The Future Of XRP: ETF Applications, SEC Case Resolution, And Price Predictions

Table of Contents

XRP ETF Applications: A Catalyst for Growth?

Exchange Traded Funds (ETFs) are investment funds traded on stock exchanges, offering investors diversified exposure to a specific asset class. An XRP ETF would allow investors to easily buy and sell XRP through their brokerage accounts, significantly increasing its accessibility and liquidity. This could be a major catalyst for growth.

However, regulatory hurdles are significant. Securities regulators in various jurisdictions, including the SEC in the United States, must approve any XRP ETF application. These approvals require a rigorous evaluation of the fund's structure, risk assessment, and compliance with securities laws. The regulatory landscape surrounding cryptocurrencies remains complex and evolving, making the approval process unpredictable.

The potential positive effects of XRP ETF approval are substantial:

- Increased liquidity and trading volume: Easier access through established brokerage platforms would dramatically increase trading volume.

- Greater institutional investment: ETFs attract institutional investors who might be hesitant to invest directly in cryptocurrencies due to regulatory and custody concerns.

- Enhanced mainstream awareness and adoption: Increased availability through traditional financial markets would boost XRP's profile and adoption among mainstream investors.

Currently, while several firms have expressed interest, no XRP ETF applications have been officially approved by major regulatory bodies. The success of any such application will significantly shape XRP's future.

The Ripple vs. SEC Lawsuit: Implications for XRP's Future

The ongoing SEC lawsuit against Ripple Labs is arguably the most significant factor influencing XRP's price and future. The SEC alleges that Ripple illegally sold XRP as an unregistered security. The outcome of this case will have profound implications for the entire cryptocurrency industry.

Several scenarios are possible:

- Scenario 1: SEC wins: A victory for the SEC could lead to XRP being classified as a security, potentially resulting in delisting from major exchanges and significant price drops. It could also set a precedent for future regulatory actions against other cryptocurrencies.

- Scenario 2: Ripple wins: A Ripple victory would solidify XRP's position as a legitimate cryptocurrency and could lead to a significant price surge. It would potentially offer regulatory clarity and boost investor confidence.

- Scenario 3: Settlement: A settlement between Ripple and the SEC could result in various outcomes, potentially including limitations on XRP sales or other concessions. The impact on XRP's price would depend heavily on the specific terms of the settlement.

The lawsuit has already created considerable market volatility, impacting investor sentiment. Recent developments and expert opinions are closely scrutinized by the XRP community. The uncertainty surrounding the case continues to be a major factor driving price fluctuations.

XRP Price Predictions: Balancing Hope and Realism

Predicting cryptocurrency prices is inherently challenging due to their volatility and sensitivity to market sentiment, regulatory changes, and technological advancements. While numerous analysts offer XRP price predictions, it's crucial to approach them with skepticism.

Various sources offer a wide range of XRP price predictions: some are extremely bullish, projecting significant price increases; others are more cautious, forecasting more modest gains or even potential declines. These predictions often consider factors like ETF approvals, the SEC case outcome, and broader cryptocurrency market trends.

- Short-term price predictions: These often fluctuate wildly based on short-term market movements and news events.

- Long-term price predictions: These tend to be more stable but are still highly speculative.

- Factors influencing price volatility: News related to the SEC lawsuit, technological advancements within the Ripple ecosystem, and broader market trends (like Bitcoin's performance) all impact XRP's price.

It is vital to conduct thorough research and understand the risks involved before investing in XRP. Remember that past performance is not indicative of future results, and price predictions should be treated as speculation, not financial advice.

Navigating the Future of XRP

The future of XRP is intricately linked to the resolution of the SEC lawsuit, the success of potential ETF applications, and broader market dynamics. While the potential for significant growth exists, substantial risks remain. The regulatory landscape for cryptocurrencies is still evolving, and the outcome of the Ripple case could significantly impact XRP's future.

Understanding these risks and opportunities is crucial for anyone considering investing in XRP. Remember that cryptocurrencies are highly volatile assets, and losses are possible. By carefully considering the factors discussed above, you can better navigate the complexities of this volatile asset. Continue your research on XRP and make informed investment decisions.

