The Trade War And Crypto: A Single Cryptocurrency's Potential

Table of Contents

The Instability of Traditional Finance During Trade Wars

Trade wars create significant instability within traditional financial systems. The imposition of tariffs and trade restrictions disrupts established supply chains, leading to reduced international trade and impacting currency valuations. This instability creates a ripple effect across global markets.

For example, the US-China trade war of 2018-2020 saw significant fluctuations in both the US dollar and the Chinese yuan, impacting businesses and investors worldwide. Historically, trade wars have consistently led to increased market volatility and decreased investor confidence in traditional assets.

- Increased volatility in forex markets: Currency values become unpredictable, making international transactions risky.

- Reduced investor confidence in traditional assets: Uncertainty leads to capital flight from stocks, bonds, and other traditional investments.

- Disruption of supply chains and global trade: Tariffs and restrictions impede the smooth flow of goods and services across borders.

- Increased risk for international investments: The unpredictability of trade policies increases the risks associated with cross-border investments.

Cryptocurrencies as a Hedge Against Trade War Uncertainty

Cryptocurrencies, with their decentralized and less regulated nature, offer a compelling alternative to traditional finance, especially during periods of geopolitical uncertainty. Their decentralized structure makes them less susceptible to the whims of national governments and the impact of trade wars.

The inherent potential for cryptocurrencies to maintain value, even amid economic instability, stems from their global reach and the fact that they operate outside the traditional financial infrastructure targeted by trade wars. This makes them an attractive hedge against instability.

- Decentralized nature makes them less susceptible to government control: Cryptocurrencies operate independently of national governments and their policies.

- Potential for price stability relative to fiat currencies during trade disputes: While volatile themselves, some cryptocurrencies might demonstrate relative stability compared to fluctuating fiat currencies.

- Global accessibility transcends geographical limitations imposed by trade wars: Crypto transactions can occur globally, regardless of trade restrictions.

- Increased demand during times of economic uncertainty: Investors may turn to cryptocurrencies as a safe haven asset during trade war-induced volatility.

Bitcoin's Unique Advantages in a Trade War Scenario

Bitcoin, the world's first and most established cryptocurrency, stands out due to its unique characteristics that make it particularly resilient during trade wars. Its decentralized nature, robust security, and global acceptance make it a compelling alternative to traditional financial instruments.

Bitcoin's inherent features allow it to overcome many of the challenges posed by trade wars, offering a more stable and accessible financial environment.

- Low transaction fees: Compared to traditional international wire transfers, Bitcoin transactions often have significantly lower fees, reducing costs associated with international trade.

- Fast and efficient cross-border transfers: Bitcoin transactions bypass the traditional banking system, circumventing potential delays and restrictions imposed by trade barriers.

- Enhanced security features: Bitcoin's cryptographic security measures protect against fraud and theft, offering a higher level of security than traditional systems.

- Decentralized governance: Bitcoin’s resistance to political influence and sanctions makes it a reliable asset during times of international conflict.

Real-World Examples and Case Studies

While the correlation isn't always direct, Bitcoin's price has historically shown periods of relative strength during times of global economic uncertainty, including periods of heightened trade tension. For example, during the peak of the US-China trade war, Bitcoin experienced periods of price appreciation, indicating a potential flight to safety amongst investors seeking alternative assets.

Further research and analysis are needed to fully establish the correlation between trade wars and Bitcoin’s performance. However, anecdotal evidence and price action suggest a positive correlation in some instances.

- Specific examples of successful transactions during trade war periods: Numerous reports highlight the use of Bitcoin to facilitate cross-border payments despite trade restrictions.

