The Trump Administration's Trade Agenda And Its Consequences For US Finance

Table of Contents

Key Features of the Trump Administration's Trade Agenda

The Trump administration's trade policy was characterized by a decisive shift towards protectionism, prioritizing domestic industries over global trade liberalization. This approach manifested in several key features:

Increased Tariffs and Trade Wars

A defining characteristic was the imposition of substantial tariffs on various imported goods. This included tariffs on steel and aluminum from numerous countries, a significant escalation of tariffs on goods from China, and retaliatory measures against the European Union and Mexico. These actions ignited trade wars, with other nations implementing their own tariffs in response.

- Specific examples of tariffs: 25% tariffs on steel imports, 10% tariffs on aluminum imports, escalating tariffs on various Chinese goods (ranging from 10% to 25%).

- Affected industries: Agriculture (soybeans, pork), manufacturing (steel, automobiles), technology (semiconductors).

- Initial economic reactions: Increased prices for consumers, disruptions to global supply chains, uncertainty in financial markets, and retaliatory tariffs leading to decreased exports for US businesses.

- Keywords: Tariff impact, trade war, protectionism, retaliatory tariffs, global trade, import tariffs, export tariffs.

Renegotiation of NAFTA (USMCA)

The Trump administration initiated a renegotiation of the North American Free Trade Agreement (NAFTA), culminating in the United States-Mexico-Canada Agreement (USMCA). While aiming to modernize the agreement, the renegotiation reflected a protectionist bent.

- Key changes in USMCA compared to NAFTA: Increased labor standards, stricter rules of origin for automobiles, enhanced intellectual property protection, and a sunset clause.

- Intended goals of renegotiation: To secure better terms for the US, improve labor standards in Mexico, and strengthen intellectual property rights.

- Impact on specific sectors: The automotive industry experienced significant changes due to new rules of origin. Agricultural trade saw some shifts but mostly remained relatively stable.

- Keywords: USMCA, NAFTA renegotiation, trade agreement, labor standards, intellectual property, trade liberalization, regional trade agreement.

"America First" Approach and Bilateral Trade Deals

The administration emphasized a shift from multilateral trade agreements (like the Trans-Pacific Partnership) to bilateral agreements, reflecting an "America First" approach. This strategy aimed to secure more favorable terms for the US in individual trade deals.

- Examples of bilateral agreements pursued: While no major new bilateral agreements were fully concluded during the Trump administration, negotiations were initiated with several countries.

- Benefits and challenges of bilateralism vs. multilateralism: Bilateral deals offer potentially more favorable terms but can be more time-consuming to negotiate and may not address broader global trade issues as effectively as multilateral agreements.

- Implications for US financial institutions: Bilateral agreements could create opportunities for US financial institutions involved in trade finance, but uncertainty surrounding the overall trade policy could negatively impact investment and lending decisions.

- Keywords: Bilateral trade, multilateral trade, America First, trade policy, global economic impact, trade negotiations, trade deals.

Consequences for US Finance

The Trump administration's trade agenda had profound consequences for the US financial system, impacting various sectors and creating both short-term volatility and potential long-term repercussions.

Impact on Financial Markets

The trade disputes created significant uncertainty in financial markets, leading to volatility in stock prices, bond yields, and the US dollar exchange rate.

- Examples of market fluctuations: Stock market declines following announcements of new tariffs, increased volatility in the bond market due to trade uncertainty, fluctuations in the US dollar’s value.

- Investor sentiment: Investor confidence was negatively impacted by the unpredictability of the trade policies. This led to decreased investment and increased risk aversion.

- Impact on foreign investment: Uncertainty surrounding US trade policy deterred some foreign investment.

- Keywords: Stock market volatility, bond yields, US dollar exchange rate, financial market instability, investor confidence, market uncertainty.

Effects on Specific Financial Sectors

The impact of the trade agenda varied across different sectors. Agriculture, manufacturing, and technology were particularly affected. Financial institutions played a significant role in both mitigating and exacerbating these effects.

- Examples of how different sectors were affected: Farmers faced reduced exports due to retaliatory tariffs; manufacturers faced increased input costs due to tariffs on raw materials; and technology companies faced disruptions to supply chains.

- Financial support mechanisms: The government implemented some support programs for farmers and businesses negatively affected by the trade disputes.

