.

- Revenue-Neutral Tax Reform: A revenue-neutral approach, which offsets tax cuts with other revenue-generating measures, might be necessary to appease concerns about the national debt.

The likelihood of successful negotiations depends on the willingness of both factions to make concessions. Finding a path forward necessitates bipartisan support for "tax legislation" that addresses concerns from both sides of the aisle. Amendments to address "middle-class tax relief" and the "national debt" are crucial to achieving a workable solution.

Conclusion

The future of Trump's Tax Plan remains deeply uncertain, with internal divisions within the GOP posing a significant threat to its passage. The potential economic consequences of failure are substantial, ranging from stock market volatility to a widening national debt. While potential compromises exist, the success of negotiations hinges on the willingness of both moderate and conservative Republicans to find common ground. Stay informed about these critical developments by following reputable news sources and engaging in informed discussions. The ongoing debate surrounding Trump's tax plan is shaping the future of the Republican Party and the U.S. economy; understanding its intricacies is vital for every engaged citizen.

Featured Posts

-

Hudsons Bay Liquidation Sale Final Markdowns Up To 70

Apr 29, 2025

Hudsons Bay Liquidation Sale Final Markdowns Up To 70

Apr 29, 2025 -

The Ftcs Investigation Of Open Ai And Chat Gpt Key Questions And Potential Outcomes

Apr 29, 2025

The Ftcs Investigation Of Open Ai And Chat Gpt Key Questions And Potential Outcomes

