Trump's Tax Bill: Republican Opposition And Potential Roadblocks

Table of Contents

The passage of Trump's Tax Bill seemed a sure thing given the Republican control of both the House and the Senate. Yet, whispers of dissent within the Republican party itself have emerged, casting a shadow of doubt on the bill's future. This unexpected opposition poses significant roadblocks, potentially preventing the bill from becoming law despite the party's unified control of Congress. This article will delve into the key sources of Republican opposition to Trump's Tax Bill and analyze the potential legislative hurdles that could derail its progress.

Conservative Concerns about Fiscal Responsibility:

The proposed tax cuts, while intended to stimulate economic growth, have sparked considerable concern among fiscal conservatives within the Republican party. The primary worry revolves around the potential for a dramatic increase in the national debt.

Increased National Debt:

- Independent analyses project a substantial rise in the national debt over the next decade if Trump's Tax Bill is enacted. These projections often exceed those associated with previous tax cuts, raising serious concerns about long-term fiscal sustainability.

- Prominent fiscal conservative Republicans have voiced their opposition, citing the unsustainable nature of such significant deficit spending and emphasizing the need for greater fiscal responsibility. Statements from Senators such as [Insert Name and Quote] highlight this growing apprehension.

- The projected budget deficit increases, fueled by decreased tax revenue, are expected to outpace economic growth, leading to a spiraling national debt, potentially impacting future government spending on crucial social programs. This argument resonates strongly with fiscal conservatives who prioritize balanced budgets.

- Keywords: Fiscal conservatism, national debt, deficit spending, budget deficit, fiscal responsibility.

Tax Cuts for the Wealthy:

Another significant source of opposition stems from concerns that the tax cuts disproportionately benefit the wealthy, contradicting the administration's claims of providing tax relief for the middle class.

- Statistical analysis reveals that a significantly larger percentage of the tax cuts will go to high-income earners, exacerbating existing income inequality. This data directly challenges the narrative of widespread tax relief.

- Critics within the Republican party have pointed out that the bill includes numerous tax loopholes that primarily benefit corporations and the wealthy, undermining the party's promise of tax fairness. Quotes from Republican critics emphasizing this point can be found in [cite source].

- This argument aligns with the concerns of those advocating for progressive taxation, suggesting that the tax burden should be more evenly distributed across income brackets. The perceived unfairness of the distribution is a potent argument against the bill.

- Keywords: Tax cuts for the wealthy, income inequality, progressive taxation, tax loopholes, tax fairness.

Ideological Divisions within the Republican Party:

The Republican party is not a monolithic entity, and significant ideological divisions exist, further complicating the passage of Trump's Tax Bill.

Libertarian Opposition:

- Some libertarian-leaning Republicans oppose certain provisions due to their perceived infringement on individual liberty and free markets. They argue that excessive government intervention in the economy is counterproductive.

- Specific provisions, such as [mention specific provisions and explain libertarian opposition], have drawn fire from this faction. Their arguments often emphasize the importance of limited government and individual choice. Quotes from prominent libertarian Republicans can be found in [cite source].

- The core tenets of libertarianism—individual liberty, minimal government intervention, and free markets—directly clash with some of the proposed regulations and interventions included in the bill. This clash fuels strong opposition from this influential segment of the Republican party.

- Keywords: Libertarianism, free market, limited government, individual liberty, regulation, economic freedom.

Social Conservative Concerns:

While fiscal policy is the primary focus, social conservatives may object to certain aspects of the bill unrelated to its economic implications.

- Although less prominent than fiscal concerns, some social conservatives may raise objections to certain provisions that conflict with their values, potentially slowing the bill's progress.

- For instance, [mention specific provisions and explain social conservative opposition] might be cited as contradicting traditional family values or religious freedom, potentially leading to opposition from this group. Quotes from relevant Republican figures can be found in [cite source].

- These concerns, while less directly related to the bill's core economic principles, could still contribute to the overall opposition and delay its progress. This highlights the complex interplay of various ideological factions within the party.

- Keywords: Social conservatism, religious freedom, family values, moral objections, conservative values.

