Ethereum Price Strength: Bulls In Control, Upside Potential High

Table of Contents

Technical Analysis: Signs of a Bullish Trend

Technical analysis provides valuable insights into the short-term and medium-term trends of Ethereum's price. Several key indicators suggest a bullish momentum for ETH.

-

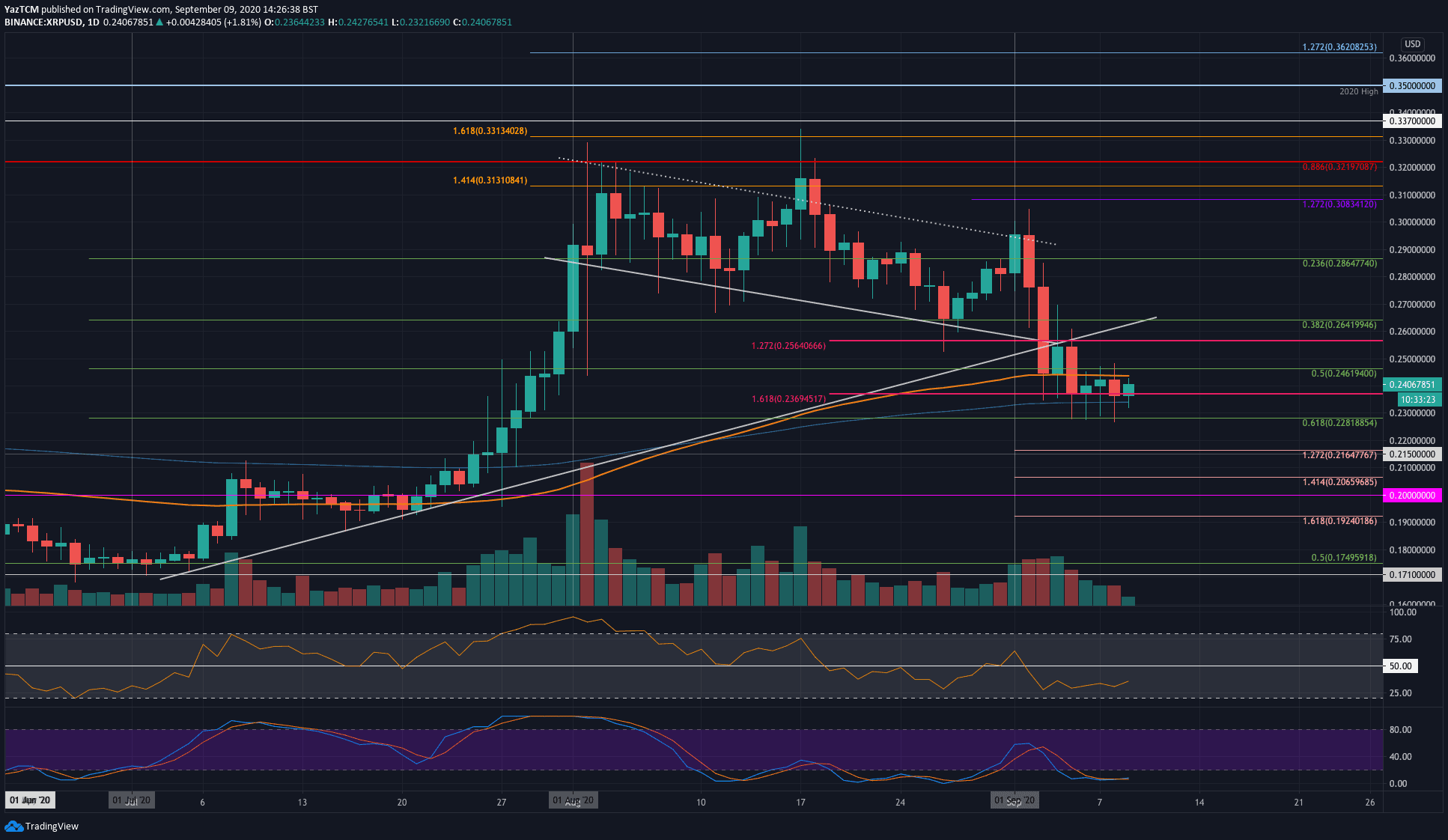

Moving Averages: The 50-day and 200-day moving averages are trending upwards, a classic bullish signal. The 50-day MA crossing above the 200-day MA (a "golden cross") often precedes significant price increases. This positive alignment strengthens the case for continued Ethereum price strength.