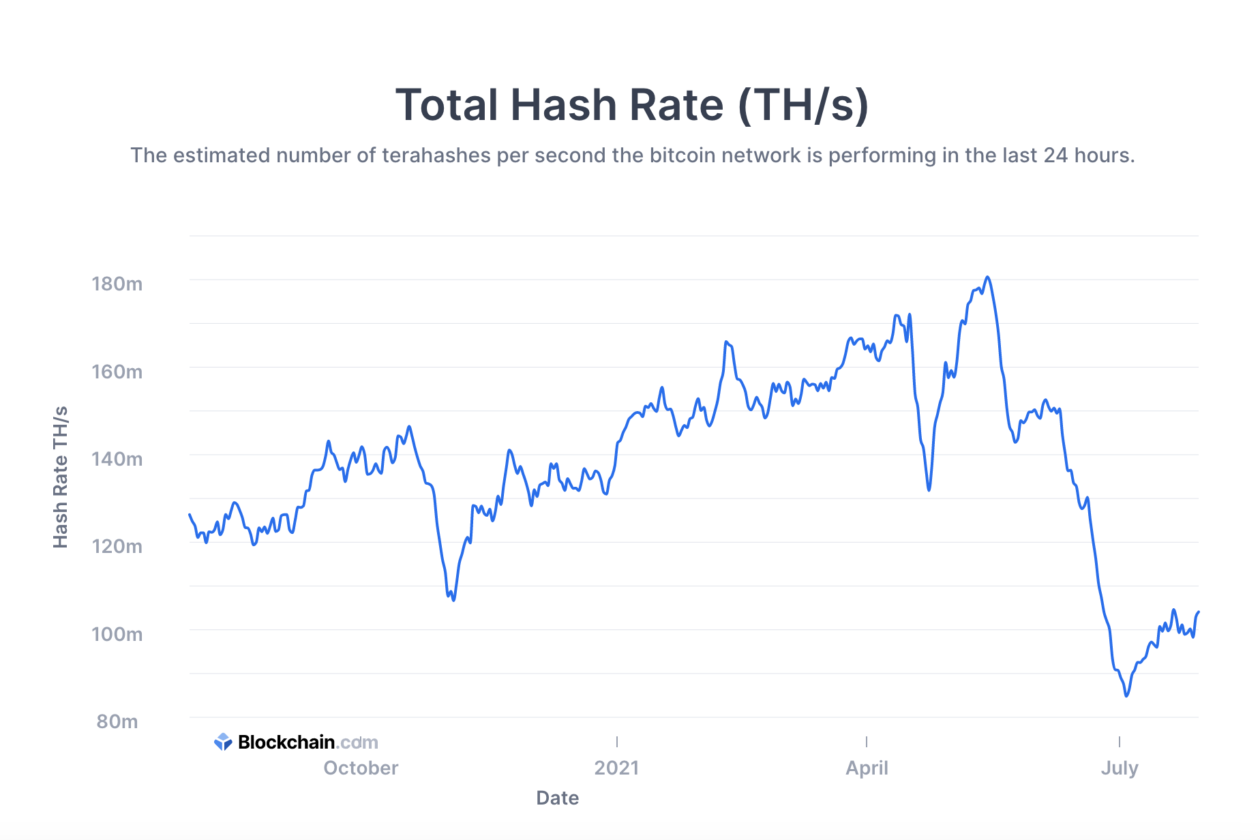

- Price analysis showing relative stability during economic uncertainty: While volatile, Bitcoin has demonstrated periods of relative stability compared to fiat currencies during times of economic uncertainty.

- Mention of any partnerships or developments supporting the cryptocurrency’s utility: Growing adoption by businesses and institutions adds to Bitcoin's utility as a reliable and valuable asset.

Potential Risks and Challenges

It's crucial to acknowledge that investing in Bitcoin, or any cryptocurrency, carries inherent risks. The cryptocurrency market is known for its volatility, and Bitcoin's price can fluctuate significantly. Regulatory uncertainty also presents a challenge, with varying levels of legal frameworks across different jurisdictions.

- Price volatility remains a risk: Bitcoin’s price can fluctuate dramatically, leading to potential losses for investors.

- Regulatory uncertainty could impact adoption: Lack of clear regulatory frameworks can hinder the widespread adoption of Bitcoin.

- Security vulnerabilities need to be addressed: While Bitcoin is relatively secure, ongoing efforts to improve its security are crucial.

The Trade War and Crypto: A Single Cryptocurrency's Potential – A Final Thought

In conclusion, the potential of Bitcoin to thrive amidst the uncertainty generated by trade wars is significant. Its unique features – decentralization, security, and global accessibility – offer a compelling alternative to traditional financial systems vulnerable to the disruptions caused by trade disputes. While risks exist, the potential benefits of Bitcoin as a hedge against trade war uncertainty warrant further investigation and consideration. Explore the potential of Bitcoin as a strategic asset in your portfolio during times of trade war uncertainty. Learn more and invest wisely.

Featured Posts

-

Understanding The Dogecoin Shiba Inu And Sui Price Increase

May 08, 2025

Understanding The Dogecoin Shiba Inu And Sui Price Increase

May 08, 2025 -

1 2

May 08, 2025

1 2

May 08, 2025 -

The Vaticans Finances An Unresolved Crisis Under Pope Francis

May 08, 2025

The Vaticans Finances An Unresolved Crisis Under Pope Francis

May 08, 2025 -

Understanding The Recent Spike In Bitcoin Mining Difficulty And Hashrate

May 08, 2025

Understanding The Recent Spike In Bitcoin Mining Difficulty And Hashrate

May 08, 2025 -

Zbog Bobija Marjanovica Istina Iza Trostrukog Poljupca Dzordana I Jokica

May 08, 2025

Zbog Bobija Marjanovica Istina Iza Trostrukog Poljupca Dzordana I Jokica

May 08, 2025

Latest Posts

-

Triunfo De Filipe Luis Conquista Un Nuevo Titulo

May 08, 2025

Triunfo De Filipe Luis Conquista Un Nuevo Titulo

May 08, 2025 -

Fecha 3 Copa Libertadores Todo Sobre Liga De Quito Vs Flamengo Grupo C

May 08, 2025

Fecha 3 Copa Libertadores Todo Sobre Liga De Quito Vs Flamengo Grupo C

May 08, 2025 -

Filipe Luis Anade Un Nuevo Titulo A Su Coleccion

May 08, 2025

Filipe Luis Anade Un Nuevo Titulo A Su Coleccion

May 08, 2025 -

La Accion De Erick Pulgar Que Conquista A La Hinchada De Flamengo

May 08, 2025

La Accion De Erick Pulgar Que Conquista A La Hinchada De Flamengo

May 08, 2025 -

Copa Libertadores Grupo C Liga De Quito Se Enfrenta A Flamengo En La Fecha 3

May 08, 2025

Copa Libertadores Grupo C Liga De Quito Se Enfrenta A Flamengo En La Fecha 3

May 08, 2025