The GOP Tax Plan And The National Debt: Fact Vs. Fiction

Table of Contents

The Republican Party's tax plans have consistently sparked heated debate, particularly concerning their impact on the national debt. Understanding the true effects requires separating fact from fiction. This article will delve into the complexities of the GOP tax plan and its relationship with the burgeoning national debt. We'll examine the claims, the counterarguments, and the lasting consequences. We will analyze the interplay between GOP tax cuts, fiscal responsibility, and the long-term health of the US economy.

<h2>The GOP Tax Plan's Core Provisions and Their Projected Impact</h2>

Various GOP tax plans have been proposed over the years, each with unique provisions. Common elements often include significant corporate tax cuts, reductions in individual income tax rates, and changes to deductions and tax credits. Let's examine the projected impact:

<h3>Projected Revenue Losses</h3>

Numerous reputable economic analyses, including those from the Congressional Budget Office (CBO), have projected substantial revenue losses as a result of these tax cuts. These projections often show a widening gap between government revenue and spending, directly contributing to increased national debt.

- Example Projection (Hypothetical): The CBO estimated a $1 trillion revenue loss over 10 years following the enactment of the hypothetical "Tax Cuts Act of 20XX." This figure is based on their dynamic scoring model, which accounts for potential economic growth stimulated by the tax cuts.

- Methodology and Limitations: It's crucial to understand that these projections rely on economic models that include assumptions about future economic growth, inflation, and taxpayer behavior. These models are inherently complex and subject to uncertainty. The accuracy of the projections depends heavily on the validity of these assumptions.

<h3>Economic Growth Arguments</h3>

Proponents of GOP tax plans argue that the tax cuts stimulate economic growth through "trickle-down" economics. This theory posits that lower taxes on businesses and high-income earners lead to increased investment, job creation, and ultimately, higher tax revenues.

- Supply-Side Economics: This is the economic theory underlying the "trickle-down" argument, suggesting that tax cuts incentivize increased production and investment.

- Counterarguments: Critics argue that trickle-down economics has historically failed to deliver on its promises, leading to increased inequality and insufficient revenue generation to offset the tax cuts. Empirical evidence supporting this counterargument is often cited. Furthermore, the distribution of the benefits from such tax cuts is often debated.

<h2>The Current State of the National Debt</h2>

The US national debt is a massive and growing figure, representing the total amount of money the government owes to its creditors. Understanding its current state and historical trends is crucial to analyzing the impact of any tax policy.

<h3>Factors Contributing to the National Debt</h3>

The national debt is influenced by various factors beyond tax policy.

- Government Spending: Entitlement programs like Social Security and Medicare, defense spending, and discretionary spending all contribute significantly to the national debt.

- Interest Rates: Higher interest rates increase the cost of servicing the national debt.

- Economic Recessions: Recessions reduce tax revenues and increase government spending on social programs, exacerbating the debt.

- Fiscal Sustainability: The concept of fiscal sustainability refers to the government's ability to meet its long-term financial obligations without resorting to unsustainable measures.

<h3>Debt-to-GDP Ratio</h3>

The debt-to-GDP ratio is a key indicator of a nation's fiscal health. It compares the national debt to the country's gross domestic product (GDP). A high debt-to-GDP ratio suggests a greater burden on taxpayers and potential risks to economic stability.

<h2>Analyzing the Relationship Between the GOP Tax Plan and the National Debt</h2>

The relationship between GOP tax plans and the national debt is complex, involving both direct and indirect effects.

<h3>Direct vs. Indirect Effects</h3>

- Direct Impact: The most direct impact is the reduction in government revenue due to lower tax rates. This directly increases the deficit and contributes to debt accumulation.

- Indirect Effects: Proponents argue that tax cuts stimulate economic growth, leading to higher employment, increased tax revenues, and ultimately offsetting some or all of the revenue loss. The magnitude of this effect is highly debated.

<h3>Long-Term Fiscal Implications</h3>

The long-term impact depends on various factors including economic growth rates, interest rates, and future government spending decisions. Uncontrolled debt growth can lead to:

- Higher Interest Rates: Increased borrowing to finance the debt can drive up interest rates, impacting both the government and the private sector.

- Inflation: Excessive money creation to finance debt can lead to inflation, eroding purchasing power.

- Reduced Credit Rating: A high debt-to-GDP ratio can result in a downgrade of the nation's credit rating, making it more expensive to borrow money.

<h2>Alternative Perspectives and Policy Recommendations</h2>

Addressing the national debt requires a multifaceted approach.

<h3>Progressive vs. Regressive Taxation</h3>

- Progressive Taxation: This system taxes higher earners at a higher rate, potentially generating more revenue and reducing income inequality.

- Regressive Taxation: This system disproportionately burdens lower earners, potentially exacerbating income inequality and offering less revenue generation potential.