- Role of banks and investment firms: Banks and investment firms played a key role in providing financing and risk management services to businesses navigating these challenging conditions.

- Keywords: Agricultural finance, manufacturing finance, technology finance, financial institutions, lending, investment, trade finance, risk management.

Long-Term Implications for Economic Growth and Stability

The long-term consequences of the Trump administration's protectionist trade policies on US economic growth and stability are still unfolding and are subject to ongoing debate.

- Potential scenarios for long-term economic growth: Some economists argue that protectionism could lead to slower long-term economic growth due to reduced efficiency and stifled innovation. Others believe that certain sectors could benefit from protectionist measures in the short term.

- Potential risks and opportunities: Increased prices for consumers, reduced global competitiveness, and potential for trade wars pose risks. Opportunities could arise for domestic industries temporarily shielded from foreign competition.

- Role of government policy: Government policy plays a crucial role in mitigating negative effects and supporting industries during periods of trade disruption.

- Keywords: Economic growth, inflation, unemployment, national debt, long-term economic outlook, sustainable growth, economic policy, trade policy effects.

Conclusion

The Trump administration's trade agenda, characterized by increased tariffs, renegotiated trade agreements, and a shift towards bilateralism, had significant and multifaceted consequences for US finance. The short-term volatility in financial markets and the varying impacts across different economic sectors highlighted the complexity of managing a protectionist trade strategy. The long-term implications for economic growth and stability remain a subject of ongoing debate and further analysis. Understanding the nuances of Trump Administration Trade Policies is crucial for navigating the evolving global economic landscape. Further research into the long-term effects is necessary for informed policymaking and strategic decision-making in the financial sector. To delve deeper into this critical topic, explore additional resources on the impact of Trump Administration Trade Policies on the US economy.

Featured Posts

-

Why Middle Managers Are Essential For Company Success

Apr 22, 2025

Why Middle Managers Are Essential For Company Success

Apr 22, 2025 -

Trump Tariffs And Tik Tok A Case Study In Circumvention

Apr 22, 2025

Trump Tariffs And Tik Tok A Case Study In Circumvention

Apr 22, 2025 -

Pope Francis A Legacy Of Compassion

Apr 22, 2025

Pope Francis A Legacy Of Compassion

Apr 22, 2025 -

Us South Sudan Partnership For Coordinated Deportee Repatriation

Apr 22, 2025

Us South Sudan Partnership For Coordinated Deportee Repatriation

Apr 22, 2025 -

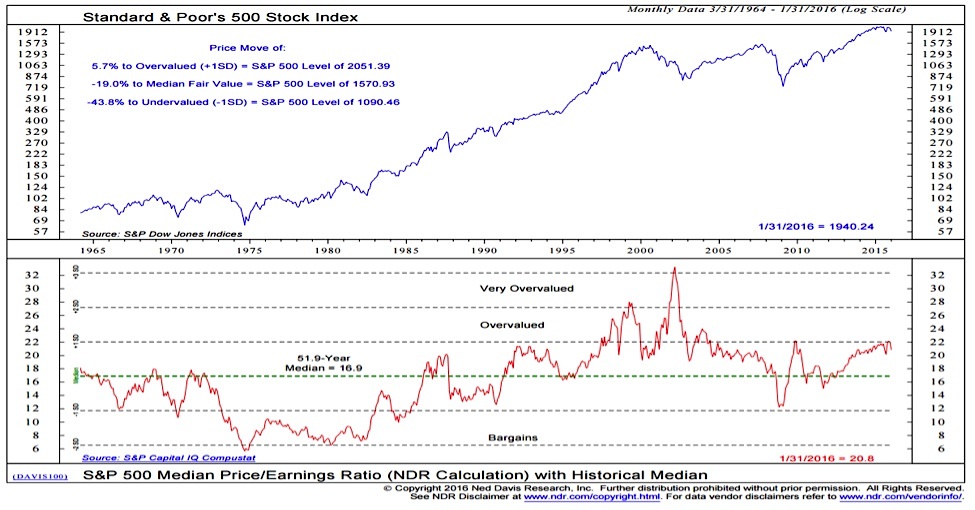

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Panic

Apr 22, 2025

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Panic

Apr 22, 2025