The Future Of XRP: How ETF Applications And SEC Actions Will Shape Its Trajectory

Table of Contents

The SEC Lawsuit and its Ripple Effect on XRP's Price and Adoption

The SEC's lawsuit against Ripple Labs, alleging the unregistered sale of securities, has profoundly impacted XRP's price and adoption. The core argument centers on whether XRP is a security or a currency, a distinction with significant regulatory implications.

The ongoing legal battle between the SEC and Ripple Labs:

- Key Events: The lawsuit, filed in December 2020, has seen numerous filings, expert testimonies, and court hearings. Ripple has consistently argued that XRP is a decentralized currency, not a security. The SEC maintains that XRP was sold as an unregistered security, raising concerns about investor protection. Recent partial summary judgements have offered some clarity but the overall outcome remains uncertain.

- Impact on XRP: The lawsuit caused significant volatility in XRP's price. Many exchanges delisted XRP, fearing regulatory repercussions, impacting trading volume and liquidity. However, other exchanges maintained XRP listings, demonstrating a belief in its eventual exoneration or regulatory clarity.

Potential Outcomes and Their Impact on XRP's Future:

Several scenarios could unfold:

- SEC Victory: A complete SEC victory could severely damage XRP's price and adoption. It might lead to further delistings and a significant loss of investor confidence.

- Ripple Victory: A decisive win for Ripple could dramatically boost XRP's price and increase its legitimacy within the cryptocurrency market. It would likely lead to increased institutional investment and broader acceptance.

- Settlement: A settlement between Ripple and the SEC might offer a more moderate outcome, potentially clarifying XRP's regulatory status but possibly without the same level of positive impact as a complete Ripple victory.

The Potential Impact of XRP ETF Applications on Market Liquidity and Price

The approval of an XRP ETF would have a significant effect on the cryptocurrency's future. While no official XRP ETF application has been approved yet, the possibility remains a major factor.

The Current State of ETF Applications for Cryptocurrencies:

Globally, the landscape for cryptocurrency ETFs is evolving rapidly. Several Bitcoin and Ether ETFs have been approved in certain jurisdictions, indicating growing regulatory acceptance of cryptocurrencies within traditional financial markets. The success or failure of these precedents will significantly influence the likelihood of XRP ETF approval.

- Examples: The approval of Bitcoin ETFs in Canada and the US has shown the potential for increased institutional involvement and price stability in the cryptocurrency markets. Conversely, rejections have highlighted regulatory hurdles.

How Approval (or Rejection) Could Affect XRP's Price and Trading Volume:

- Approval: ETF approval would likely lead to a substantial increase in XRP's price and trading volume due to increased accessibility and institutional investment. The influx of institutional capital could stabilize the price, making XRP less volatile.

- Rejection: Rejection would likely negatively impact XRP's price and investor sentiment. It could signal continuing regulatory uncertainty and hinder broader adoption.

Beyond the SEC and ETFs: Other Factors Shaping XRP's Future

While the SEC lawsuit and ETF applications are pivotal, other factors contribute to XRP's future trajectory.

Technological Advancements and Ripple's Ongoing Development:

Ripple continues to develop its technology, focusing on improving scalability and fostering partnerships.

- Key Advancements: Improvements in RippleNet's efficiency and the expansion of its global reach could significantly increase XRP's utility for cross-border payments. Any advancements in blockchain technology that benefit XRP's functionality will positively impact its value proposition.

Market Sentiment and Investor Confidence:

Broader market trends and investor sentiment heavily influence XRP's price.

- Influencing Factors: Overall crypto market performance, global economic conditions, and regulatory developments in various jurisdictions all play a significant role. Positive news regarding Ripple's legal battles or technological advancements will boost investor confidence.

Conclusion: Navigating the Uncertain Future of XRP

The future of XRP remains intertwined with the outcome of the SEC lawsuit and the possibility of ETF approvals. While these factors present significant uncertainty, the potential for significant price appreciation remains. A Ripple victory and ETF approval could lead to substantial price increases and increased adoption. Conversely, a negative outcome could significantly damage XRP's prospects. Careful analysis and monitoring of these developments are crucial. Stay informed about the future of XRP and its evolving regulatory landscape to make informed investment decisions. The potential of XRP, despite its current challenges, makes it a compelling case study in the constantly shifting world of cryptocurrency.

