The Trump Tax Bill: How The House's Final Vote Impacts You

Table of Contents

Individual Income Tax Changes Under the Trump Tax Bill

The Trump Tax Bill significantly restructured individual income taxes. Understanding these changes is critical for accurately calculating your tax liability.

Lower Tax Rates:

The bill lowered individual income tax rates across several brackets. This resulted in a simpler tax system with fewer brackets, but the impact varied based on income level.

- Before the Tax Cuts: The US had seven tax brackets with rates ranging from 10% to 39.6%.

- After the Tax Cuts: The number of brackets was reduced, generally lowering rates. (Note: Specific rate changes would need to be inserted here reflecting the actual rates from the Trump Tax Bill. This information is readily available from the IRS website and should be included for accuracy).

- Impact: While many taxpayers saw a reduction in their overall tax liability, the benefit was disproportionately greater for higher-income earners. For example, a taxpayer in the highest bracket before the changes would have experienced a substantial decrease in their tax rate.

Standard Deduction and Exemptions:

The Trump Tax Bill significantly increased the standard deduction while eliminating personal and dependent exemptions.

- Increased Standard Deduction: This change benefited many taxpayers, particularly those with lower incomes who previously itemized deductions.

- Elimination of Exemptions: This change offset some of the benefits of the increased standard deduction, especially for families with multiple children.

- Example: A family of four might have seen a net decrease or a minor increase in their tax liability depending on their income and prior itemized deductions.

- Advantages: Simpler tax filing for many.

- Disadvantages: Reduced tax benefits for large families.

Child Tax Credit:

The Trump Tax Bill made changes to the Child Tax Credit (CTC), increasing the amount and expanding eligibility.

- Increased Credit Amount: The maximum credit amount was increased. (Again, specific amounts are needed here and can be easily sourced).

- Expanded Eligibility: More families were eligible for the full or partial credit.

- Impact: Families with children benefited significantly, particularly those with lower incomes who may have previously been ineligible for the full credit.

Itemized Deductions:

Significant changes were made to itemized deductions, including limitations on State and Local Tax (SALT) deductions.

- SALT Deduction Limit: This cap significantly impacted taxpayers in high-tax states, reducing the tax benefits of deducting state and local property taxes and income taxes.

- Impact on Itemizers: Taxpayers who previously itemized deductions might have found it more advantageous to take the standard deduction after the changes.

- Example: A high-income taxpayer in a high-tax state saw a considerable increase in their tax liability due to the SALT deduction limit.

Business Tax Changes Under the Trump Tax Bill

The Trump Tax Bill also significantly altered business taxation, aiming to boost economic growth.

Corporate Tax Rate Reduction:

The corporate tax rate was dramatically reduced from 35% to 21%.

- Impact on Businesses: This substantial reduction was intended to increase corporate profits, spur investment, and create jobs.

- Economic Effects: The long-term effects on corporate investment and job growth are complex and subject to ongoing debate.

Pass-Through Business Deduction:

The bill introduced a new deduction for pass-through businesses (like S corporations and partnerships).

- Impact on Small Businesses: This deduction provided tax relief for small business owners and self-employed individuals.

- Example: A small business owner saw a reduction in their personal income tax liability due to this deduction.

Impact on Investment and Business Growth:

The Trump Tax Bill aimed to stimulate business investment and economic growth.

- Positive Perspectives: Proponents argued the tax cuts would lead to increased investment, job creation, and higher wages.

- Negative Perspectives: Critics countered that the tax cuts would disproportionately benefit large corporations and exacerbate income inequality.

- Economic Forecasts: Numerous economic forecasts offered varying predictions regarding the bill's long-term impact on economic growth.

Long-Term Implications and Potential Economic Effects of the Trump Tax Bill

The long-term effects of the Trump Tax Bill remain a subject of ongoing debate and analysis.

National Debt:

The significant tax cuts contributed to a projected increase in the national debt.

- Fiscal Impact: The long-term fiscal implications of these tax cuts are a source of ongoing concern for many economists.

- Differing Opinions: Economists hold diverse opinions on the extent and severity of the potential long-term fiscal impact.

Economic Growth Projections:

The bill's effect on economic growth, job creation, and inflation is debated.

- Economic Analyses: Various economic analyses offered different predictions regarding the bill's impact.

- Forecasts: Forecasts ranged from optimistic projections of robust growth to more pessimistic views of limited impact or even negative consequences.

Income Inequality:

The impact of the tax cuts on income inequality is a contentious issue.

- Arguments: Some argued that the tax cuts exacerbated income inequality by disproportionately benefiting higher-income individuals and corporations. Others countered that the tax cuts stimulated economic growth, ultimately benefiting all income groups.

Conclusion: Understanding Your Impact from the Trump Tax Bill

The Trump Tax Bill significantly reshaped the American tax system. The key changes included lower individual income tax rates, increased standard deductions, modifications to the Child Tax Credit, limitations on itemized deductions (especially SALT), a lower corporate tax rate, and changes to the pass-through business deduction. These changes have had varied and complex impacts on individuals and businesses, with long-term economic effects still unfolding.

