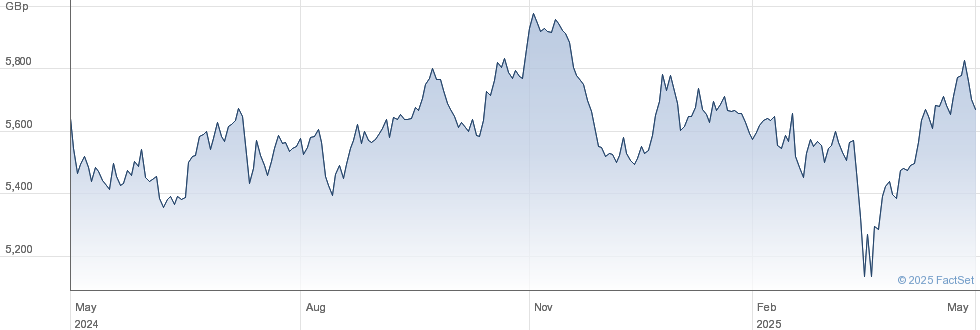

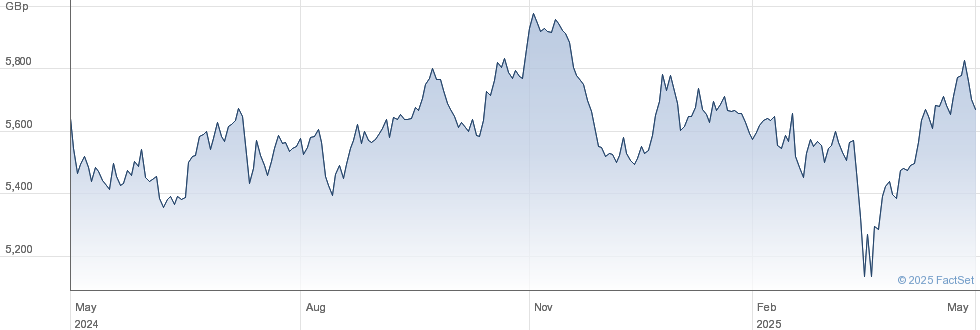

Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

How to Find the Amundi MSCI World II UCITS ETF NAV

Finding the Amundi MSCI World II UCITS ETF's NAV is straightforward. Real-time and historical NAV data is readily available from several sources. The most reliable source is the official Amundi website, which provides precise and up-to-date information. You can also access NAV data through various reputable financial news websites and brokerage platforms where you hold your investment.

The NAV is typically presented as a numerical value representing the net asset value per share, usually displayed in the ETF's base currency (USD in this case), alongside the date and time of calculation.

- Direct Link to Amundi's Official Website: [Insert Link Here - replace with actual link to the relevant ETF page on Amundi's website] This should be your primary source for accurate NAV data.

- Reputable Financial Websites: Major financial news providers like Bloomberg, Yahoo Finance, and Google Finance often list ETF NAVs, including the Amundi MSCI World II UCITS ETF.

- Popular Brokerage Platforms: If you hold the Amundi MSCI World II UCITS ETF within your brokerage account (e.g., Interactive Brokers, Fidelity, Schwab), your account statement and online portfolio will display the current NAV.

Factors Influencing the Amundi MSCI World II UCITS ETF NAV

Several factors influence the daily NAV fluctuations of the Amundi MSCI World II UCITS ETF USD Hedged Dist. Understanding these elements is key to interpreting NAV changes.

- Underlying Assets (MSCI World Index): The ETF tracks the MSCI World Index, a benchmark representing large and mid-cap equities across developed markets globally. The performance of the companies within this index directly impacts the ETF's NAV. Positive market movements generally lead to NAV increases, while negative movements result in decreases.

- Currency Fluctuations (USD Hedged): The "USD Hedged" designation means the ETF employs a hedging strategy to minimize the impact of currency fluctuations between the base currency of the underlying assets and the US dollar. While this helps reduce risk, it doesn't eliminate it entirely, and minor fluctuations can still affect the NAV.

- Expense Ratio: The ETF has an expense ratio, a yearly fee charged to cover management and operational costs. While this fee is relatively small, it subtly impacts the NAV over time by reducing the overall returns. This reduction is usually calculated and deducted daily to reflect an accurate NAV.

Importance of Monitoring Amundi MSCI World II UCITS ETF NAV

Regularly monitoring the Amundi MSCI World II UCITS ETF's NAV is crucial for several reasons:

-

Investment Performance Assessment: Tracking the NAV allows you to gauge your investment's performance over time. You can easily compare the change in NAV against your initial investment to understand your returns.

-

Market Trend Reflection: Changes in the NAV reflect broader market trends. A rising NAV might suggest positive market sentiment, while a decline could indicate negative market conditions or specific issues affecting the underlying assets.

-

Investment Decision Support: Monitoring NAV fluctuations helps inform your investment strategy. Consistent declines might prompt you to reassess your risk tolerance or consider rebalancing your portfolio.

-

Portfolio Management: Regular NAV monitoring helps in effective portfolio management, allowing timely adjustments based on your investment goals and risk tolerance.

-

Tax Reporting: Accurate NAV data is essential for preparing tax returns, as it is a fundamental component in calculating capital gains or losses.

-

Buy/Sell Decisions: While not the sole factor, understanding NAV trends can provide insights to help inform timing decisions related to buying or selling your Amundi MSCI World II UCITS ETF shares.

Tools and Resources for Tracking Amundi MSCI World II UCITS ETF NAV

Several tools can simplify NAV tracking:

- Financial Software and Apps: Many financial software applications and mobile apps offer built-in ETF tracking capabilities, allowing you to monitor multiple investments, including the Amundi MSCI World II UCITS ETF, simultaneously. Examples include [insert examples of relevant software and apps].

- Spreadsheet Programs (Manual Tracking): You can manually track the NAV using spreadsheet software like Microsoft Excel or Google Sheets by regularly downloading NAV data from the sources mentioned earlier.

- APIs for Automated Data Retrieval: For more advanced users, Application Programming Interfaces (APIs) from financial data providers can automate NAV data retrieval and analysis.

Conclusion: Stay Informed on Your Amundi MSCI World II UCITS ETF Investment

Effectively tracking the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF USD Hedged Dist investment is crucial for informed decision-making and maximizing returns. By utilizing the resources and methods discussed – from checking Amundi's official website to employing dedicated financial software – you can gain a clear understanding of your investment's performance and make adjustments as needed. Regularly monitor your Amundi MSCI World II UCITS ETF's NAV to stay informed about its performance and make strategic investment choices. Don't underestimate the power of consistent NAV tracking to achieve your investment goals!

Featured Posts

-

Porsche 356 Dari Zuffenhausen Jerman Menuju Legenda

May 24, 2025

Porsche 356 Dari Zuffenhausen Jerman Menuju Legenda

May 24, 2025 -

Palestine Keyword Blocked By Microsoft Emails Employee Protests And Response

May 24, 2025

Palestine Keyword Blocked By Microsoft Emails Employee Protests And Response

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav Calculation And Analysis

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav Calculation And Analysis

May 24, 2025 -

Kak Khorosho Vy Znaete Roli Olega Basilashvili

May 24, 2025

Kak Khorosho Vy Znaete Roli Olega Basilashvili

May 24, 2025 -

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025