Featured Posts

-

Serious Fall At Baseball Game Fan Hospitalized After Outfield Incident

May 02, 2025

Serious Fall At Baseball Game Fan Hospitalized After Outfield Incident

May 02, 2025 -

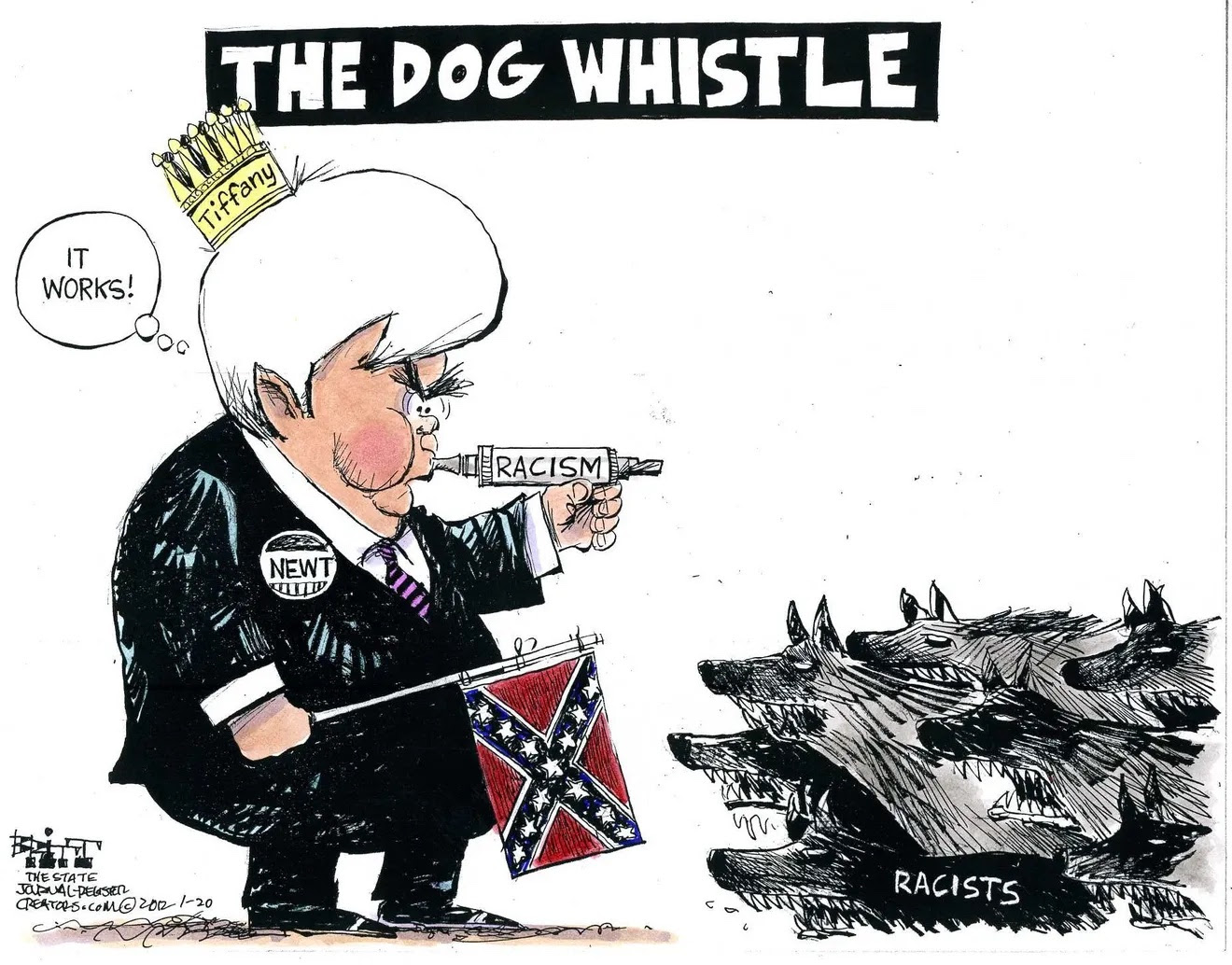

Dog Whistle Politics Vs Clear Messaging Analysing Rupert Lowes X Strategy For Uk Reform

May 02, 2025

Dog Whistle Politics Vs Clear Messaging Analysing Rupert Lowes X Strategy For Uk Reform

