The Future Of XRP: ETF Potential, SEC Case Resolution, And Market Outlook

Table of Contents

H2: The SEC Lawsuit and its Potential Resolution

The SEC lawsuit against Ripple Labs, the company behind XRP, has cast a long shadow over the cryptocurrency's trajectory. Understanding the case's intricacies is crucial for predicting XRP's future.

H3: Understanding the SEC's Claims

The SEC's core argument centers on the classification of XRP as an unregistered security. They allege that Ripple Labs' sale of XRP constituted an investment contract, violating federal securities laws.

- Bullet Points:

- The SEC argues that XRP sales satisfied the Howey Test, a legal framework used to determine whether an asset is a security.

- The SEC highlights Ripple's fundraising activities and the expectation of profit based on Ripple Labs' efforts.

- Ripple's defense counters that XRP is a decentralized digital asset, not a security, and that the SEC's claims are overly broad.

H3: Potential Outcomes and Their Impact on XRP Price

Several scenarios could unfold:

- Bullet Points:

- Ripple Wins: A victory for Ripple could lead to a significant surge in XRP's price, potentially boosting investor confidence and removing the regulatory uncertainty. Trading volume would likely increase dramatically.

- SEC Wins: An SEC victory could result in a sharp decline in XRP's price, potentially leading to delisting from some exchanges and a significant loss of investor confidence. The regulatory landscape for other cryptocurrencies could also shift.

- Settlement: A settlement between Ripple and the SEC could offer a more moderate outcome, with the price impact depending on the terms of the agreement. A settlement could alleviate some uncertainty but might not be as bullish as a complete Ripple victory.

H3: Timeline and Predictions

Predicting the timeline for the SEC case's resolution is challenging.

- Bullet Points:

- The process involves complex legal arguments, evidence presentation, and potential appeals.

- Delays are common in such high-profile cases.

- While a definitive timeline is impossible, informed speculation suggests a resolution could potentially occur within the next year, but this is purely speculative and should not be taken as financial advice.

H2: The Potential for XRP ETFs

The possibility of XRP ETFs represents a significant catalyst for the cryptocurrency's future growth.

H3: The Current State of ETF Applications

The regulatory environment for crypto ETFs is still evolving.

- Bullet Points:

- No XRP ETF applications are currently approved.

- The SEC's stance on crypto ETFs is crucial, with approvals requiring a demonstrably robust framework to prevent market manipulation and fraud.

- The success of other crypto ETF applications will influence the likelihood of XRP ETF approval.

H3: The Impact of ETF Approval on XRP

Approval of an XRP ETF would have transformative effects.

- Bullet Points:

- Increased liquidity: Trading volumes would soar, leading to greater price discovery.

- Institutional investment: A substantial influx of institutional capital would significantly boost XRP's market capitalization.

- Accessibility: Retail investors would gain easier access to XRP through regulated investment vehicles.

H3: Comparing XRP ETF Potential to other Crypto ETFs

Comparing XRP to other cryptocurrencies reveals nuanced dynamics.

- Bullet Points:

- Bitcoin and Ethereum ETFs are further along in the regulatory approval process.

- XRP's regulatory uncertainty, stemming from the SEC lawsuit, is a significant differentiating factor.

- The resolution of the SEC case will be paramount for any future ETF applications.

H2: Overall Market Outlook for XRP

The overall outlook for XRP encompasses technical analysis, adoption rates, and competitive pressures.