-

Relative Strength Index (RSI): The RSI is currently above 50, suggesting that the buying pressure is stronger than the selling pressure. While a reading above 70 could indicate overbought conditions, the current level suggests room for further upward movement in Ethereum's price.

-

Moving Average Convergence Divergence (MACD): The MACD histogram is showing a bullish trend, with the MACD line crossing above the signal line, reinforcing the positive momentum.

-

Chart Patterns: The price charts are displaying several bullish chart patterns.

- Breaking above key resistance levels signifies overcoming a significant hurdle and signifies stronger Ethereum price strength.

- Increasing trading volume accompanying price increases confirms the strength of the bullish trend and reduces the likelihood of a short-lived rally.

- Formation of bullish candlestick patterns, such as hammer and engulfing patterns, suggest further upward movement.

[Insert relevant chart/graph here]

Fundamental Factors Fueling Ethereum's Rise

Beyond technical indicators, several fundamental factors contribute to the current Ethereum price strength.

-

Growing adoption of Ethereum in DeFi applications: The total value locked (TVL) in decentralized finance (DeFi) protocols built on Ethereum continues to grow exponentially. This increasing usage drives demand for ETH, boosting its price.

-

Increased network activity and transaction volume: Higher transaction volumes indicate increased usage and network activity, creating a positive feedback loop that reinforces the Ethereum price strength. Increased transaction fees (gas fees) further contribute to the demand for ETH.

-

Positive developments in the Ethereum 2.0 roadmap: The ongoing transition to Ethereum 2.0, with its enhanced scalability and reduced energy consumption, instills confidence in the long-term prospects of the Ethereum network, indirectly impacting the current Ethereum price strength.

-

Growing institutional investment in ETH: More institutional investors are allocating capital to ETH, treating it as a digital asset class similar to gold, which further supports the price. This increased institutional interest lends credence to the belief in sustained Ethereum price strength.

Potential Risks and Challenges

While the outlook for Ethereum appears bullish, it's crucial to acknowledge potential risks:

-

Regulatory uncertainty surrounding cryptocurrencies: Government regulations worldwide remain a significant uncertainty for the cryptocurrency market, including Ethereum. Negative regulatory developments could negatively impact Ethereum price strength.

-

Potential for market corrections: The cryptocurrency market is notoriously volatile, and sharp corrections are possible. Even with strong bullish indicators, a significant market downturn could impact ETH.

-

Competition from other blockchain platforms: Ethereum faces competition from other blockchain platforms, which could potentially slow down its growth and affect its price.

To mitigate these risks, investors should employ sound risk management strategies such as diversification and dollar-cost averaging.

Predicting Ethereum's Upside Potential

Based on the current technical and fundamental analysis, Ethereum's price could see further upside in the coming months. However, predicting precise price targets is inherently speculative. Several factors, like the pace of Ethereum 2.0 implementation and overall market sentiment, will significantly influence future price movements. The successful adoption of Ethereum in the burgeoning Metaverse could also bolster Ethereum price strength. While a conservative estimate points towards a potential increase, it is important to understand the highly volatile nature of cryptocurrencies. Always conduct thorough research and only invest what you can afford to lose.

Conclusion: Ethereum Price Strength – A Look Ahead

Our analysis suggests a strong bullish trend for Ethereum, driven by both positive technical indicators and robust fundamental factors. While risks exist, the growing adoption of Ethereum in DeFi, its ongoing development, and increasing institutional investment support a positive outlook for Ethereum price strength. However, remember that the cryptocurrency market is volatile, and predicting future prices with certainty is impossible. Stay informed about Ethereum price strength by following our updates and conducting your own thorough research before making any investment decisions. Remember to always prioritize your risk tolerance when making investment choices related to Ethereum price strength.

