The Hard Truth: Earning Less Than Your A-List Spouse

Table of Contents

The Emotional Toll of an Income Disparity

An income gap in a marriage can significantly impact the emotional landscape of the relationship. The emotional stress stemming from financial inequality in marriage can manifest in various ways, impacting both partners' self-esteem and the overall dynamics of the relationship. Keywords like income gap marriage, relationship stress, financial insecurity, and communication are central to understanding this aspect.

-

Feeling Inadequate or Less Valuable: Earning less than your spouse can trigger feelings of inadequacy, especially if societal expectations and traditional gender roles play a part. This can lead to self-doubt and a diminished sense of personal worth.

-

Resentment and Power Imbalances: Financial dependence can create power imbalances, leading to resentment and conflict. One partner might feel controlled or beholden, while the other might feel burdened by the responsibility of providing. Open communication about finances is essential to mitigate this.

-

Struggles with Self-Esteem and Confidence: Financial contribution is often a significant factor in how we perceive our self-worth. When one partner earns significantly less, it can negatively affect their self-esteem and confidence, impacting their overall emotional well-being.

-

Difficulties in Open and Honest Communication about Finances: Money is often a sensitive topic, and income disparity can exacerbate communication challenges. Avoiding open and honest conversations about finances can lead to simmering resentment and misunderstandings.

-

Increased Stress and Anxiety Surrounding Financial Security: The responsibility of managing household expenses, saving for the future, and planning for retirement can be stressful, particularly when one income carries the bulk of the burden. This can lead to anxiety and negatively affect mental health.

Here's how to address these emotional challenges:

- Identify and address feelings of inadequacy through self-reflection, journaling, or seeking support from a therapist.

- Foster open and honest communication with your spouse about finances and feelings. Create a safe space for vulnerability.

- Focus on your personal strengths and contributions beyond financial income. Value your non-monetary contributions to the family.

- Seek professional help (couples counseling or individual therapy) if resentment or communication issues become overwhelming.

Practical Strategies for Managing Finances When One Earns Significantly More

Managing finances when there's a significant income disparity requires careful planning and open communication. Effective money management and financial planning are crucial, encompassing aspects like joint accounts, budgeting, and saving.

-

Creating a Joint Budget: Develop a joint budget that fairly reflects both incomes and expenses. Consider using budgeting apps or spreadsheets to track income and expenses. This promotes transparency and shared responsibility.

-

Establishing Clear Financial Roles and Responsibilities: Define clear roles for managing different aspects of household finances (e.g., bill paying, saving, investing). This ensures accountability and prevents misunderstandings.

-

Developing a Shared Financial Plan: Create a long-term financial plan that addresses saving, investing, retirement, and other shared financial goals. This fosters a sense of shared responsibility and mutual understanding.

-

Exploring Strategies for Individual Financial Independence: Even if one partner earns significantly less, aim for some level of financial independence. This could involve having separate savings accounts or pursuing opportunities for professional development and increased earning potential.

-

Utilizing Financial Tools and Resources: Take advantage of budgeting apps, financial planning websites, and consider consulting a financial advisor for personalized guidance.

Practical steps for financial management:

- Regularly review and adjust your budget to account for changes in income or expenses.

- Allocate funds towards individual savings and investment goals, ensuring both partners have a sense of financial security.

- Consult with a financial advisor to create a personalized financial plan tailored to your unique circumstances.

- Consider setting aside a portion of income for personal spending to maintain a sense of independence and avoid feeling controlled.

Redefining Success Beyond the Paycheck

The key to navigating income disparity lies in redefining success beyond solely financial achievement. This involves recognizing non-monetary contributions, focusing on personal value, and strengthening the emotional bond within the relationship.

-

Recognizing and Valuing Non-Monetary Contributions: Acknowledge and appreciate the contributions of the lower-earning spouse, which might include childcare, household management, emotional support, or other significant contributions that don't have a direct monetary value.

-

Focusing on Personal Growth and Pursuing Individual Passions: Encourage and support each partner's personal growth and pursuit of individual passions. This fosters self-esteem and helps maintain a sense of individuality within the partnership.

-

Defining Success on Your Own Terms: Challenge traditional notions of success and define it based on shared values, personal fulfillment, and overall well-being, not just financial wealth.

-

Maintaining a Healthy Work-Life Balance: Prioritize work-life balance to prevent burnout and maintain a healthy relationship dynamic. This ensures both partners can contribute meaningfully to the household and relationship.

-

Strengthening the Emotional Bond Within the Relationship: Prioritize quality time, communication, and shared experiences to strengthen the emotional connection and build a resilient partnership.

Actions to redefine success:

- Identify and articulate your non-monetary contributions to the family to your partner and yourself.

- Set personal goals outside of work to foster self-worth and fulfillment.

- Regularly engage in activities that strengthen your relationship and promote shared enjoyment.

- Prioritize self-care to manage stress and maintain overall well-being.

Conclusion:

Earning less than your high-earning spouse presents unique challenges, but by openly communicating, strategically managing finances, and redefining success, you can build a strong and fulfilling partnership. Remember, your value extends far beyond your paycheck. Address the emotional aspects, create a sustainable financial plan, and prioritize your well-being. Don't hesitate to seek professional help – a therapist or financial advisor can provide invaluable support in navigating the complexities of earning less than your spouse. Take control of your financial future and build a thriving relationship built on mutual respect and understanding. Start planning today to overcome the challenges of earning less than your high-earning spouse.

