Trade Wars And Crypto: Identifying A Winning Cryptocurrency

Table of Contents

Understanding the Impact of Trade Wars on Crypto Markets

Trade wars significantly impact global markets by disrupting supply chains, increasing tariffs, and creating uncertainty for businesses and investors. This uncertainty often leads to volatility in traditional asset classes like stocks and bonds. While there isn't always a direct, perfectly correlated relationship between trade tensions and cryptocurrency prices, the impact is undeniable.

-

Increased volatility in traditional markets often leads to increased interest in alternative assets like crypto. Investors seeking to diversify away from traditional assets often turn to cryptocurrencies, perceiving them as a hedge against economic instability.

-

Geopolitical uncertainty can drive demand for decentralized and censorship-resistant currencies. Cryptocurrencies, by their nature, operate outside the control of any single government or institution, making them attractive during times of political unrest.

-

Specific examples of how past trade disputes affected crypto prices: The 2018 trade war between the US and China saw increased volatility in the cryptocurrency market, with some cryptocurrencies experiencing significant price drops while others saw increased demand as investors sought refuge in alternative assets.

-

The impact on different crypto asset classes (e.g., Bitcoin, altcoins, stablecoins): Bitcoin, as the largest cryptocurrency by market capitalization, tends to be less volatile than many altcoins. However, even Bitcoin experiences price swings during periods of geopolitical uncertainty. Altcoins, with their higher risk profiles, can experience even more dramatic price fluctuations. Stablecoins, pegged to fiat currencies, offer relative stability in turbulent times, acting as a safe haven for some investors.

Analyzing Cryptocurrencies for Trade War Resilience

Selecting a cryptocurrency that can withstand the pressures of trade wars requires careful analysis. Fundamental analysis, focusing on the underlying value and potential of a cryptocurrency, is crucial. Don't just chase the hype; look for solid fundamentals.

-

Market Capitalization: Focus on established, large-cap cryptocurrencies with greater stability. Larger market caps generally indicate greater liquidity and resilience to market shocks.

-

Technology & Adoption: Look for cryptocurrencies with strong underlying technology and growing adoption rates. A robust technology and widespread usage suggest a higher likelihood of long-term success.

-

Team & Development: Analyze the experience and reputation of the development team. A skilled and transparent team is essential for the long-term success of a cryptocurrency project.

-

Community & Network Effects: Strong community support and network effects contribute to long-term growth. A thriving community demonstrates faith and active participation in the project.

-

Regulatory Landscape: Assess how the cryptocurrency is positioned relative to evolving regulations. Cryptocurrencies with clear regulatory pathways or those operating in jurisdictions with favorable regulations are less likely to experience sudden shocks due to regulatory changes.

Diversification and Risk Management in a Trade War Environment

Diversification is paramount in any investment strategy, but it's particularly crucial during periods of economic uncertainty like trade wars. Never put all your eggs in one basket.

-

Diversify across different cryptocurrency asset classes: Don't just invest in Bitcoin; consider allocating a portion of your portfolio to altcoins and stablecoins to balance risk and potential reward.

-

Utilize dollar-cost averaging to reduce the impact of price fluctuations: Investing a fixed amount at regular intervals, regardless of price, mitigates the risk of buying high and selling low.

-

Consider hedging strategies using stablecoins or other less volatile assets: Stablecoins can act as a safe haven during market downturns, preserving your capital while waiting for market recovery.

-

Set stop-loss orders to limit potential losses: Stop-loss orders automatically sell your cryptocurrency if the price falls below a predetermined level, limiting potential losses.

-

Importance of only investing what you can afford to lose: Never invest more than you're willing to lose. The cryptocurrency market is inherently risky, and losses are possible.

Identifying Potential "Winning" Cryptocurrencies (Examples)

While offering specific investment advice is beyond the scope of this article, cryptocurrencies with strong fundamentals, like those with established ecosystems and significant real-world applications, may be better positioned to weather economic storms. Thorough research is crucial before making any investment decisions.

Conclusion

Navigating the complexities of trade wars and the cryptocurrency market requires careful analysis and a well-defined strategy. By understanding the impact of trade tensions, identifying resilient cryptocurrencies, and employing effective risk management techniques, investors can potentially identify winning cryptocurrencies and navigate the turbulent economic landscape.

Ready to identify your own winning cryptocurrency portfolio? Start by conducting thorough research, focusing on the factors discussed in this article. Remember to diversify your investments and manage risk effectively. Begin your journey towards finding your winning cryptocurrency today!

