This Week's Bitcoin Mining Increase: A Deep Dive

Table of Contents

Increased Hash Rate: A Closer Look

The recent Bitcoin mining increase is largely reflected in a substantial rise in the Bitcoin network's hash rate. The hash rate represents the total computational power dedicated to solving complex cryptographic puzzles to validate Bitcoin transactions and add new blocks to the blockchain. A higher hash rate signifies a more secure and robust network, making it exponentially more difficult for malicious actors to manipulate the blockchain.

New Mining Hardware and its Impact

The release of new, more energy-efficient Application-Specific Integrated Circuit (ASIC) miners has played a crucial role in boosting the hash rate. These advanced machines offer:

- Increased processing power: New ASICs boast significantly higher terahashes per second (TH/s) compared to their predecessors, enabling miners to solve more puzzles and earn more rewards.

- Lower energy consumption per TH/s: Improved manufacturing processes and more efficient chip designs have reduced the energy needed to generate each TH/s, making mining more profitable even with fluctuating electricity prices.

- Impact on mining difficulty: The increased hash rate leads to an automatic adjustment in mining difficulty. While the difficulty increases to maintain a consistent block generation time (approximately 10 minutes), the improved efficiency of new hardware offsets this increase, allowing miners to remain profitable.

Growing Institutional Investment in Mining

Large-scale mining operations, often backed by substantial institutional investment, are expanding their infrastructure significantly. This contributes to the overall increase in hash rate through:

- Increased mining farm capacity: These operations build massive facilities housing thousands of mining rigs, significantly increasing their computational power.

- Geographical distribution of mining operations: Mining farms are strategically located in regions with low electricity costs and favorable regulatory environments, further expanding the network's geographical reach.

- Impact on network decentralization: While the increased institutional investment contributes to higher hash rate, it also raises concerns about the potential centralization of mining power, a topic we'll discuss further below.

The Influence of Bitcoin Price

The price of Bitcoin is intrinsically linked to mining profitability. A higher Bitcoin price directly translates to:

- Higher Bitcoin price = higher profitability = increased mining activity: Miners are incentivized to operate more rigs when the rewards (in Bitcoin) are higher.

- Impact of price volatility on mining decisions: Price volatility can influence miners' decisions. During periods of high volatility, some miners might choose to scale down operations to mitigate risk, while others might take advantage of price surges to increase their mining activity.

Mining Profitability and its Drivers

Bitcoin mining profitability is a delicate balance determined by three key factors: the Bitcoin price, the mining difficulty, and electricity costs. A profitable operation requires a combination of high Bitcoin prices, efficient mining equipment, and low electricity costs.

Decreased Electricity Costs in Certain Regions

The cost of electricity is a significant expense for Bitcoin miners. Lower energy prices in specific regions can significantly boost profitability:

- Renewable energy sources: Regions with abundant hydropower, geothermal energy, or wind power can offer significantly lower electricity costs, making them attractive locations for mining operations.

- Government subsidies: Some governments offer subsidies or incentives to attract cryptocurrency mining operations, further reducing energy costs.

- Regional electricity price fluctuations: Fluctuations in regional electricity markets can influence mining profitability, with miners often migrating to areas with temporarily lower prices.

Improved Mining Efficiency and Economies of Scale

Technological advancements and economies of scale play a crucial role in reducing mining costs:

- Improved cooling systems: Efficient cooling systems minimize energy waste and prolong the lifespan of mining hardware.

- Optimized mining software: Sophisticated software optimizes mining processes, increasing efficiency and reducing energy consumption.

- Bulk purchasing of hardware: Large-scale mining operations benefit from economies of scale, enabling them to purchase mining hardware in bulk at lower prices.

Implications for the Bitcoin Network and Future

The increased Bitcoin mining activity has significant implications for the Bitcoin network's security and stability, but also presents certain challenges.

Enhanced Network Security

The surge in hash rate strengthens the Bitcoin network's security against 51% attacks:

- Increased computational power: A higher hash rate makes it exponentially more difficult for a single entity or group to control more than 50% of the network's computational power, thus preventing malicious attacks on the blockchain.

- Improved resilience to malicious actors: The robust network becomes more resilient to attempts to reverse transactions or alter the blockchain's history.

Potential Challenges and Concerns

While the increased hash rate benefits network security, it also presents some concerns:

- Environmental impact of increased energy consumption: The high energy consumption associated with Bitcoin mining raises environmental concerns, particularly regarding carbon emissions. Sustainable energy sources and efficient mining practices are crucial to mitigating this impact.

- Potential for manipulation: Increased concentration of mining power in the hands of a few large players could create a risk of manipulation, impacting the decentralization and fairness of the Bitcoin network.

- Future regulatory challenges: Governments worldwide are increasingly scrutinizing the environmental and economic implications of cryptocurrency mining, leading to potential regulatory challenges and restrictions.

Conclusion

This week's Bitcoin mining increase is a complex phenomenon driven by multiple interacting factors, including the introduction of new hardware, increased institutional investment, and fluctuating Bitcoin price and electricity costs. While the surge in hash rate significantly enhances network security, it's crucial to monitor potential challenges, such as centralization risks and environmental concerns. Understanding the dynamics of Bitcoin mining is essential for anyone invested in or interested in the future of this groundbreaking cryptocurrency. Stay informed about future Bitcoin mining increase trends and the evolving landscape of Bitcoin mining profitability to make well-informed decisions.