Apr 29, 2025 -

The Challenges Of Producing All American Goods

Apr 29, 2025

The Challenges Of Producing All American Goods

Apr 29, 2025 -

Top Universities Unite In Private Collective Against Trump Policies

Apr 29, 2025

Top Universities Unite In Private Collective Against Trump Policies

Apr 29, 2025 -

Trumps Tax Bill Republican Opposition And Potential Roadblocks

Apr 29, 2025

Trumps Tax Bill Republican Opposition And Potential Roadblocks

Apr 29, 2025

Latest Posts

-

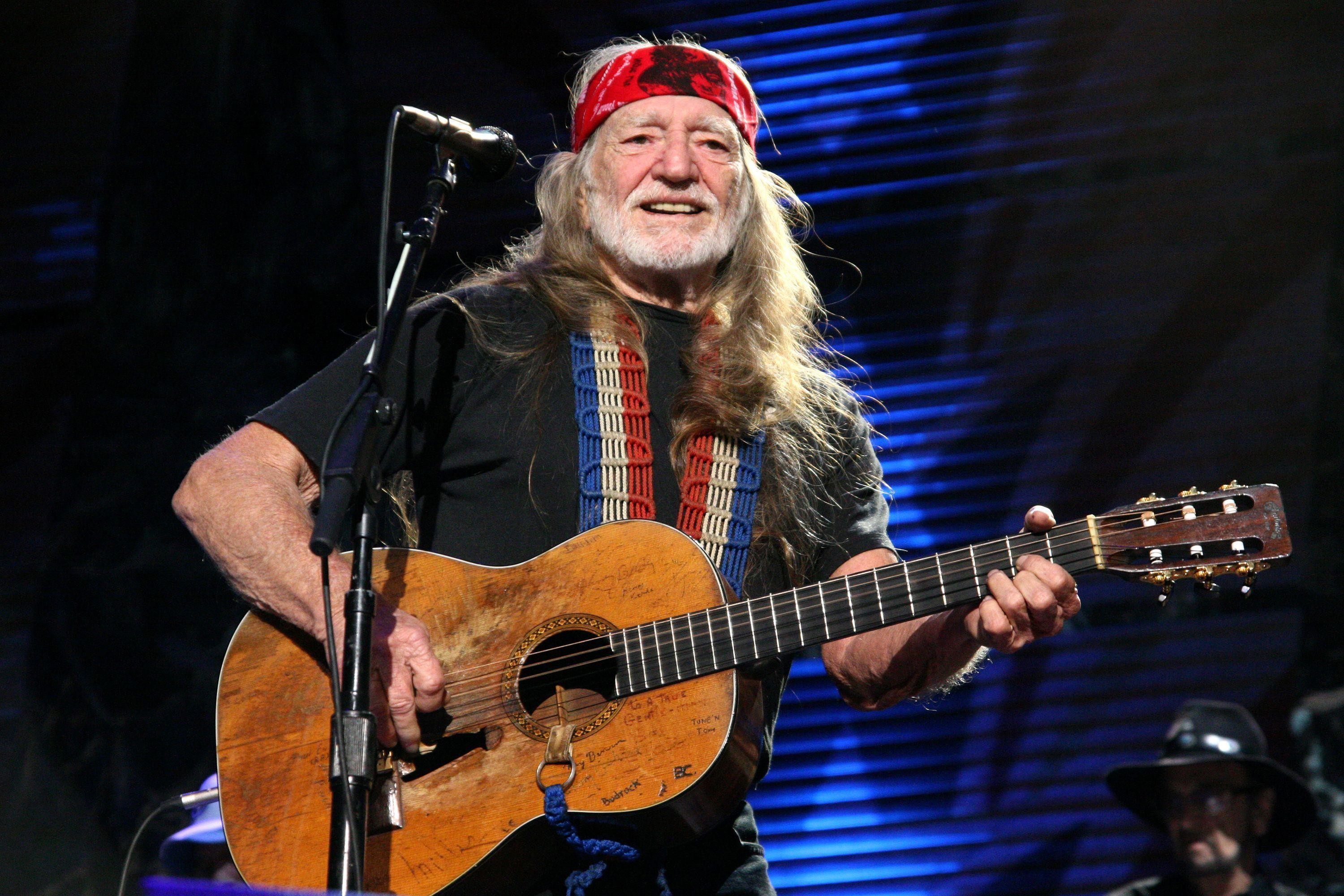

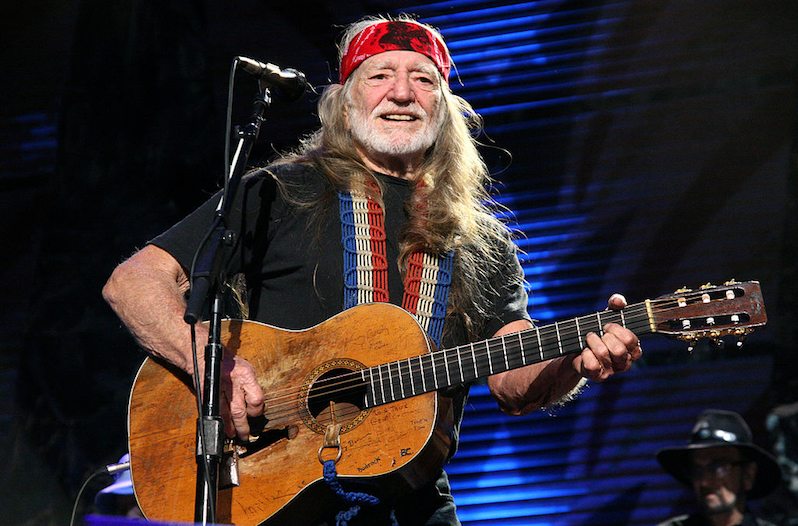

New Music Willie Nelsons Oh What A Beautiful World Album Details

Apr 29, 2025

New Music Willie Nelsons Oh What A Beautiful World Album Details

Apr 29, 2025 -

Willie Nelson Documentary Leading Austin News Story

Apr 29, 2025

Willie Nelson Documentary Leading Austin News Story

Apr 29, 2025 -

Quick Facts About Willie Nelson Life Career And Legacy

Apr 29, 2025

Quick Facts About Willie Nelson Life Career And Legacy

Apr 29, 2025 -

Willie Nelson Announces New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelson Announces New Album Oh What A Beautiful World

Apr 29, 2025 -

Willie Nelson Documentary Tops Austins Weekly News

Apr 29, 2025

Willie Nelson Documentary Tops Austins Weekly News

Apr 29, 2025