Featured Posts

-

The Strengthening Taiwan Dollar And The Path To Economic Restructuring

May 08, 2025

The Strengthening Taiwan Dollar And The Path To Economic Restructuring

May 08, 2025 -

Stephen King Thinks This Thriller Is Too Intense The Long Walk Trailer

May 08, 2025

Stephen King Thinks This Thriller Is Too Intense The Long Walk Trailer

May 08, 2025 -

Analizando La Derrota Del Lyon Ante El Psg En Casa

May 08, 2025

Analizando La Derrota Del Lyon Ante El Psg En Casa

May 08, 2025 -

Fetterman Addresses Ny Magazines Fitness To Serve Concerns

May 08, 2025

Fetterman Addresses Ny Magazines Fitness To Serve Concerns

May 08, 2025 -

Behind The Scenes Of Andor Cast Discusses The Rogue One Prequels Conclusion

May 08, 2025

Behind The Scenes Of Andor Cast Discusses The Rogue One Prequels Conclusion

May 08, 2025

Latest Posts

-

Sergio Hernandez Dirigira Al Flamengo Un Nuevo Capitulo Para El Equipo

May 08, 2025

Sergio Hernandez Dirigira Al Flamengo Un Nuevo Capitulo Para El Equipo

May 08, 2025 -

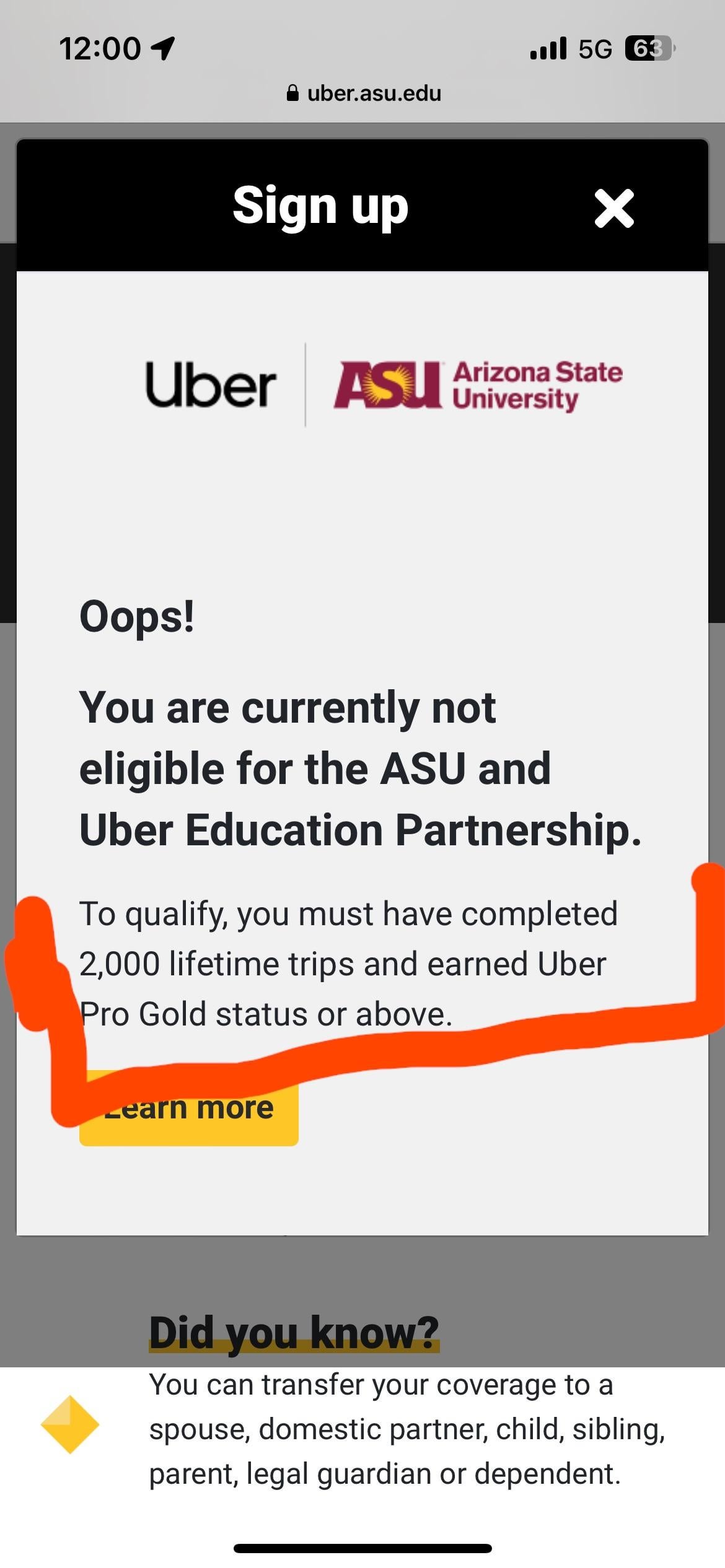

Understanding Ubers New Driver Subscription Plans

May 08, 2025

Understanding Ubers New Driver Subscription Plans

May 08, 2025 -

Taca Guanabara El Golazo De Arrascaeta Que Decidio El Partido Para El Flamengo

May 08, 2025

Taca Guanabara El Golazo De Arrascaeta Que Decidio El Partido Para El Flamengo

May 08, 2025 -

Uber One Arrives In Kenya Get Free Delivery And More

May 08, 2025

Uber One Arrives In Kenya Get Free Delivery And More

May 08, 2025 -

Flamengo Confirma A Sergio Hernandez Como Su Nuevo Entrenador

May 08, 2025

Flamengo Confirma A Sergio Hernandez Como Su Nuevo Entrenador

May 08, 2025