Featured Posts

-

0 4

May 08, 2025

0 4

May 08, 2025 -

Jhl Privatization Ghas Strong Opposition And The Potential Ramifications

May 08, 2025

Jhl Privatization Ghas Strong Opposition And The Potential Ramifications

May 08, 2025 -

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025 -

Xrp Ripple Investment Potential For Long Term Growth

May 08, 2025

Xrp Ripple Investment Potential For Long Term Growth

May 08, 2025 -

Inter Milan Defeat Feyenoord Advance To Europa League Quarter Finals

May 08, 2025

Inter Milan Defeat Feyenoord Advance To Europa League Quarter Finals

May 08, 2025

Latest Posts

-

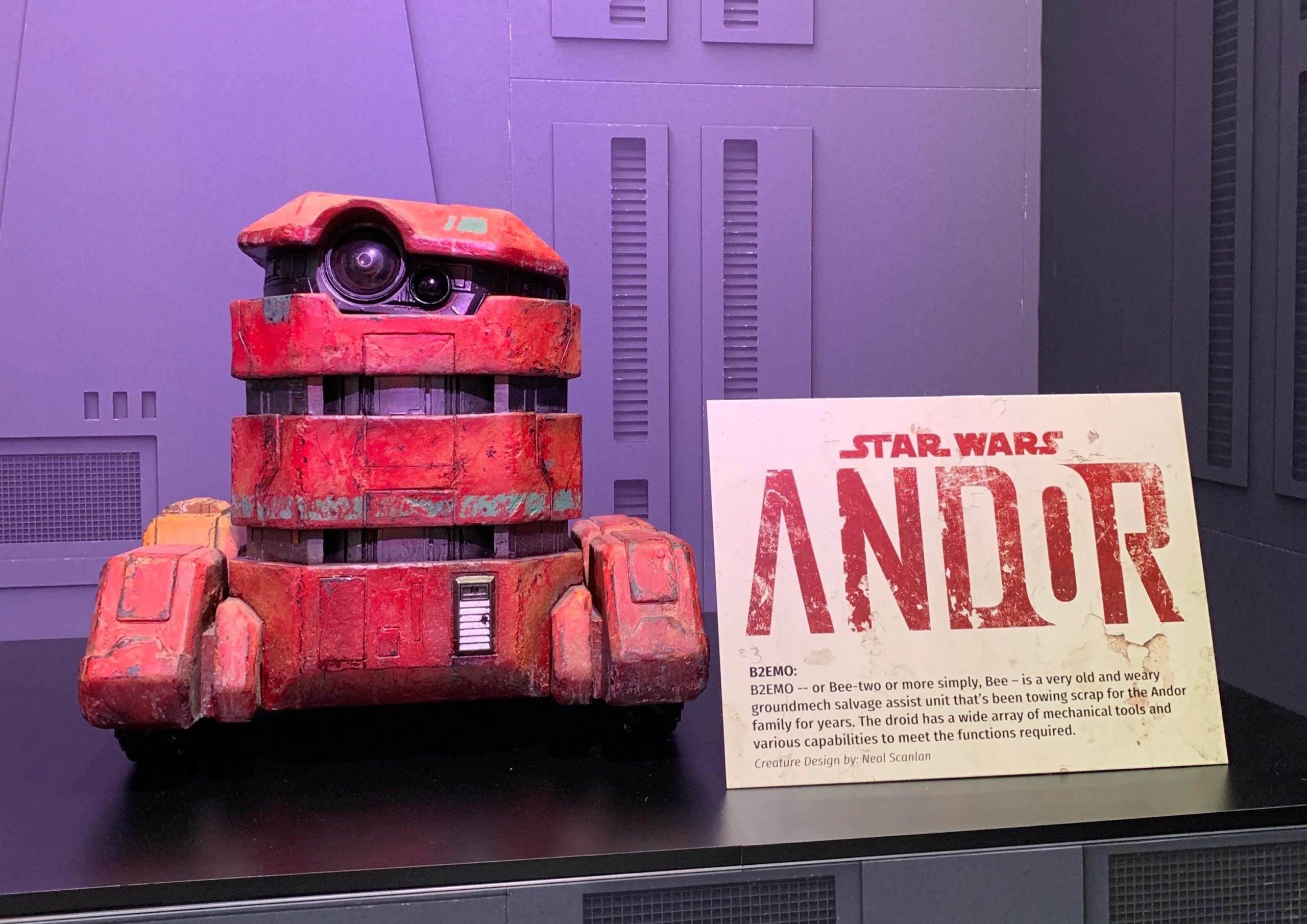

Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Streaming Options

May 08, 2025

Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Streaming Options

May 08, 2025 -

Andor First Look Delivers On Decades Of Star Wars Teases

May 08, 2025

Andor First Look Delivers On Decades Of Star Wars Teases

May 08, 2025 -

Andor First Look A 31 Year Old Star Wars Mystery Solved

May 08, 2025

Andor First Look A 31 Year Old Star Wars Mystery Solved

May 08, 2025 -

Star Wars Andor A Look At Tony Gilroys Creative Vision

May 08, 2025

Star Wars Andor A Look At Tony Gilroys Creative Vision

May 08, 2025 -

Tony Gilroys Positive Andor Experience A Star Wars Success Story

May 08, 2025

Tony Gilroys Positive Andor Experience A Star Wars Success Story

May 08, 2025