Understanding the intricacies of the Trump Tax Bill is crucial. Consult a tax professional to determine how these changes impact your tax liability and to optimize your tax planning. This will ensure you are taking full advantage of the changes and are prepared for filing tax season. (Insert link to relevant resources here if applicable)

Featured Posts

-

Netflixs New Drama Series White Lotus Star And Oscar Winner Headline Sexy Darkly Funny Show

May 23, 2025

Netflixs New Drama Series White Lotus Star And Oscar Winner Headline Sexy Darkly Funny Show

May 23, 2025 -

Thqyq Mqtl Mwzfy Alsfart Alisrayylyt Mn Hw Ilyas Rwdryjyz

May 23, 2025

Thqyq Mqtl Mwzfy Alsfart Alisrayylyt Mn Hw Ilyas Rwdryjyz

May 23, 2025 -

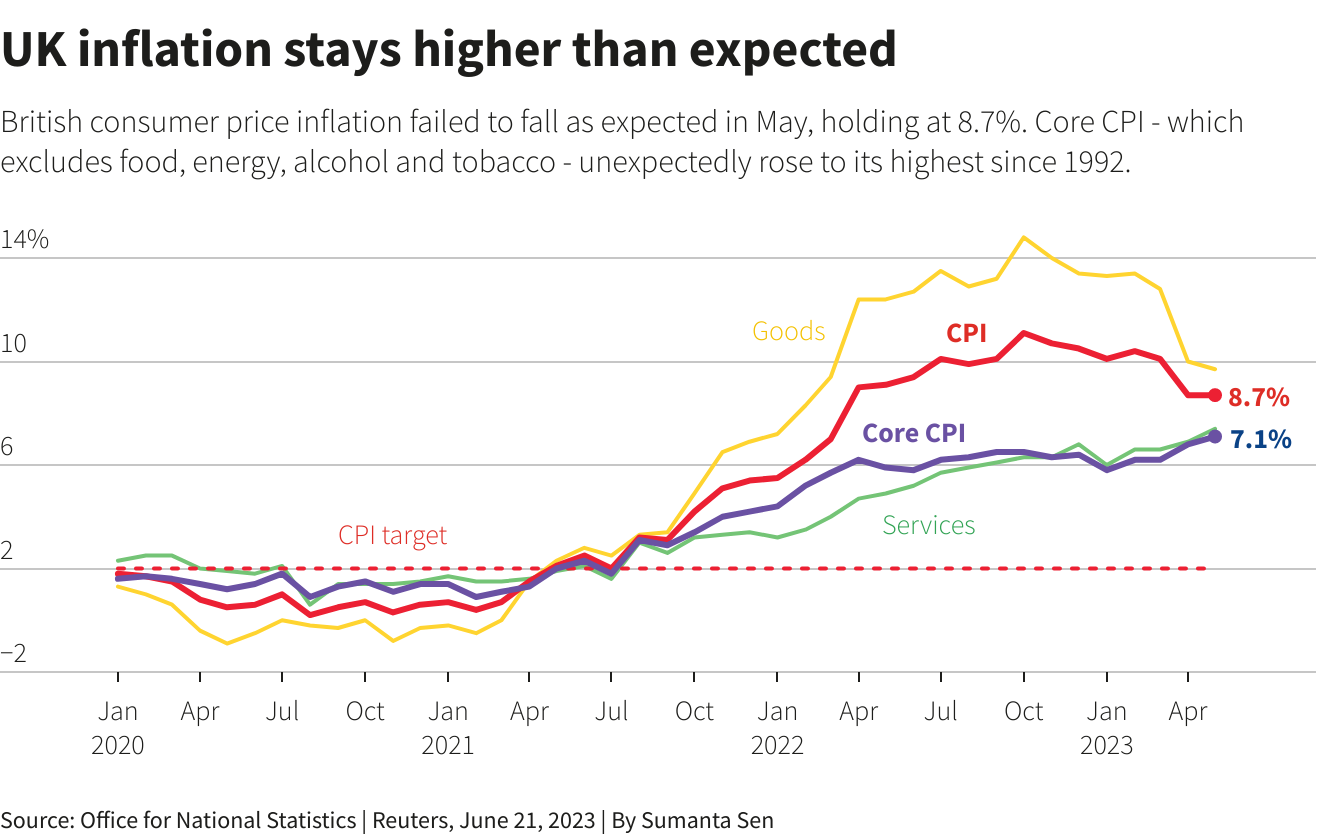

Uk Inflation Slows Impact On Boe Rate Cuts And The Pound

May 23, 2025

Uk Inflation Slows Impact On Boe Rate Cuts And The Pound

May 23, 2025 -

Atempause And Radtour Entdecken Sie Essen Auf Zwei Raedern

May 23, 2025

Atempause And Radtour Entdecken Sie Essen Auf Zwei Raedern

May 23, 2025 -

Collaboration Extended Ooredoo Qatar And Qtspbfs Continued Growth

May 23, 2025

Collaboration Extended Ooredoo Qatar And Qtspbfs Continued Growth

May 23, 2025