Procedural Hurdles and Legislative Challenges:

Even if the Republican party could overcome internal divisions, significant procedural hurdles remain.

Senate Filibuster:

- The Senate's filibuster rule allows a minority of senators to block legislation unless a supermajority (60 votes) can be achieved. This poses a significant threat to the bill's passage.

- Given the narrow Republican majority in the Senate, securing 60 votes for cloture (ending the filibuster) will be a considerable challenge. Strategies such as utilizing the "reconciliation" process to bypass the filibuster may be necessary but also risky.

- The potential for a filibuster highlights the delicate balance of power in the Senate and the crucial role of individual senators in determining the bill's fate. The legislative process is fraught with potential roadblocks.

- Keywords: Senate filibuster, cloture vote, legislative process, reconciliation, supermajority.

Intra-Party Negotiations and Compromises:

Achieving party unity on a complex piece of legislation like Trump's Tax Bill requires significant intra-party negotiations and potentially difficult compromises.

- The diverse factions within the Republican party—fiscal conservatives, libertarians, social conservatives—hold divergent priorities and may demand concessions to support the bill.

- The role of party leadership in brokering these compromises will be critical, and failure to do so could lead to a fracturing of the party and the bill's demise. The internal party divisions are a major hurdle in this complex legislative process.

- Navigating these negotiations and forging compromises that satisfy these diverse interests will be a significant challenge for Republican leadership. Bipartisanship, although unlikely, might be necessary to overcome these hurdles.

- Keywords: Bipartisanship, legislative negotiations, political compromise, party unity, internal divisions.

Conclusion:

In conclusion, Trump's Tax Bill faces significant headwinds from within the Republican party itself. Concerns about the national debt, the disproportionate benefits to the wealthy, and fundamental ideological divisions create considerable hurdles. Adding to these internal challenges are the procedural obstacles posed by the Senate filibuster and the complexities of achieving intra-party consensus. Despite Republican control of Congress, the potential for failure remains significant. The key takeaway is the fragility of party unity and the considerable challenges of passing major legislation in a highly polarized political climate. Follow the developments of Trump's Tax Bill closely and stay informed about the future of Trump's tax plan – its passage or failure will have profound implications for the American economy and the political landscape.