Featured Posts

-

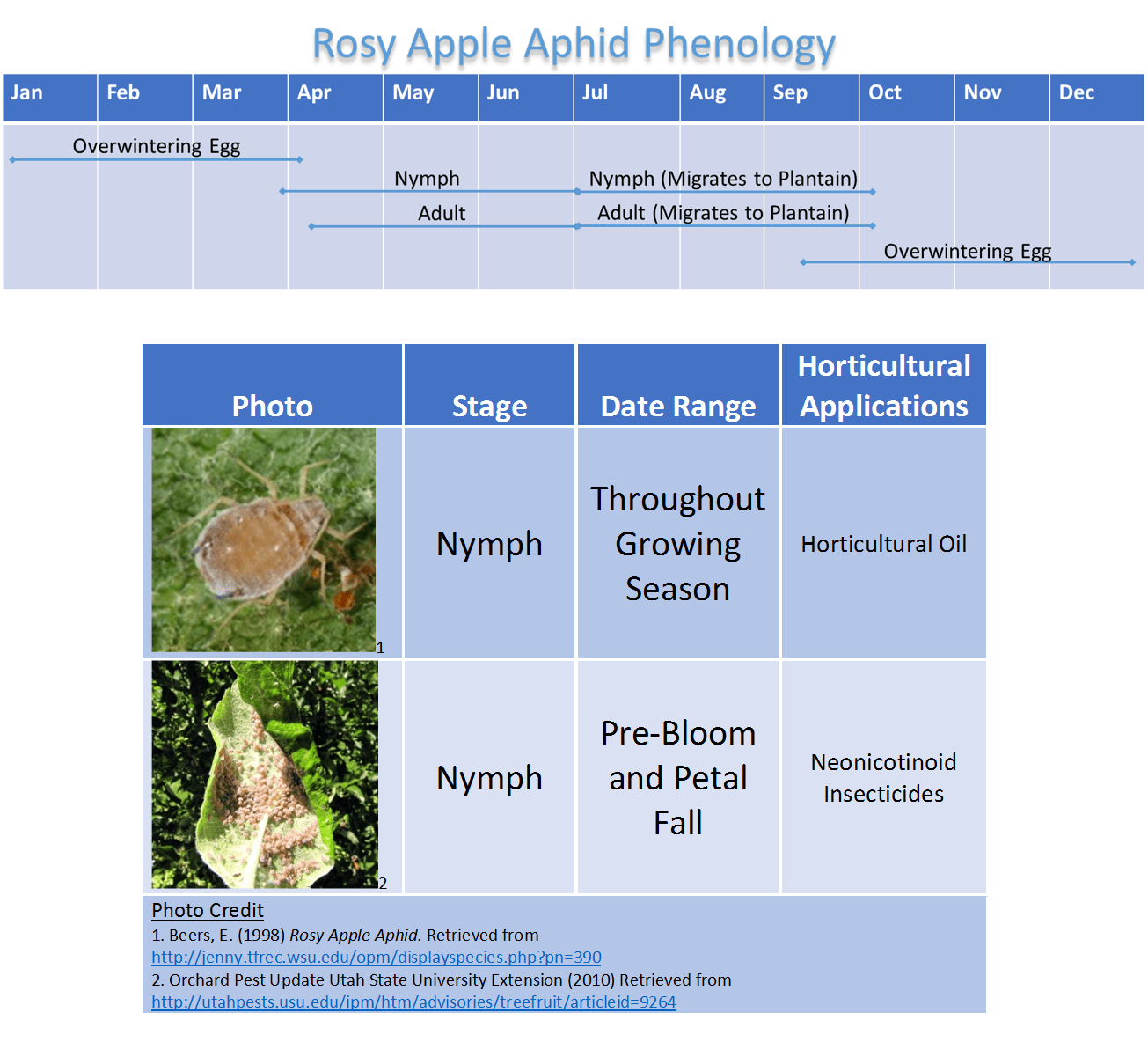

Rosy Apple Aphid Threatens Apple Harvest 10 30 Reduction Predicted

May 19, 2025

Rosy Apple Aphid Threatens Apple Harvest 10 30 Reduction Predicted

May 19, 2025 -

Cooke Maroney And Jennifer Lawrence Couple Steps Out After Second Child Reports

May 19, 2025

Cooke Maroney And Jennifer Lawrence Couple Steps Out After Second Child Reports

May 19, 2025 -

Bud Pa Eurovision 2026 Oernskoeldsvik I Hetluften

May 19, 2025

Bud Pa Eurovision 2026 Oernskoeldsvik I Hetluften

May 19, 2025 -

First Amputee To Drive In A Run In College Baseball Parker Byrds Achievement

May 19, 2025

First Amputee To Drive In A Run In College Baseball Parker Byrds Achievement

May 19, 2025 -

Ryujinx Emulator Development Halted Nintendos Intervention

May 19, 2025

Ryujinx Emulator Development Halted Nintendos Intervention

May 19, 2025