The High Cost Of Liberal Spending: A Call For Fiscal Responsibility In Canada

Table of Contents

H2: The Growing National Debt and Deficit

Canada's national debt and deficit are spiraling upwards, jeopardizing the country's long-term financial stability. The current deficit represents billions of dollars annually, adding to the already massive national debt. This isn't just about numbers; it's about the real-world impact on Canadian citizens.

- Impact of Increased Interest Payments: The rising debt necessitates larger interest payments, diverting funds from essential public services like healthcare and education. Every dollar spent on interest is a dollar less available for crucial programs.

- Consequences of a Growing National Debt: A continuously growing national debt weakens Canada's credit rating, making it more expensive to borrow money in the future. This can stifle economic growth and limit the government's ability to respond effectively to crises.

- Debt-to-GDP Ratio Comparison: Compared to other developed nations, Canada's debt-to-GDP ratio is relatively high, indicating a need for urgent fiscal reform. This ratio needs to be brought down through a combination of spending cuts and revenue increases.

H2: Inefficient Government Spending and Programs

While some government spending is undeniably necessary, significant inefficiencies and a lack of accountability plague numerous programs. Identifying and addressing these issues is crucial to achieving fiscal responsibility.

- Example 1: The Canada Emergency Response Benefit (CERB): While necessary during the COVID-19 pandemic, the CERB program faced criticism for its significant cost and potential for fraud. [Link to relevant government report on CERB]. A more targeted and efficient approach could have minimized costs while achieving similar outcomes.

- Example 2: Provincial Healthcare Spending: Many provincial healthcare systems grapple with inefficiencies and rising costs. [Link to a report on provincial healthcare spending]. Implementing cost-saving measures, such as improved technology and streamlined administrative processes, is vital.

- Alternative Solutions: Instead of blanket funding increases, a performance-based budgeting system could incentivize efficiency and accountability within government programs. Prioritizing evidence-based policymaking is also crucial to ensure that public funds are used effectively.

H2: The Impact of Liberal Spending on Future Generations

The high cost of liberal spending today directly impacts the financial well-being of future generations. The burden of a massive national debt will fall squarely on their shoulders.

- Higher Taxes: Future generations will likely face significantly higher taxes to service the debt and fund essential services. This could hinder economic opportunities and limit their ability to build wealth.

- Reduced Government Services: A large national debt restricts the government's capacity to invest in crucial social programs such as education, healthcare, and infrastructure, potentially diminishing the quality of life for future Canadians.

- Increased Economic Uncertainty: A high national debt creates economic uncertainty, making it more difficult for businesses to invest and create jobs, impacting future economic prosperity.

H2: Promoting Fiscal Responsibility in Canada

Addressing the high cost of liberal spending requires a multi-pronged approach that prioritizes fiscal responsibility and sustainable economic policies.

- Policy Changes: This includes implementing comprehensive tax reforms that broaden the tax base and address tax loopholes, coupled with a thorough review of government spending to identify areas for cuts and reallocation.

- Transparency and Accountability: Greater transparency in government spending is crucial. Independent audits of government programs should be mandatory, ensuring accountability and identifying inefficiencies. Open data initiatives can also help increase public understanding and scrutiny.

- Long-Term Planning: Implementing long-term fiscal plans with clear targets for reducing the deficit and debt is essential. This requires political will and a commitment to sustainable fiscal management.

3. Conclusion

The high cost of liberal spending in Canada is unsustainable and poses serious risks to the country's long-term economic and social well-being. The growing national debt, inefficient government programs, and the burden on future generations necessitate immediate action. We need to shift towards a model of fiscal responsibility that prioritizes efficient spending, transparency, and accountability.

It's time for Canadians to demand fiscal responsibility from their government. Let's work together to address the high cost of liberal spending, advocate for responsible budgeting, and secure a brighter future for our nation. Contact your elected officials, support organizations advocating for fiscal responsibility, and engage in informed discussions about this critical issue. The future of Canada depends on it.

Featured Posts

-

B And B April 3 Recap Liams Dramatic Collapse After A Row With Bill

Apr 24, 2025

B And B April 3 Recap Liams Dramatic Collapse After A Row With Bill

Apr 24, 2025 -

Nba 3 Point Contest Herro Triumphs Over Hield In Miami

Apr 24, 2025

Nba 3 Point Contest Herro Triumphs Over Hield In Miami

Apr 24, 2025 -

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025 -

Over The Counter Birth Control Implications For Reproductive Healthcare Post Roe

Apr 24, 2025

Over The Counter Birth Control Implications For Reproductive Healthcare Post Roe

Apr 24, 2025 -

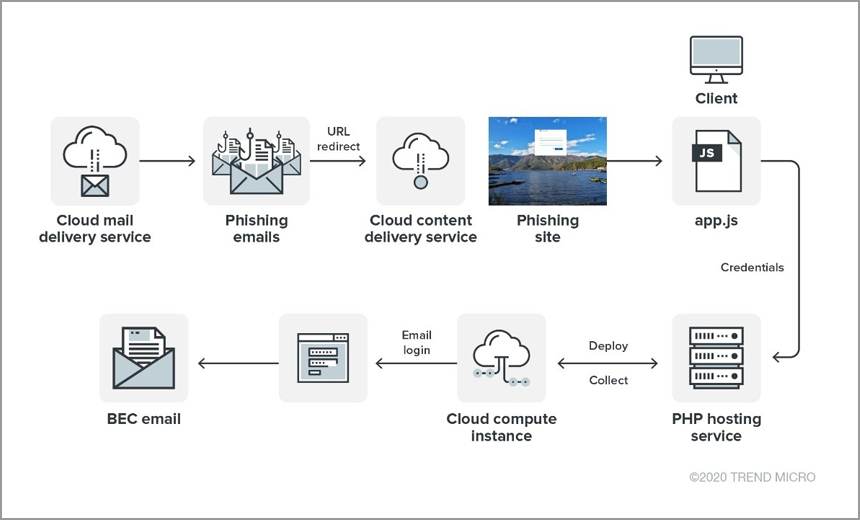

Cybercriminal Makes Millions Targeting Executive Office365 Accounts

Apr 24, 2025

Cybercriminal Makes Millions Targeting Executive Office365 Accounts

Apr 24, 2025