The Impact Of Trump's First 100 Days On Elon Musk's Fortune

Table of Contents

Regulatory Changes and Their Effect on Tesla

The early days of the Trump administration saw significant shifts in environmental and economic policy. These changes directly impacted Tesla, a company heavily reliant on government support for its electric vehicle (EV) ambitions and sensitive to shifts in market sentiment.

Impact of Environmental Policy Shifts

Trump's administration signaled a potential weakening of environmental regulations, a move that could have had both positive and negative consequences for Tesla.

- Changes to fuel efficiency standards: The proposed rollback of Obama-era fuel efficiency standards could have reduced pressure on traditional automakers to produce EVs, potentially lessening Tesla's competitive advantage in the short term.

- Potential weakening of emission regulations: Similar rollbacks on emission regulations could have, in theory, reduced the demand for electric vehicles, though Tesla's focus on sustainability and performance often transcends regulatory pressure.

- Impact on Tesla's competitive advantage: While a less stringent regulatory environment might have reduced Tesla's immediate advantage, it also could have opened up the market to more competition, potentially spurring innovation. However, this didn't materialize as rapidly as some predicted.

The actual financial impact was complex and not directly attributable solely to regulatory changes. While some analysts speculated on potential losses, Tesla's overall success in the market during this period largely outweighed any negative regulatory consequences.

Tax Policy and Tesla's Financial Performance

The Trump administration's significant corporate tax cuts, enacted in late 2017, had a more direct and positive impact on Tesla's financial performance.

- Corporate tax rate changes: The reduction in the corporate tax rate from 35% to 21% significantly boosted Tesla's bottom line, freeing up capital for reinvestment and expansion.

- Potential impact on investment in Tesla: The tax cuts may have also encouraged greater investment in Tesla, leading to increased stock valuation.

- Effects on Tesla's profitability: While the long-term effects are still debated, the immediate impact of the tax cuts was undeniably positive for Tesla's profitability. This contributed to a rise in Tesla's stock price, positively impacting Elon Musk's net worth.

SpaceX and the Trump Administration's Space Policy

SpaceX, Musk's space exploration company, also experienced shifts influenced by the early Trump administration.

Increased NASA Funding and its Influence on SpaceX Contracts

Trump's administration initially expressed support for increased NASA funding, potentially benefiting SpaceX which relies heavily on NASA contracts for its Falcon 9 and other projects.

- Changes in NASA budget allocation: While the specific allocation of funds varied, overall increases in NASA's budget created opportunities for increased contracts with SpaceX.

- Potential increase in contracts for SpaceX: This potential increase in contracts directly translated into a boost for SpaceX's revenue and overall valuation.

- Impact on SpaceX's valuation: The increased funding and associated contracts strengthened investor confidence in SpaceX, contributing to a rise in its valuation and, consequently, to Elon Musk's wealth.

Changes in National Security Policy and SpaceX's Role

The Trump administration's focus on strengthening national security also had implications for SpaceX.

- Changes in military space programs: Increased emphasis on military space capabilities potentially opened up new avenues for SpaceX to secure contracts related to national security.

- Potential impact on SpaceX contracts: This contributed to a diversification of SpaceX's revenue streams, strengthening its overall financial stability.

- Strategic implications for SpaceX: The potential for involvement in national security projects solidified SpaceX's position as a major player in the aerospace industry.

Market Volatility and its Influence on Elon Musk's Net Worth

The overall market climate during Trump's first 100 days played a significant role in influencing Elon Musk's net worth.

The Overall Market Reaction to Trump's Policies

The initial market reaction to Trump's policies was mixed, with periods of both significant gains and losses.

- Overall market trends during the period: The market experienced considerable volatility, influenced by uncertainty surrounding Trump's proposed policies and their potential impact on various sectors.

- Specific stock market impacts on Tesla and SpaceX: Tesla and SpaceX stock prices mirrored broader market trends, experiencing upswings and downswings in response to various news and policy announcements.

- Correlation with Trump's policies: While direct causal links are difficult to establish, correlations between specific policy announcements and stock price movements were clearly present.

Investor Sentiment Towards Musk's Companies

Investor sentiment toward Tesla and SpaceX fluctuated during this period, directly impacting Elon Musk's net worth.

- Positive and negative investor reactions: Positive news regarding Tesla's production and SpaceX's contracts led to increased investor confidence, boosting stock prices. Conversely, negative news or uncertainty created downward pressure.

- Shifts in stock valuations: These fluctuating sentiments resulted in significant shifts in the valuations of Tesla and SpaceX, directly impacting Musk's personal wealth.

- Impact on Musk's personal wealth: Musk's net worth, heavily tied to the stock performance of his companies, was significantly influenced by the volatility of the market and investor confidence.

Conclusion

The impact of Trump's first 100 days on Elon Musk's fortune was multifaceted and complex. While corporate tax cuts positively impacted Tesla's profitability, the effects of potential shifts in environmental and space policy were more nuanced and less directly quantifiable. Overall market volatility, influenced by the uncertainty surrounding the new administration, played a significant role in shaping the fluctuating valuations of Tesla and SpaceX, and consequently, Elon Musk's net worth. To gain a deeper understanding of the intricate connection between political leadership and business success, continue exploring the impact of Trump's policies and Elon Musk’s business ventures by exploring further resources and conducting your own research.

