Thousands Owe HMRC: Unclaimed Savings And Refunds

Table of Contents

For those unfamiliar, HMRC stands for Her Majesty's Revenue and Customs, the UK's tax authority. They manage tax collection and the distribution of various government benefits. If you're owed money, this is your guide to getting it back.

How to Check if You Have Unclaimed HMRC Money

Checking if you have unclaimed funds is surprisingly straightforward. Here are several ways to investigate potential unclaimed tax refunds or other outstanding payments:

-

Online Portal Access: The quickest and easiest method is to access the HMRC online portal. You'll need your Government Gateway user ID and password. [Link to the relevant HMRC website here]. This portal allows you to view your tax records and identify any overpayments or unclaimed benefits.

-

Contacting HMRC Directly: If you don't have online access or prefer a more personal approach, you can contact HMRC directly via phone or post. Their contact details can be found on their official website. Be prepared to provide your full name, National Insurance number, and date of birth.

-

Using Third-Party Services: While some third-party services claim to help find unclaimed money, exercise caution. Always verify their legitimacy and ensure they are not charging excessive fees. Disclaimer: We do not endorse any specific third-party services and advise you to proceed with extreme caution.

Accurate Information is Key: Ensure all the personal information you provide is accurate. Incorrect details will delay or prevent your claim from being processed.

Types of Unclaimed Savings and Refunds

Several types of unclaimed savings and refunds might be waiting for you:

-

Overpaid Income Tax: This is perhaps the most common reason for unclaimed money. Overpayment can occur due to various reasons, including changes in circumstances or errors in tax calculations.

-

Unclaimed Child Benefit: If you're eligible for Child Benefit but haven't claimed it, you might be owed back payments.

-

Unclaimed Tax Credits: Similar to Child Benefit, unclaimed Working Tax Credits or Child Tax Credits can accumulate over time.

-

Unclaimed National Insurance contributions: Errors in National Insurance records can lead to unclaimed contributions.

-

Other government benefits or schemes: Various other government schemes and benefits might result in unclaimed funds. Check the government website for a comprehensive list. [Link to relevant government website here]

The Claiming Process: A Step-by-Step Guide

Once you've identified potential unclaimed HMRC money, follow these steps to claim it:

-

Gather Necessary Documentation: Collect relevant documents such as your P60 (or equivalent), payslips, and any correspondence from HMRC.

-

Complete the Relevant Forms: Download the appropriate claim forms from the HMRC website. [Link to relevant forms here, if available]. Fill them out accurately and completely.

-

Submit Your Claim: Submit your claim online via the HMRC portal or by post, depending on the instructions provided with the form.

-

Expected Processing Times: HMRC usually processes claims within a certain timeframe (specify timeframe if available). You may be contacted for further information.

-

What to Do if Your Claim is Rejected: If your claim is rejected, understand the reasons provided and consider appealing the decision if necessary.

Avoiding Scams Related to Unclaimed HMRC Money

Be wary of scams targeting individuals seeking unclaimed HMRC money. Fraudsters often use sophisticated methods to trick people into revealing their personal and financial information.

-

Never share your personal or financial information unless you are absolutely certain of the legitimacy of the request. HMRC will never ask for your bank details via email or text message.

-

Always verify communications: Check the sender's email address and phone number to confirm their authenticity. Look for official HMRC contact details on their website.

Recognising HMRC's Official Communication Channels

HMRC primarily communicates via:

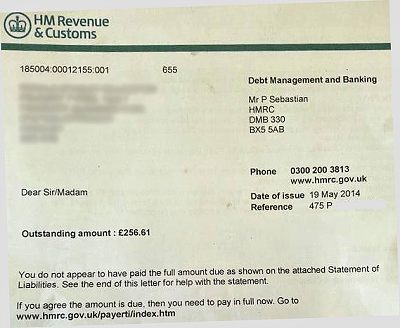

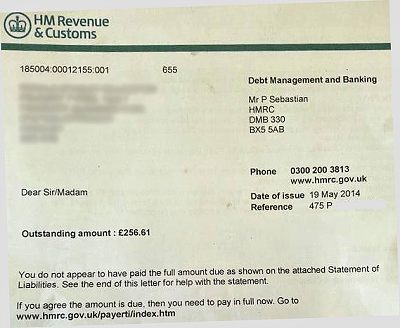

- Official letters: Sent via Royal Mail, with official HMRC branding and letterhead.

- Secure online messages: Through your Government Gateway account.

- Phone calls: From official HMRC numbers, which can be verified on their website. They will never ask for sensitive information over the phone.

HMRC will never contact you unexpectedly via email or text message asking for your bank details or passwords.

Reclaim What's Yours: Unclaimed Savings and Refunds

Don't let your hard-earned money go unclaimed! This article has shown you how easy it is to check for and claim your unclaimed savings and refunds, potentially retrieving substantial sums in overpaid tax, unclaimed benefits, or other owed funds. Take action today and check for your unclaimed tax refunds or other HMRC unclaimed money. Use the resources and methods outlined above to reclaim what's rightfully yours. Share this article with friends and family who might also benefit from this valuable information, helping them recover their unclaimed HMRC money as well.

Featured Posts

-

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025 -

Jennifer Lawrence I Drugo Dijete Detalji O Rodenju

May 20, 2025

Jennifer Lawrence I Drugo Dijete Detalji O Rodenju

May 20, 2025 -

Suki Waterhouses Met Gala 2023 A Full Circle Fashion Moment

May 20, 2025

Suki Waterhouses Met Gala 2023 A Full Circle Fashion Moment

May 20, 2025 -

50 Years Of Gma A Paley Center Tribute

May 20, 2025

50 Years Of Gma A Paley Center Tribute

May 20, 2025 -

La Buena Noticia De Michael Schumacher Que Conmociono Al Mundo

May 20, 2025

La Buena Noticia De Michael Schumacher Que Conmociono Al Mundo

May 20, 2025