Featured Posts

-

Istoriya Matchey Arsenal Ps Zh Vse Rezultaty I Statistika

May 08, 2025

Istoriya Matchey Arsenal Ps Zh Vse Rezultaty I Statistika

May 08, 2025 -

Top Ps 5 Pro Enhanced Games A Must Play List For Owners

May 08, 2025

Top Ps 5 Pro Enhanced Games A Must Play List For Owners

May 08, 2025 -

The Unforeseen Consequences Of Liberation Day Tariffs On Stock Investments

May 08, 2025

The Unforeseen Consequences Of Liberation Day Tariffs On Stock Investments

May 08, 2025 -

Superman Footage Analysis More Than Just Krypto A Critical Scene Discussion

May 08, 2025

Superman Footage Analysis More Than Just Krypto A Critical Scene Discussion

May 08, 2025 -

Toronto Housing Market Slowdown Sales Fall 23 Average Prices Down 4

May 08, 2025

Toronto Housing Market Slowdown Sales Fall 23 Average Prices Down 4

May 08, 2025

Latest Posts

-

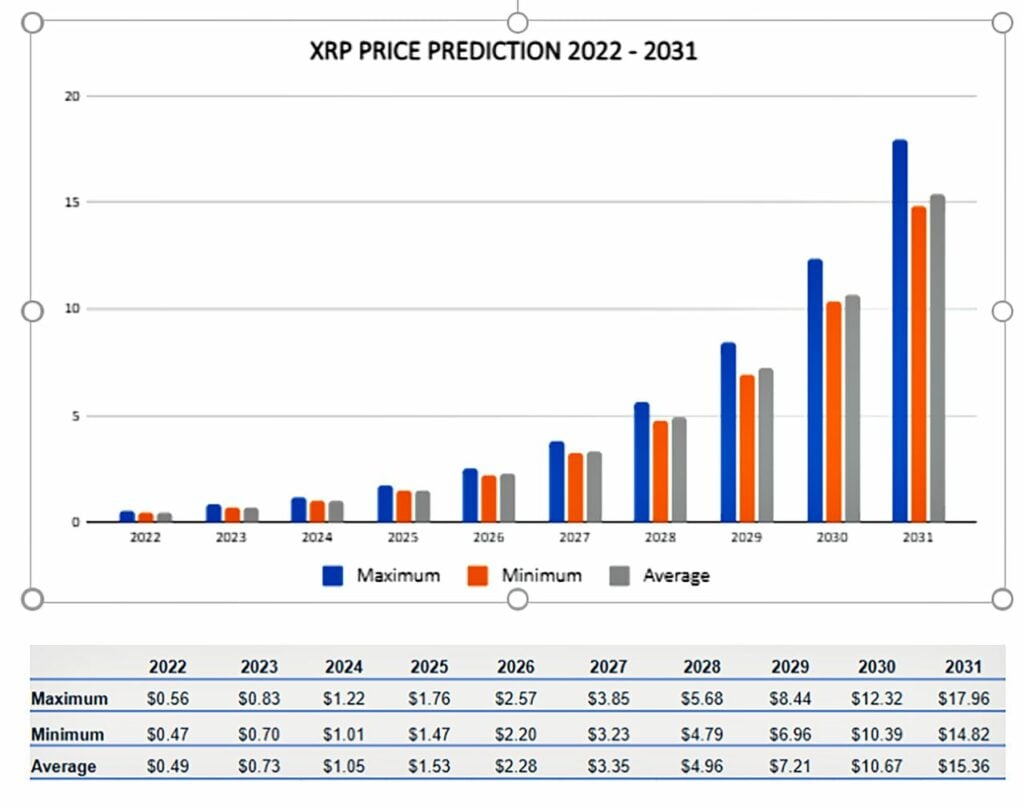

Xrps 400 Jump Whats Next For The Ripple Cryptocurrency

May 08, 2025

Xrps 400 Jump Whats Next For The Ripple Cryptocurrency

May 08, 2025 -

Xrp Future Price Analyzing The Potential For Growth Following The Sec Case

May 08, 2025

Xrp Future Price Analyzing The Potential For Growth Following The Sec Case

May 08, 2025 -

Xrp Price Prediction Can Xrp Rise Further After A 400 Surge

May 08, 2025

Xrp Price Prediction Can Xrp Rise Further After A 400 Surge

May 08, 2025 -

Will Xrp Reach 5 An Xrp Price Prediction Analysis Post Sec Lawsuit

May 08, 2025

Will Xrp Reach 5 An Xrp Price Prediction Analysis Post Sec Lawsuit

May 08, 2025 -

Xrp Price Prediction 5 Target Realistic After Sec Developments

May 08, 2025

Xrp Price Prediction 5 Target Realistic After Sec Developments

May 08, 2025