Featured Posts

-

Hargreaves Predicts Winner Arsenal Or Psg In Champions League Final

May 08, 2025

Hargreaves Predicts Winner Arsenal Or Psg In Champions League Final

May 08, 2025 -

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025 -

Predicting The Arsenal Vs Psg Semi Final A More Difficult Challenge Than Real Madrid

May 08, 2025

Predicting The Arsenal Vs Psg Semi Final A More Difficult Challenge Than Real Madrid

May 08, 2025 -

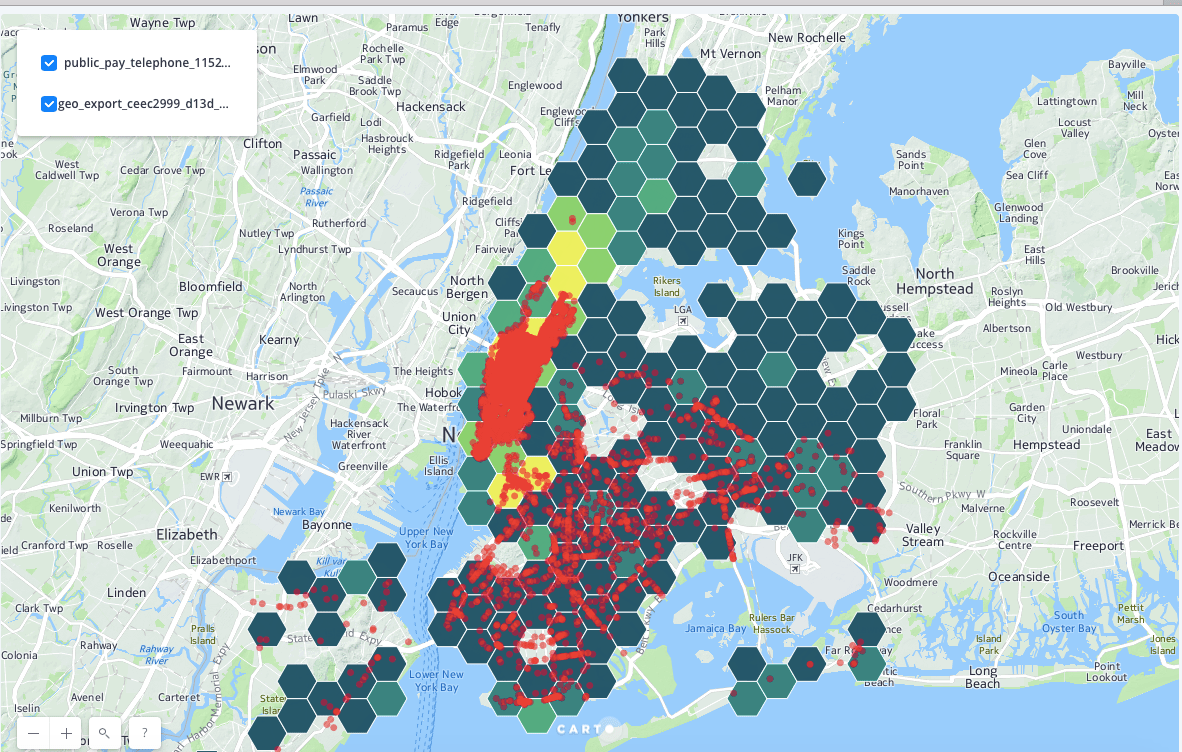

New Business Hotspots A Map Of The Countrys Fastest Growing Areas

May 08, 2025

New Business Hotspots A Map Of The Countrys Fastest Growing Areas

May 08, 2025 -

10 Best Characters In Saving Private Ryan Ranked

May 08, 2025

10 Best Characters In Saving Private Ryan Ranked

May 08, 2025

Latest Posts

-

Saglik Bakanligi 37 Bin Personel Alimi Son Dakika Bilgileri Ve Basvuru Sartlari

May 08, 2025

Saglik Bakanligi 37 Bin Personel Alimi Son Dakika Bilgileri Ve Basvuru Sartlari

May 08, 2025 -

Pakstan Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Mnayy Jaye Gy

May 08, 2025

Pakstan Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Mnayy Jaye Gy

May 08, 2025 -

Aym Aym Ealm 12 Wyn Brsy Ky Tqrybat Ka Aghaz

May 08, 2025

Aym Aym Ealm 12 Wyn Brsy Ky Tqrybat Ka Aghaz

May 08, 2025 -

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Ke Mwqe Pr Khswsy Prwgram

May 08, 2025

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Ke Mwqe Pr Khswsy Prwgram

May 08, 2025 -

Ptt Personel Alimi 2025 Basvuru Kilavuzu Ve Oenemli Tarihler

May 08, 2025

Ptt Personel Alimi 2025 Basvuru Kilavuzu Ve Oenemli Tarihler

May 08, 2025