Featured Posts

-

Caso Maddie Mc Cann Polonesa Detida No Reino Unido

May 09, 2025

Caso Maddie Mc Cann Polonesa Detida No Reino Unido

May 09, 2025 -

Fatal Pedestrian Accident On Elizabeth City Road Police Investigation Underway

May 09, 2025

Fatal Pedestrian Accident On Elizabeth City Road Police Investigation Underway

May 09, 2025 -

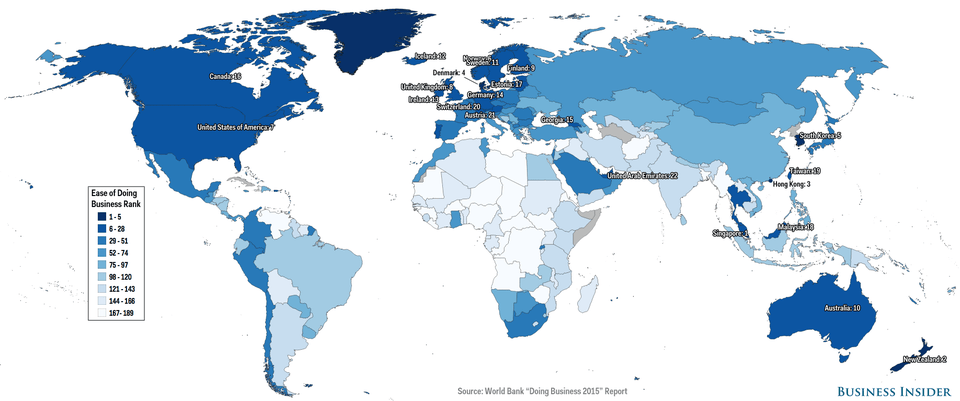

Mapping The Countrys Hottest New Business Hubs

May 09, 2025

Mapping The Countrys Hottest New Business Hubs

May 09, 2025 -

Sensex Live 100 Points Higher Nifty Above 17 950 Market Analysis

May 09, 2025

Sensex Live 100 Points Higher Nifty Above 17 950 Market Analysis

May 09, 2025 -

Whats The Real Safe Bet A Comparative Analysis Of Investment Vehicles

May 09, 2025

Whats The Real Safe Bet A Comparative Analysis Of Investment Vehicles

May 09, 2025

Latest Posts

-

The Joanna Page And Wynne Evans Bbc Show Confrontation

May 09, 2025

The Joanna Page And Wynne Evans Bbc Show Confrontation

May 09, 2025 -

Emmerdale Star Shows Solidarity With Wynne Evans Amidst Strictly Scandal

May 09, 2025

Emmerdale Star Shows Solidarity With Wynne Evans Amidst Strictly Scandal

May 09, 2025 -

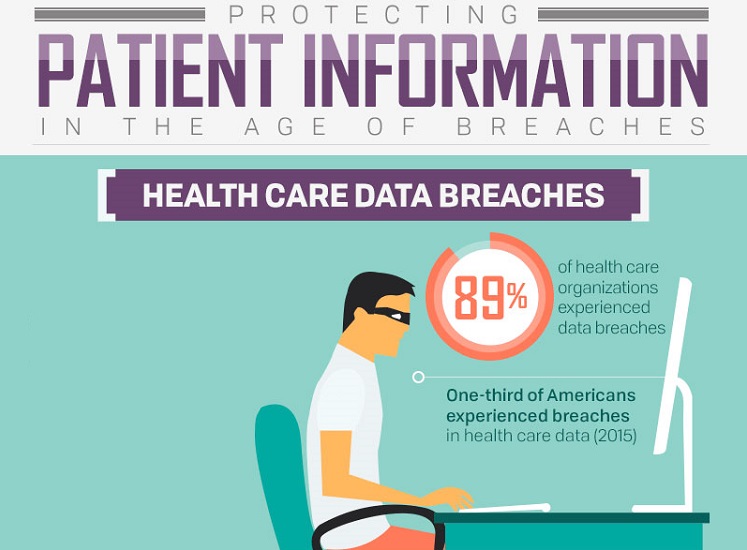

Nhs Data Breach Investigation Into Access Of Nottingham Attack Victim Records By 90 Staff

May 09, 2025

Nhs Data Breach Investigation Into Access Of Nottingham Attack Victim Records By 90 Staff

May 09, 2025 -

Nhs Trust Boss Cooperates With Nottingham Attack Investigation

May 09, 2025

Nhs Trust Boss Cooperates With Nottingham Attack Investigation

May 09, 2025 -

Nottingham Hospital Data Breach Over 90 Nhs Staff Accessed Victim Records

May 09, 2025

Nottingham Hospital Data Breach Over 90 Nhs Staff Accessed Victim Records

May 09, 2025