Featured Posts

-

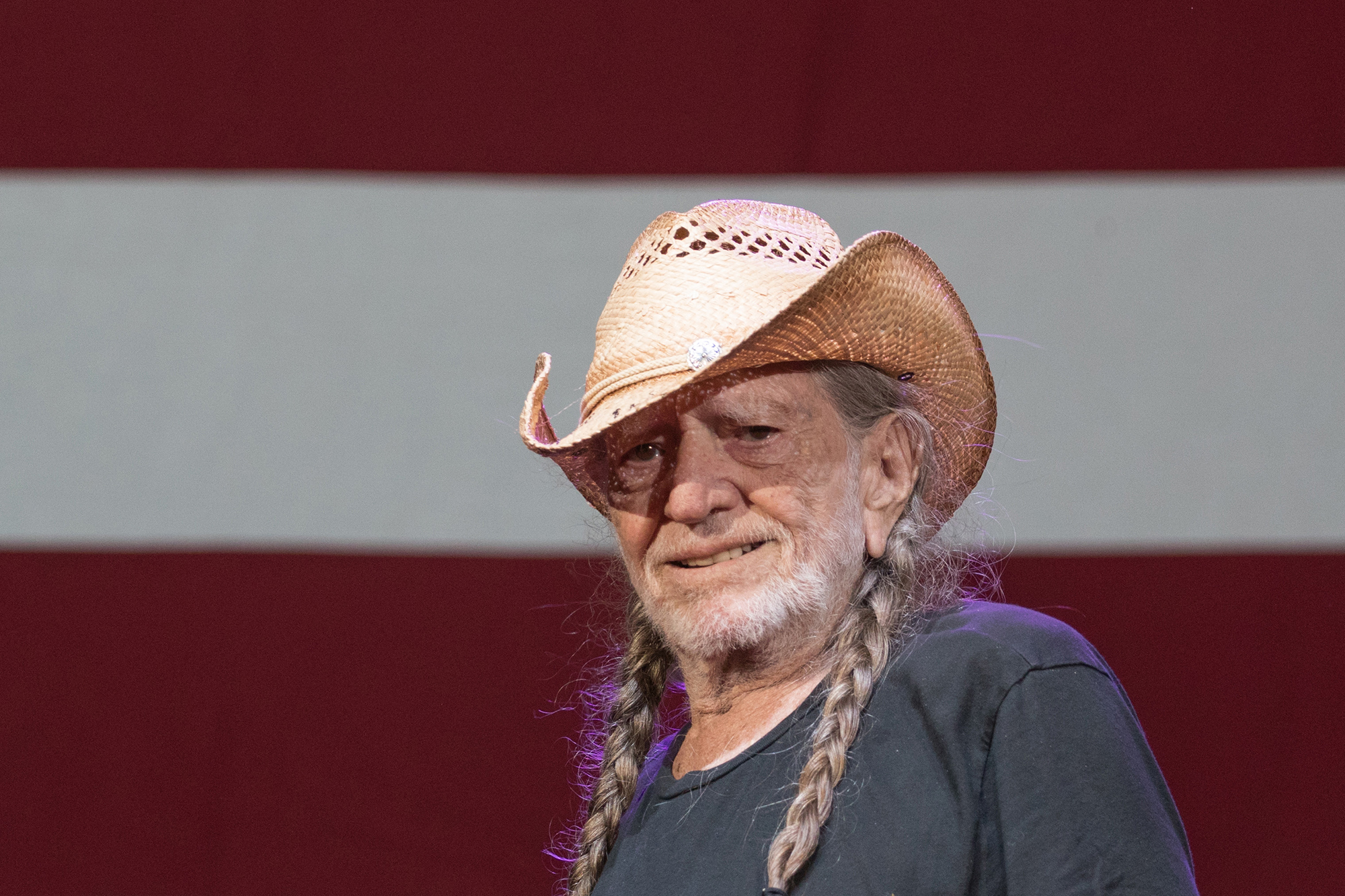

Willie Nelsons Outlaw Music Festival Bob Dylan And Billy Strings In Portland

Apr 29, 2025

Willie Nelsons Outlaw Music Festival Bob Dylan And Billy Strings In Portland

Apr 29, 2025 -

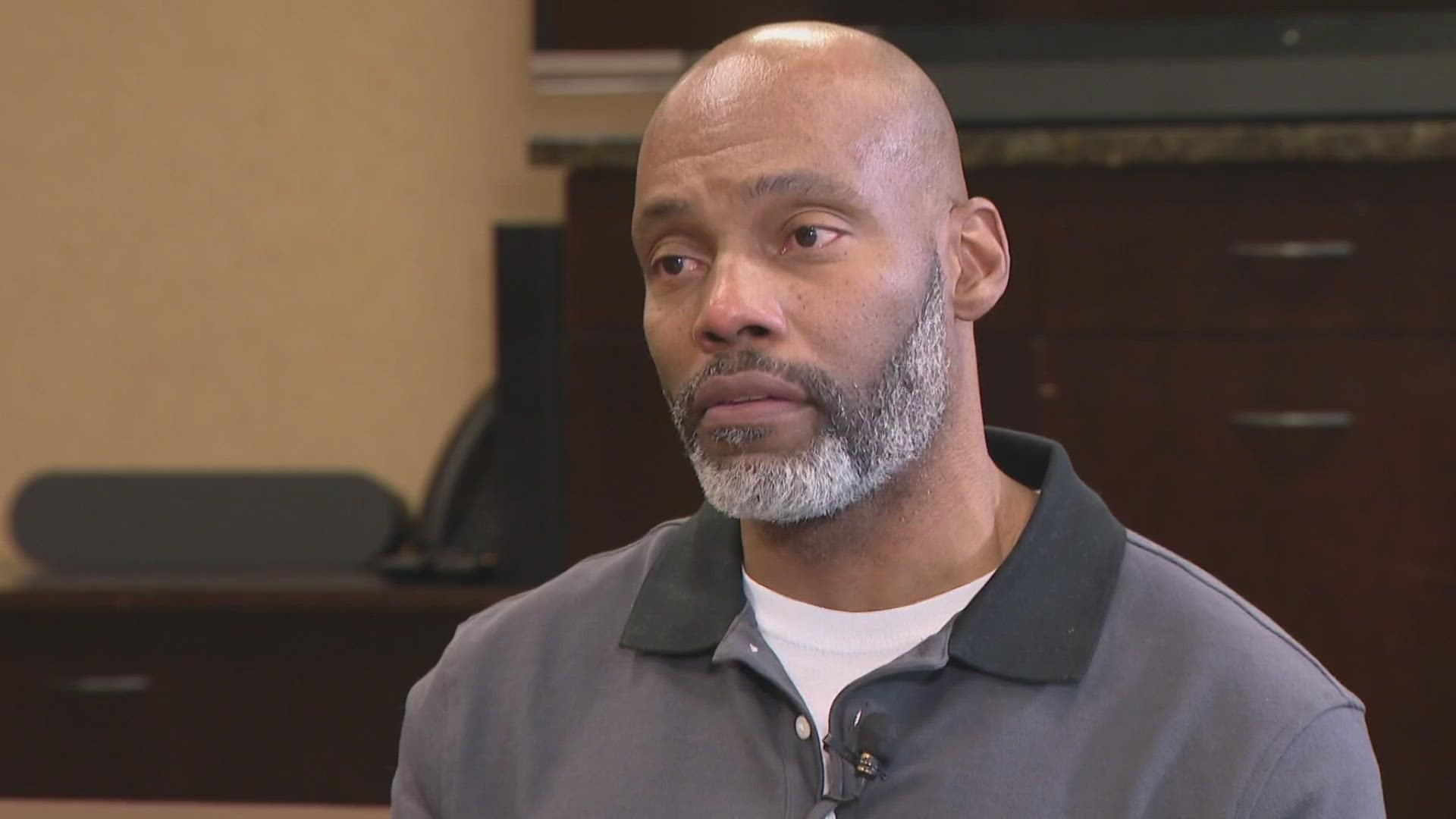

Ohio Doctors Murder Conviction Sons Emotional Journey Before Parole Decision

Apr 29, 2025

Ohio Doctors Murder Conviction Sons Emotional Journey Before Parole Decision

Apr 29, 2025 -

Son Of Falcons Dc Apologizes For Prank Call To Browns Draft Pick Shedeur Sanders

Apr 29, 2025

Son Of Falcons Dc Apologizes For Prank Call To Browns Draft Pick Shedeur Sanders

Apr 29, 2025 -

Ecb Lingering Pandemic Fiscal Support Fuels Inflation

Apr 29, 2025

Ecb Lingering Pandemic Fiscal Support Fuels Inflation

Apr 29, 2025 -

Willie Nelsons Wife Responds To False Media Report

Apr 29, 2025

Willie Nelsons Wife Responds To False Media Report

Apr 29, 2025

Latest Posts

-

Oh What A Beautiful World A Review Of Willie Nelsons New Album

Apr 29, 2025

Oh What A Beautiful World A Review Of Willie Nelsons New Album

Apr 29, 2025 -

Country Legend Willie Nelson Releases Oh What A Beautiful World

Apr 29, 2025

Country Legend Willie Nelson Releases Oh What A Beautiful World

Apr 29, 2025 -

New Music Willie Nelson Releases 77th Solo Album At 91

Apr 29, 2025

New Music Willie Nelson Releases 77th Solo Album At 91

Apr 29, 2025 -

New Music Willie Nelsons Oh What A Beautiful World

Apr 29, 2025

New Music Willie Nelsons Oh What A Beautiful World

Apr 29, 2025 -

Oh What A Beautiful World Willie Nelsons Latest Album Details

Apr 29, 2025

Oh What A Beautiful World Willie Nelsons Latest Album Details

Apr 29, 2025