Toronto Company's Bid For Hudson's Bay: A Challenging Acquisition Prospect

Table of Contents

The Allure of Hudson's Bay: Assets and Potential

The appeal of acquiring Hudson's Bay rests primarily on two key pillars: its substantial real estate holdings and its established brand recognition within the Canadian retail landscape.

Prime Real Estate Holdings

HBC owns a vast and valuable portfolio of prime real estate across major Canadian cities. This real estate represents a considerable portion of the company's overall worth, offering significant potential for future revenue generation.

- Locations in major urban centers offer high rental income potential: Many HBC properties are situated in high-traffic, desirable locations, guaranteeing a strong stream of rental income. This consistent cash flow provides a solid financial base for any acquiring company.

- Redevelopment opportunities could significantly increase asset value: Many of these properties present opportunities for redevelopment and modernization, potentially unlocking substantial increases in their value. This could involve converting underutilized spaces into residential or commercial units, or creating mixed-use developments.

- Strategic partnerships with developers could maximize returns: Collaborating with experienced real estate developers can optimize the redevelopment process, maximizing returns and mitigating risks associated with large-scale construction projects. Such partnerships leverage expertise and minimize capital outlay for the acquiring company.

Established Brand Recognition

Hudson's Bay is a household name in Canada, synonymous with quality and heritage. This strong brand recognition, built over centuries, offers a substantial advantage to any acquiring company.

- Brand loyalty offers a solid foundation for future growth: The existing customer base represents a loyal and established market segment, offering a platform for continued sales and revenue generation.

- Potential for expansion into new markets or product lines: The well-recognized brand provides a springboard for expansion into new markets or the introduction of new product lines, capitalizing on the existing brand equity.

- Rebranding strategies could revitalize the brand: A strategic rebranding campaign can breathe new life into the Hudson's Bay brand, attracting new customer segments and aligning with contemporary consumer preferences.

Significant Challenges in the Hudson's Bay Acquisition

Despite the attractive assets, the acquisition of HBC is fraught with significant challenges that could derail even the most well-planned investment strategy.

High Acquisition Cost

The price tag for acquiring HBC is expected to be substantial, presenting a major financial hurdle for any prospective buyer. Securing the necessary funding will require careful planning and strategic financial maneuvering.

- Financing the acquisition may require significant debt or equity: The sheer scale of the acquisition will likely necessitate a mix of debt financing and equity contributions, potentially increasing the financial risk for the acquiring company.

- Market conditions and interest rates will impact financing options: The prevailing economic climate and prevailing interest rates will significantly impact the cost and availability of financing, creating uncertainty in the acquisition process.

- Potential for overpaying for assets: Accurately assessing the true value of HBC's assets, including its real estate portfolio and brand equity, is crucial to avoid overpaying and jeopardizing the financial viability of the acquisition.

Competitive Retail Landscape

The Canadian retail sector is fiercely competitive, with established players battling for market share. Successfully navigating this environment requires astute strategic planning and a robust competitive advantage.

- Increased pressure on profit margins: The intense competition will place significant pressure on profit margins, requiring the acquiring company to implement efficient cost management strategies.

- Need for innovative strategies to stand out from competitors: Differentiating from established competitors requires creativity and innovation in product offerings, marketing campaigns, and overall customer experience.

- Adapting to evolving consumer preferences is crucial for success: Understanding and adapting to the ever-shifting landscape of consumer preferences is paramount for long-term survival and success in the retail industry.

Operational and Integration Challenges

Merging two large organizations is a complex process fraught with potential pitfalls. Successfully integrating operations, IT systems, and employees is critical for the overall success of the acquisition.

- Potential for disruptions to business operations during integration: The integration process will inevitably cause some disruptions to normal business operations, requiring careful planning and mitigation strategies.

- Employee retention and morale are key factors for a successful merger: Maintaining employee morale and retaining key talent during the integration process is crucial for a smooth transition and continued operational efficiency.

