The Unexpected Wall Street Rally: A Deep Dive Into The Reversal Of Bear Market Trends

Table of Contents

Economic Indicators Fueling the Wall Street Rally

Several significant economic indicators have contributed to the unexpected Wall Street rally, shifting investor sentiment from pessimism to cautious optimism.

Inflation Cooling & Interest Rate Hikes Slowdown

Easing inflation has played a crucial role in boosting investor confidence. Lower inflation reduces the pressure on the Federal Reserve to aggressively raise interest rates. The anticipation of a less aggressive Fed, or even potential interest rate pauses or slowdowns, has injected much-needed stability into the market.

- Lower inflation figures reported: Recent data shows a significant decrease in inflation rates, exceeding market expectations in several key areas.

- Market anticipation of a less aggressive Fed: Investors are betting on the Fed adopting a more moderate approach to interest rate hikes, reducing the risk of a significant economic slowdown.

- Positive impact on consumer spending: Lower inflation translates to increased consumer purchasing power, stimulating economic growth and boosting corporate earnings.

Strong Corporate Earnings Reports

Positive surprises in corporate earnings reports from major companies across various sectors have further fueled the Wall Street rally. Many businesses have exceeded expectations, showcasing resilience and adaptability in the face of economic headwinds.

- Examples of companies exceeding expectations: Several prominent tech companies and consumer staples giants have reported surprisingly strong earnings, surpassing analysts' forecasts.

- Analysis of sector-specific growth: Specific sectors, such as energy and technology, have shown particularly robust growth, contributing disproportionately to the overall market rebound.

- Impact on investor sentiment: These positive earnings reports have significantly improved investor sentiment, bolstering confidence in the overall economic outlook.

Geopolitical Stability and Unexpected Positive Developments

Unexpected positive shifts in the global geopolitical landscape have also played a role in the Wall Street rally. Reduced uncertainty in certain regions has improved investor risk appetite.

- Examples of positive geopolitical developments: Recent diplomatic initiatives and de-escalation of tensions in certain conflict zones have contributed to a more stable global environment.

- Impact on investor risk appetite: Decreased geopolitical risks have encouraged investors to move away from safer assets and embrace higher-risk investments.

- Reduction of uncertainty in the market: A more predictable geopolitical environment reduces uncertainty, allowing investors to focus on fundamental economic factors.

Investor Behavior and the Wall Street Rally

The Wall Street rally isn't solely driven by economic fundamentals; investor behavior plays a significant role.

Shifting Investor Sentiment from Bearish to Bullish

The shift in investor sentiment from bearish to bullish has been dramatic. Fear and panic selling have been replaced, at least for now, by optimism and increased buying activity.

- Data on investor sentiment indices: Various investor sentiment indices show a clear shift towards optimism, though still remaining cautious in comparison to previous bull markets.

- Analysis of market psychology: The psychology of the market is complex, with the recent rally potentially fueled by a combination of hope, fear of missing out (FOMO), and short covering.

- Role of media narratives: Positive media coverage of the rally itself can further reinforce the bullish sentiment, creating a self-fulfilling prophecy.

The Role of Short Covering and Margin Calls

Short covering, where investors buy back stocks they previously shorted, has significantly contributed to the price increases. Margin calls, which force investors to deposit more funds to cover their losses, have also played a role, albeit a less positive one.

- Explanation of short-selling and covering: Short-selling involves borrowing and selling a stock, hoping to buy it back later at a lower price. Covering involves buying back the stock to return it to the lender. A rapid increase in price forces short-sellers to buy back to limit losses.

- Impact on stock prices: Mass short covering can rapidly drive up prices, amplifying the upward momentum of the rally.

- Consequences of margin calls: Margin calls can trigger forced selling, potentially destabilizing the market in certain sectors if too many investors are forced to liquidate simultaneously.

Increased Retail Investor Participation

The increased participation of retail investors, fueled partly by meme stocks and social media trends, has added to the volatility and momentum of the Wall Street rally.

- Data on retail investor activity: Data shows a surge in retail investor participation, particularly in certain high-profile stocks.

- Impact of social media sentiment: Social media platforms have become powerful tools for spreading information and influencing market sentiment, both positively and negatively.

- Potential risks associated with retail investor behavior: The unpredictable nature of retail investor behavior can increase market volatility and susceptibility to speculative bubbles.