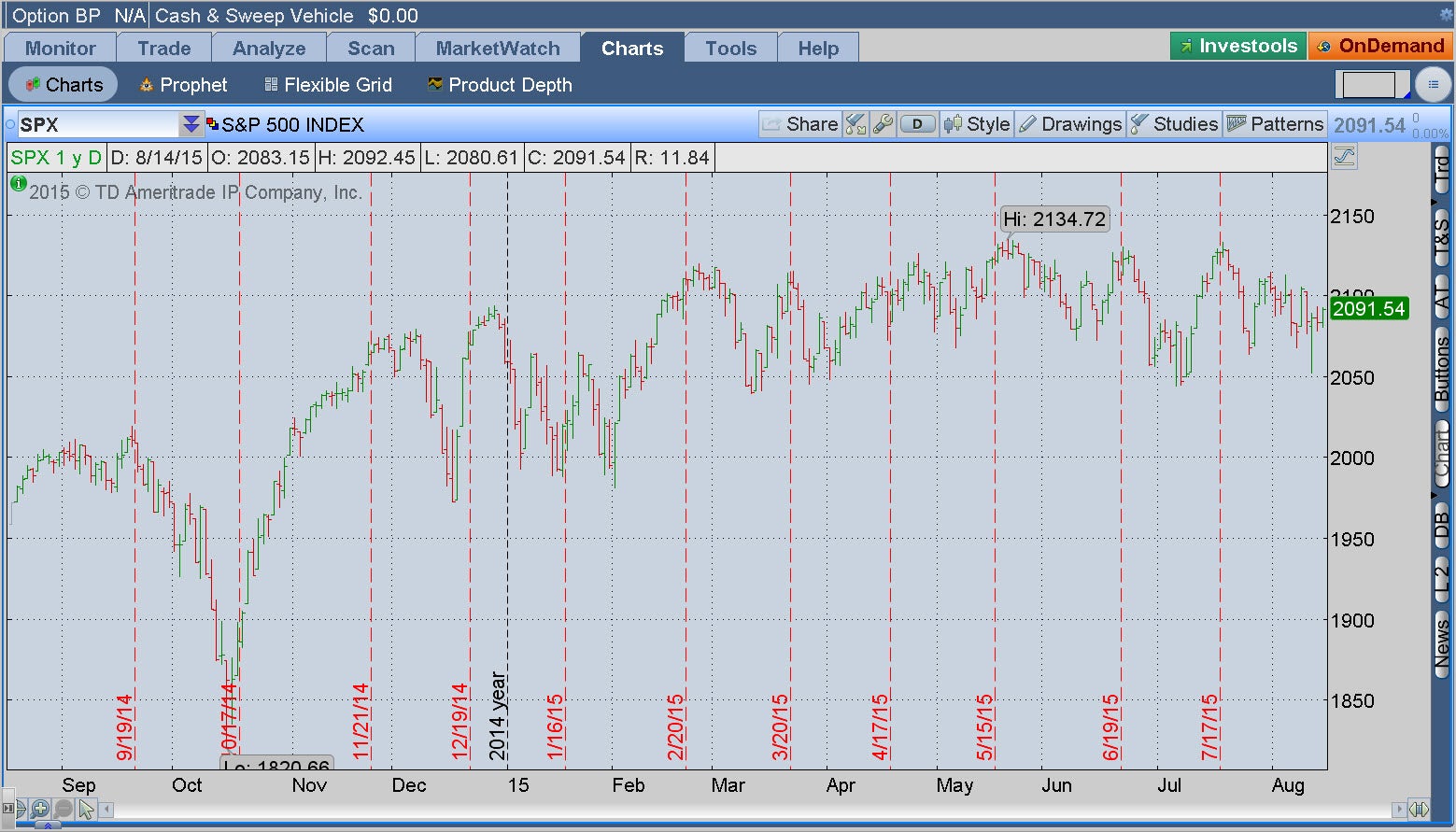

H3: Technical Analysis and Price Predictions

Technical analysis can offer insights, but remember, this is speculation, not financial advice.

- Bullet Points:

- Support and resistance levels are key indicators of potential price movements.

- Moving averages can suggest prevailing trends.

- Price predictions are highly speculative and should be viewed cautiously.

H3: Adoption and Technological Developments

XRP's technological advancements and adoption rate play a critical role.

- Bullet Points:

- Improvements in the XRP Ledger's scalability and efficiency could increase adoption.

- Partnerships and collaborations could enhance the utility and reach of XRP.

H3: Competition and Market Position

XRP faces competition within a dynamic cryptocurrency market.

- Bullet Points:

- Competitors offer similar functionalities, making market position a key factor.

- XRP's strengths lie in its speed and low transaction costs.

- Weaknesses could include the ongoing legal battle.

3. Conclusion:

The future of XRP is undeniably intertwined with the SEC lawsuit's resolution and the potential for ETF approval. A favorable outcome in the legal battle and subsequent ETF approval could significantly propel XRP's price and market adoption. However, cryptocurrency investments carry inherent risks. Staying updated on XRP developments and conducting thorough research before investing is crucial. Monitor the SEC case and the potential for XRP ETFs to make informed decisions regarding your XRP investments. Remember to always do your own research before investing in any cryptocurrency, including XRP.

Featured Posts

-

Is The 12 Inch Surface Pro Right For You A Detailed Look

May 08, 2025

Is The 12 Inch Surface Pro Right For You A Detailed Look

May 08, 2025 -

The Rise Of Bitcoin Miners Analyzing This Weeks Growth

May 08, 2025

The Rise Of Bitcoin Miners Analyzing This Weeks Growth

May 08, 2025 -

Rogue One Actor Challenges Fan Perception Of Popular Character

May 08, 2025

Rogue One Actor Challenges Fan Perception Of Popular Character

May 08, 2025 -

The Long Walk Movie Trailer Reactions And Analysis

May 08, 2025

The Long Walk Movie Trailer Reactions And Analysis

May 08, 2025 -

Dwp Alert Verify Your Bank Details 12 Benefits May Be Affected

May 08, 2025

Dwp Alert Verify Your Bank Details 12 Benefits May Be Affected

May 08, 2025

Latest Posts

-

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

May 08, 2025

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

May 08, 2025 -

Dwps April May Universal Credit Refunds Understanding The 5 Billion Cut Impact

May 08, 2025

Dwps April May Universal Credit Refunds Understanding The 5 Billion Cut Impact

May 08, 2025 -

Scholar Rock Stock Performance Mondays Negative Trend

May 08, 2025

Scholar Rock Stock Performance Mondays Negative Trend

May 08, 2025 -

Dwp 3 Month Benefit Stop Warning For 355 000

May 08, 2025

Dwp 3 Month Benefit Stop Warning For 355 000

May 08, 2025 -

Understanding The Recent Decline In Scholar Rock Stock Price

May 08, 2025

Understanding The Recent Decline In Scholar Rock Stock Price

May 08, 2025