- Significant investment in technology and infrastructure may be required: Integrating IT systems and upgrading outdated infrastructure may require significant investment, adding to the overall cost of the acquisition.

Conclusion

The Toronto company's bid for Hudson's Bay presents a compelling investment opportunity, but one burdened by considerable challenges. While the value of HBC's real estate and brand are undeniable, the competitive retail landscape and complexities of a large-scale acquisition demand careful assessment. The success of this acquisition hinges on successful integration, innovative strategies, and astute financial management. A thorough understanding of these factors is crucial for determining the ultimate viability of this ambitious undertaking.

Call to Action: Stay informed about the unfolding developments in this significant Canadian business transaction. Continue following news regarding the Toronto company's bid for Hudson's Bay for further analysis and updates on this challenging acquisition prospect.

Featured Posts

-

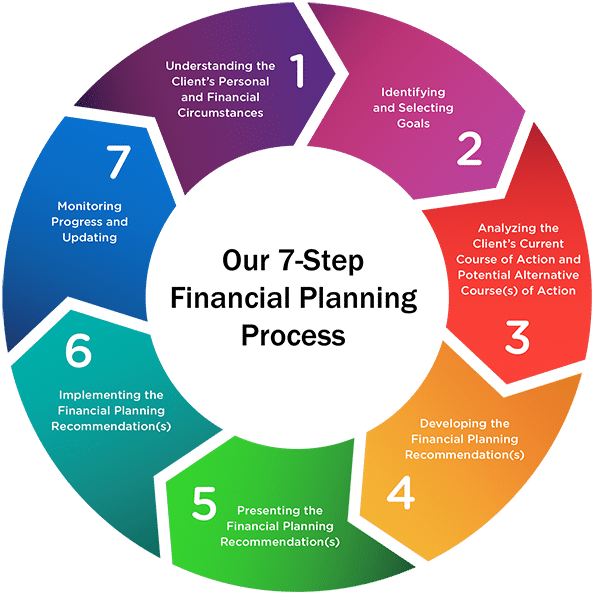

Retirement Of Cfp Board Ceo Implications For The Financial Planning Industry

May 02, 2025

Retirement Of Cfp Board Ceo Implications For The Financial Planning Industry

May 02, 2025 -

The Complete Guide To Exploring This Country

May 02, 2025

The Complete Guide To Exploring This Country

May 02, 2025 -

Priscilla Pointer Dead Dallas And Carrie Actress Passes Away

May 02, 2025

Priscilla Pointer Dead Dallas And Carrie Actress Passes Away

May 02, 2025 -

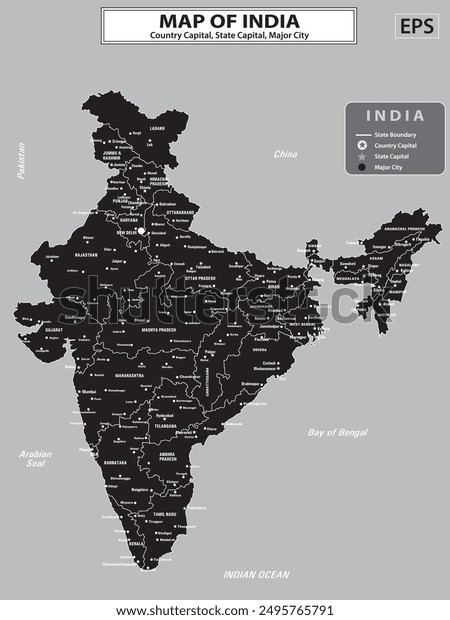

The Geography And Politics Of This Country

May 02, 2025

The Geography And Politics Of This Country

May 02, 2025 -

U S Army To Dramatically Expand Drone Use An Exclusive Look

May 02, 2025

U S Army To Dramatically Expand Drone Use An Exclusive Look

May 02, 2025