<h3>Spending Cuts and Fiscal Responsibility</h3>

Government spending cuts can play a role in reducing the debt, but achieving significant reductions faces political and economic challenges. Finding a balance between essential services and fiscal responsibility is critical.

<h2>Conclusion</h2>

The GOP tax plan's impact on the national debt is a complex issue with no easy answers. While proponents argue for economic growth stimulating revenue, critics point to projected revenue losses and the potential for unsustainable debt growth. Understanding the various perspectives, including the current state of the national debt and contributing factors beyond tax policy, is crucial. Further research and informed discussion are essential for developing effective solutions to address the national debt. Continue to explore the complexities of the GOP tax plan and national debt to form your own informed opinion. Engage in responsible citizenship by staying updated on related policies and engaging in civil discourse on fiscal responsibility.

Featured Posts

-

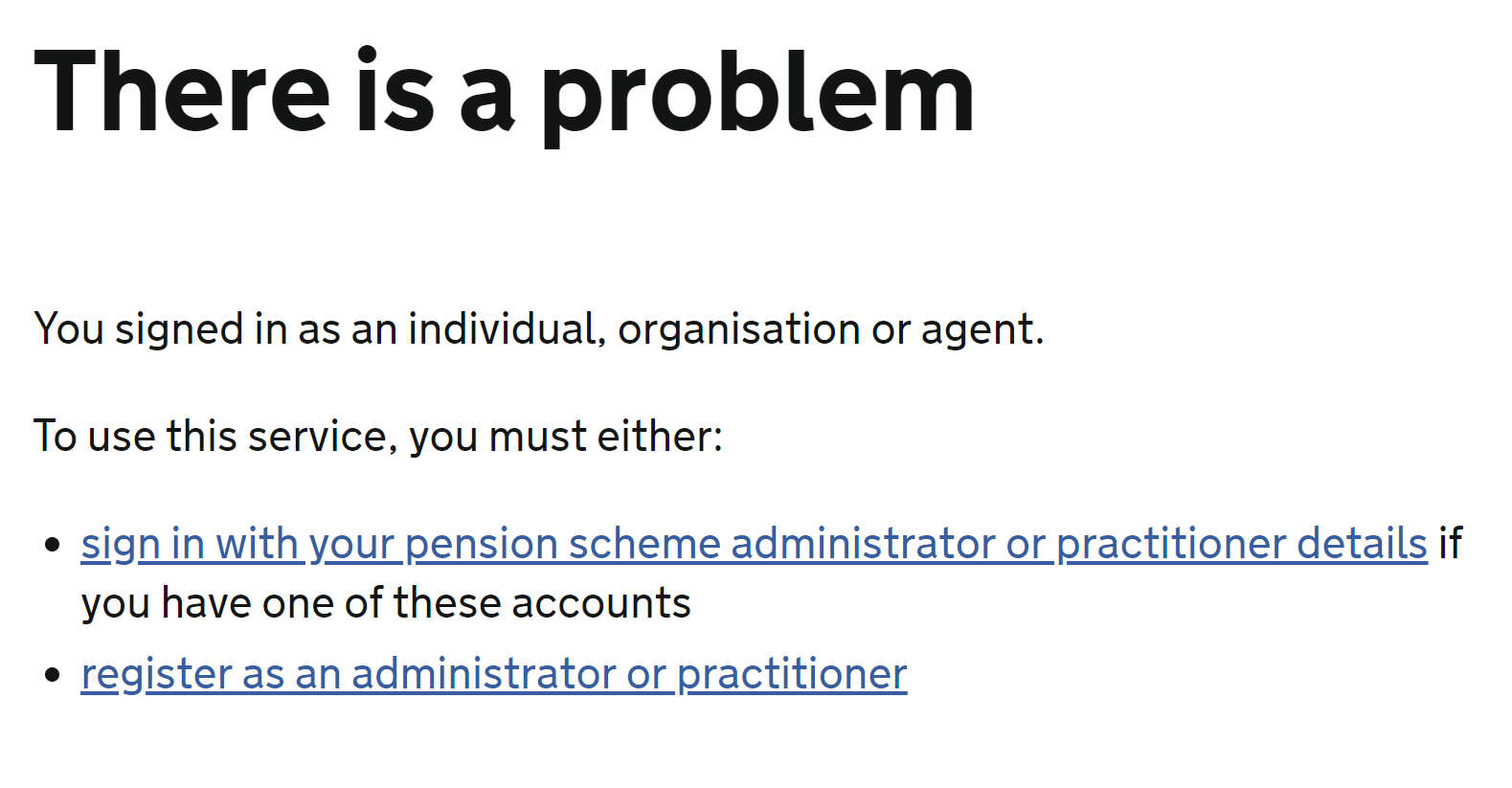

Major Hmrc Website Failure Leaves Uk Users Unable To Access Accounts

May 20, 2025

Major Hmrc Website Failure Leaves Uk Users Unable To Access Accounts

May 20, 2025 -

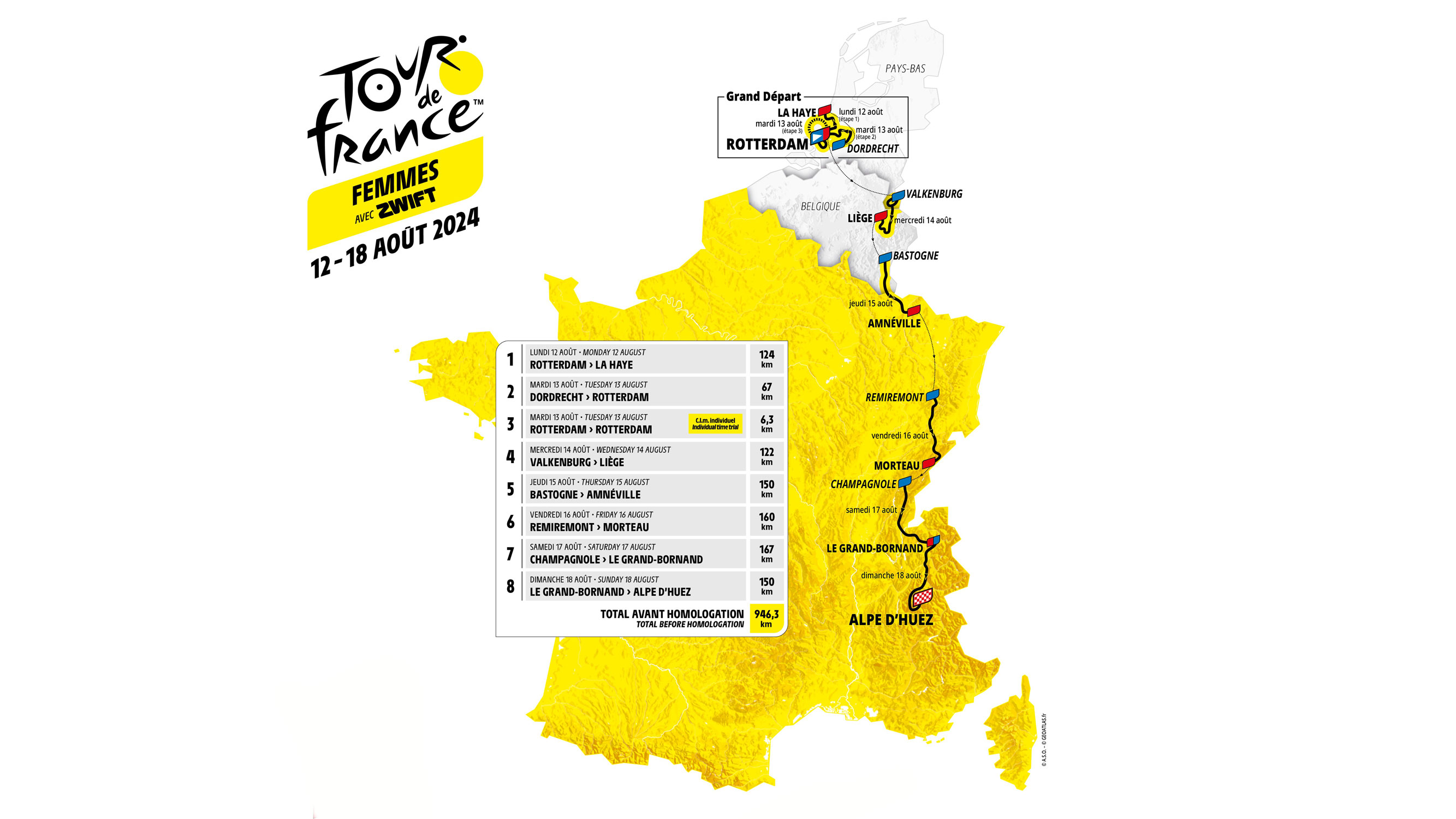

Biarritz Celebre Le 8 Mars Parcours De Femmes Un Programme D Echanges Et De Debats

May 20, 2025

Biarritz Celebre Le 8 Mars Parcours De Femmes Un Programme D Echanges Et De Debats

May 20, 2025 -

Stay Safe Strong Wind And Severe Storm Warning Issued

May 20, 2025

Stay Safe Strong Wind And Severe Storm Warning Issued

May 20, 2025 -

Matheus Cunha To Man United Latest Update From A Journalist

May 20, 2025

Matheus Cunha To Man United Latest Update From A Journalist

May 20, 2025 -

Paolini Makes History With Rome Tournament Win

May 20, 2025

Paolini Makes History With Rome Tournament Win

May 20, 2025