Potential Risks and Future Outlook for the Wall Street Rally

While the current Wall Street rally is encouraging, several risks remain.

Lingering Economic Uncertainty

Despite the positive signs, significant economic uncertainty persists. The potential for a recession, stubbornly high inflation, and ongoing geopolitical tensions pose threats to the rally's sustainability.

- Potential economic slowdown: While growth remains positive in some sectors, the risk of a broader economic slowdown remains.

- Inflationary pressures: Inflation, although cooling, may not fall to the desired levels, necessitating further interest rate hikes.

- Geopolitical risks: Unforeseen geopolitical events could easily reignite market volatility and negatively impact investor confidence.

Market Volatility and Correction Potential

The likelihood of a market correction or pullback remains significant. Several factors could trigger such an event.

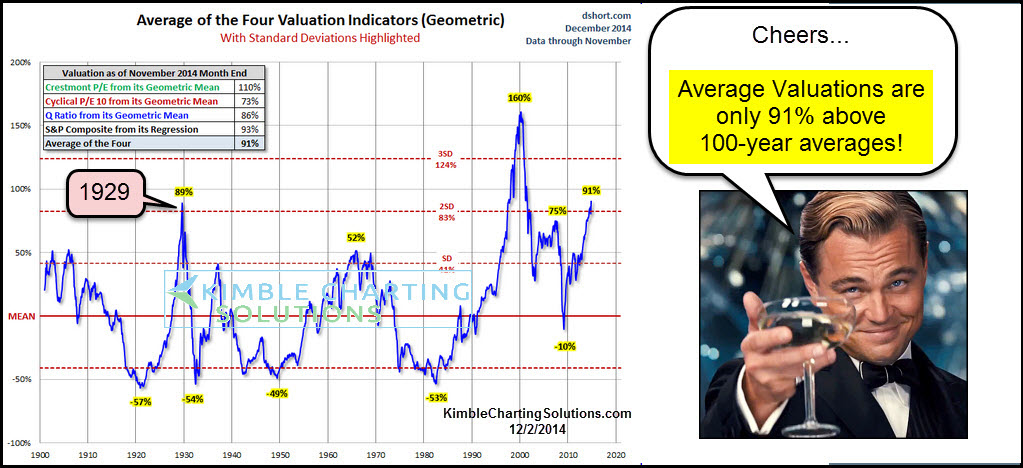

- Historical precedents: History shows that market rallies are rarely uninterrupted and are often followed by periods of consolidation or correction.

- Technical analysis indicators: Technical indicators, such as overbought conditions and bearish divergence, can signal potential corrections.

- Potential catalysts for a correction: Negative economic news, disappointing earnings reports, or renewed geopolitical tensions could easily trigger a market downturn.

Conclusion: Navigating the Unexpected Wall Street Rally

The unexpected Wall Street rally is a complex phenomenon driven by a combination of positive economic indicators, shifting investor sentiment, and increased retail participation. While the recent market rebound is encouraging, lingering economic uncertainty and the potential for a market correction must be considered. Understanding the nuances of this unexpected Wall Street rally is crucial for navigating the current market landscape. Stay informed, conduct thorough research, and make strategic investment choices to capitalize on opportunities while mitigating potential risks. Keep a close eye on the economic indicators that are shaping this dynamic Wall Street rally.

Featured Posts

-

Will Palantir Be A Trillion Dollar Company By 2030 Analysis And Predictions

May 10, 2025

Will Palantir Be A Trillion Dollar Company By 2030 Analysis And Predictions

May 10, 2025 -

Wynne Evans Responds To Strictly Come Dancing Return Calls Truth Will Win

May 10, 2025

Wynne Evans Responds To Strictly Come Dancing Return Calls Truth Will Win

May 10, 2025 -

Bof As Reassurance Why Stretched Stock Market Valuations Shouldnt Worry Investors

May 10, 2025

Bof As Reassurance Why Stretched Stock Market Valuations Shouldnt Worry Investors

May 10, 2025 -

Vegas Golden Knights Win Adin Hills Strong Performance Shutouts Columbus

May 10, 2025

Vegas Golden Knights Win Adin Hills Strong Performance Shutouts Columbus

May 10, 2025 -

Young Thug Addresses Not Like U Mention Following His Release From Prison

May 10, 2025

Young Thug Addresses Not Like U Mention Following His Release From Prison

May 10, 2025