May 02, 2025 -

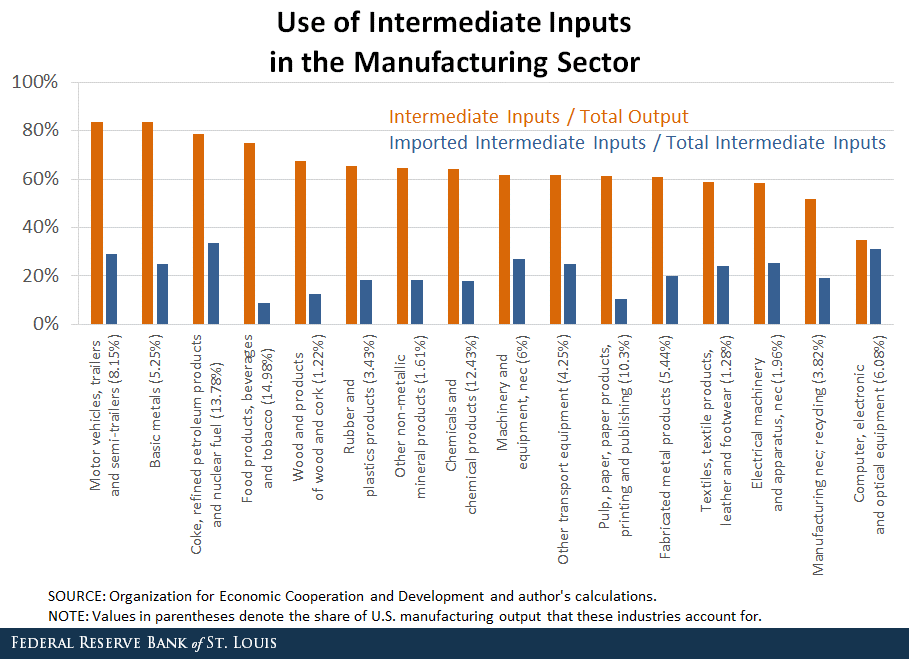

Us Tariffs Prompt Brookfield To Re Evaluate Manufacturing Investments

May 02, 2025

Us Tariffs Prompt Brookfield To Re Evaluate Manufacturing Investments

May 02, 2025 -

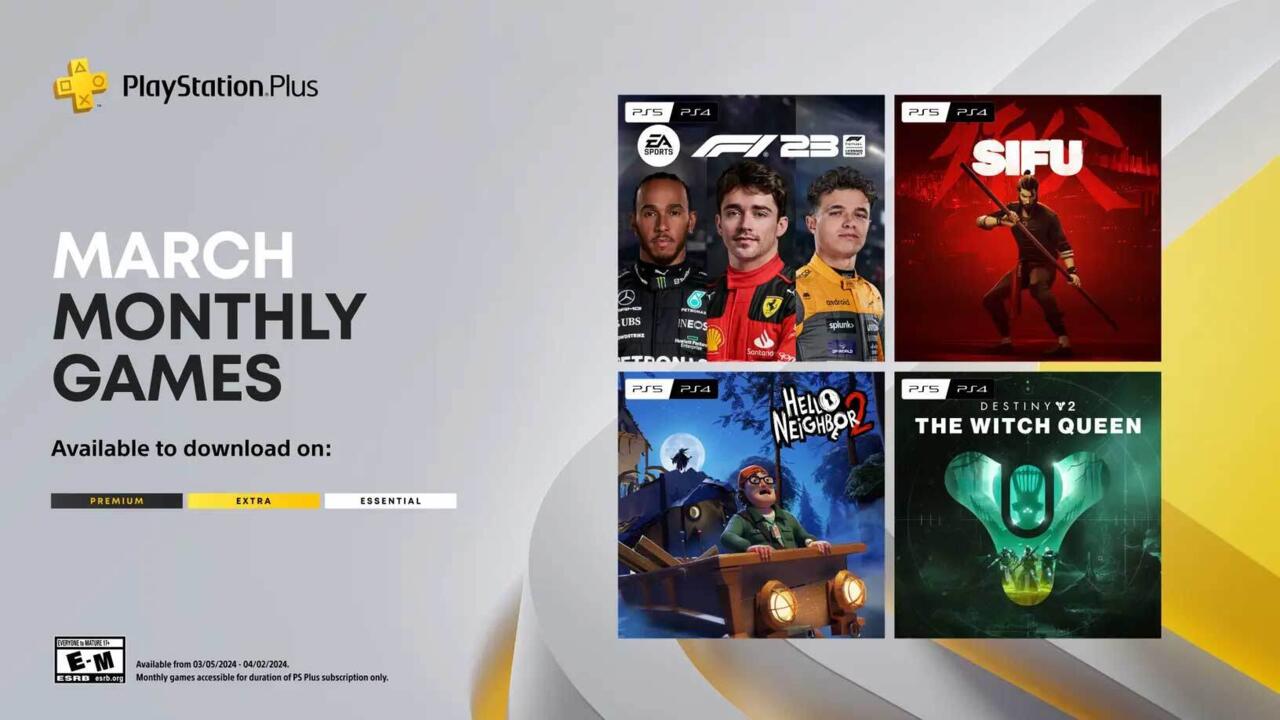

Discover 2024s Underrated Ps Plus Game Game Title

May 02, 2025

Discover 2024s Underrated Ps Plus Game Game Title

May 02, 2025 -

Dont Miss Out Underrated Ps Plus Game For January 2024

May 02, 2025

Dont Miss Out Underrated Ps Plus Game For January 2024

May 02, 2025